Renters Crp Form

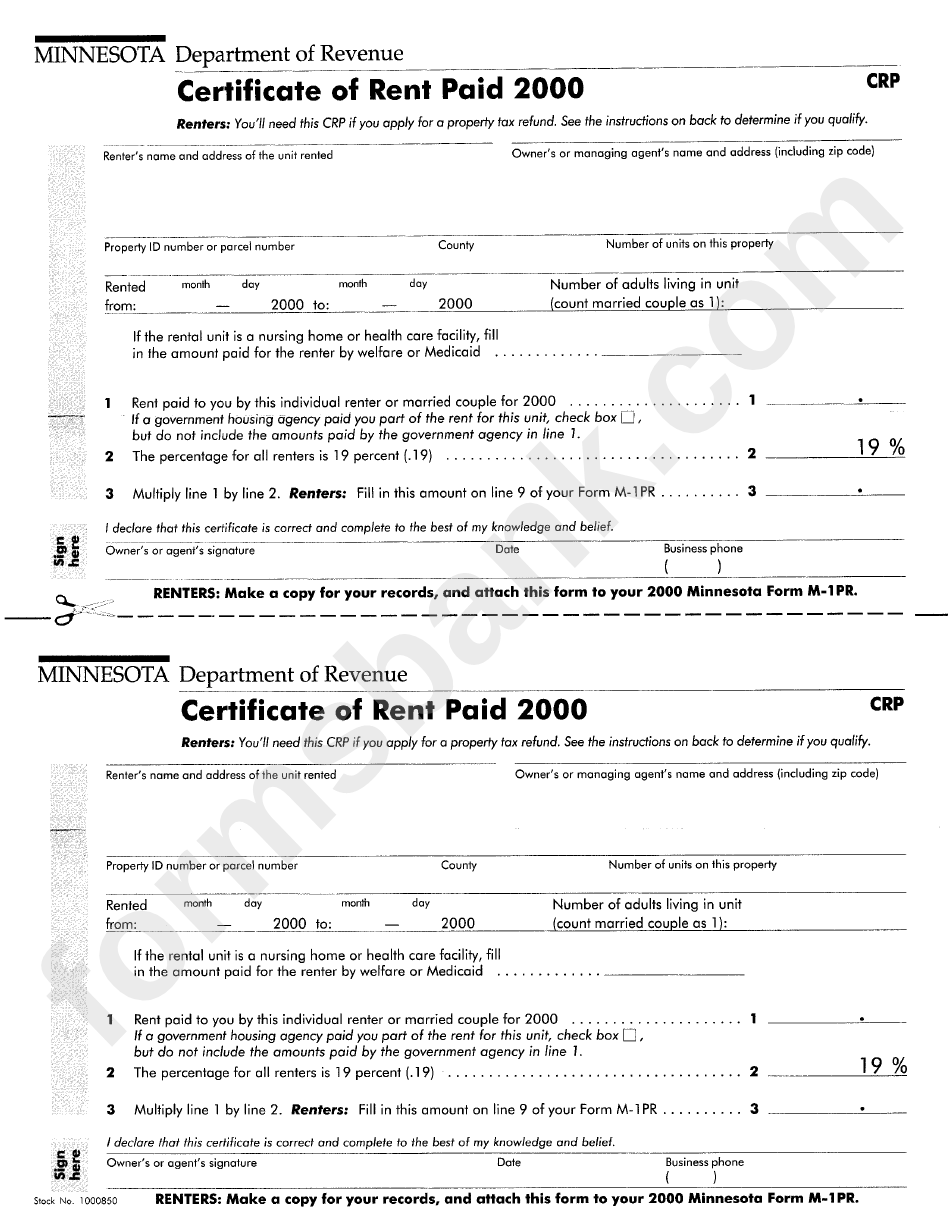

Renters Crp Form - If you own rental property in minnesota, you or your managing agent must issue a crp every year to your tenants (updated for tax year 2022). Web minnesota — form crp certificate of rent paid landlord instructions. Failure to provide landlord information will result in denial or delay of your claim. Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2022. If you own, use your property tax statement. Web we last updated the form crp certificate of rent paid landlord instructions in february 2023, so this is the latest version of form crp instructions, fully updated for tax year. Get the tax form called the 2022. Web how are claims filed? Web received a crp that divided the rent you paid between you and your dependent your dependent received a crp with a portion of the rent for the same rental unit include the. Property managers must provide a certificate of rent paid to every renter no later than january 31. Web how are claims filed? Schedule m1pr is filed separately. If you own rental property in minnesota, you or your managing agent must issue a crp every year to your tenants (updated for tax year 2022). Web 2022 certificate of rent paid (crp) instructions. Web how are claims filed? Failure to provide landlord information will result in denial or delay of your claim. If you own, use your property tax. Web received a crp that divided the rent you paid between you and your dependent your dependent received a crp with a portion of the rent for the same rental unit include the. Use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web minnesota — form crp certificate of rent paid landlord. Hours [+] address [+] related. Ad formfindr.com has been visited by 10k+ users in the past month Quick way to create the key documents necessary for owning or managing rental property. Web we last updated the homestead credit refund and renter’s property tax refund instruction booklet in february 2023, so this is the latest version of form m1pr. Web 2022. Web we last updated the homestead credit refund and renter’s property tax refund instruction booklet in february 2023, so this is the latest version of form m1pr. If you own, use your property tax statement. Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Web property owners or managing agents must issue one certificate of rent paid. Failure to provide landlord information will result in denial or delay of your claim. Web minnesota — form crp certificate of rent paid landlord instructions. If you own rental property in minnesota, you or your managing agent must issue a crp every year to your tenants (updated for tax year 2022). Your landlord is required to. Refund claims are filed. Web property owners or managing agents must issue one certificate of rent paid (crp) to each adult renter by january 31, 2021. A managing agent acts on behalf of the property. • get the tax form called the 2021. Web minnesota — form crp certificate of rent paid landlord instructions. Web we last updated the form crp certificate of rent. Ad formfindr.com has been visited by 10k+ users in the past month Use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web how are claims filed? Hours [+] address [+] related. Schedule m1pr is filed separately from the individual income. Web property owners or managing agents must issue one certificate of rent paid (crp) to each adult renter by january 31, 2021. Property owners or managing agents must issue one certificate of rent paid (crp) to each adult renter by january 31, 2023. Web 2022 certificate of rent paid forms due january 31. Property managers must provide a certificate of. A managing agent acts on behalf of the property. Use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web 2022 certificate of rent paid (crp) instructions. Web if you are filing form m1pr for the renter's property tax refund, you must attach the certificate of rent paid (crp) provided by your landlord.. Web 2022 certificate of rent paid (crp) instructions. Web the minnesota renter’s credit/refund is a state property tax refund for tenants. Property managers must provide a certificate of rent paid to every renter no later than january 31. Web property owners or managing agents must issue one certificate of rent paid (crp) to each adult renter by january 31, 2021. Failure to provide landlord information will result in denial or delay of your claim. If you own, use your property tax statement. Get the tax form called the 2022. Web 2022 certificate of rent paid forms due january 31. Web how are claims filed? Schedule m1pr is filed separately from the individual income. Web if you are filing form m1pr for the renter's property tax refund, you must attach the certificate of rent paid (crp) provided by your landlord. Use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Your landlord is required to. If you own rental property in minnesota, you or your managing agent must issue a crp every year to your tenants (updated for tax year 2022). Property owners or managing agents must issue one certificate of rent paid (crp) to each adult renter by january 31, 2023. • get the tax form called the 2021. This refund assists renters with the tax burden they pay directly to their landlord because. When you file form m1pr, you. Web • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2022.️certificate Of Rent Paid (Crp) Sample Template ️ pertaining to

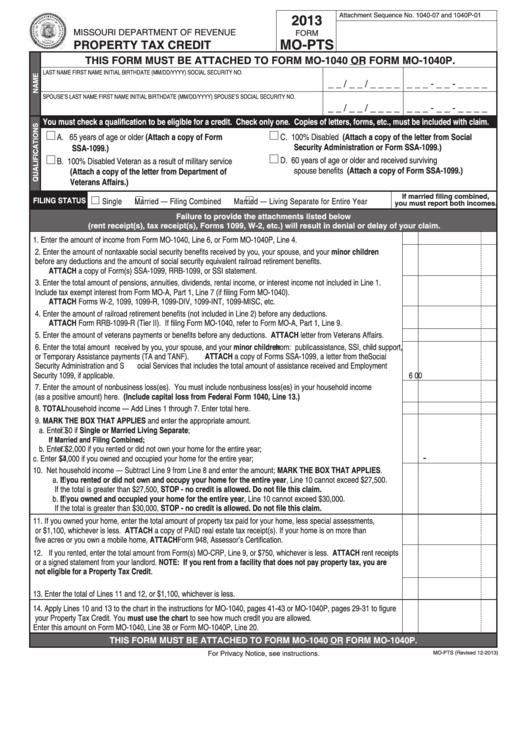

Fillable Form MoPts Property Tax Credit 2013, Form MoCrp

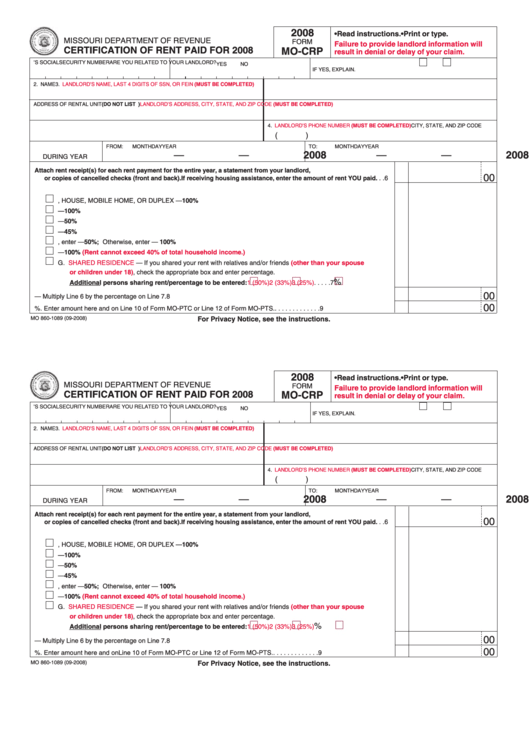

Form MoCrp Certification Of Rent Paid For 2008 printable pdf download

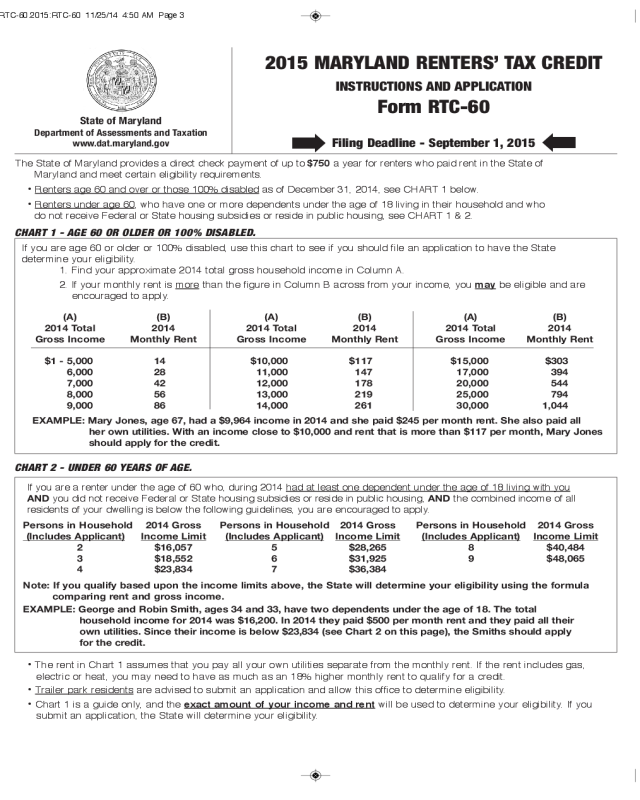

Renters' Tax Credit Instructions and Application Form Maryland Edit

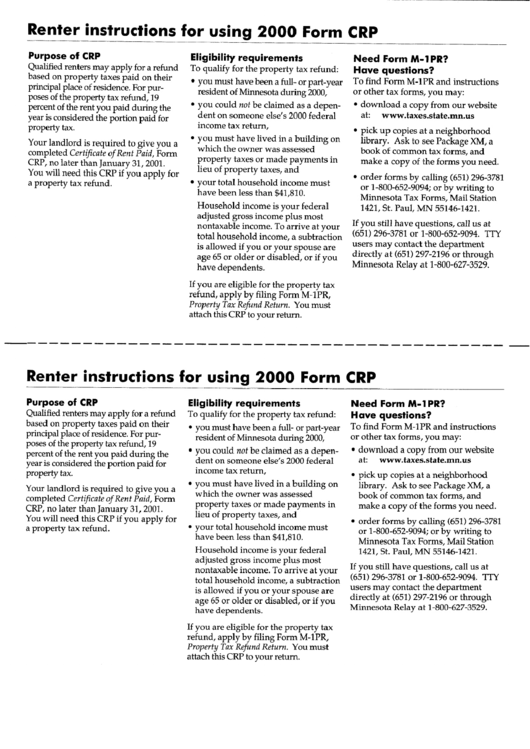

Form Crp Certificate Of Rent Paid 2000 printable pdf download

Form Crp Certificate Of Rent Paid 2000 Instructions printable pdf

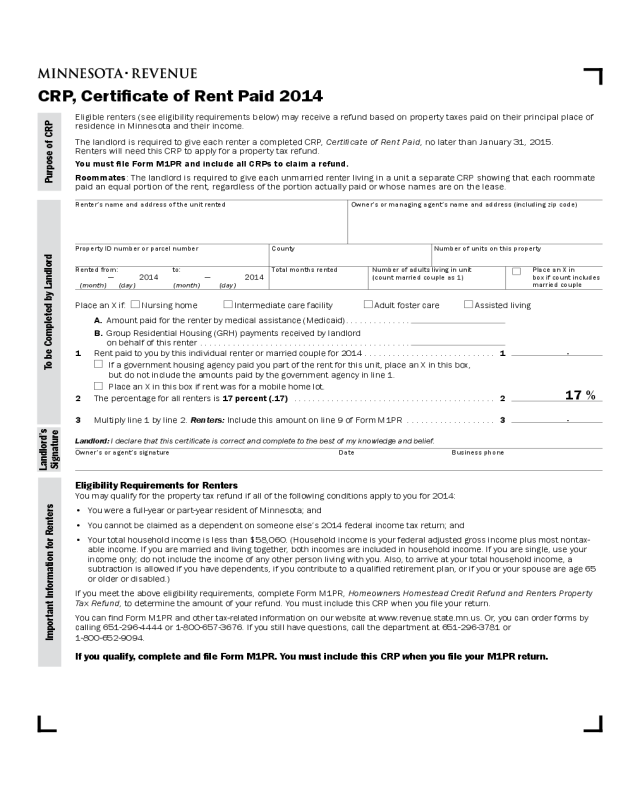

CRP, Certificate of Rent Paid 2014 Minnesota Edit, Fill, Sign

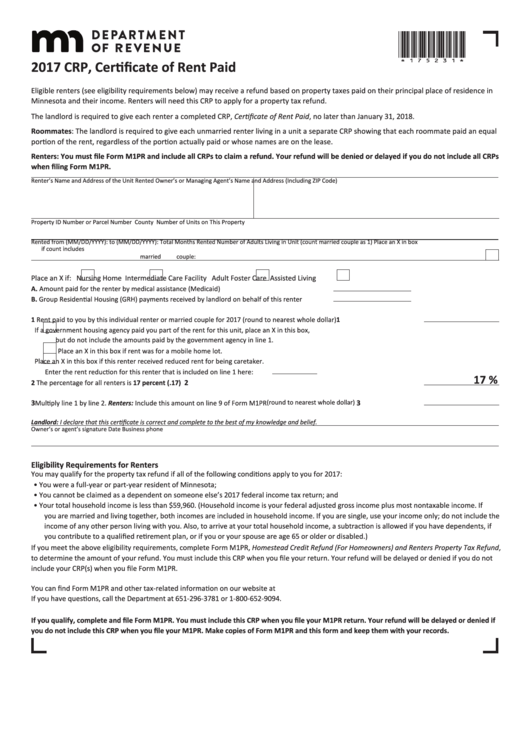

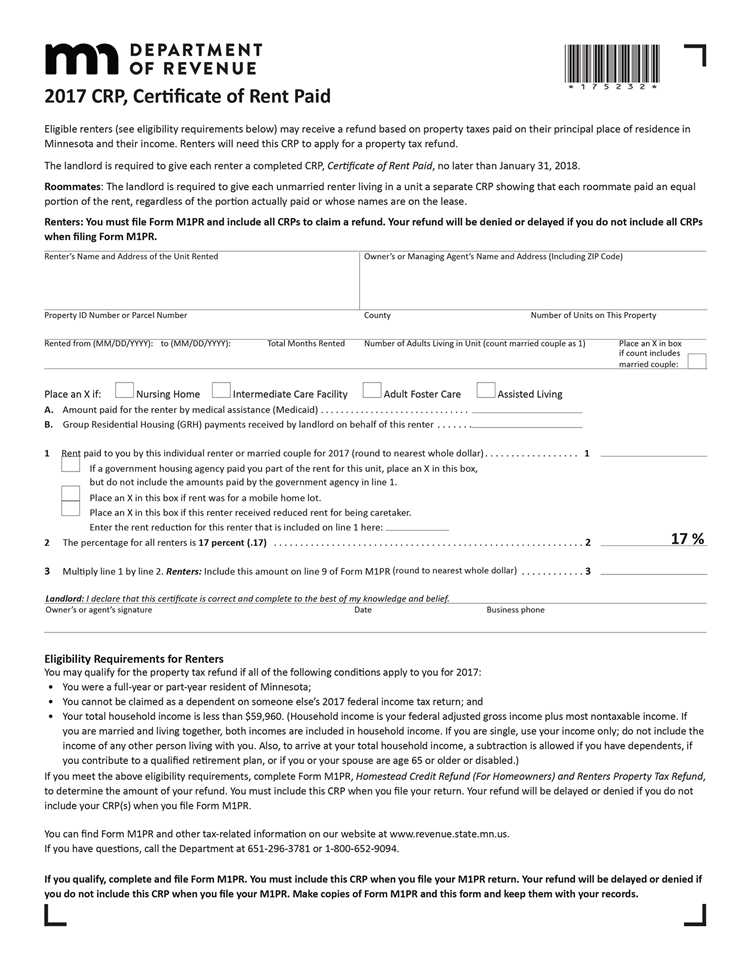

Fillable Form Crp Certificate Of Rent Paid 2017 printable pdf download

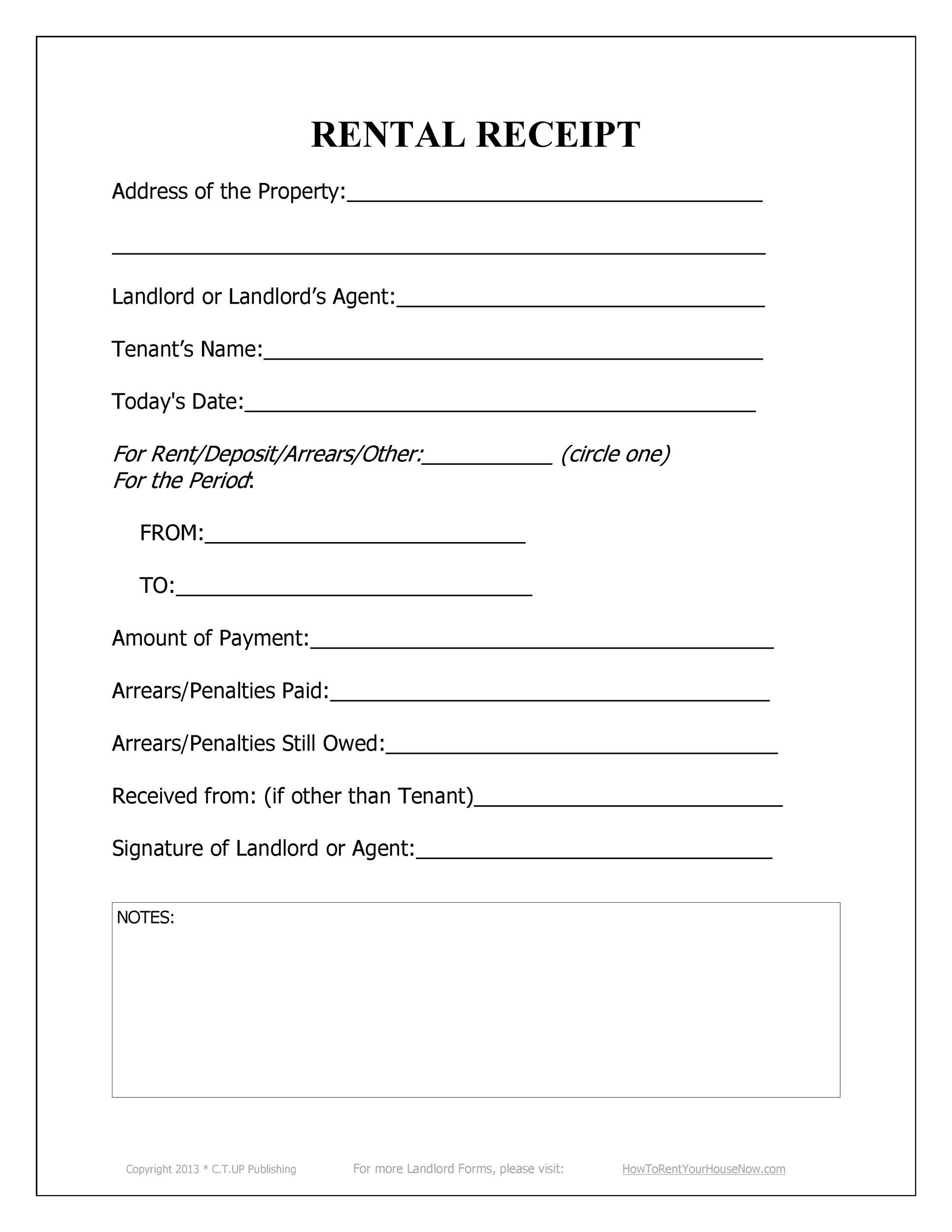

49 Printable Rent Receipts (Free Templates) ᐅ TemplateLab

Minnesota Certificate of Rent Paid (CRP) EZ Landlord Forms

Related Post: