Schedule 3 Form 1040

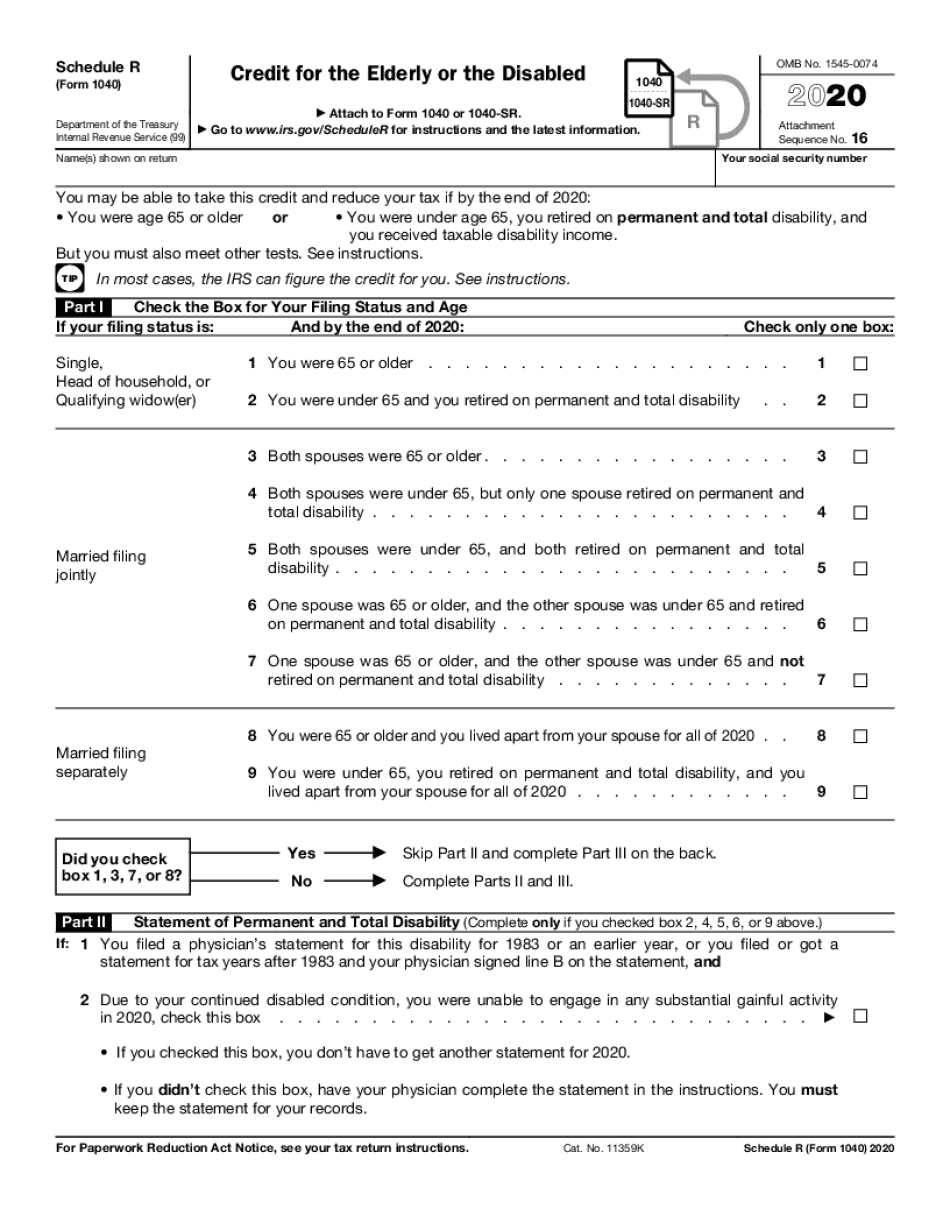

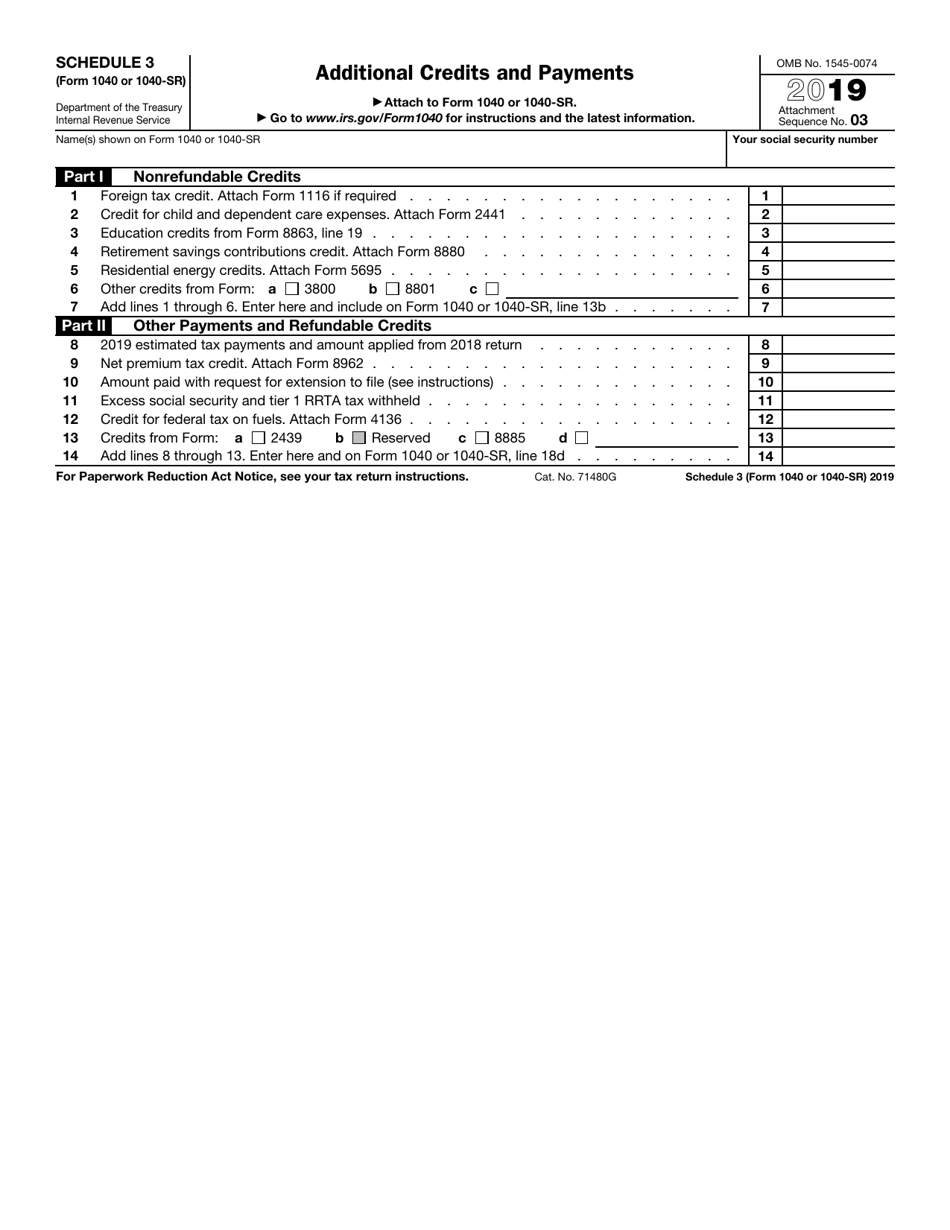

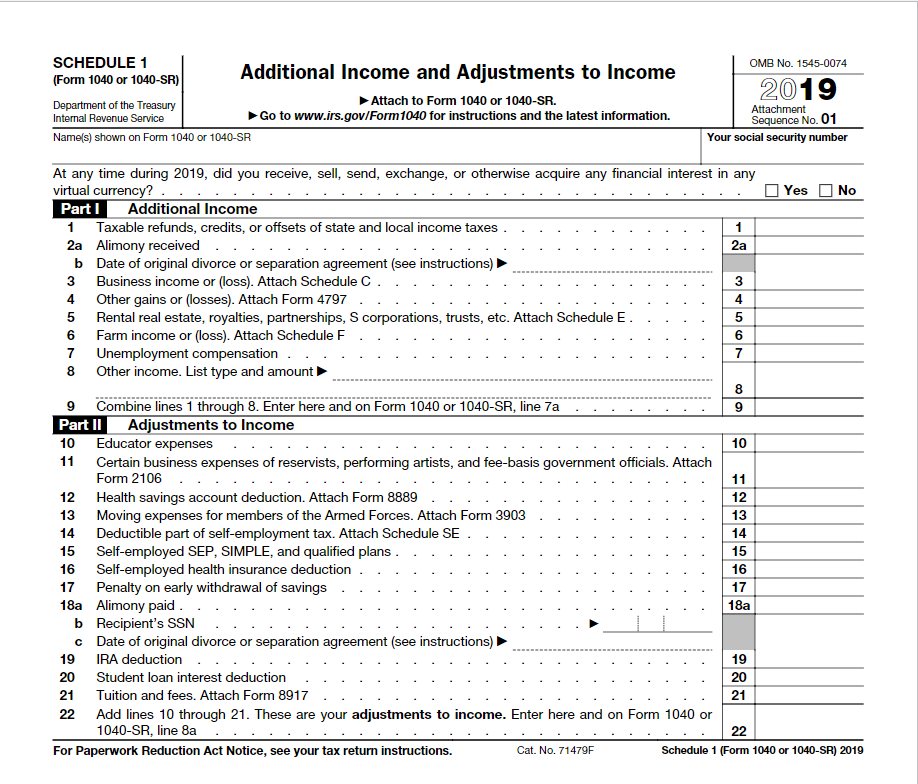

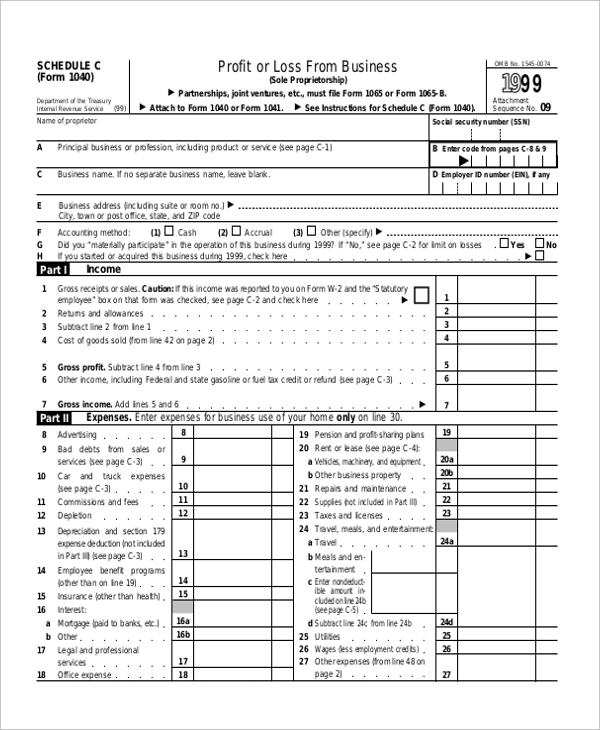

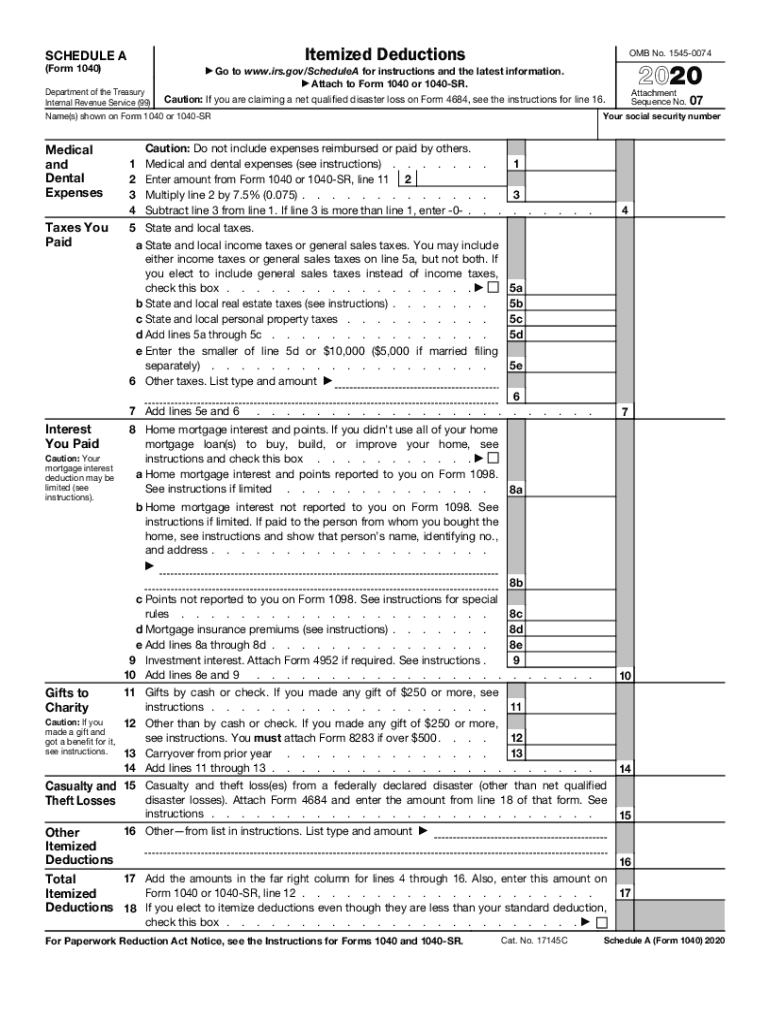

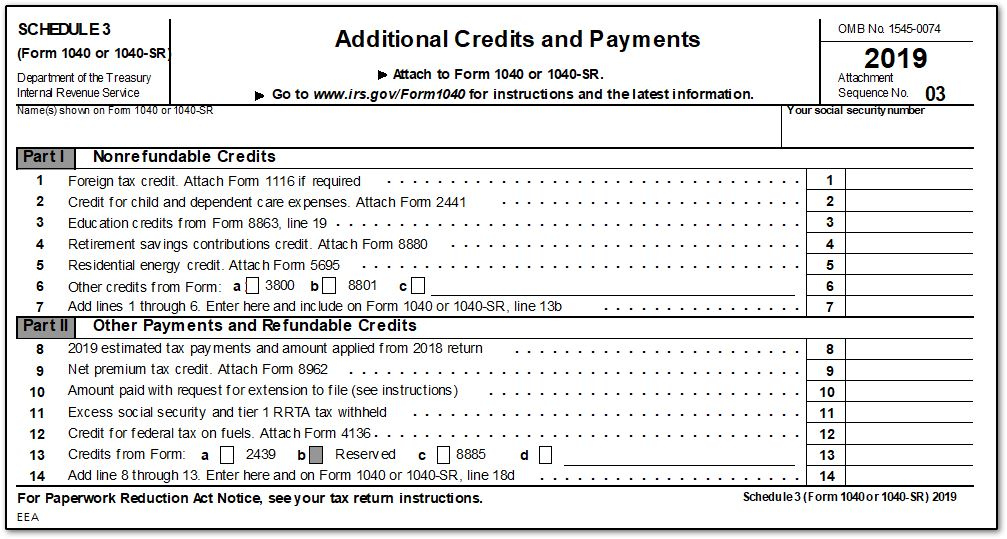

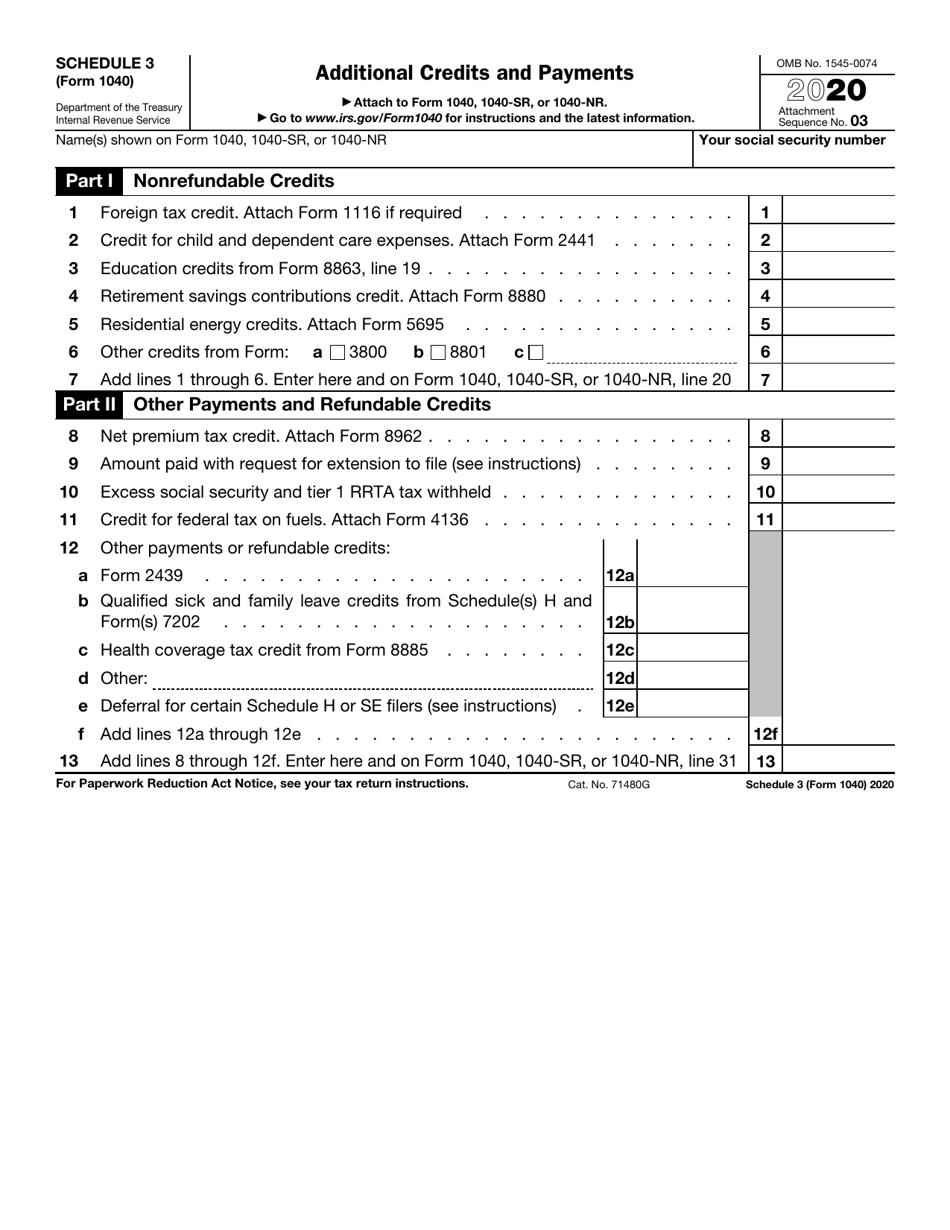

Schedule 3 Form 1040 - Web form 1040 is the standard u.s. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. You can take advantage of various nonrefundable and. Ad discover helpful information and resources on taxes from aarp. Ad get ready for tax season deadlines by completing any required tax forms today. Additional income and adjustments to income. Input from schedule d is entered. However, if your return is more complicated (for example, you. If the employer doesn't adjust the overcollection, you can file a claim for refund using form 843. Any interest or dividend income under that amount only needs. Individual tax return form 1040 instructions; Web form 1040 is the standard u.s. Figure this amount separately for you. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. Individual tax return form that taxpayers use to file their annual. Web based on the provided information, the explaination for schedule 1 and schedule 3 of form 1040 are as follows: Ad get ready for tax season deadlines by completing any required tax forms today. Individual tax return form that taxpayers use to file their annual income tax returns with the irs. And irs.gov/schedulea for schedule a (form 1040), for example,. Any interest or dividend income under that amount only needs. Web if you’ve made more than $1,500 in income from interest and dividends, you’ll report it on schedule b. Request for taxpayer identification number (tin) and. Additional income and adjustments to income. Web form 1040 schedule 3 holds invaluable information for taxpayers hoping to make the most of their tax. If the employer doesn't adjust the overcollection, you can file a claim for refund using form 843. Web the employer should adjust the tax for you. Individual tax return form that taxpayers use to file their annual income tax returns with the irs. Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service. Web schedule 2, part i schedule 3, part i schedule 2, part ii schedule 3, part ii. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Input from schedule d is entered. Web what is schedule 3 (form 1040)? Web form 1040 is the standard u.s. Web the employer should adjust the tax for you. Web based on the provided information, the explaination for schedule 1 and schedule 3 of form 1040 are as follows: Request for taxpayer identification number (tin) and. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Figure this amount separately for you. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web this course will help tax professionals navigate common questions they may receive about schedule c. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Web based on the provided information, the. Web schedule 2, part i schedule 3, part i schedule 2, part ii schedule 3, part ii. Web what is schedule 3 (form 1040)? Web this course will help tax professionals navigate common questions they may receive about schedule c. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Enter this amount. However, if your return is more complicated (for example, you. For 2022, you will use form 1040 or, if you were born before january 2,. Web the employer should adjust the tax for you. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Any interest or dividend income under that amount only. Web form 1040 schedule 3 holds invaluable information for taxpayers hoping to make the most of their tax credits. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Request for taxpayer identification number (tin) and. Complete, edit or print tax forms instantly. Web schedule 3 (form 1040) 2020 additional credits and. Web this course will help tax professionals navigate common questions they may receive about schedule c. Additional income and adjustments to income. If the employer doesn't adjust the overcollection, you can file a claim for refund using form 843. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web based on the provided information, the explaination for schedule 1 and schedule 3 of form 1040 are as follows: Enter this amount on schedule 1, line 5 of your form. Web schedule 2, part i schedule 3, part i schedule 2, part ii schedule 3, part ii. Web schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. Individual tax return form that taxpayers use to file their annual income tax returns with the irs. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. New line 13g added for the refundable. Additional credits and payments irs schedule 3 covers nonrefundable credits (such as the foreign tax credit and the credit for child and. Web form 1040 schedule 3 holds invaluable information for taxpayers hoping to make the most of their tax credits. Web schedule 3 (form 1040) 2020 additional credits and payments department of the treasury internal revenue service. Request for taxpayer identification number (tin) and. How to fill out irs. Individual tax return form 1040 instructions; Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Ad discover helpful information and resources on taxes from aarp.Free Printable 1040a Tax Form Printable Templates

IRS Form 1040 (1040SR) Schedule 3 Download Fillable PDF or Fill Online

Irs 1040 Form Schedule 1 IRS Form 1040 Schedule 3 Download Fillable

Irs 1040 Form 2020 Pdf 1040ez Form Fill Out And Sign Printable Pdf

Irs Schedule A Fill Out and Sign Printable PDF Template signNow

1040 Schedule 3 Form 2441 1040 Form Printable

2019 Schedule Example Student Financial Aid

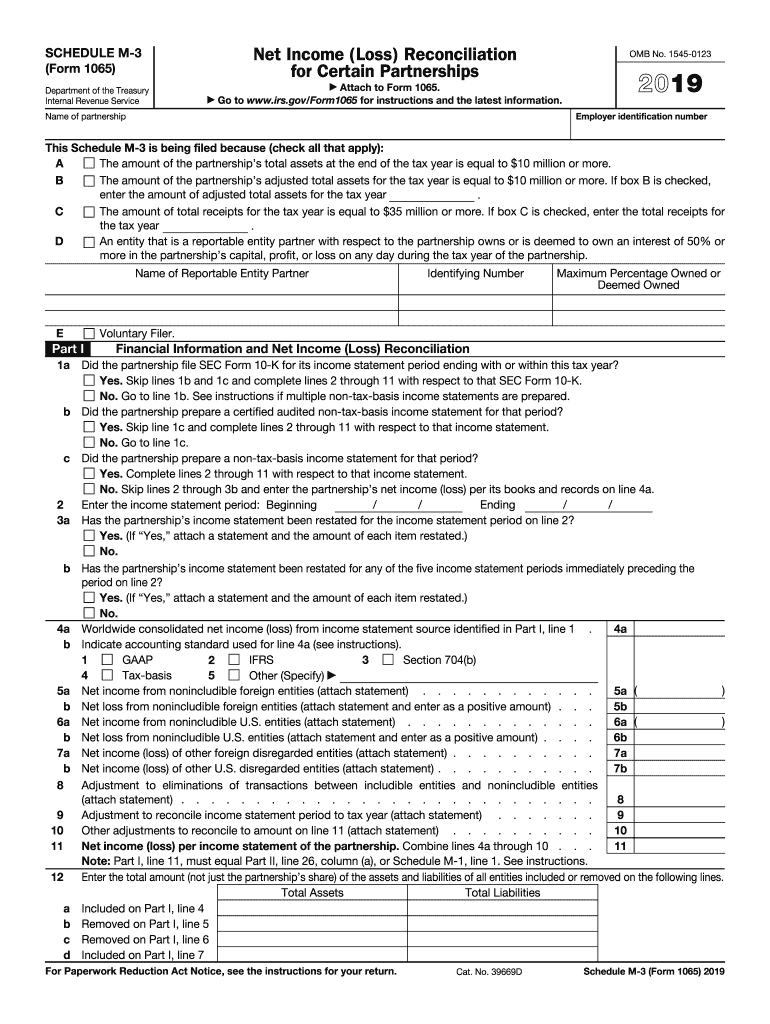

1065 3 Form Fill Out and Sign Printable PDF Template signNow

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

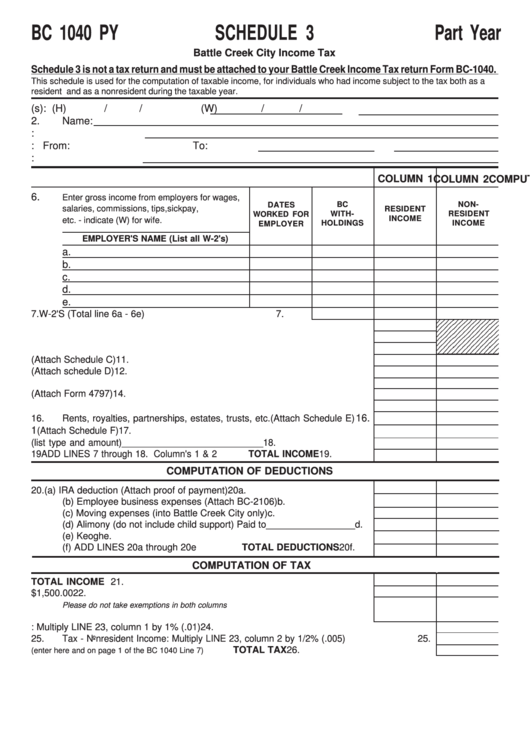

Form Bc 1040 Py Schedule 3 Battle Creek City Tax printable

Related Post: