Form 3804-Cr

Form 3804-Cr - Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. When will the elective tax expire? Attach to your california tax return. Address 1 address 2 (optional) city state. Ssn or itin fein part i elective tax credit amount. I figured out how to delete the. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Attach form 4684 to your tax. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. The pte elective tax credit will. Attach form 4684 to your tax. Ssn or itin fein part i elective tax credit amount. If reporting a qualified disaster loss, see the instructions for special rules that apply. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Address 1 address 2 (optional) city state. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. If reporting a qualified disaster loss, see the instructions for special rules that apply. Attach form 4684 to your tax. I figured out how to delete the. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Name(s) as shown on your california tax return. If reporting a qualified disaster loss, see the instructions for special rules that apply. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. I figured out how to delete the. In addition to entering the current year credit. Web use form ftb 3804 to report the elective tax. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. If reporting a qualified disaster loss, see the instructions for special rules that apply. The pte elective tax credit will. I figured out how to delete the. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net. If reporting a qualified disaster loss, see the instructions for special rules that apply. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. I figured out how to delete the. Attach to your california tax return. Name(s) as shown on your california tax return. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Attach to your california tax return. In addition to entering the current year credit. Ssn or itin fein part i elective tax credit amount. I figured out how to delete the. When will the elective tax expire? Attach to your california tax return. Attach form 4684 to your tax. In addition to entering the current year credit. When will the elective tax expire? Attach to your california tax return. I figured out how to delete the. Attach form 4684 to your tax. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Address 1 address 2 (optional) city state. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Name(s) as shown on your california tax return. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. When will the elective tax expire? Attach form 4684 to your tax. Attach to your california tax return. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. I figured out how to delete the. The pte elective tax credit will. Address 1 address 2 (optional) city state. When will the elective tax expire? Form ftb 3804 also includes a schedule of qualified taxpayers that requires. If reporting a qualified disaster loss, see the instructions for special rules that apply. Name(s) as shown on your california tax return. Ssn or itin fein part i elective tax credit amount. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. In addition to entering the current year credit.CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

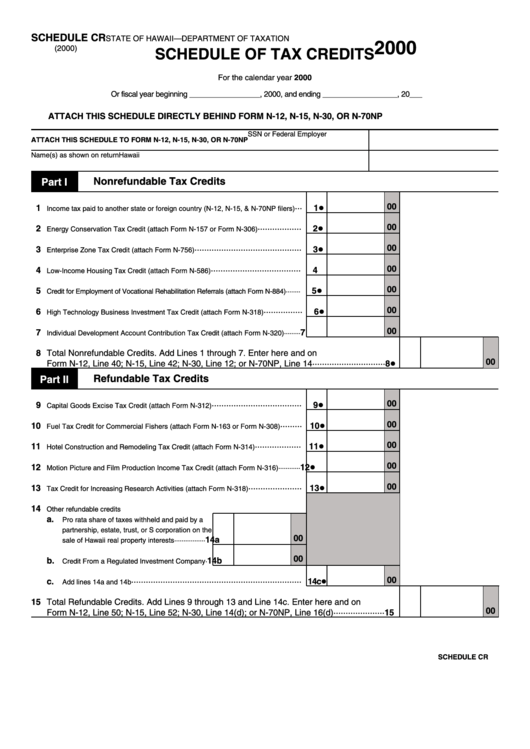

Schedule Cr Schedule Of Tax Credits 2000 printable pdf download

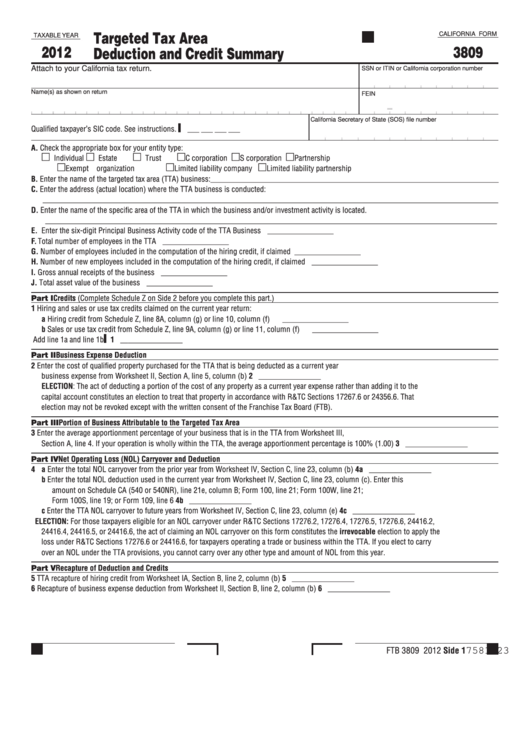

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

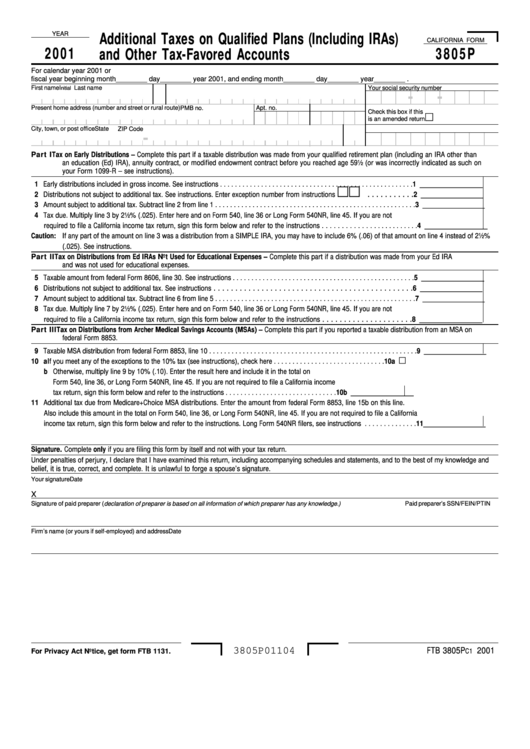

California Form 3805p Additional Taxes On Qualified Plans (Including

Cr 186 Form Fill Online, Printable, Fillable, Blank pdfFiller

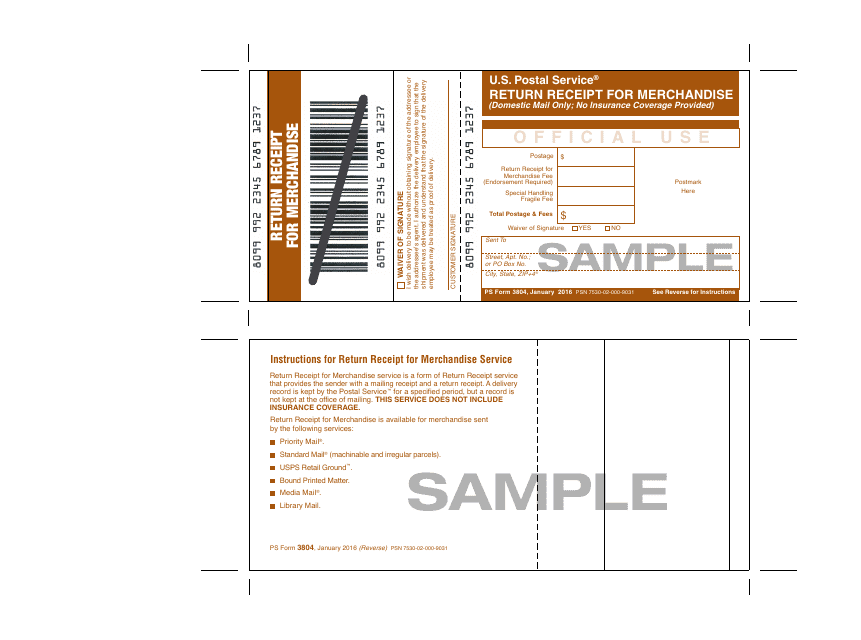

Sample PS Form 3804 Download Printable PDF or Fill Online Return

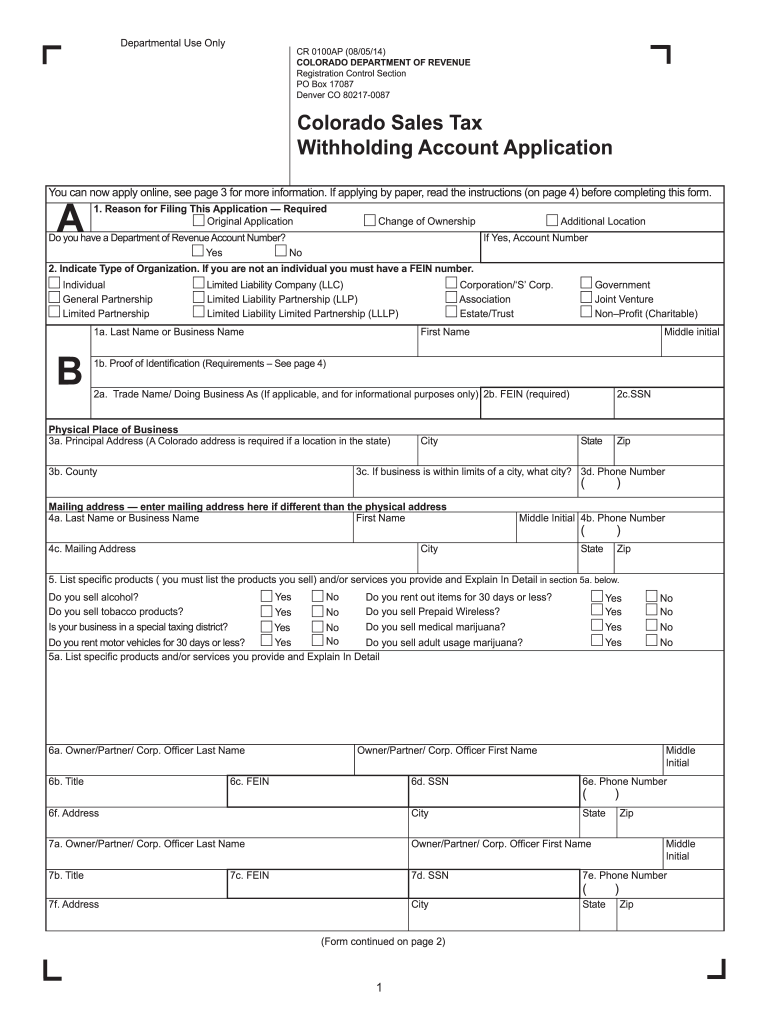

Cr 0100ap Form Fill Out and Sign Printable PDF Template signNow

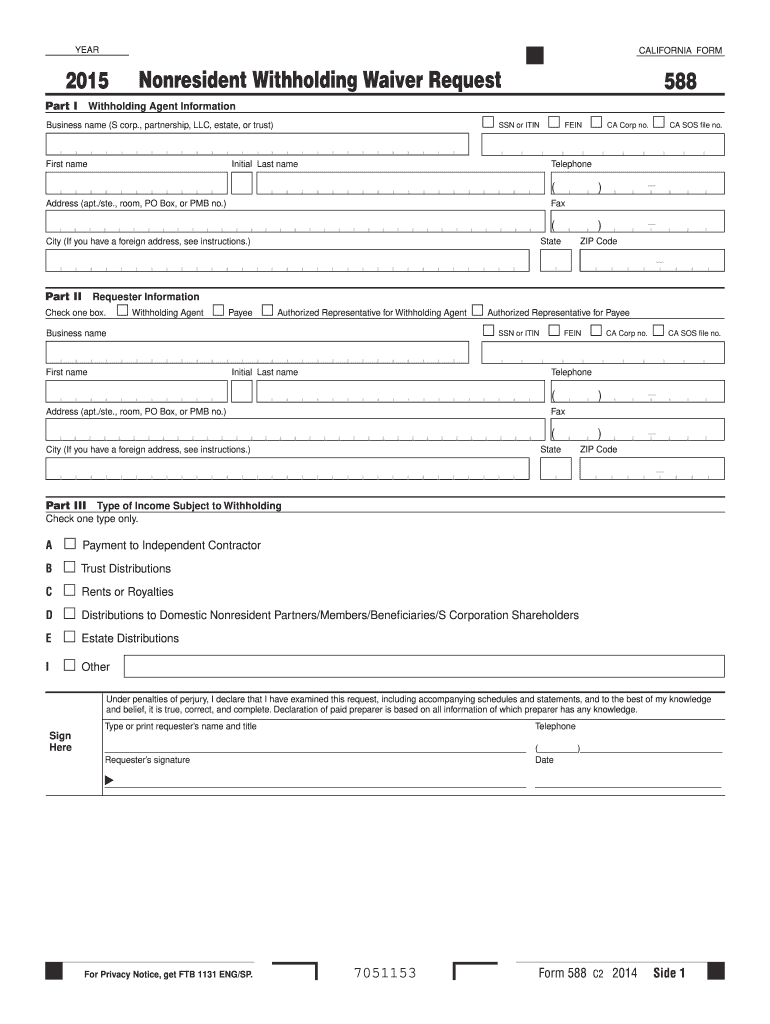

Form 588 California Franchise Tax Board Fill out & sign online DocHub

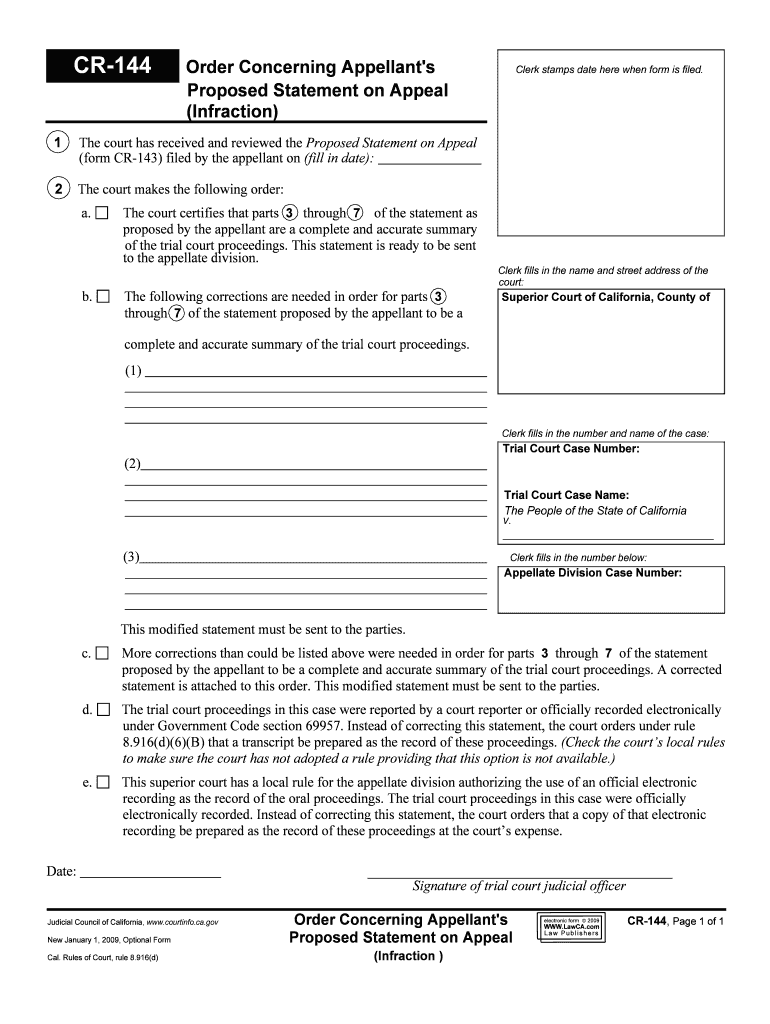

CR 144 Order Concerning Appellant's Proposed Statement on Form Fill

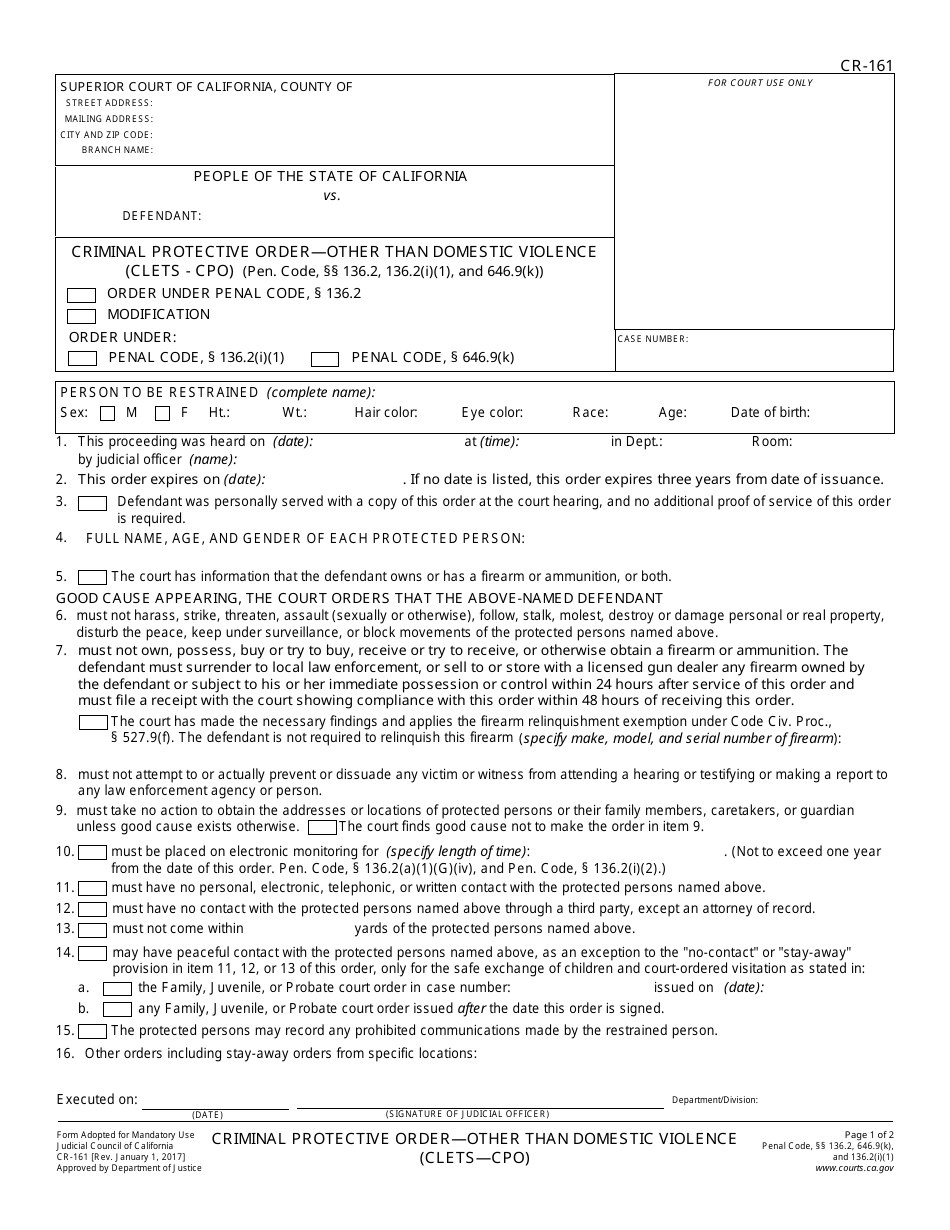

Form CR161 Fill Out, Sign Online and Download Fillable PDF

Related Post: