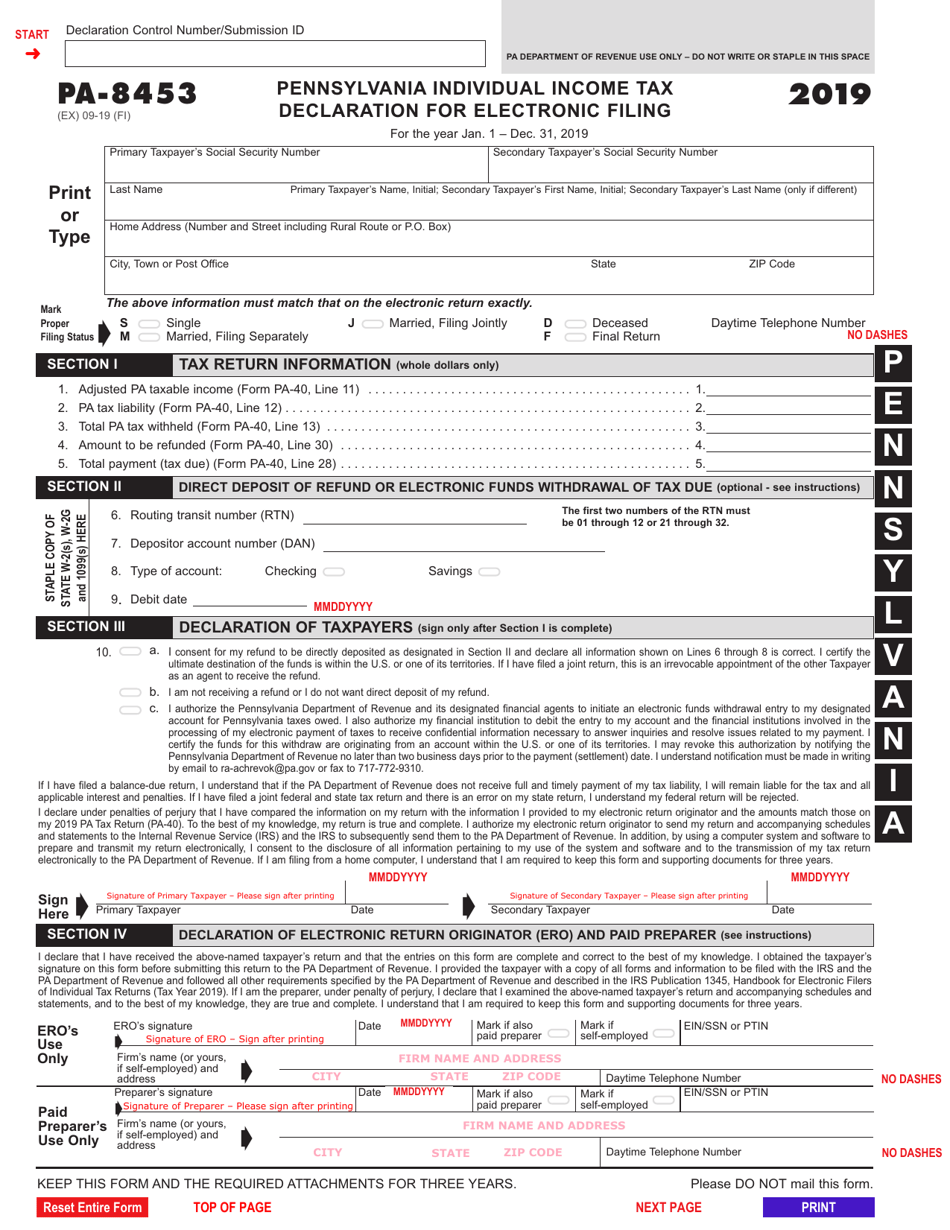

Pa 8453 Form

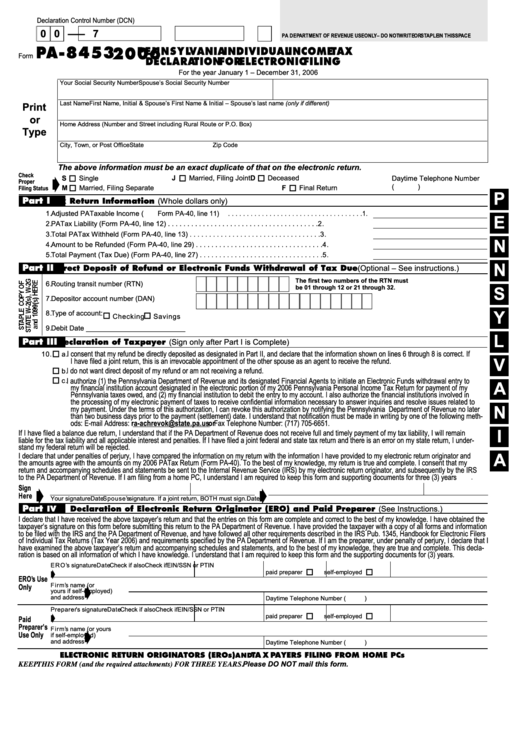

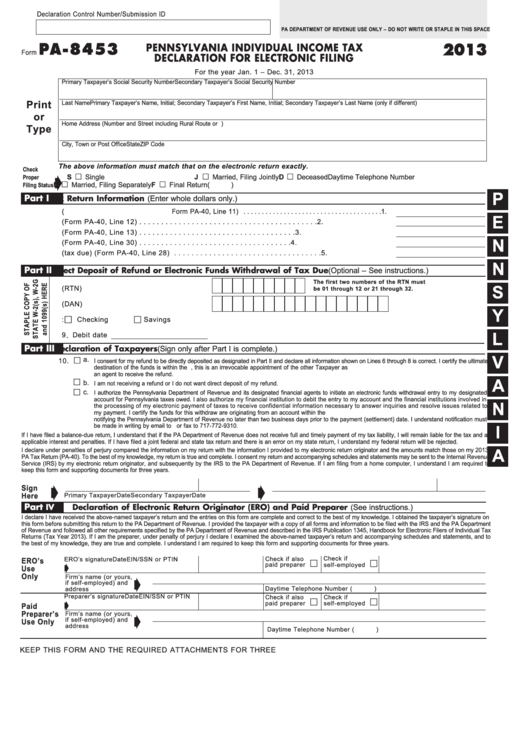

Pa 8453 Form - Web 1 best answer. This form is for income earned in tax year 2022, with tax. Web taxpayers must make the documents available to the pa department of revenue upon request. Yes, you can sign the form and just keep it with your tax records for three years. If the ero makes changes to the electronic return after the. Do i need to file form 8453? Easily fill out pdf blank, edit, and sign them. The ero must provide the estate or trust fiduciary with a copy of this form. It does not need to be sent in to the. Web individual pennsylvania paperless electronic filing frequently asked questions in lacerte solved • by intuit • updated june 20, 2023 use the. It does not need to be sent in to the. Web 1 best answer. Do i need to file form 8453? This form is for income earned in tax year 2022, with tax. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax. What is use form 8453 us individual income tax transmittal? It does not need to be sent in to the. Web what is a pa 8453 form? The ero must provide the estate or trust fiduciary with a copy of this form. 03 export or print immediately. Go to www.irs.gov/form8453 for the. Easily fill out pdf blank, edit, and sign them. It does not need to be sent in to the. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. What is use form 8453 us individual income tax transmittal? Do i need to file form 8453? Web what is a pa 8453 form? Yes, you can sign the form and just keep it with your tax records for three years. Save or instantly send your ready documents. Go to www.irs.gov/form8453 for the. Web 1 best answer. Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web you do not actually send the form to pa or anywhere. Web 1 best answer. Easily fill out pdf blank, edit, and sign them. Web 01 fill and edit template. Save or instantly send your ready documents. It does not need to be sent in to the. Save or instantly send your ready documents. Web form 8453 is used solely to transmit the forms listed on the front of the form. 03 export or print immediately. Yes, you can sign the form and just keep it with your tax records for three years. What is use form 8453 us individual income tax transmittal? This form is for income earned in tax year 2022, with tax. Yes, you can sign the form and just keep it with your tax records for three years. Web what is a pa 8453 form? Do i need to file form 8453? Web individual pennsylvania paperless electronic filing frequently asked questions in lacerte solved • by intuit • updated june 20, 2023 use the. Web form 8453 is used solely to transmit the forms listed on the front of the form. Do i have to pay local taxes if i work out of state?. For calendar year 2021 or tax year beginning,. What is use form 8453 us individual income tax transmittal? Easily fill out pdf blank, edit, and sign them. Web 1 best answer. The ero must provide the estate or trust fiduciary with a copy of this form. Web what is a pa 8453 form? This form is for income earned in tax year 2022, with tax. Web taxpayers must make the documents available to the pa department of revenue upon request. It does not need to be sent in to the. Web 01 fill and edit template. Web what is a pa 8453 form? What is use form 8453 us individual income tax transmittal? Web 1 best answer. Save or instantly send your ready documents. Do i need to file form 8453? Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. The ero must provide the estate or trust fiduciary with a copy of this form. If the ero makes changes to the electronic return after the. Easily fill out pdf blank, edit, and sign them. Do i have to pay local taxes if i work out of state?. Web you do not actually send the form to pa or anywhere. For calendar year 2021 or tax year beginning, 2021, ending, 20_____. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. After your return has been accepted, the form should be in your pdf file of the return if you want to download it. Web individual pennsylvania paperless electronic filing frequently asked questions in lacerte solved • by intuit • updated june 20, 2023 use the.Form PA8453 Download Fillable PDF or Fill Online Pennsylvania

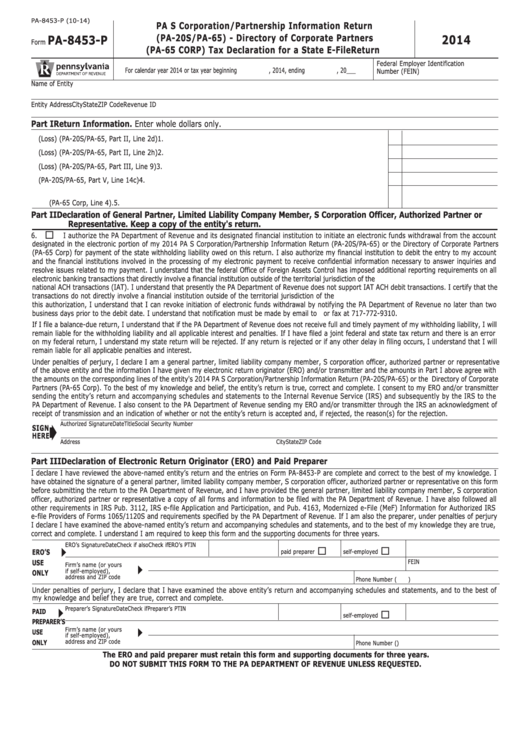

PA8453C 2015 PA Corporation Tax Declaration for a State EFile

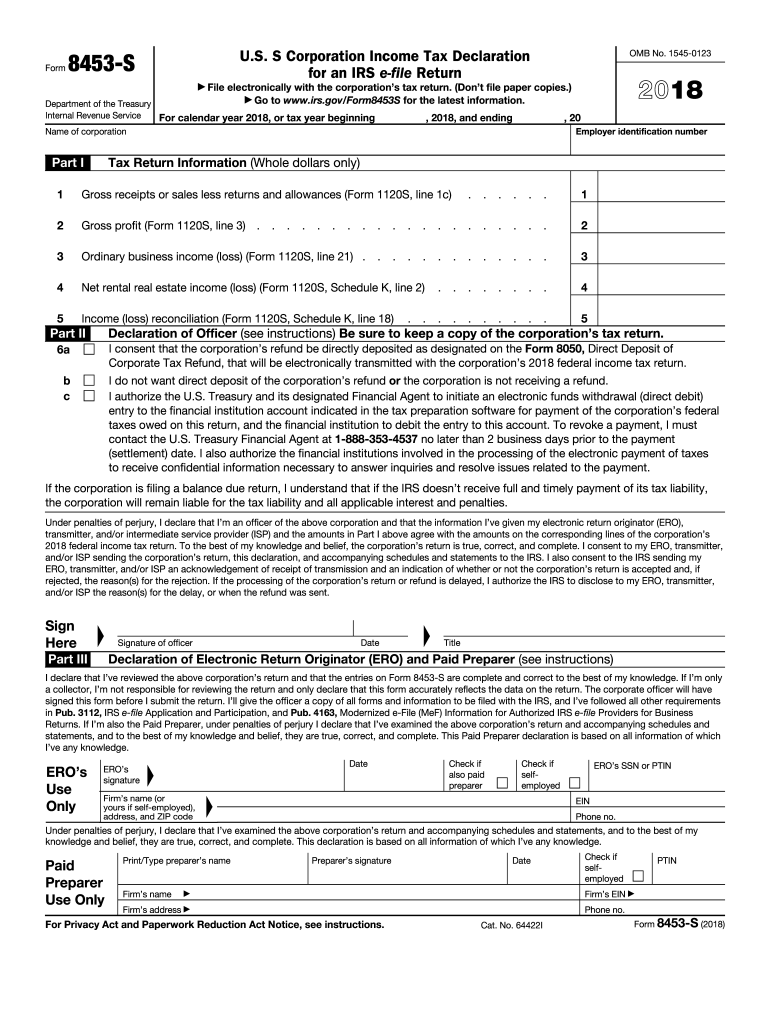

Form 8453 S Fill Out and Sign Printable PDF Template signNow

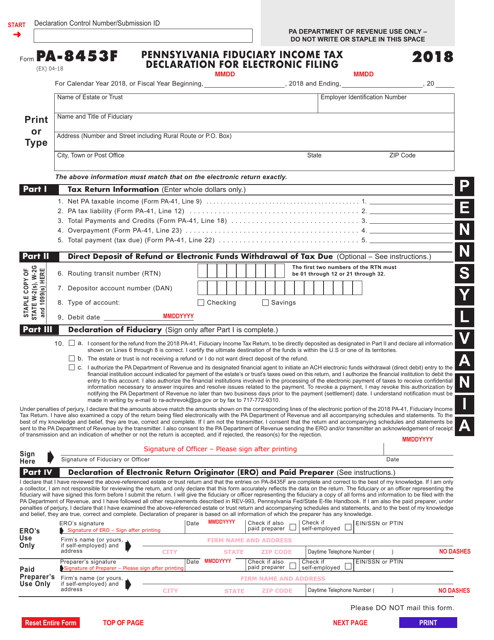

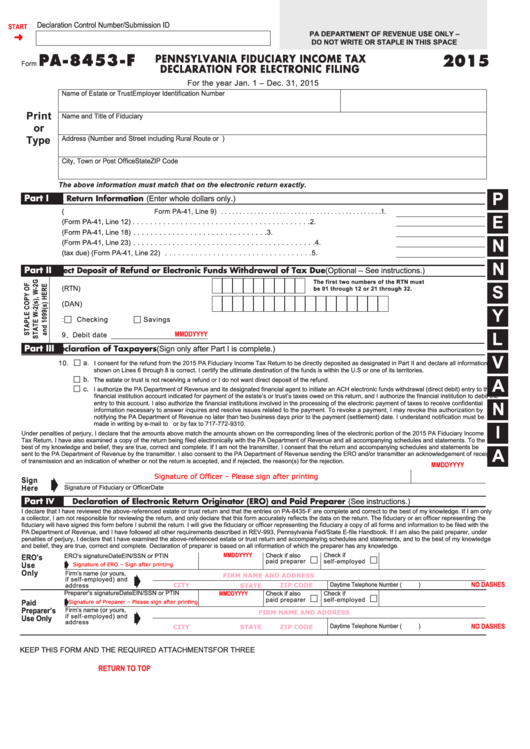

Form PA8453F 2018 Fill Out, Sign Online and Download Fillable PDF

Form Pa8453P Pa S Corporation/partnership Information Return 2014

IRS 8453S 2020 Fill out Tax Template Online US Legal Forms

Fillable Form Pa8453F Pennsylvania Fiduciary Tax Declaration

PA8453C 2014 PA Corporation Tax Declaration for a State EFile

Form Pa 8453 Pennsylvania Individual Tax Declaration For

Form Pa8453 Pennsylvania Individual Tax Declaration For

Related Post: