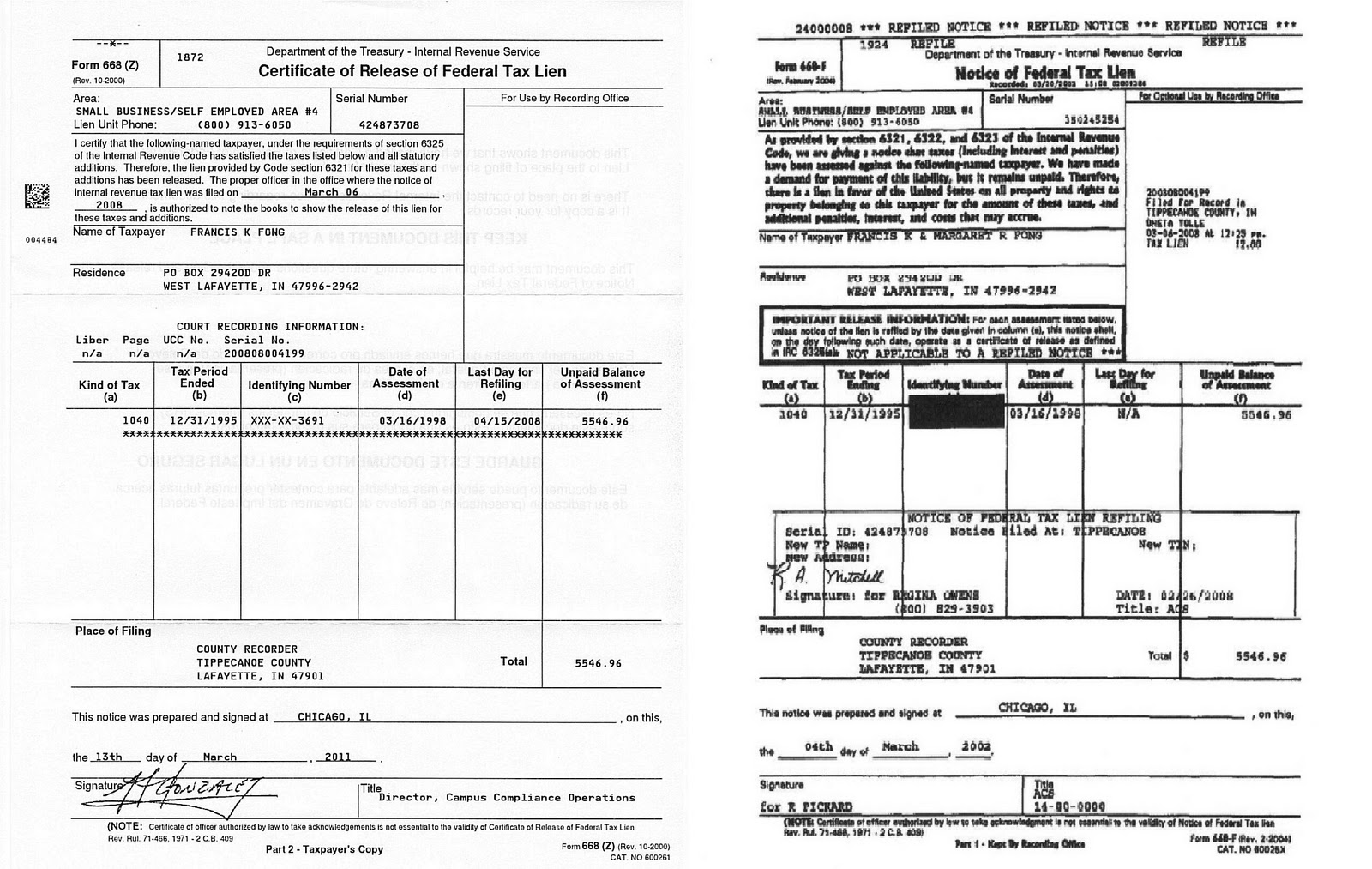

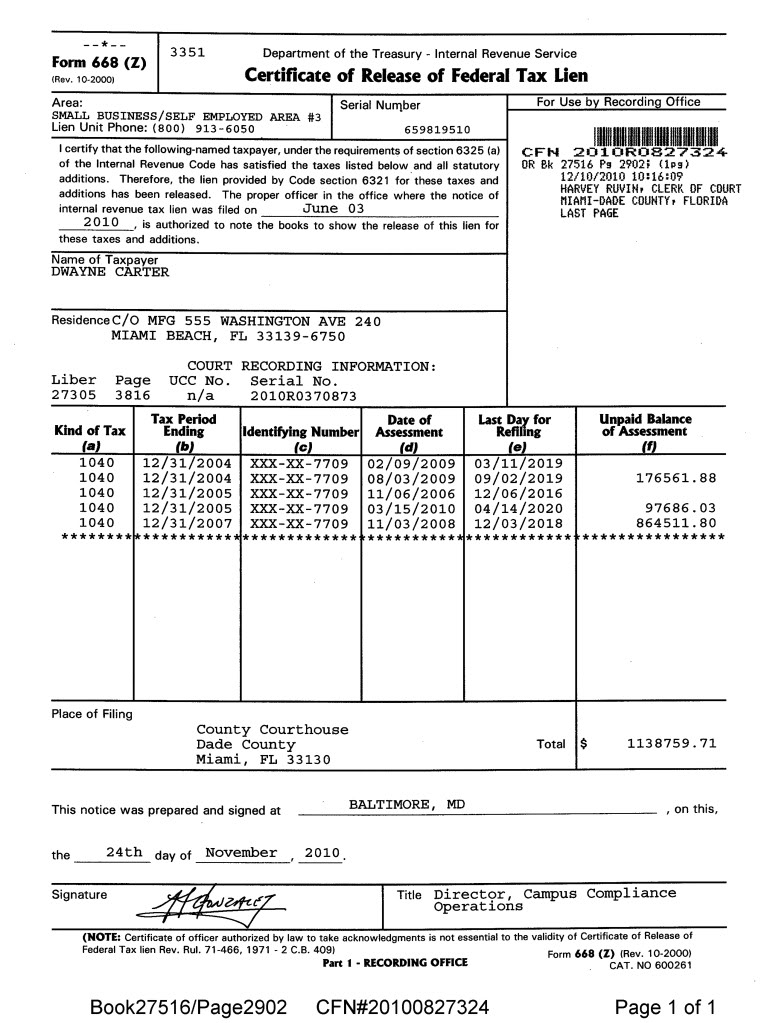

Certificate Of Release Of Federal Tax Lien Form 668 Z

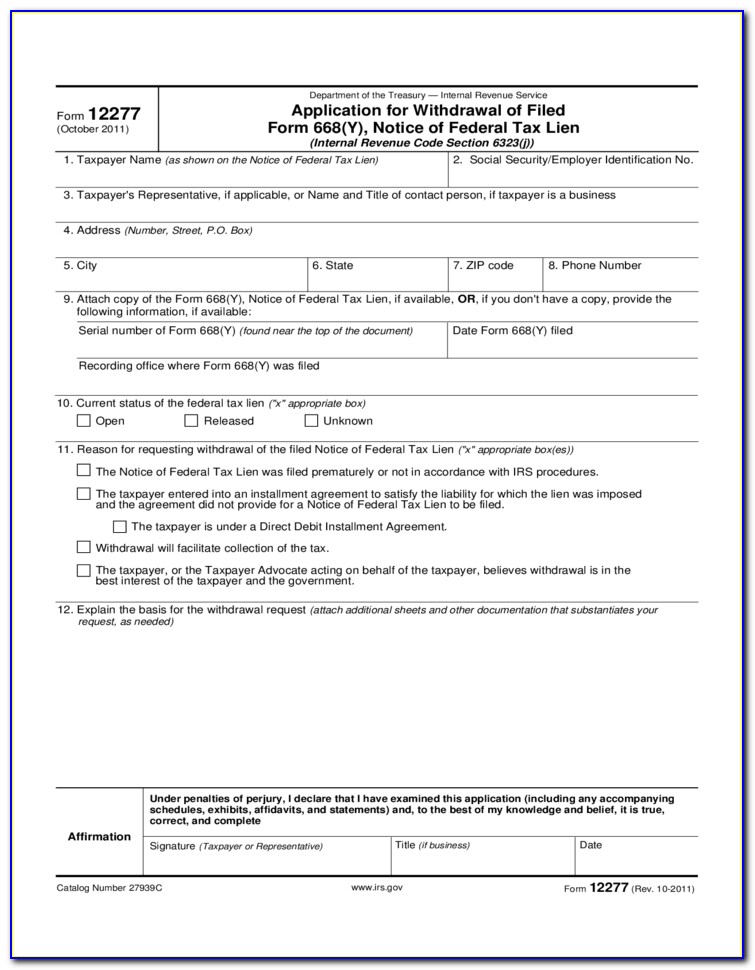

Certificate Of Release Of Federal Tax Lien Form 668 Z - To obtain this release, the. Get your online template and fill it in using progressive features. Web and irs will “release” the lien once you have paid the borrowed in full — either in a clots sum or over time, or once the irs belongs no longer legally able for collect the debt. Web the irs must issue a certificate of release within 30 days after the liability is satisfied or no longer enforceable, or when a bond payment is accepted. Web payment in full with cash or certified funds. Web if the internal revenue service (irs) has placed a tax lien on your property, once you've satisfied the debt, the irs should notify you that the lien has been removed. Web attach to all property you acquire in the future. The full amount, including penalties and interest, is paid, irs accepts a bond guaranteeing. Web topic instructions, forms, or additional information* office to contact general question about a notice of federal tax lien irs website: The request must be in. To obtain this release, the. I'm trying to find out more about form 668z. Get ready for tax season deadlines by completing any required tax forms today. Web the irs is required to issue and record a “certificate of release of federal tax lien” (irs form 668(z)) within 30 days after full payment by a taxpayer (including. The request must. Certificate of release of federal tax lien section 6325 (a) of the internal revenue code enables us to negotiate for a release of federal tax lien after a liability. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release. The request must be in. It may damage your. Issuance of a release of federal tax lien (irs form 668 [z]) which indicates a complete satisfaction of the entire debt secured by the lien. The notice of federal tax lien is a public record. Web attach to all property you acquire in the future. Background a revision of the irm 5.12 chapter has been. Web the irs is required. Web if the internal revenue service (irs) has placed a tax lien on your property, once you've satisfied the debt, the irs should notify you that the lien has been removed. Issuance of a release of federal tax lien (irs form 668 [z]) which indicates a complete satisfaction of the entire debt secured by the lien. The notice of federal. Web how to fill out and sign certificate of release of federal tax lien form 668 z online? Ad download or email irs 668(z) & more fillable forms, register and subscribe now! Web attach to all property you acquire in the future. Web up to $9 cash back hi. Web if the internal revenue service (irs) has placed a tax. Web the irs is required to issue and record a “certificate of release of federal tax lien” (irs form 668(z)) within 30 days after full payment by a taxpayer (including. Get ready for tax season deadlines by completing any required tax forms today. Web how to fill out and sign certificate of release of federal tax lien form 668 z. Understanding a federal tax lien. Web what does certificate of release of federal tax lien mean? Certificate of release of federal tax lien section 6325 (a) of the internal revenue code enables us to negotiate for a release of federal tax lien after a liability. I received a certificate of release for taxes owed, but when i filed my taxes. The release of a federal tax lien for a particular year is an indication that the irs considers the debt for that years'. Ad download or email irs 668(z) & more fillable forms, register and subscribe now! Web and irs will “release” the lien once you have paid the borrowed in full — either in a clots sum or over. Web attach to all property you acquire in the future. Web how to fill out and sign certificate of release of federal tax lien form 668 z online? Web and irs will “release” the lien once you have paid the borrowed in full — either in a clots sum or over time, or once the irs belongs no longer legally. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release. To obtain this release, the. Web prepare form 668(z), certificate of release of federal tax lien, in accordance with irm 5.12.3.4.2, manually preparing a certificate of release. Web what does certificate of release of federal tax lien mean?. Get ready for tax season deadlines by completing any required tax forms today. I received a certificate of release for taxes owed, but when i filed my taxes for this year my. Understanding a federal tax lien. Issuance of a release of federal tax lien (irs form 668 [z]) which indicates a complete satisfaction of the entire debt secured by the lien. It may damage your credit rating or make it difficult for you to get credit (such as. Web attach to all property you acquire in the future. If someone gets one of these notices,. Web and irs will “release” the lien once you have paid the borrowed in full — either in a clots sum or over time, or once the irs belongs no longer legally able for collect the debt. The full amount, including penalties and interest, is paid, irs accepts a bond guaranteeing. Web topic instructions, forms, or additional information* office to contact general question about a notice of federal tax lien irs website: Web up to $9 cash back hi. The request must be in. Web the irs must issue a certificate of release within 30 days after the liability is satisfied or no longer enforceable, or when a bond payment is accepted. Web what does certificate of release of federal tax lien mean? Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release. Web october 14, 2013 purpose (1) this transmits the new irm 5.12.8, federal tax liens, notice of lien refiling. I'm trying to find out more about form 668z. Ad download or email irs 668(z) & more fillable forms, register and subscribe now! Web if the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. The notice of federal tax lien is a public record.LETTER and NOTICE to France A. Cordova Treasury's Certificate

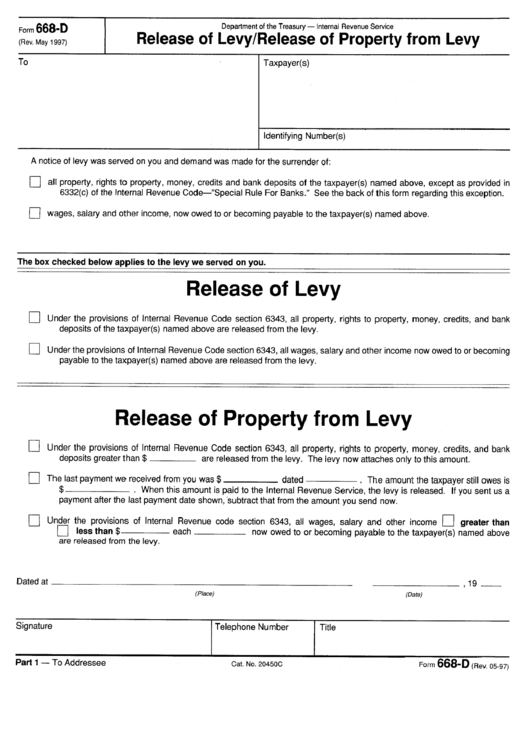

Form 668D Release Of Levy/release Of Property From Levy Department

What is IRS Form 668 Z? Global Gate IRS Tax Relief

Form 668(a) Notice Of Federal Tax Lien Form Resume Examples xg5bG7VOlY

IRS Notice Federal Tax Lien Colonial Tax Consultants

What are the Options For Dealing With an IRS Tax Lien? I Owe the IRS

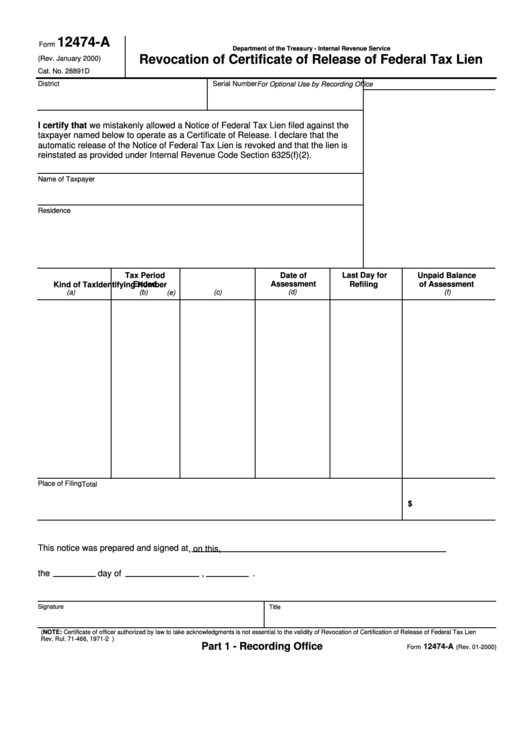

Fillable Form 12474A Revocation Of Certificate Of Release Of Federal

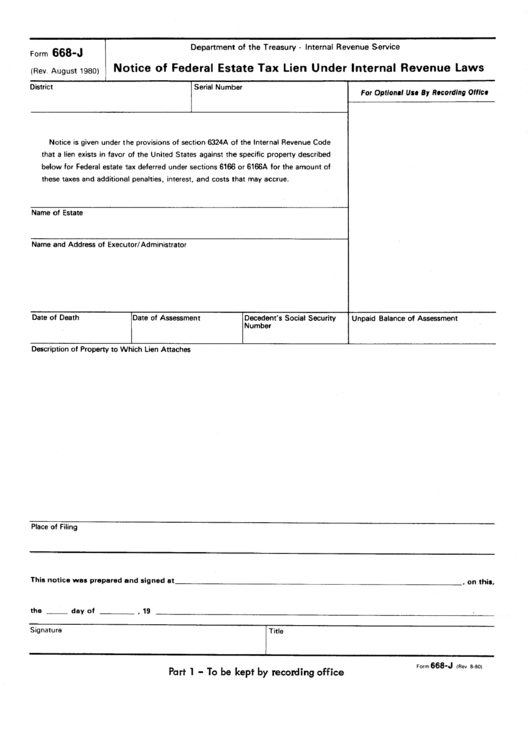

Form 668J Notice Of Federal Estate Tax Lien Under Internal Revenue

How To Get Form 668 Fill and Sign Printable Template Online US

The Tax Times Procedures for Withdrawals and Releases of Notices of

Related Post: