Business Name Change Irs Form

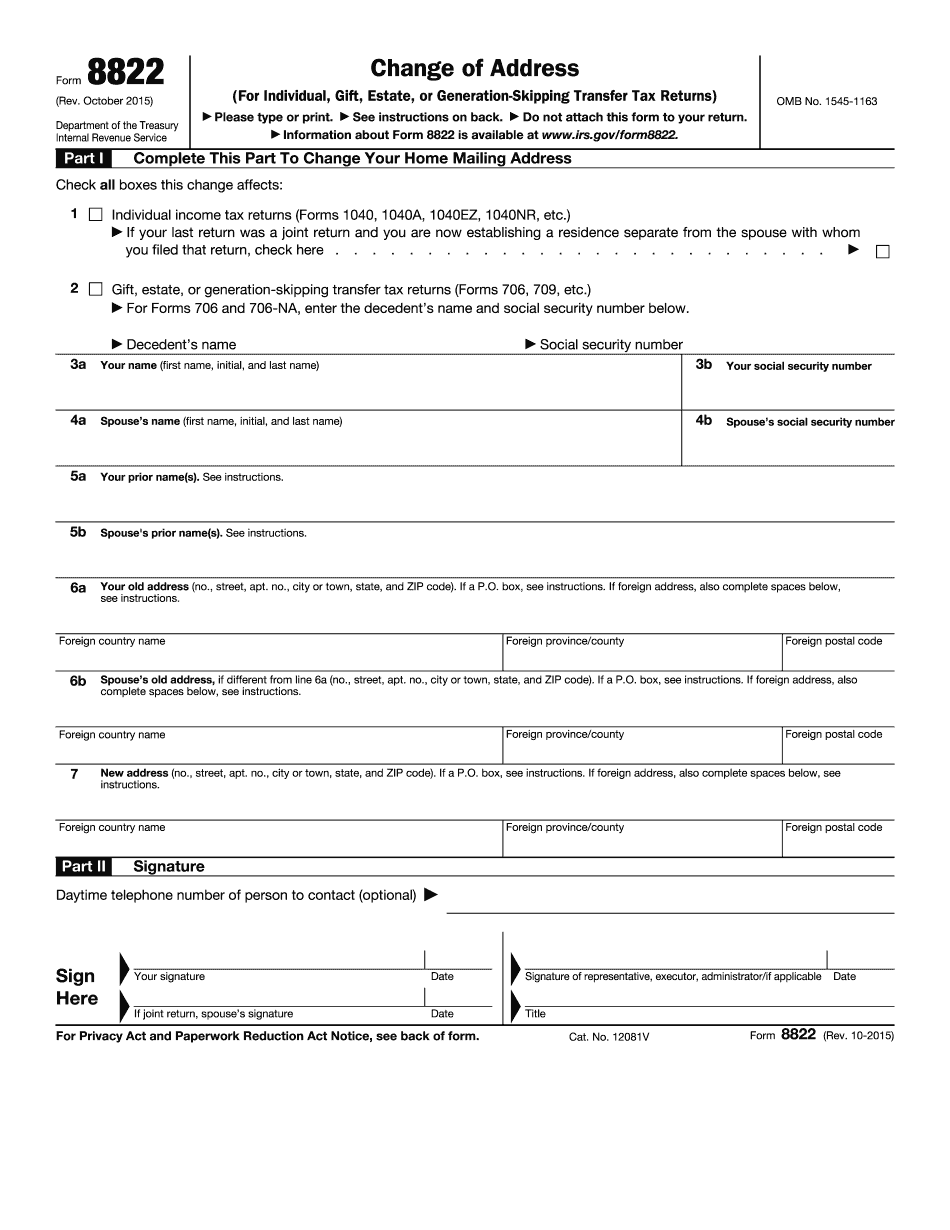

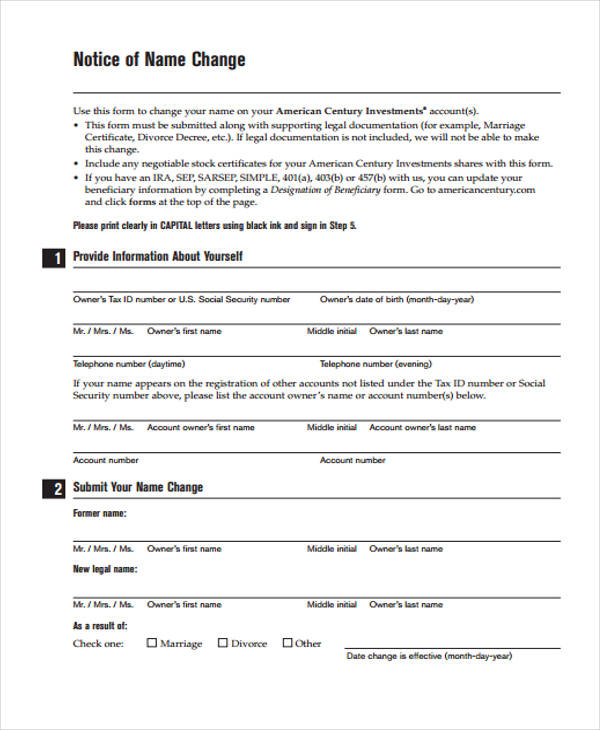

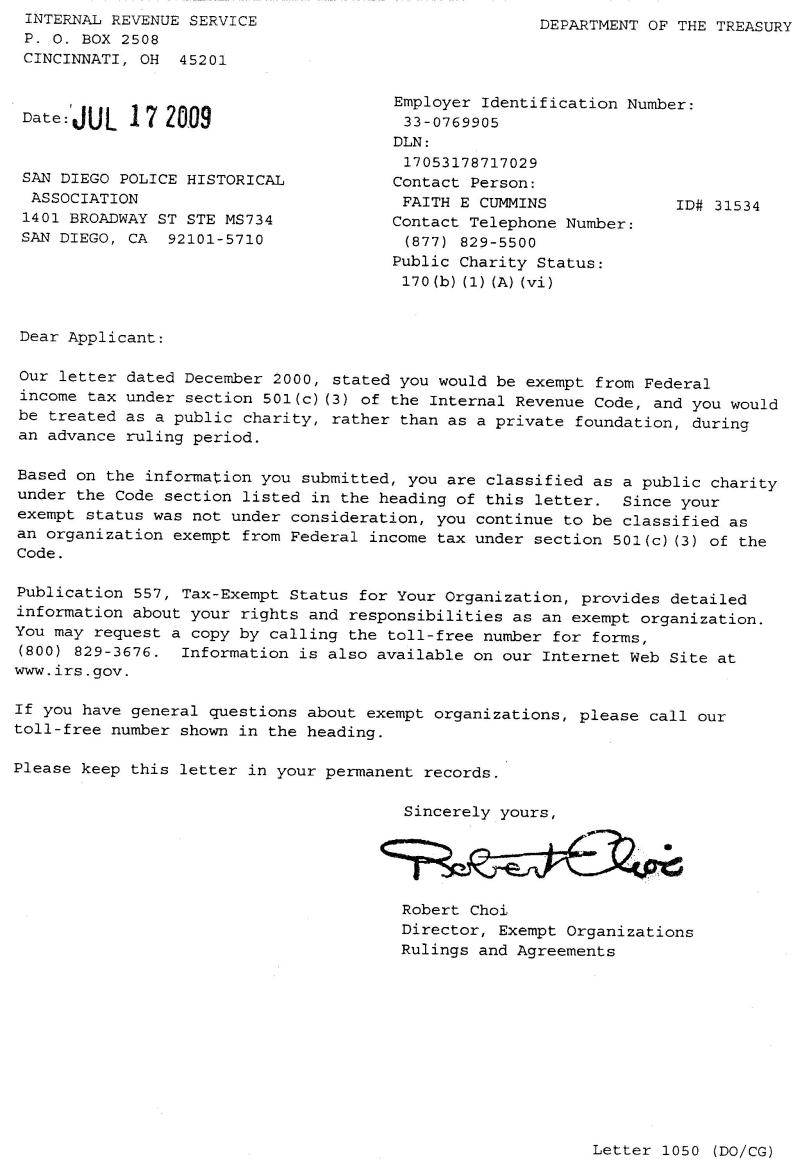

Business Name Change Irs Form - It should include a copy of the certificate of amendment filed with the state of delaware that is the. Web when you change your business name, you generally do not have to file for a new ein. Instead, you submit an ein name change. How do i notify the irs of a name change. Web filing a certificate of amendment with the secretary of state office. The specific action required may vary depending on the type of business. Web change of address or responsible party — business. Ad make office life easier with efficient recordkeeping supported by appropriate forms. To change the name of your business with the irs, follow these steps: Web a change of name notice must be signed by an authorized person. This form will indicate that the business name has changed, but the federal tin has remained the same. To change the name of your llc or corporation, you will need to file “articles of amendment” with your state. It should include a copy of the certificate of amendment filed with the state of delaware that is the. Web this will. Before dealing with administration, you must choose a new name for your business. If the ein was recently assigned and filing liability has yet to be determined,. This form will indicate that the business name has changed, but the federal tin has remained the same. (i) the ein number for the business, (ii) the old business name, and. Web although. Web you purchase or inherit an existing business that you operate as a sole proprietorship. Patent and trademark office's trademark search tool to find out if. The specific action required may vary depending on the type of business. Web here are some of the most common irs business forms you’ll see in this case: Web when you change your business. Instead, you submit an ein name change. Web change of address or responsible party — business. To change the name of your business with the irs, follow these steps: Web a change of name notice must be signed by an authorized person. This form will indicate that the business name has changed, but the federal tin has remained the same. Review a chart to determine the required documents needed for your type of organization. It was an acquired habit, the result of a. How do i notify the irs of a name change. Web step by step instructions. Corporate name change sample trusted and secure by over 3 million people of the. Ad make office life easier with efficient recordkeeping supported by appropriate forms. A name change can have an impact on your taxes and delay your refund. Ad fill out any legal form in minutes. (i) the ein number for the business, (ii) the old business name, and. Web gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Web although changing the name of your business does not require you to obtain a new ein, you may wish to visit the business name change page to find out what actions are. Do not attach this form to your return. Web here are some of the most common irs business forms you’ll see in this case: It should include. Web filing a certificate of amendment with the secretary of state office. It was an acquired habit, the result of a. An irs corporate name change form 8822 can be made by indicating the name change on the corporation's annual form 1120. Web up to 10% cash back yes. Once approved, you can start. It was an acquired habit, the result of a. The specific action required may vary depending on the type of business. Web exempt organizations must report a name change to the irs. Easy to use, save, & print. Instead, you submit an ein name change. To change the name of your business with the irs, follow these steps: Web gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Web you purchase or inherit an existing business that you operate as a sole proprietorship. All the names on a taxpayer's tax return must match social security. Identity of your responsible party. Web you purchase or inherit an existing business that you operate as a sole proprietorship. Once approved, you can start. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Corporate name change sample trusted and secure by over 3 million people of the. Web step by step instructions. A name change can have an impact on your taxes and delay your refund. To change the name of your business with the irs, follow these steps: Do not attach this form to your return. How do i notify the irs of a name change. Web this will ensure that your employees’ social security benefits are not affected by the name change. Web gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. The specific action required may vary depending on the type of business. An irs corporate name change form 8822 can be made by indicating the name change on the corporation's annual form 1120. Review a chart to determine the required documents needed for your type of organization. Web business owners and other authorized individuals can submit a name change for their business. Irs form 1040 is used to file your individual income tax return. Web update your name. Web exempt organizations must report a name change to the irs. You will also need to notify your. It should include a copy of the certificate of amendment filed with the state of delaware that is the.Business Name Change Letter Template To Irs

irs name change form Fill Online, Printable, Fillable Blank form

Irs Name Change Letter Sample / irs business name change letter Edit

Irs Business Name Change Form 8822b Armando Friend's Template

Irs Business Name Change Form 8822b Armando Friend's Template

Irs Form 8822 Pdf Fillable Printable Forms Free Online

Business Name Change Irs Sample Letter

Irs Business Name Change Letter Template

Business Name Change Irs Sample Letter 20 Printable Business Name

Irs Name Change Letter Sample business name change letter template

Related Post: