Ny Form It 201

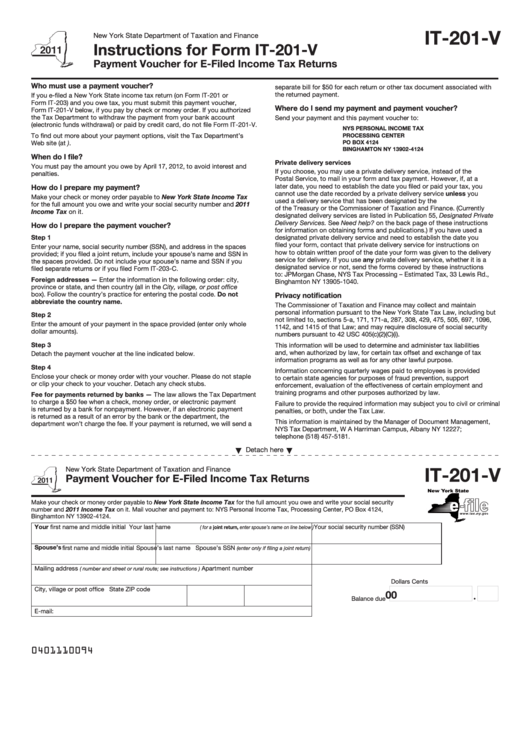

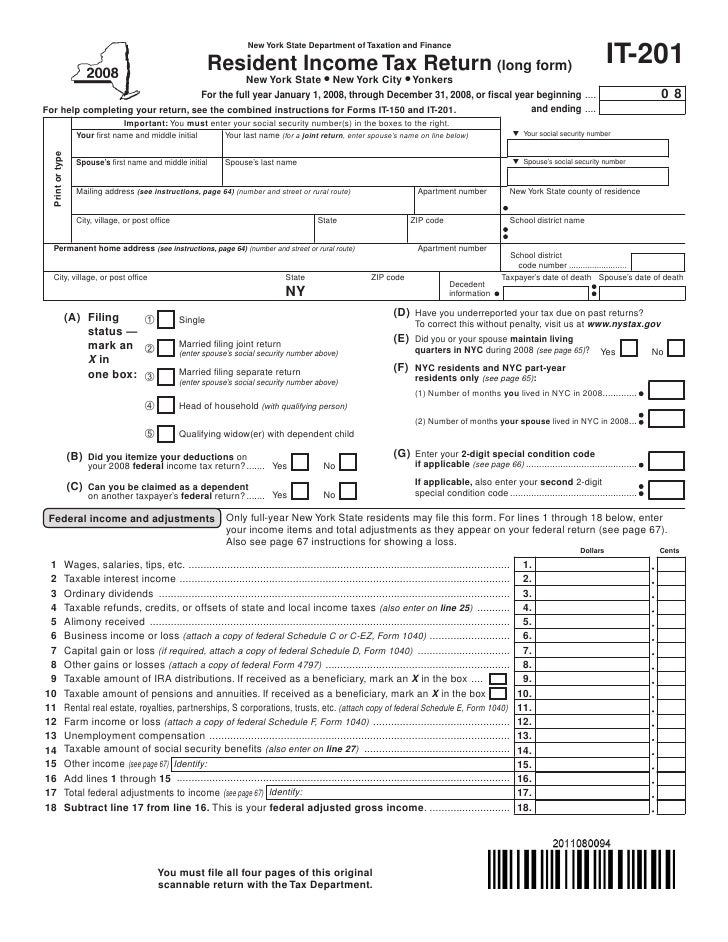

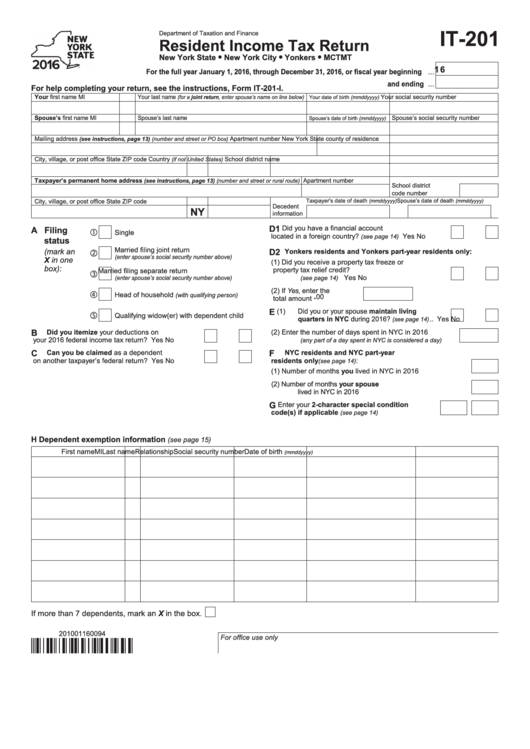

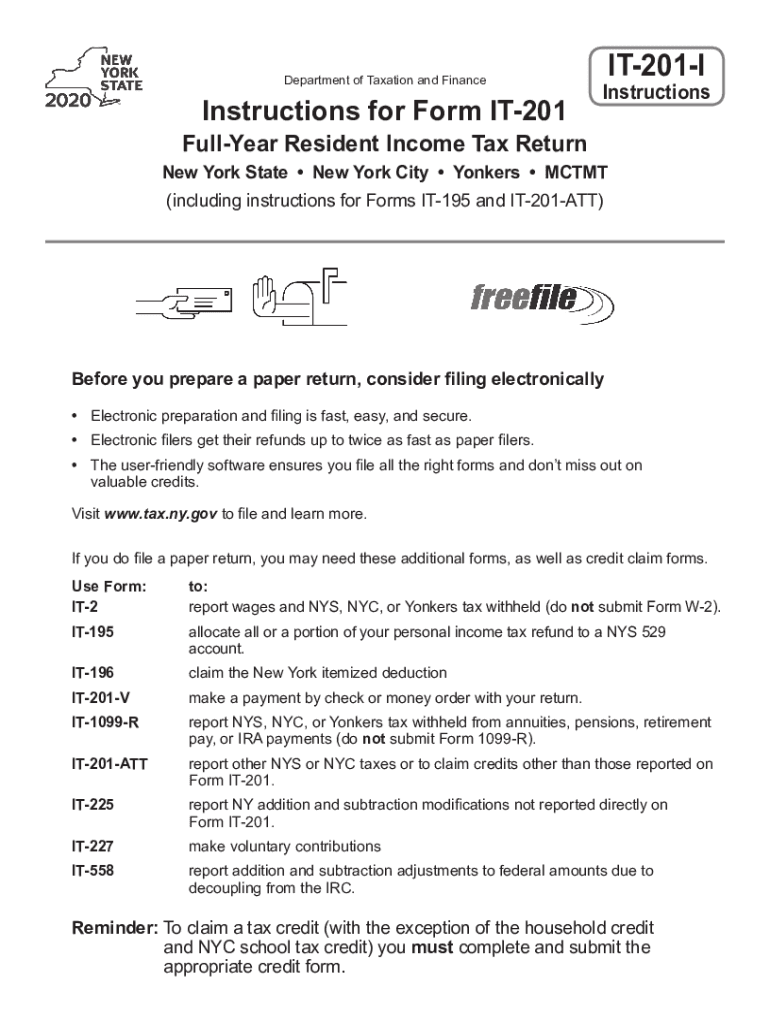

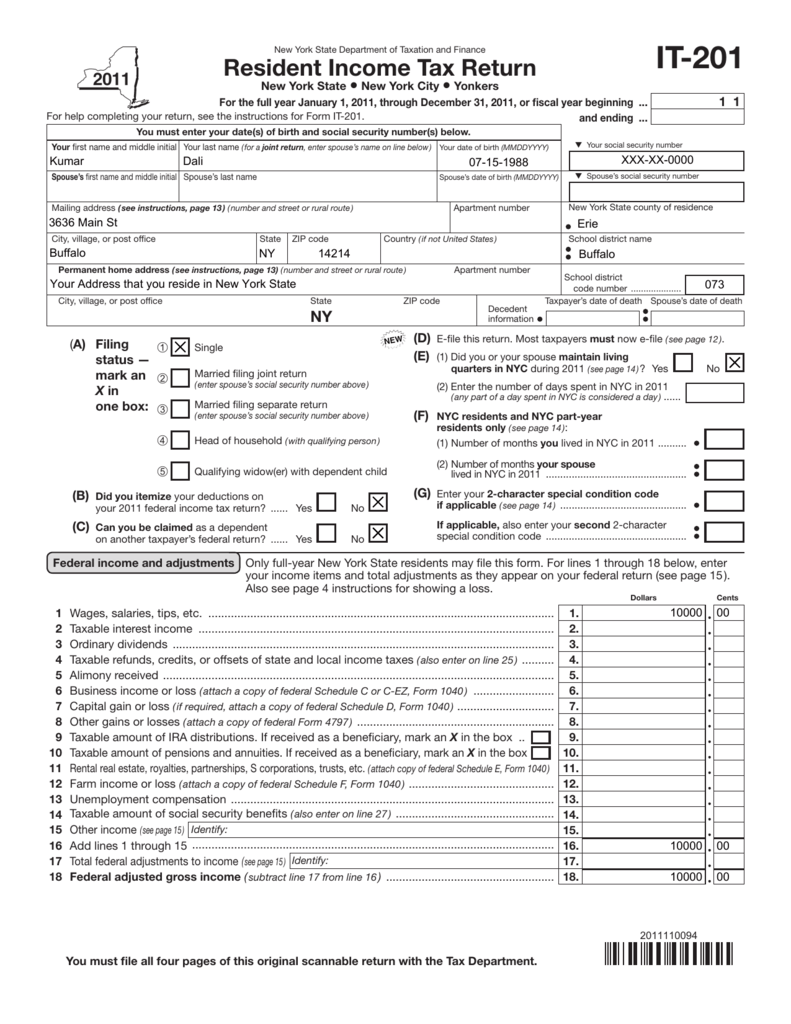

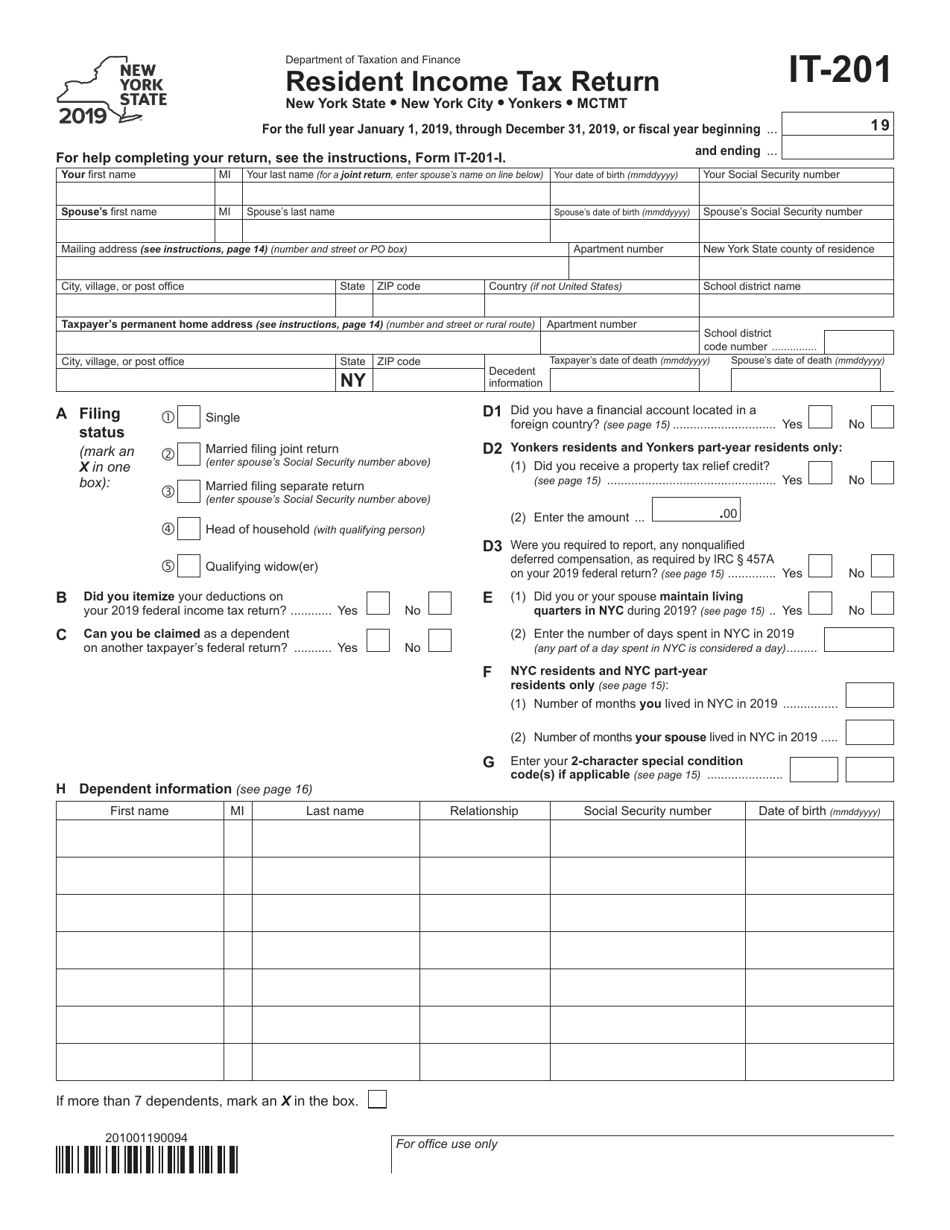

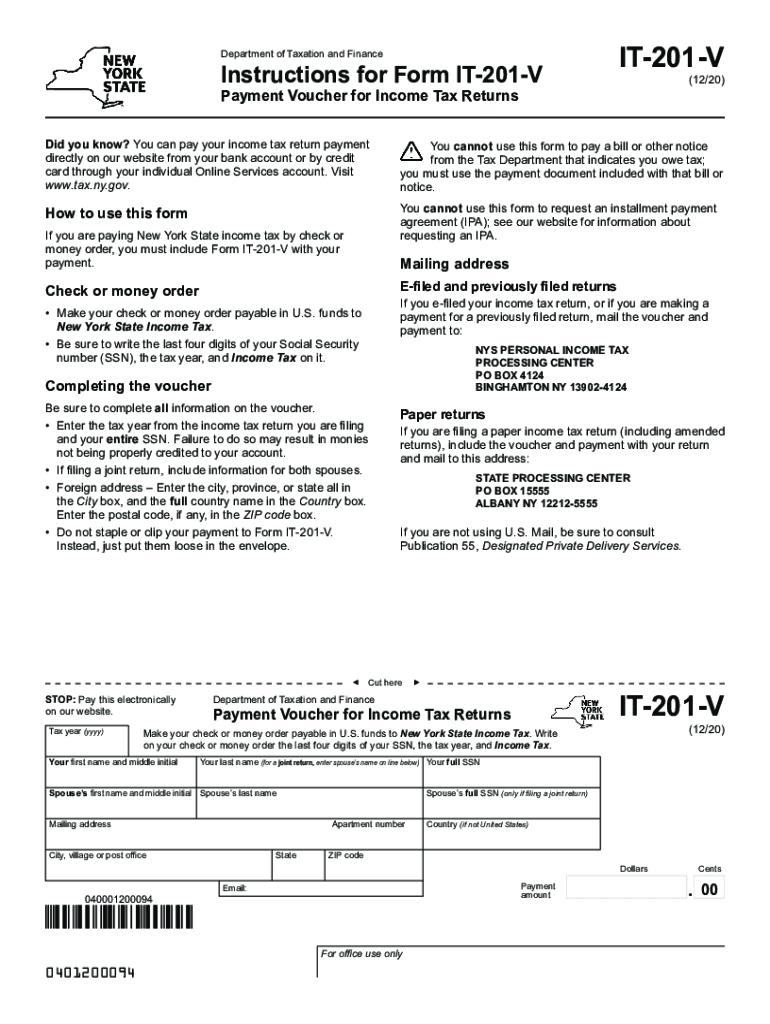

Ny Form It 201 - We'll handle every form for you! However, if you both choose to file a. To claim a tax credit. New york state income tax. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. For the full year january 1, 2020, through december 31, 2020, or fiscal year beginning. Web resident income tax return. Lacerte will optimize between the ny. New york state • new york city • yonkers • mctmt. Individual income tax return tax return: However, if you both choose to file a. Individual income tax return tax return: Ad we prepare your u.s. Lacerte will optimize between the ny. Web resident income tax return. Name(s) as shown on your form. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Lacerte will optimize between the ny. To claim a tax credit. Ad we prepare your u.s. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. For the full year january 1, 2020, through december 31, 2020, or fiscal year beginning. Individual income tax return. New york state • new york city • yonkers • mctmt. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. For the full year january 1, 2020, through december 31, 2020, or fiscal year beginning. Payment vouchers are provided to accompany checks mailed to pay off tax. Web in 1993, mr. To claim a tax credit. New york state • new york city • yonkers • mctmt. We'll handle every form for you! Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. New york state • new york city • yonkers • mctmt. Name(s) as shown on your form. New york state income tax. Web resident income tax return. Web in 1993, mr. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31,. New york state • new york city • yonkers • mctmt. For the full year january 1, 2020, through december 31, 2020, or fiscal year. New york state • new york city • yonkers • mctmt. Web in 1993, mr. Lacerte will optimize between the ny. Ad we prepare your u.s. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31,. New york state income tax. Ad we prepare your u.s. Individual income tax return tax return: However, if you both choose to file a. We'll handle every form for you! Web in 1993, mr. Name(s) as shown on your form. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Ad we prepare your u.s. New york state • new york city • yonkers • mctmt. For the full year january 1, 2020,. Lacerte will optimize between the ny. Web in 1993, mr. Ad we prepare your u.s. Name(s) as shown on your form. For the full year january 1, 2020, through december 31, 2020, or fiscal year beginning. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31,. We'll handle every form for you! Web resident income tax return. New york state • new york city • yonkers • mctmt. New york state income tax. Individual income tax return tax return: New york state • new york city • yonkers • mctmt. However, if you both choose to file a. To claim a tax credit. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth.Fillable Form It201V (2011) Payment Voucher For EFiled Tax

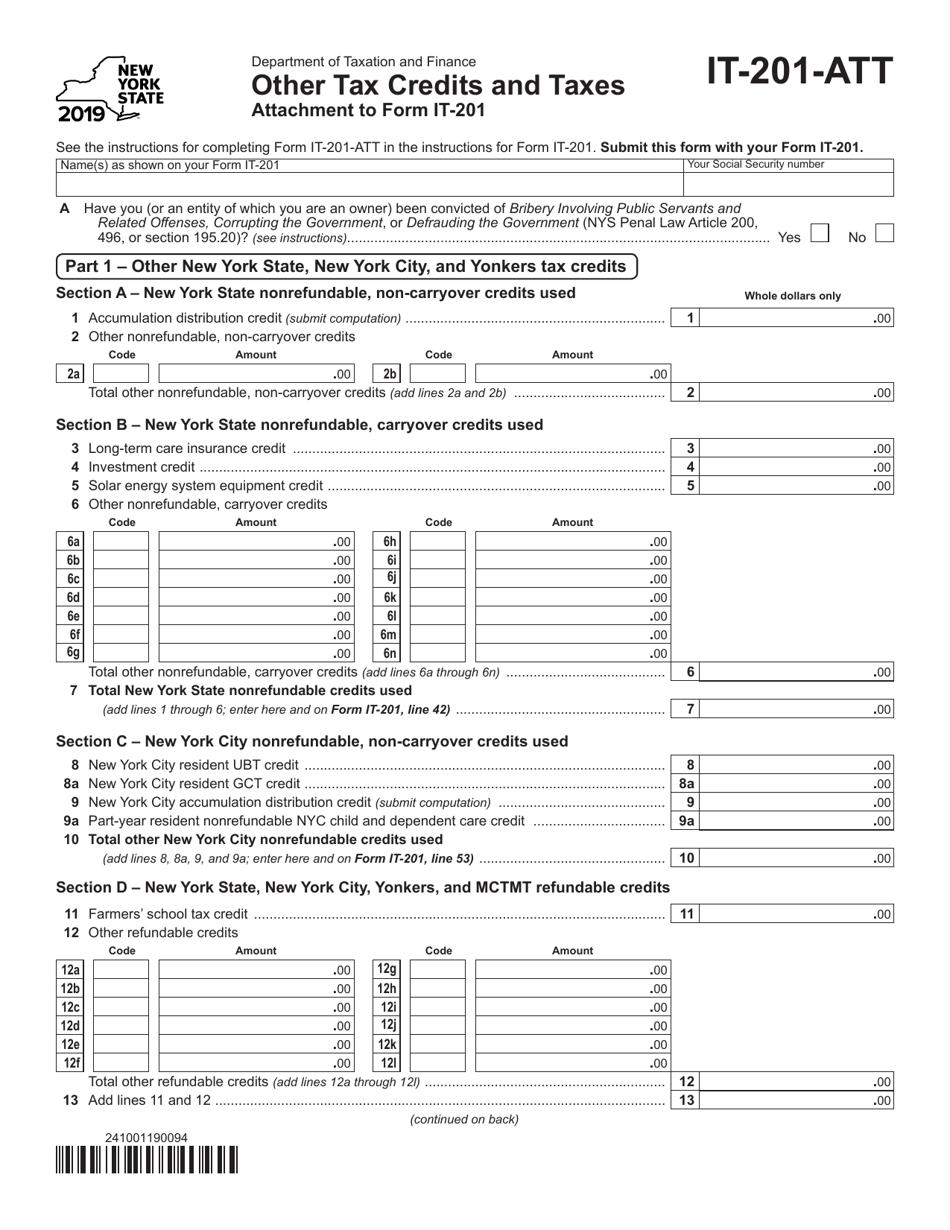

IT201ATT Other Taxes and Tax Credits Attachment to Form IT201

Form IT201ATT 2019 Fill Out, Sign Online and Download Fillable

Top 106 New York State Form It201 Templates free to download in PDF format

NY IT201I 2020 Fill out Tax Template Online US Legal Forms

Form IT2012011Resident Tax ReturnIT201

Form IT201X (2010) (Fillin) Amended Resident Tax Return (long

Form IT 201 Resident Tax Return YouTube

Form IT201 Download Fillable PDF or Fill Online Resident Tax

NY IT201V 2020 Fill out Tax Template Online US Legal Forms

Related Post: