Form 592 Pte Instructions

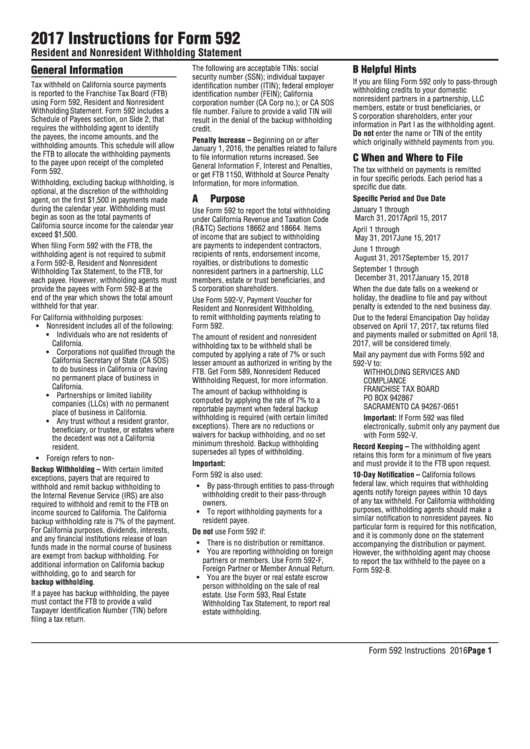

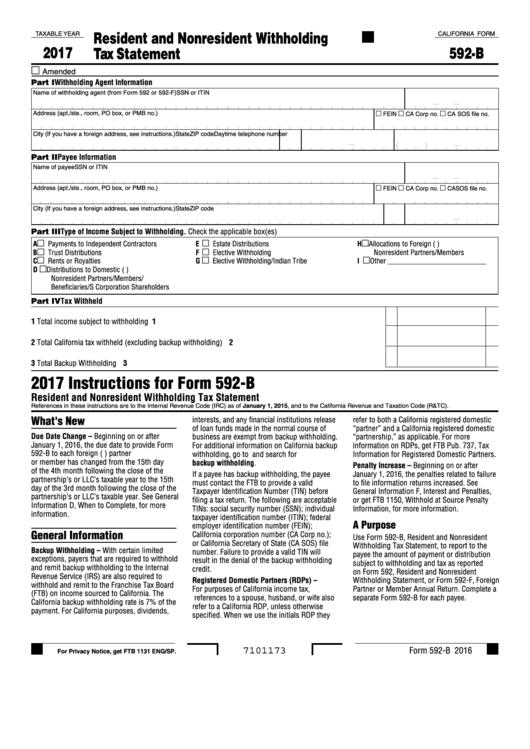

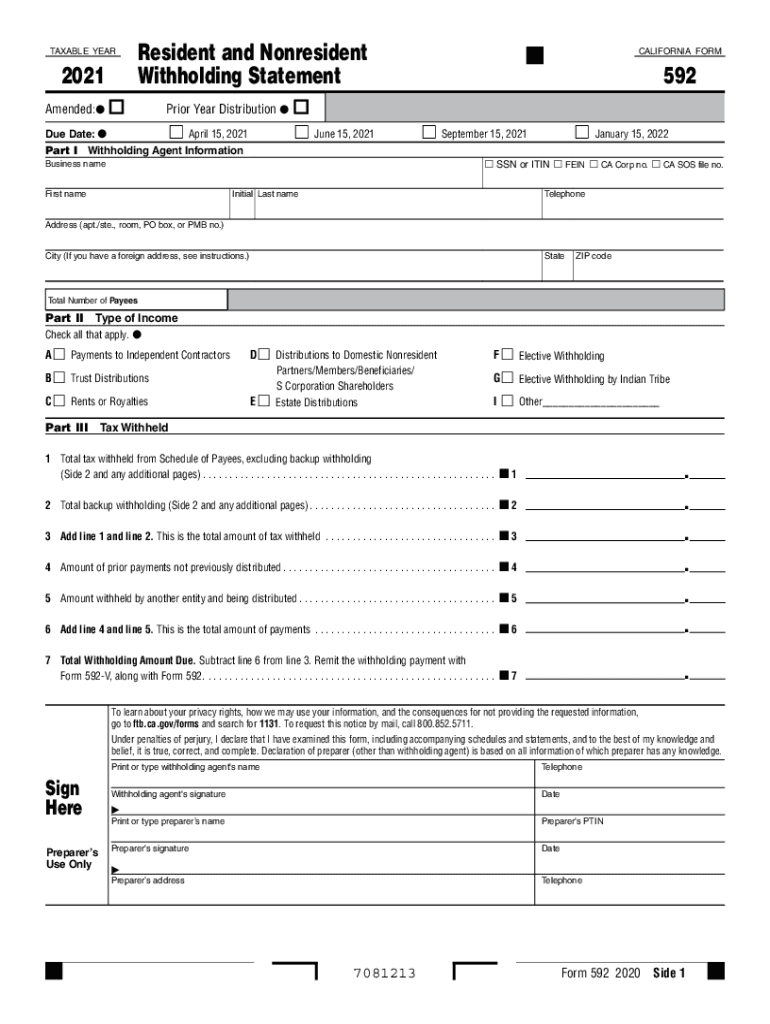

Form 592 Pte Instructions - Start completing the fillable fields and carefully. Web city (if you have a foreign address, see instructions.) state. Ca sos file no first. When and where to file. Go to partners > partner information. Verify the state of california is active in the return; Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. When and where to file. Verify the state of california is active in the return; Web do not use form 592 to report tax withheld on foreign partners. Web city (if you have a foreign address, see instructions.) state. General information, check if total withholding at end of year. Web form 592 is also used to report withholding payments for a resident payee. Verify the state of california is active in the return; No payment, distribution or withholding occurred. Ca sos file no first. When and where to file. Web city (if you have a foreign address, see instructions.) state. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully. Web city (if you have a foreign address, see instructions.) state. Do not use form 592 if any of the following apply: Go to partners > partner information. Web form 592 is also used to report withholding payments for a resident payee. Web city (if you have a foreign address, see instructions.) state. Either state form 565 or 568 should be generated. Do not use form 592 if any of the following apply: Web do not use form 592 to report tax withheld on foreign partners. Verify the state of california is active in the return; No payment, distribution or withholding occurred. Do not use form 592 if any of the following apply: Corporation name, street address, city, state code, corporation telephone number. Verify the state of california is active in the return; Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Either. Use get form or simply click on the template preview to open it in the editor. Either state form 565 or 568 should be generated. No payment, distribution or withholding occurred. Go to partners > partner information. Verify the state of california is active in the return; Do not use form 592 if any of the following apply: Either state form 565 or 568 should be generated. Use get form or simply click on the template preview to open it in the editor. Verify the state of california is active in the return; Web form 592, resident and nonresident withholding statement can be added to the return. Start completing the fillable fields and carefully. Use get form or simply click on the template preview to open it in the editor. General information, check if total withholding at end of year. Do not use form 592 if any of the following apply: Ca sos file no first. Go to partners > partner information. Ca sos file no first. Web city (if you have a foreign address, see instructions.) state. Web form 592 is also used to report withholding payments for a resident payee. Use get form or simply click on the template preview to open it in the editor. Corporation name, street address, city, state code, corporation telephone number. Either state form 565 or 568 should be generated. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully. General information, check if total withholding at end of year. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Corporation name, street address, city, state code, corporation telephone number. General information, check if total withholding at end of year. Web city (if you have a foreign address, see instructions.) state. Web form 592 is also used to report withholding payments for a resident payee. Do not use form 592 if any of the following apply: Either state form 565 or 568 should be generated. Verify the state of california is active in the return; Web city (if you have a foreign address, see instructions.) state. When and where to file. Use get form or simply click on the template preview to open it in the editor. Go to partners > partner information. Ca sos file no first. Web do not use form 592 to report tax withheld on foreign partners. When and where to file. No payment, distribution or withholding occurred. Verify the state of california is active in the return; Start completing the fillable fields and carefully. Either state form 565 or 568 should be generated.Form 592 Instructions 2017 printable pdf download

Form 592 Fillable Printable Forms Free Online

592 Form Fill Out and Sign Printable PDF Template signNow

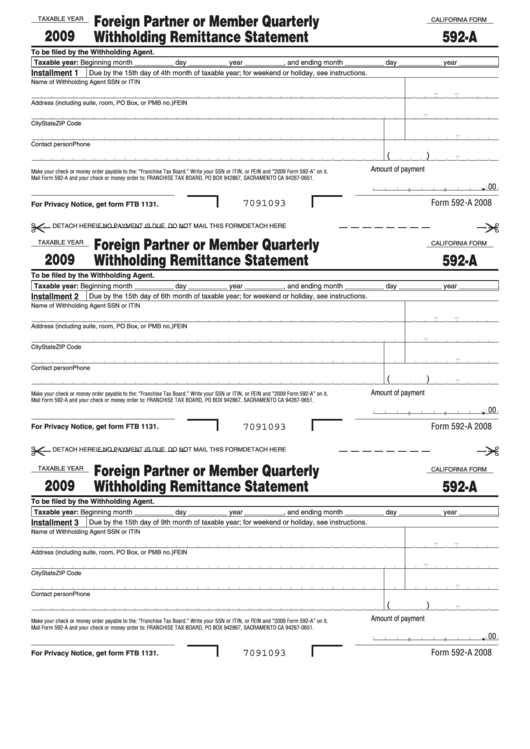

Fillable California Form 592A Foreign Partner Or Member Quarterly

AF Form 592 Usaf Hot Work Permit Finder Doc

Fillable Form 592A Installment Payment Worksheet Sacramento

Form 592 B ≡ Fill Out Printable PDF Forms Online

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

2021 Form 592 Resident and Nonresident Withholding Statement 2021, Form

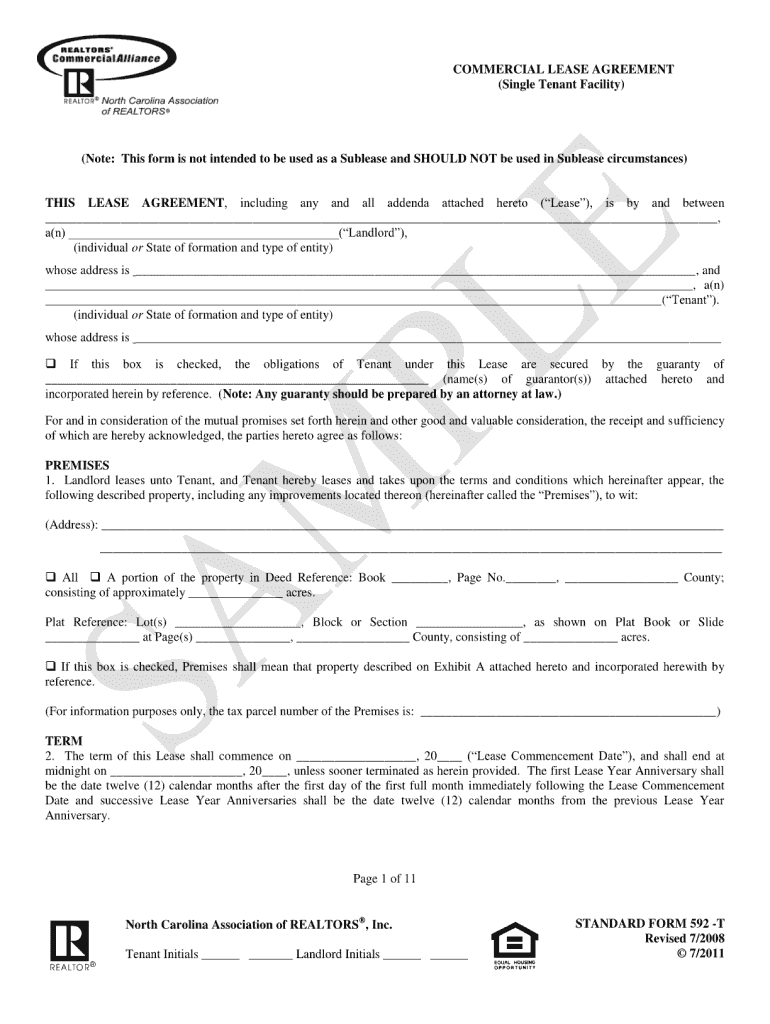

Standard form 592 t Fill out & sign online DocHub

Related Post: