Ny Form Ct 3

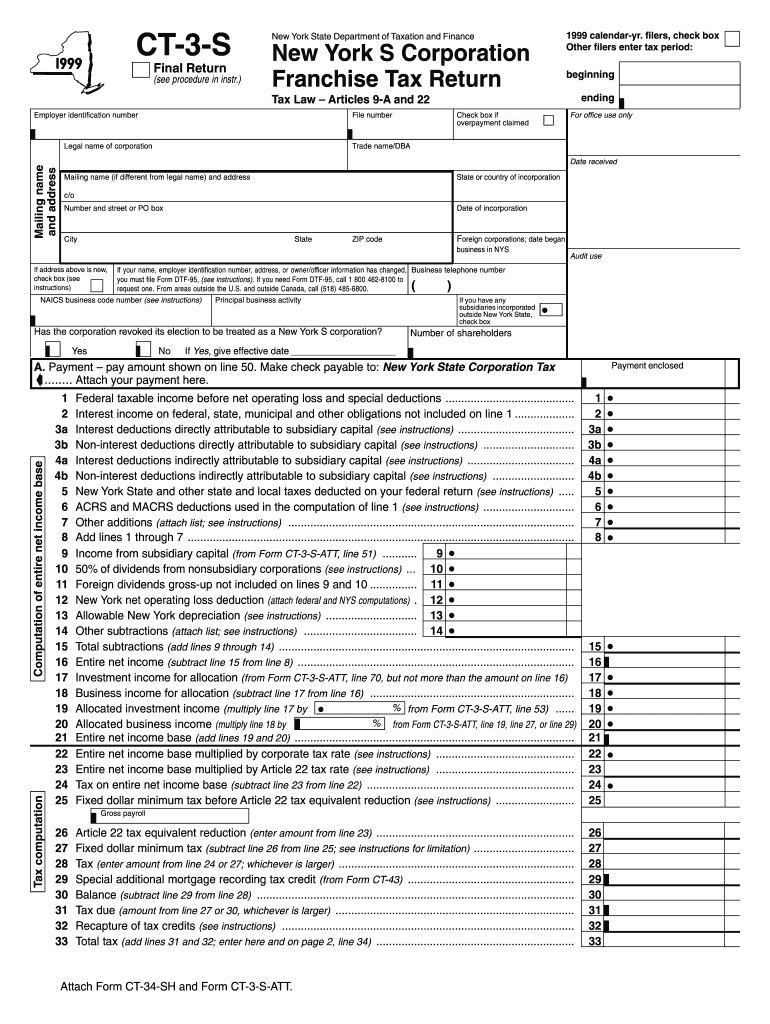

Ny Form Ct 3 - Easily sign the form with your finger. ★ ★ ★ ★ ★. Who must file ny ct 3? Web form ct‐3‐a/bc is an individual certification that must be filed by each member, including non‐taxpayer members, of the new york state combined group except for the taxpayer. Web new york state return within 90 days thereafter. Send filled & signed form or save. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Web what is nys form ct 3? Web in 1993, mr. Changes for the current tax year (general and by tax law article). Open form follow the instructions. For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. For calendar year filers, this deadline is april. Ad signnow.com has been visited by 100k+ users in the past month Use a ct 3 s 2022 template to make your document workflow more streamlined. This form must be used only for tax periods beginning on or after january 1, 2022. For a detailed list of what’s new,. Who must file ny ct 3? Web what is nys form ct 3? Open form follow the instructions. For a detailed list of what’s new, including a summary of tax law changes, visit new for 2022 or visit our website at www.tax.ny.gov (search: Web solved•by intuit•2•updated 1 year ago. For calendar year filers, this deadline is april. This form must be used only for tax periods beginning on or after january 1, 2022. ★ ★ ★ ★ ★. General business corporation combined franchise tax return. Web form ct‐3‐a/bc is an individual certification that must be filed by each member, including non‐taxpayer members, of the new york state combined group except for the taxpayer. Changes for the current tax year (general and by tax law article). This form must be used only for. For calendar year filers, this deadline. Who must file ny ct 3? Web new york state return within 90 days thereafter. For a detailed list of what’s new, including a summary of tax law changes, visit new for 2022 or visit our website at www.tax.ny.gov (search: ★ ★ ★ ★ ★. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including. Web form ct‐3‐a/bc is an individual certification that must be filed by each member, including non‐taxpayer members, of the new york state combined group except for the taxpayer. ★ ★ ★ ★ ★. This form must be used only for tax periods beginning on or after january 1, 2022. Web new york state return within 90 days thereafter. Who must. Web new york state return within 90 days thereafter. Ad signnow.com has been visited by 100k+ users in the past month Easily sign the form with your finger. This form must be used only for tax periods beginning on or after january 1, 2022. Use a ct 3 s 2022 template to make your document workflow more streamlined. For a detailed list of what’s new, including a summary of tax law changes, visit new for 2022 or visit our website at www.tax.ny.gov (search: Web new york state return within 90 days thereafter. Transportation and transmission corporation franchise tax returns. Web what is nys form ct 3? Ad signnow.com has been visited by 100k+ users in the past month Easily sign the form with your finger. Send filled & signed form or save. Who must file ny ct 3? For a detailed list of what’s new,. Web solved•by intuit•2•updated 1 year ago. Web what is nys form ct 3? ★ ★ ★ ★ ★. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Web solved•by intuit•2•updated 1 year ago. Web form ct‐3‐a/bc is an individual certification that must be filed by each member,. Send filled & signed form or save. Web in 1993, mr. Web solved•by intuit•2•updated 1 year ago. All filers must enter tax period: For a detailed list of what’s new, including a summary of tax law changes, visit new for 2022 or visit our website at www.tax.ny.gov (search: Ad signnow.com has been visited by 100k+ users in the past month Who must file ny ct 3? For calendar year filers, this deadline is april. Use a ct 3 s 2022 template to make your document workflow more streamlined. This form must be used only for. Web what is nys form ct 3? Web form ct‐3‐a/bc is an individual certification that must be filed by each member, including non‐taxpayer members, of the new york state combined group except for the taxpayer. For a detailed list of what’s new,. General business corporation combined franchise tax return. Transportation and transmission corporation franchise tax returns. This form must be used only for tax periods beginning on or after january 1, 2022. For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. Easily sign the form with your finger. ★ ★ ★ ★ ★. Changes for the current tax year (general and by tax law article).1999 Form NY DTF CT3S Fill Online, Printable, Fillable, Blank pdfFiller

Ny Form 3 A Instructions appearhigher

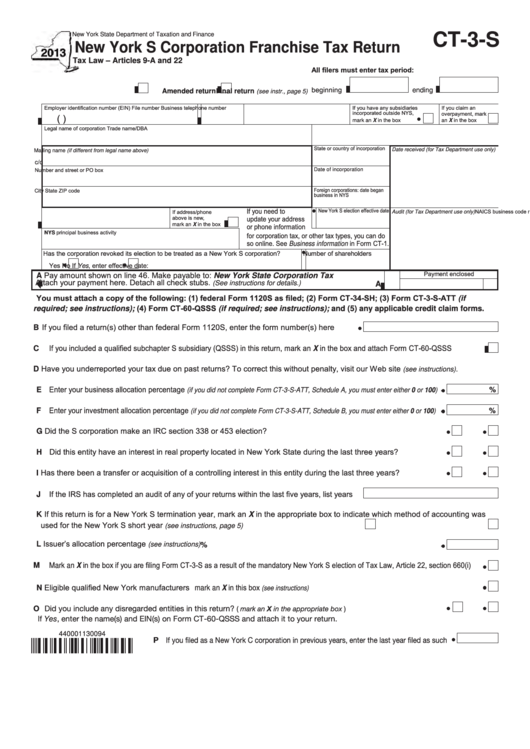

Form Ct3S New York S Corporation Franchise Tax Return 2013

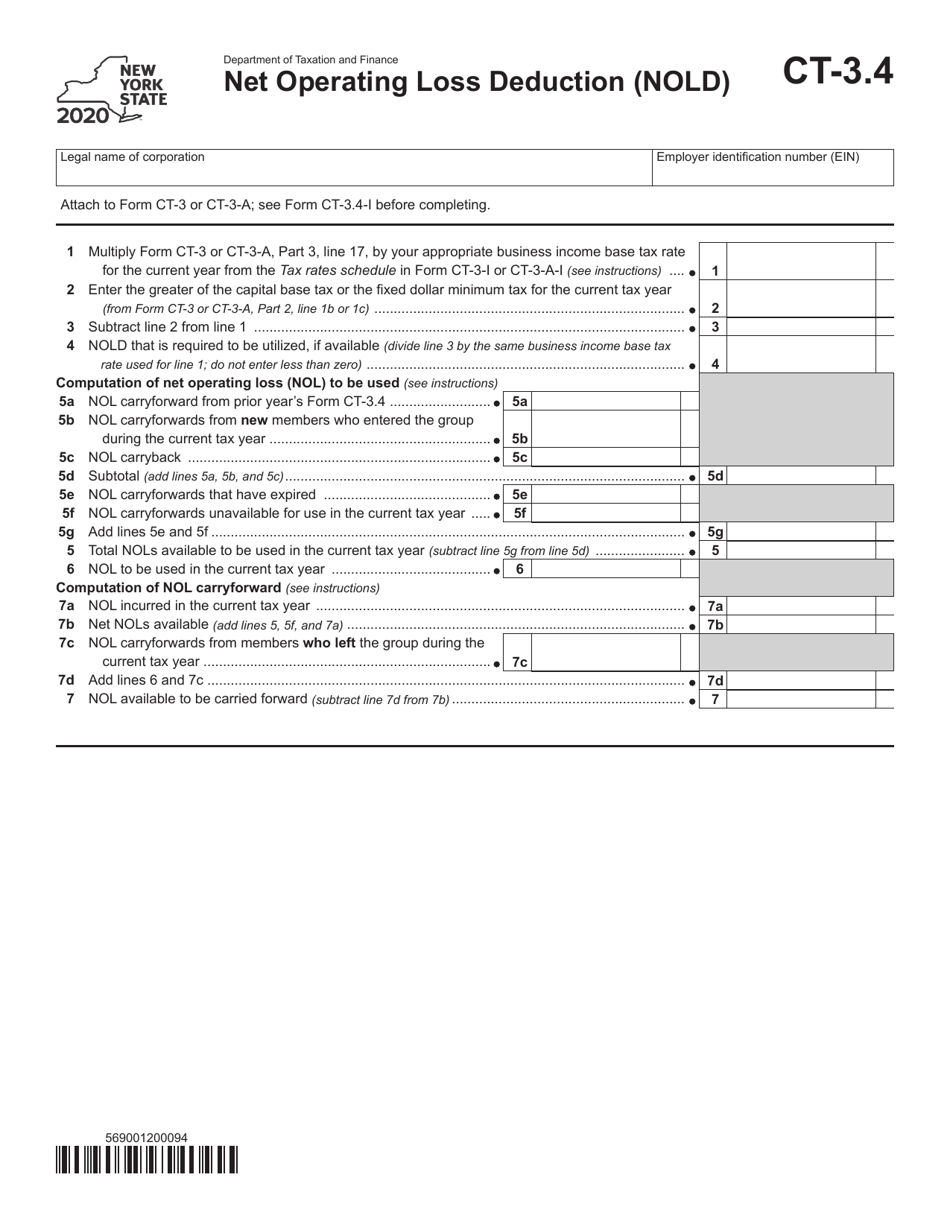

Form CT3.4 2020 Fill Out, Sign Online and Download Printable PDF

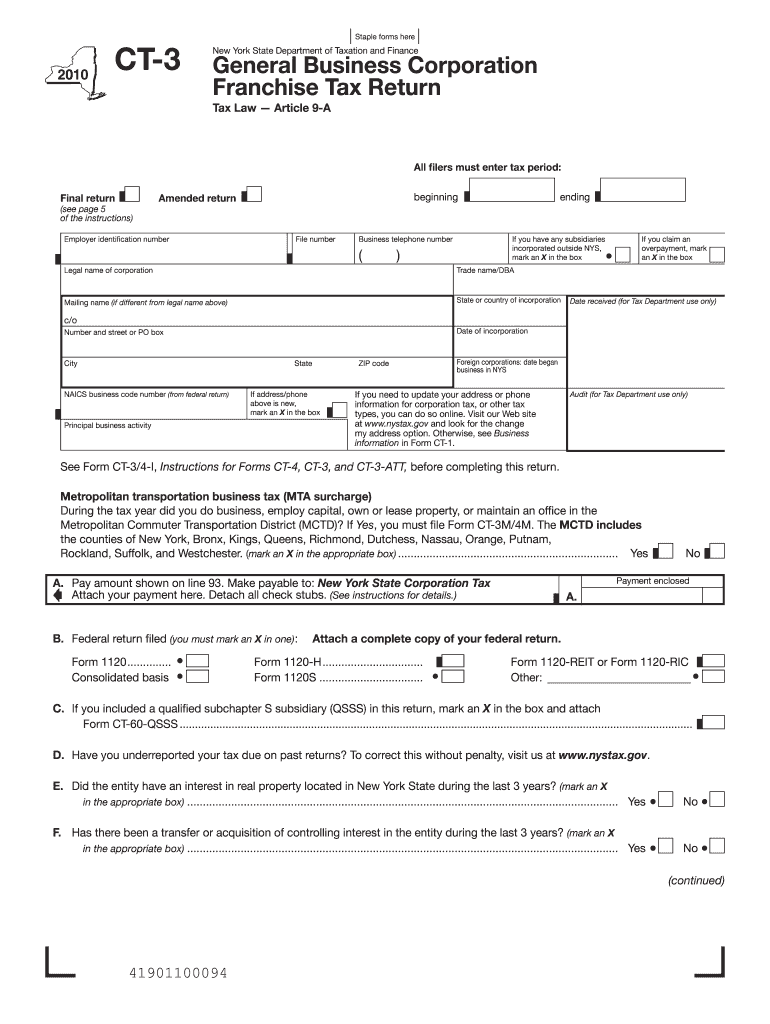

2010 Form NY DTF CT3 Fill Online, Printable, Fillable, Blank pdfFiller

Download Instructions for Form CT3.2 Subtraction Modification for

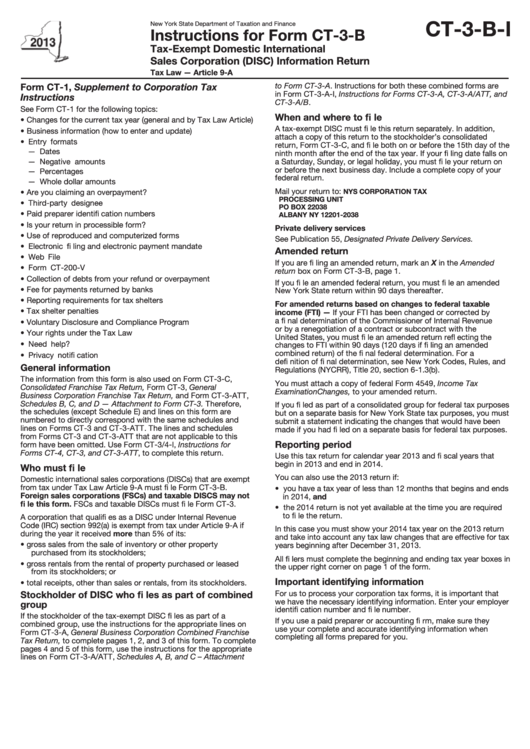

Form Ct3BI Instructions For Form Ct3B New York State

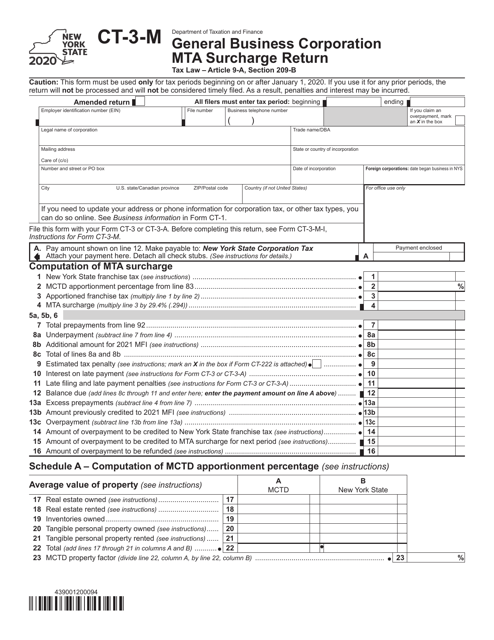

Form CT3M Download Printable PDF or Fill Online General Business

2020 Form NY DTF CT3S Fill Online, Printable, Fillable, Blank pdfFiller

Nys Fillable Tax Forms Ct 3 S Printable Forms Free Online

Related Post: