4972 Tax Form

4972 Tax Form - Multiply line 17 by 10%.21. Web withholding tax information authorization. United states tax exemption form; Download or email irs 4972 & more fillable forms, register and subscribe now! Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Ad access irs tax forms. Complete, edit or print tax forms instantly. The file is in adobe. Use distribution code a and answer. Use screen 1099r in the income folder to complete form 4972. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Web united states tax exemption form. Ad access irs tax forms. Web the 2017 tax return. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Poa and disclosure forms, withholding forms. Use distribution code a and answer. To claim these benefits, you must file irs. Filing this form may result in paying. Web the 2017 tax return. Ad access irs tax forms. Web the purpose tax form 4972 is used for reducing taxes. Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. Multiply line 17 by 10%.21. To qualify, the entire account must be payed out to the beneficiary in. Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. Filing this form may result in paying. The file is in adobe. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Do not misread the. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. United states tax exemption form; Download or email irs 4972 & more fillable forms, register and subscribe now! Use distribution code a and answer. Web united states tax exemption form. Being born before january 2, 1936, is. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Use this form to figure the. Individual estimated tax payment booklet. To claim these benefits, you must file irs. United states tax exemption form; Complete, edit or print tax forms instantly. Web the purpose tax form 4972 is used for reducing taxes. Web united states tax exemption form. Poa and disclosure forms, withholding forms. Being born before january 2, 1936, is. Poa and disclosure forms, withholding forms. Withholding tax payroll service company authorization. Complete, edit or print tax forms instantly. Multiply line 17 by 10%.21. Use this form to figure the. Download or email irs 4972 & more fillable forms, register and subscribe now! The file is in adobe. Web the 2017 tax return. Use distribution code a and answer. Web the purpose tax form 4972 is used for reducing taxes. Web what is irs form 4972 used for? Web withholding tax information authorization. Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. Individual estimated tax payment booklet. This form is for income earned in tax year 2022, with tax returns due in april. Download or email irs 4972 & more fillable forms, register and subscribe now! Web the purpose tax form 4972 is used for reducing taxes. To claim these benefits, you must file irs. Use this form to figure the. Web tax form 4972 is used to reduce the tax load for lump sum distribution of a qualified retirement account. United states tax exemption form; Download or email irs 4972 & more fillable forms, register and subscribe now! Web withholding tax information authorization. Web the 2017 tax return. Use screen 1099r in the income folder to complete form 4972. It allows beneficiaries to receive their entire benefit in. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Multiply line 17 by 10%.21. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Individual estimated tax payment booklet. Web united states tax exemption form. Filing this form may result in paying. Being born before january 2, 1936, is. Complete, edit or print tax forms instantly.Form 4972 Tax on LumpSum Distributions (2015) Free Download

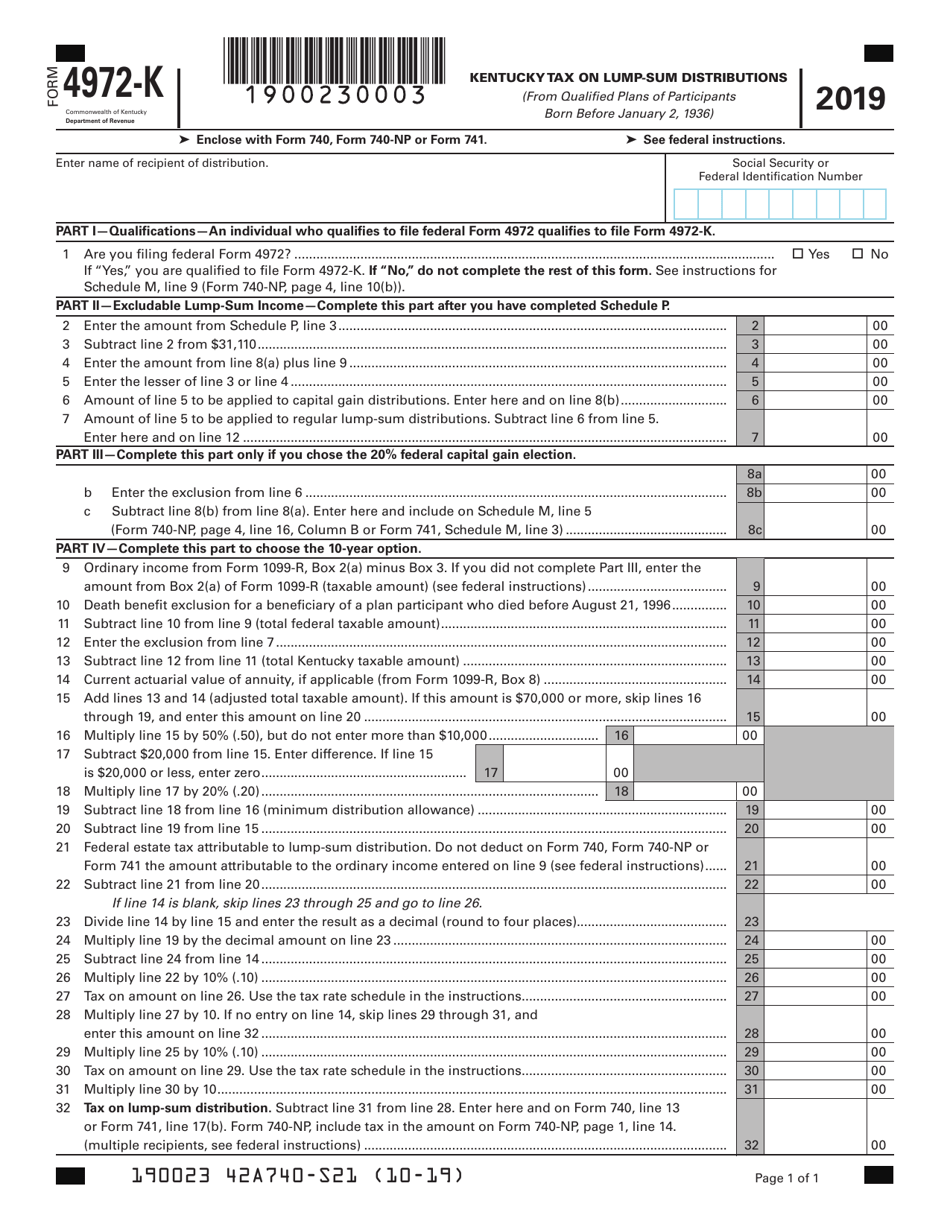

4972K Kentucky Tax on Lump Sum Distribution Form 42A740S21

2019 Form IRS 5498Fill Online, Printable, Fillable, Blank pdfFiller

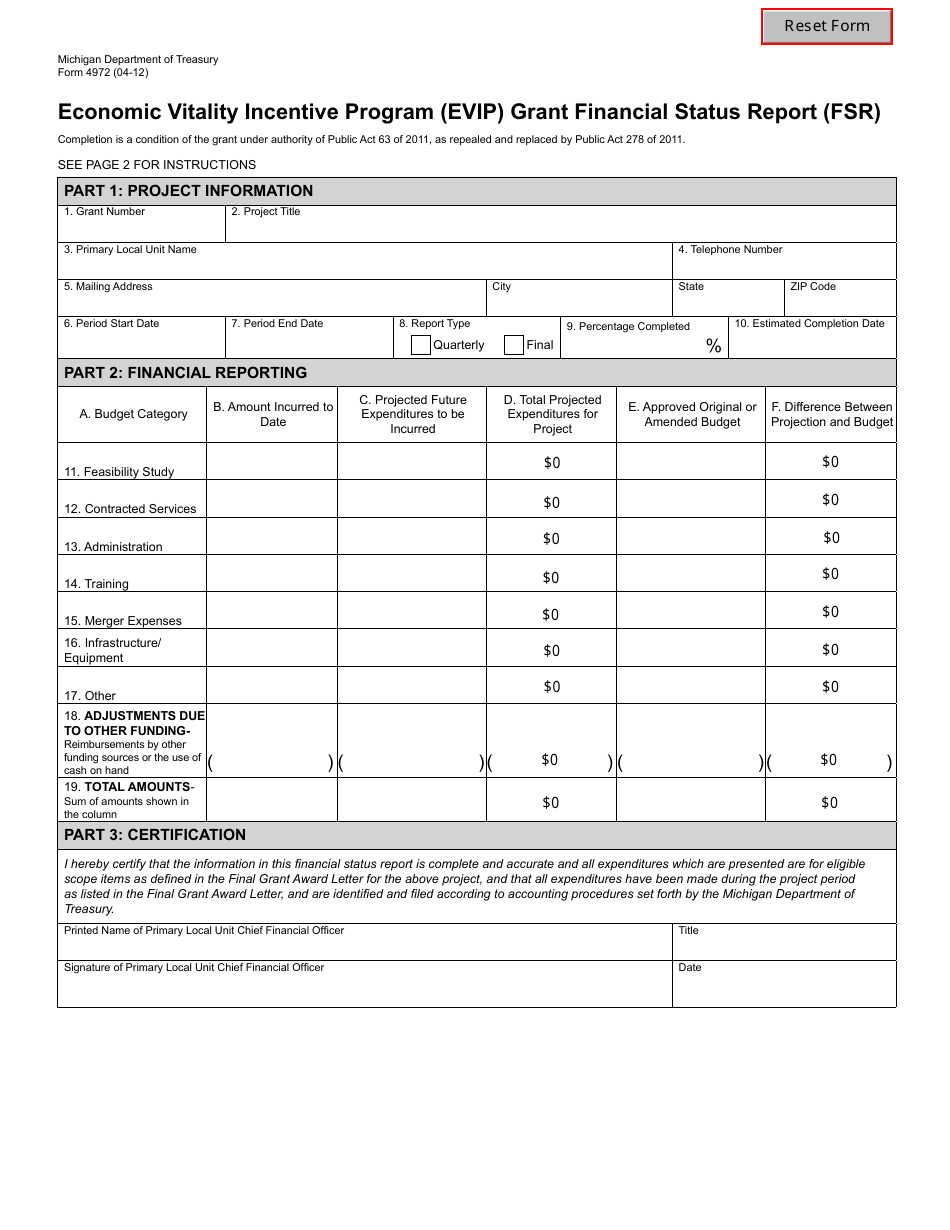

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Publication 575 Pension and Annuity Taxation of Nonperiodic

2019 IRS Form 4972 Fill Out Digital PDF Sample

Fill Form 4972 Tax on LumpSum Distributions

Form 4972K Download Fillable PDF or Fill Online Kentucky Tax on Lump

Form 4972 Tax on LumpSum Distributions Stock Photo Image of checking

Related Post: