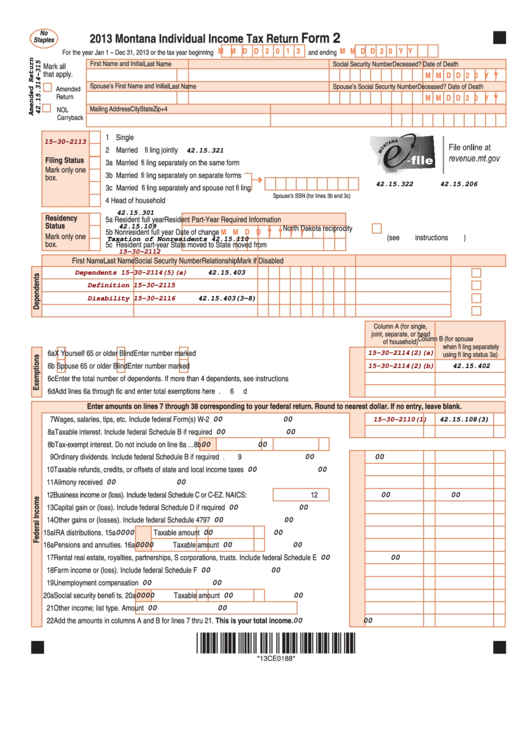

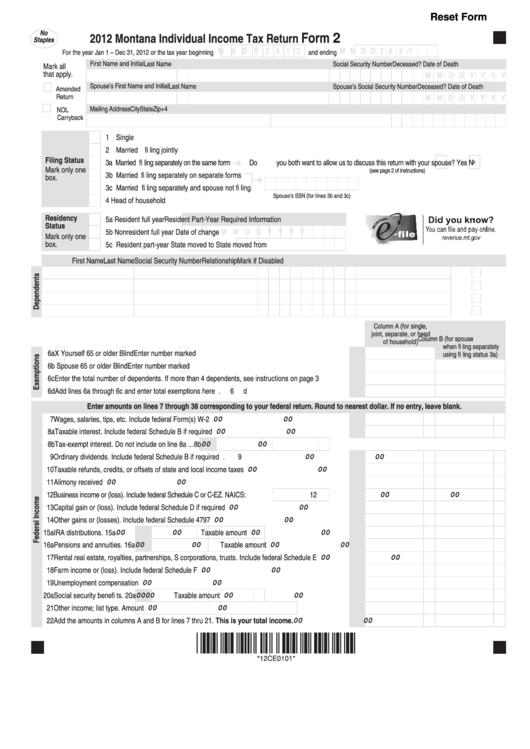

Montana Tax Form 2

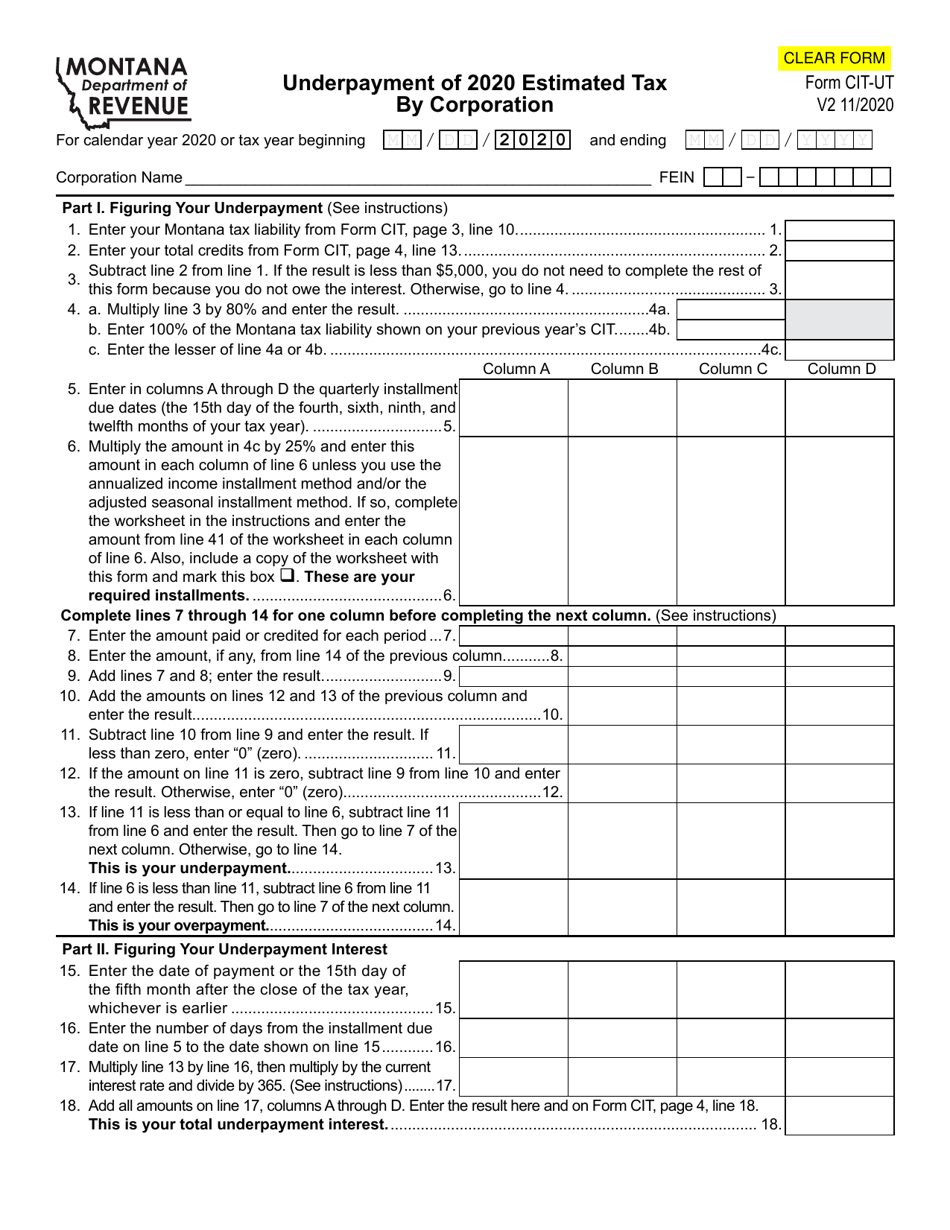

Montana Tax Form 2 - Single under age 65, $5,090; Head over to the federal income tax forms page to get any forms you need for completing your federal income tax return in april. We last updated the montana itemized deductions (obsolete) in march 2021, and the latest form we have available is for tax year 2019. Printable montana income tax form 2. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. If you live or work in montana, you may need to file and pay individual income tax. Montana form 2, also known as the montana individual income tax return, is a crucial document that montana residents must complete and submit to report their annual income and calculate the state taxes owed. Montana state income tax form 2 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. It was an acquired habit, the result of a process of moral dulling and rage. Easily sign the form with your finger. Find the instructions, schedules, and other forms you need to complete your tax return. Web form 2, montana individual income tax return. Find out how to fill out the form and calculate your tax liability or refund. When you are required to file a form 2, use the montana subtractions schedule, line 8. Web this booklet addresses most tax filing. If only part of your income can be subtracted from montana income tax, and your nonexempt income exceeds the filing thresholds, you must file form 2 with form etm. Easily sign the form with your finger. Instead, you must file form etm. Web you must pay montana state income tax on any wages received for work performed while in montana,. Enrolled tribal member exempt income certification/return (form etm) approved commercial tax software. We will update this page with a new version of the form for 2024 as soon as it is made available by the montana government. How to fill out and sign a form online? Web this booklet addresses most tax filing situations. Get your online template and fill. Find the instructions, schedules, and other forms you need to complete your tax return. Web montana individual income tax return (form 2) form 2 instructions and booklet. Head of household under age 65, $10,180; Montana form 2, also known as the montana individual income tax return, is a crucial document that montana residents must complete and submit to report their. Web this booklet addresses most tax filing situations. Instead, you must file form etm. Web form 2, montana individual income tax return. Open form follow the instructions. Head of household under age 65, $10,180; We will update this page with a new version of the form for 2024 as soon as it is made available by the montana government. Head of household under age 65, $10,180; If you have a tax situation not represented in this booklet, see title 15 of the montana code annotated. Web we last updated the individual income tax instructional. Montana state income tax form 2 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. The form is similar to the federal income tax return (form 1040) but is specific to montana's state tax. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service. Find out how to fill out the form and calculate your tax liability or refund. Web understanding montana form 2. Check the status of your refund with the “where’s my refund?” tool in our transaction portal (tap). We will update this page with a new version of the form for 2024 as soon as it is made available by the. Web we last updated the montana individual income tax return in march 2023, so this is the latest version of form 2, fully updated for tax year 2022. It was an acquired habit, the result of a process of moral dulling and rage. We last updated the montana itemized deductions (obsolete) in march 2021, and the latest form we have. Web we last updated montana form 2 worksheet ii in march 2021 from the montana department of revenue. Montana state income tax form 2 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. If only part of your income can be subtracted from montana income tax, and your nonexempt income exceeds the filing thresholds,. Printed all of your montana income tax forms? Web this booklet addresses most tax filing situations. Enrolled tribal member exempt income certification/return (form etm) approved commercial tax software. Web we last updated the individual income tax instructional booklet in february 2023, so this is the latest version of form 2 instructions, fully updated for tax year 2022. Get your online template and fill it in using progressive features. This form is for income earned in tax year 2022, with tax returns due in april 2023. Check the status of your refund with the “where’s my refund?” tool in our transaction portal (tap). Web free printable and fillable 2022 montana form 2 and 2022 montana form 2 instructions booklet in pdf format to fill in, print, and mail your state income tax return due april 18, 2023. Montana form 2, also known as the montana individual income tax return, is a crucial document that montana residents must complete and submit to report their annual income and calculate the state taxes owed. If only part of your income can be subtracted from montana income tax, and your nonexempt income exceeds the filing thresholds, you must file form 2 with form etm. We will update this page with a new version of the form for 2024 as soon as it is made available by the montana government. Web a montana income tax return, form 2. Send filled & signed form or save. Showing 1 to 25 of 50 entries. Web beginning in tax year 2018, the montana income tax return (form 2) schedules are no longer available separately from the montana income tax return (form 2). Web we last updated montana form 2 in march 2023 from the montana department of revenue. Find out what's new, what forms you need, and how to calculate your taxes. Form 2 schedule 1, credit for income tax paid to another state or county schedule. ★ ★ ★ ★ ★. It was an acquired habit, the result of a process of moral dulling and rage.Form CITUT Download Fillable PDF or Fill Online Underpayment of

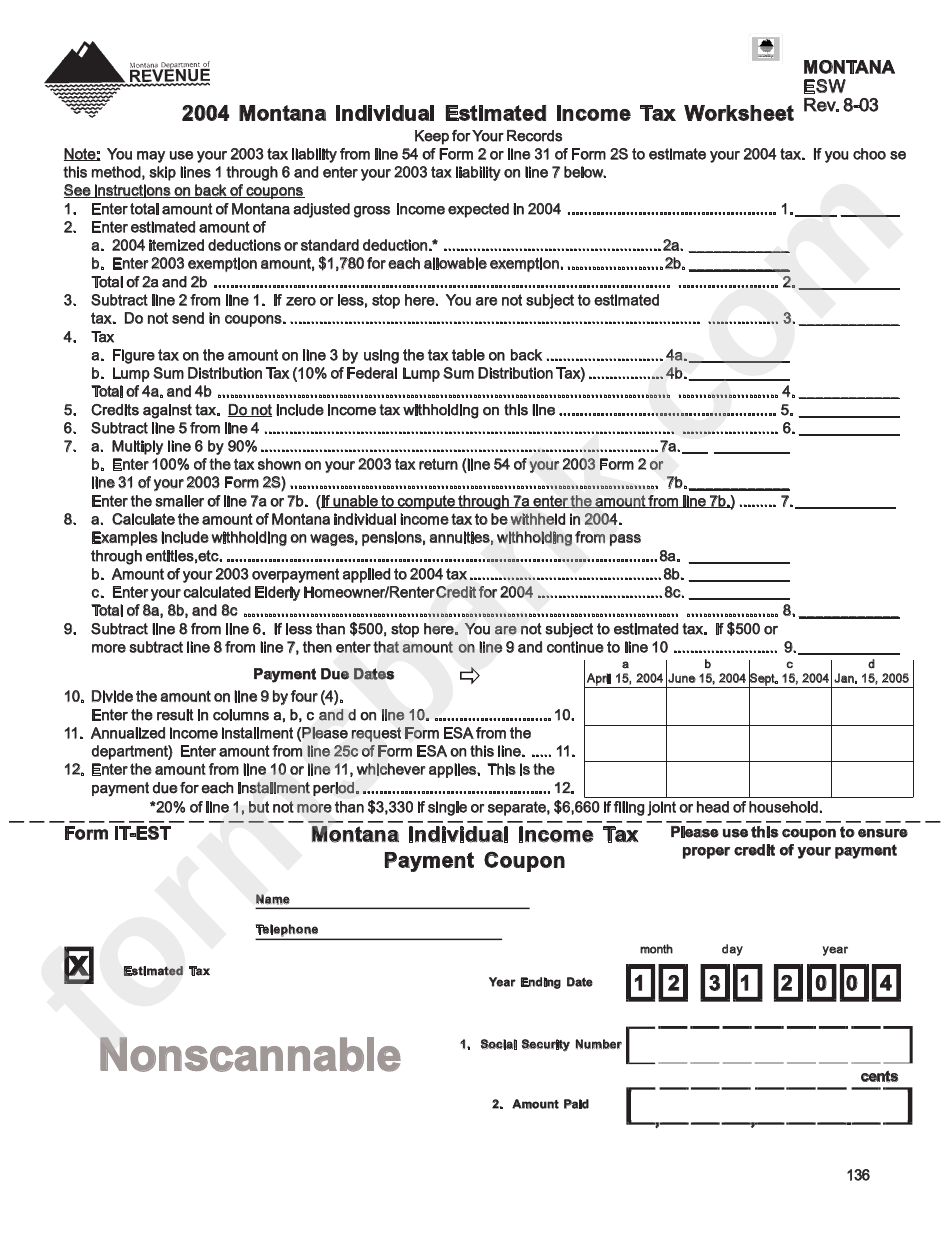

Form Esw Montana Individual Estimated Tax Withheld 2004

Fillable Form 2 Montana Individual Tax Return 2013 printable

Fillable Form 2 Montana Individual Tax Return 2012 printable

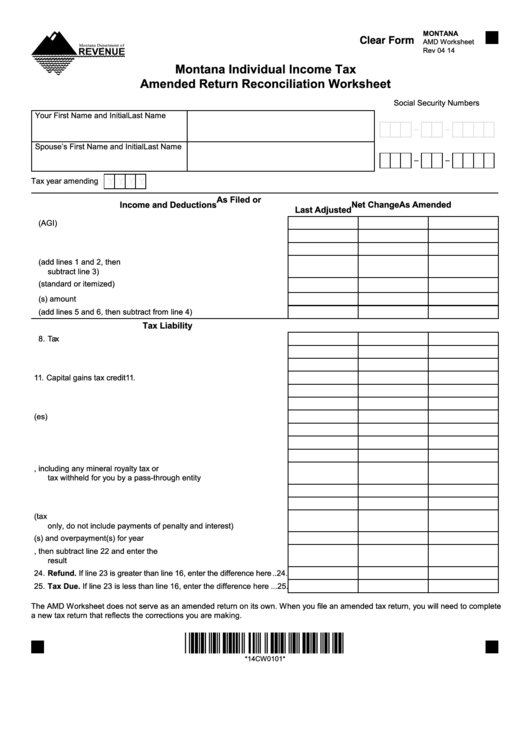

Fillable Form Amd Montana Individual Tax Amended Return

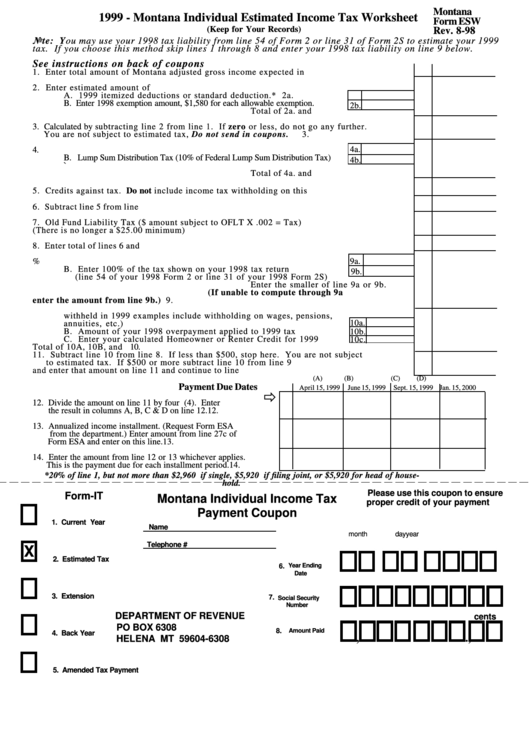

Fillable Form Esw Montana Individual Estimated Tax Worksheet

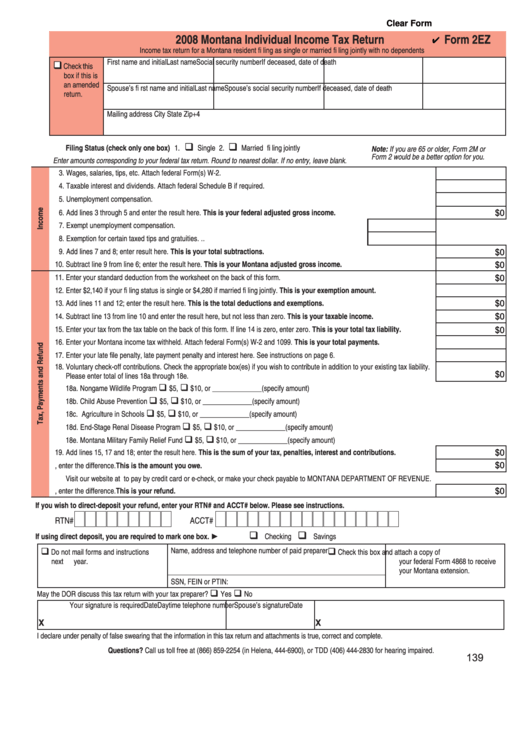

Form 2ez Montana Individual Tax Return 2008 printable pdf

Form 2 Montana Individual Tax Return YouTube

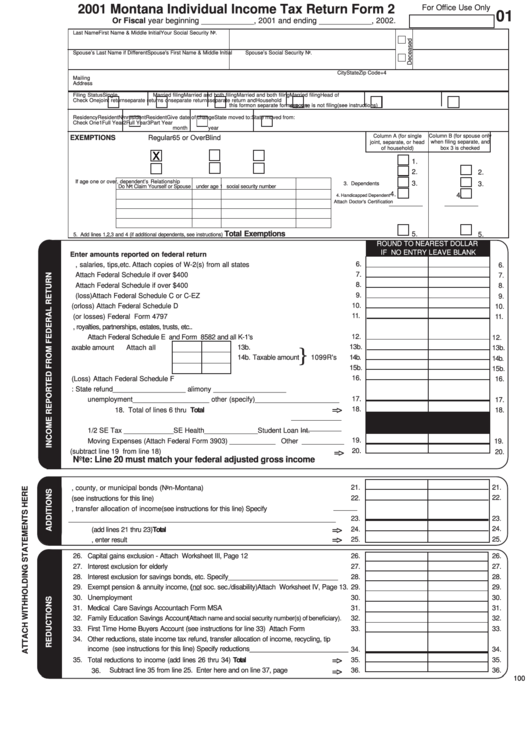

Form 2 Montana Individual Tax Return 2001 printable pdf download

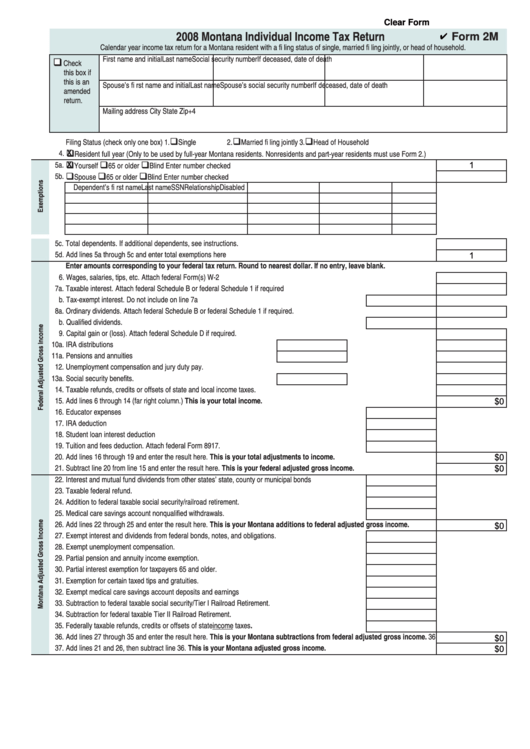

Fillable Form 2m 2008 Montana Individual Tax Return printable

Related Post: