New York State Sales Tax Form St 100

New York State Sales Tax Form St 100 - 3rd quarter quarterly sales and use tax return. If you are filing this return after the due date and/or not paying the full amount of tax due, stop!. Web make check or money order payable to new york state sales tax. Web local sales and use tax. June 1, 2023, through august 31,. Ad see how to streamline your sales tax filings and improve accuracy before annual reporting. Web enter gross sales and services — enter the total taxable, nontaxable, and exempt sales and services from your new york state business locations and from locations outside. Quarterly sales and use tax return. But you should work with the best. New york state and local quarterly sales and use tax return. New york state and local annual sales and use tax return. New york state and local quarterly sales and use tax return. If you are filing this return after the due date and/or not paying the full amount of tax due, stop!. Web 12 rows 2nd quarter: Web new york state and local quarterly sales and use tax return. Web 12 rows 2nd quarter: If you are filing this return after the due date and/or not paying the full amount of tax due, stop!. Work with a cpa you can trust with your business accounting. Web department of taxation and finance. New york state and local annual sales and use tax return. Web york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet the conditions in either group a or group b: Call our sales tax information center for. Ad there are tons of tax cpas out there who are just okay. If you are filing this return. New york state and local. But you should work with the best. New york state and local quarterly sales and use tax return. Web new york state and local quarterly sales and use tax return. Ad there are tons of tax cpas out there who are just okay. Web make check or money order payable to new york state sales tax. Quarterly sales and use tax return. If you are filing this return. Web department of taxation and finance. New york state and local annual sales and use tax return. New york state and local quarterly sales and use tax return. 3rd quarter quarterly sales and use tax return. Web 12 rows 2nd quarter: Work with a cpa you can trust with your business accounting. June 1, 2023, through august 31,. Web local sales and use tax. Web york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet the conditions in either group a or group b: Ad see how to streamline your sales tax filings and improve accuracy before annual reporting. Web make check or money order payable to new york state sales tax. New york state. Ad see how to streamline your sales tax filings and improve accuracy before annual reporting. Quarterly sales and use tax return. Web make check or money order payable to new york state sales tax. If you are filing this return. Web york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet. Call our sales tax information center for. Web the new york state excise tax increased on september 1, 2023. Web make check or money order payable to new york state sales tax. But you should work with the best. New york state and local quarterly. If you are filing this return after the due date and/or not paying the full amount of tax due, stop!. Ad there are tons of tax cpas out there who are just okay. But you should work with the best. Work with a cpa you can trust with your business accounting. If you are a retail dealer, wholesale dealer, or. New york state and local. Ad see how to streamline your sales tax filings and improve accuracy before annual reporting. If you are iling this return after the due date. Web new york state and local quarterly sales and use tax return. Web make check or money order payable to new york state sales tax. New york state and local quarterly. Web enter gross sales and services — enter the total taxable, nontaxable, and exempt sales and services from your new york state business locations and from locations outside. Quarterly sales and use tax return. If you are filing this return after the due date and/or not paying the full amount of tax due, stop!. Web local sales and use tax. Our tax preparers will ensure that your tax returns are complete, accurate and on time. Web make check or money order payable to new york state sales tax. If you are filing this return. New york state and local quarterly sales and use tax return. Web department of taxation and finance. Call our sales tax information center for. Web the new york state excise tax increased on september 1, 2023. Web york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet the conditions in either group a or group b: Click the link to get the form instructions from the new york website. Ad there are tons of tax cpas out there who are just okay.Nys St 100 Fillable Form Printable Forms Free Online

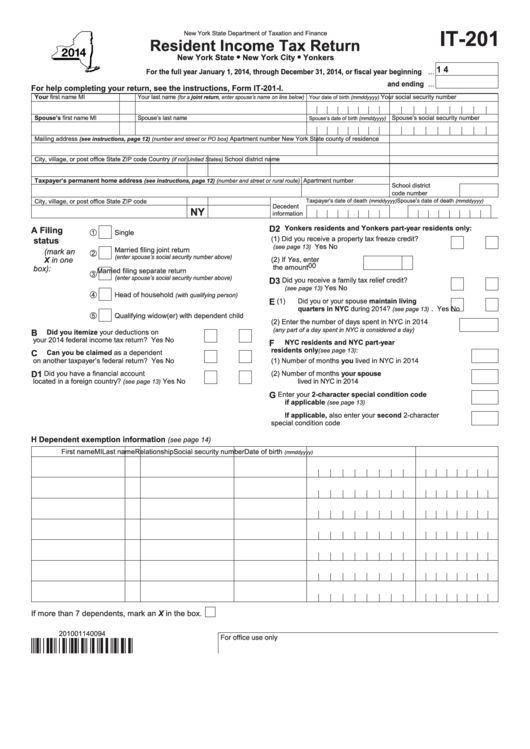

Fillable It201 New York Tax Form Printable Forms Free Online

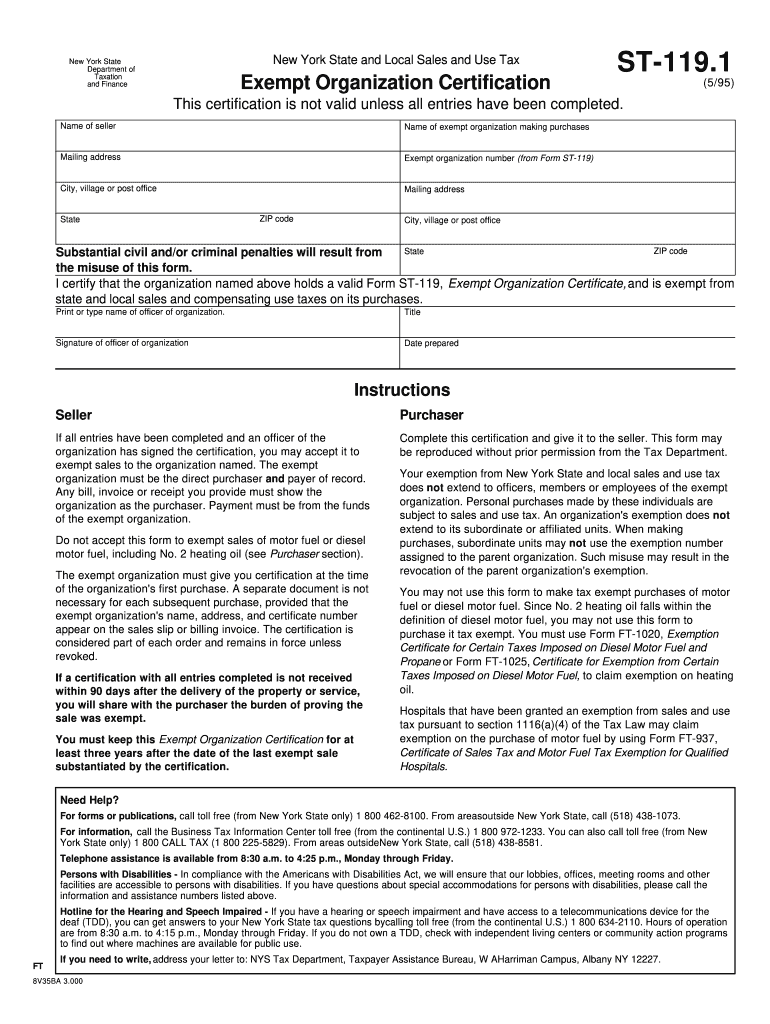

Nys Sales Tax Form St 100 Printable Fill Out and Sign Printable PDF

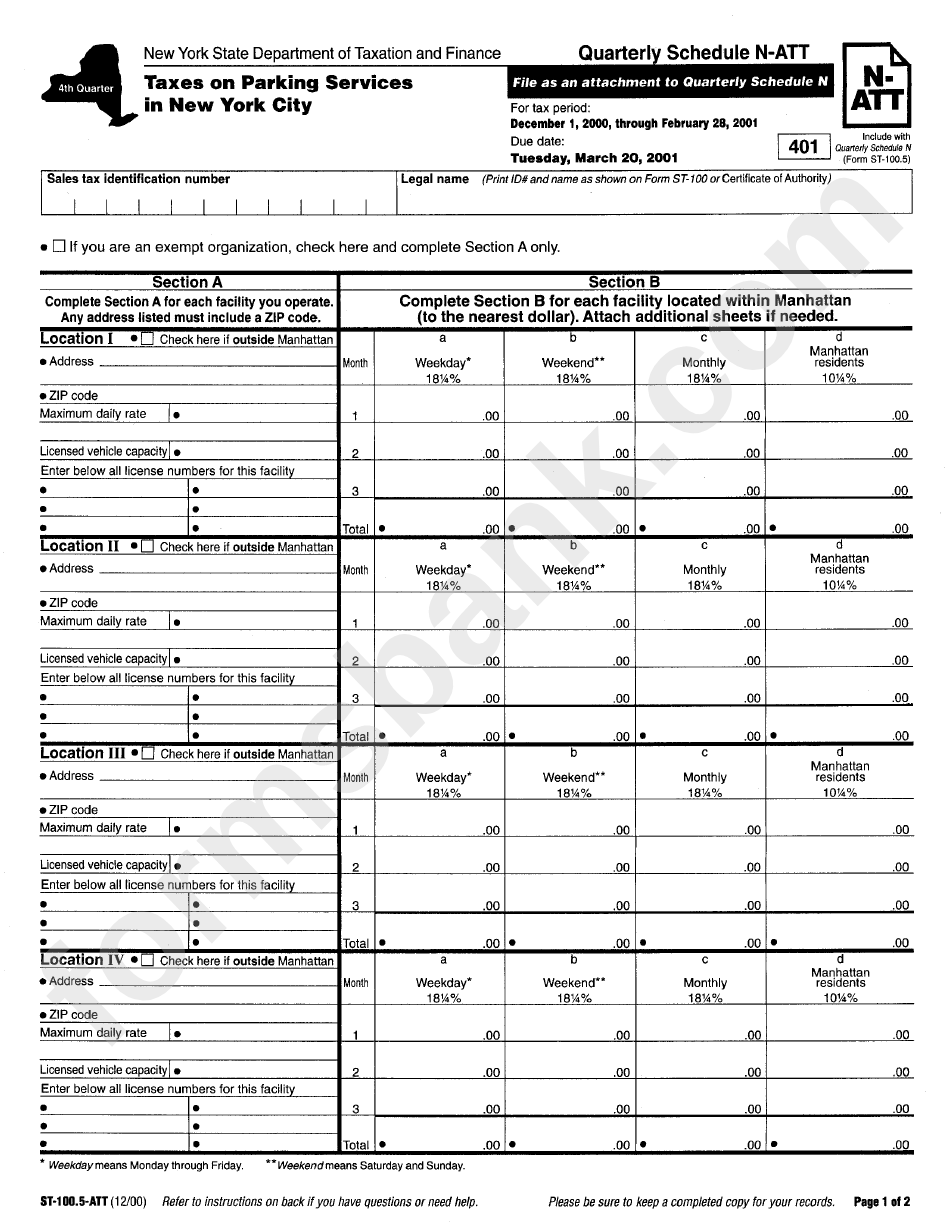

Form St100.5Att Taxes On Parking Services In New York City New

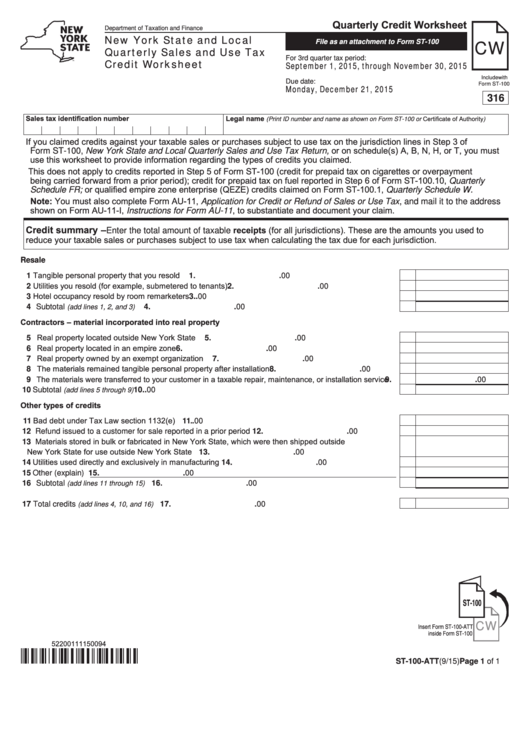

Form St100Att New York State And Local File As An Attachment To

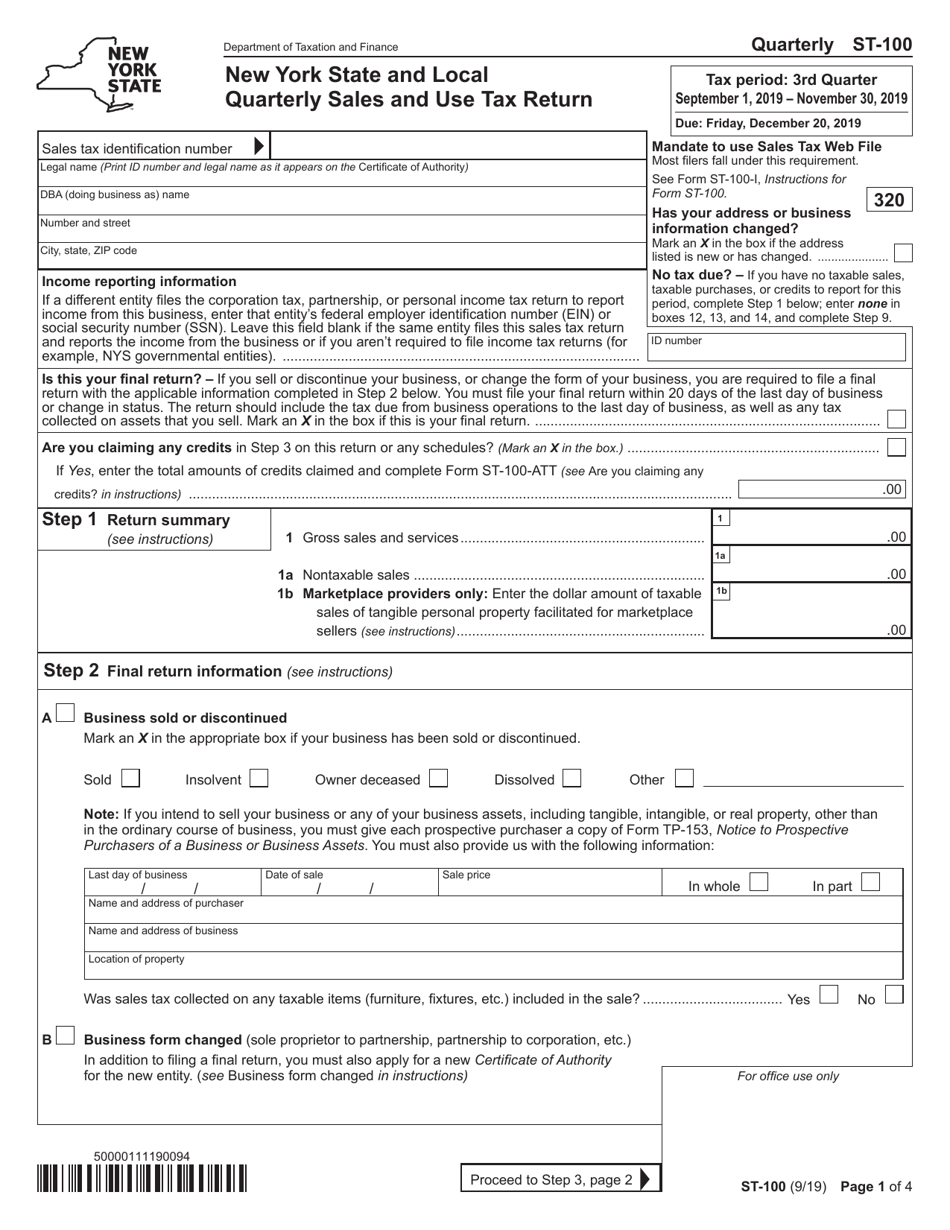

Form ST100 Download Printable PDF or Fill Online New York State and

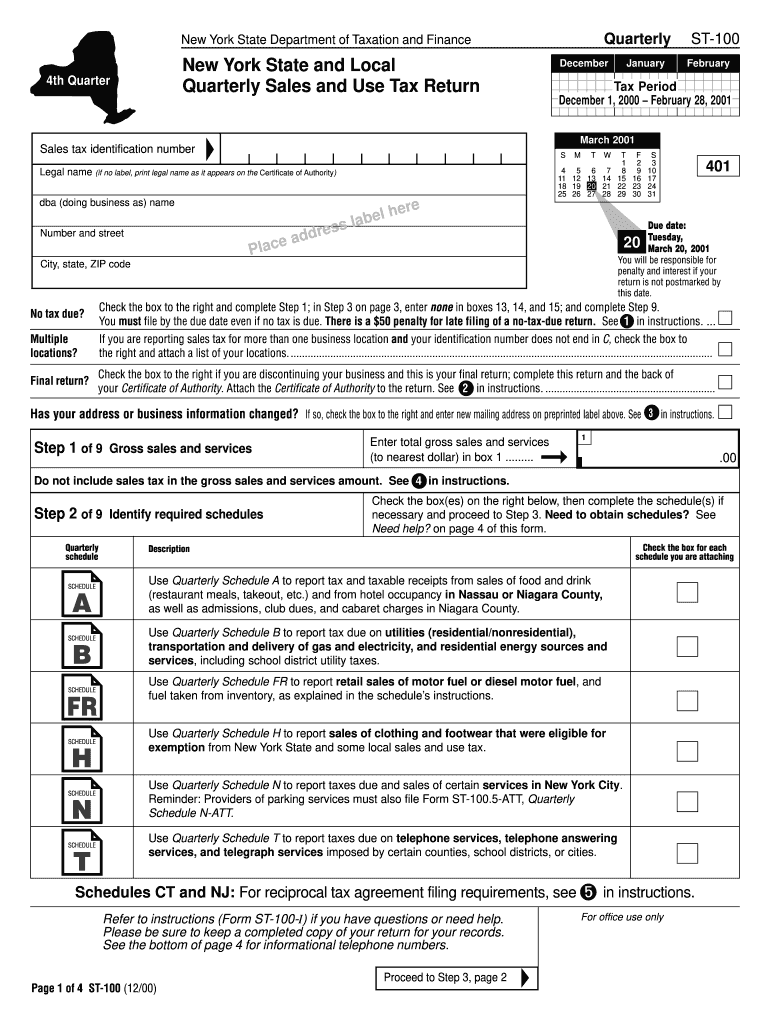

New York State Sales Tax Form St 100 Dec 12 Feb 13 Fill Out and Sign

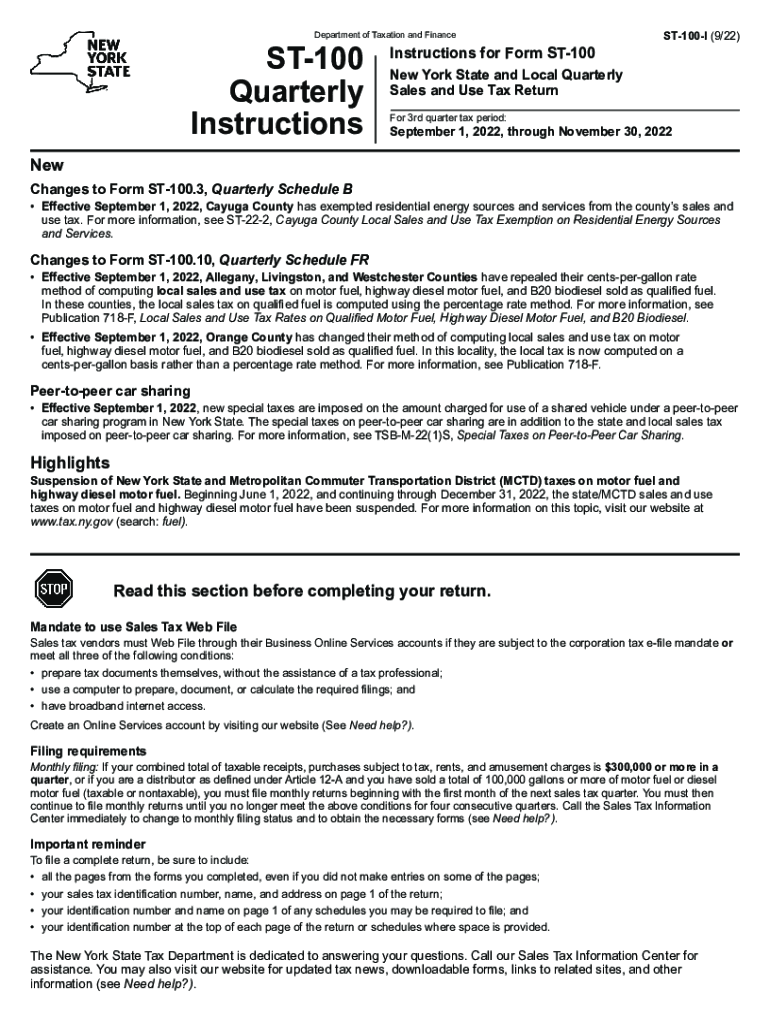

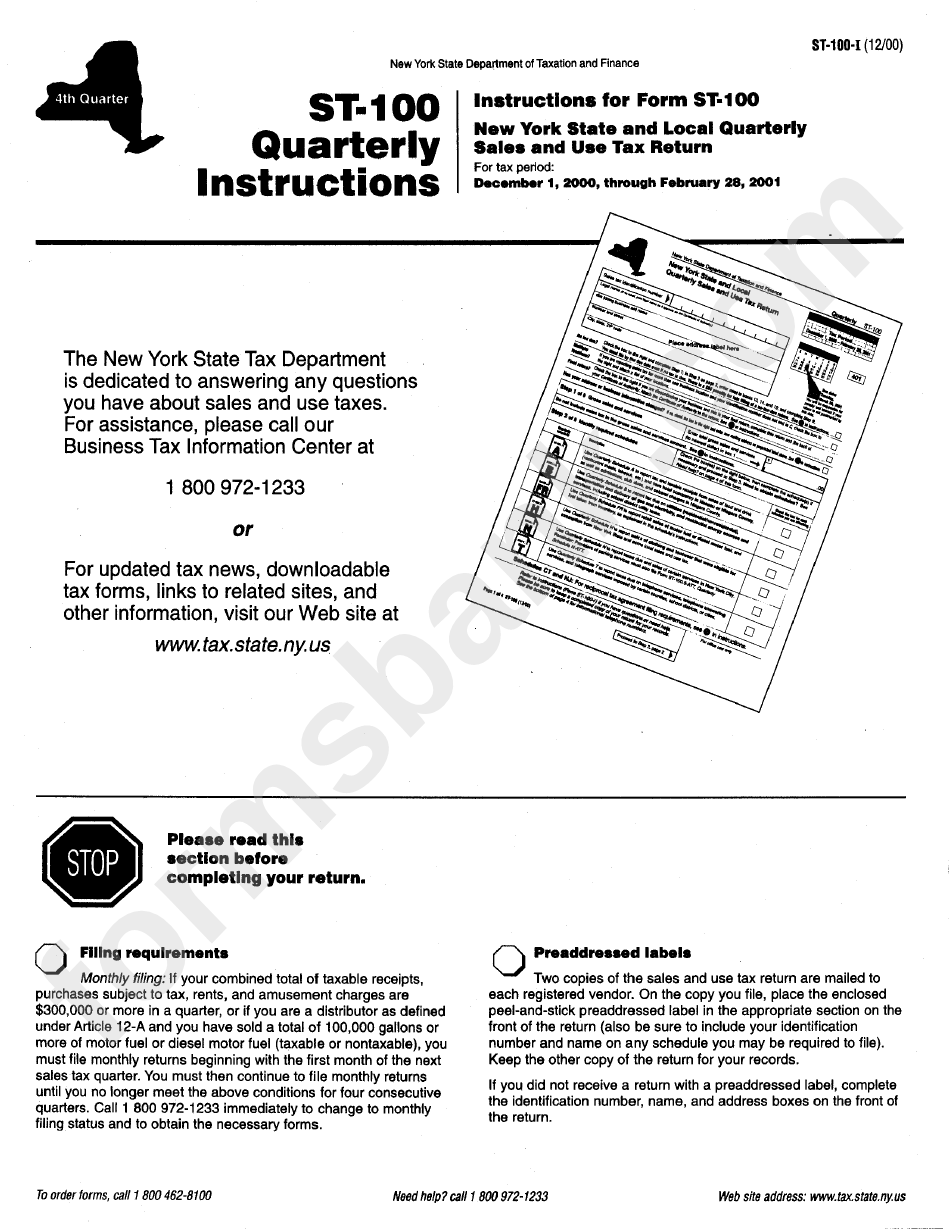

Form St100 Instructions printable pdf download

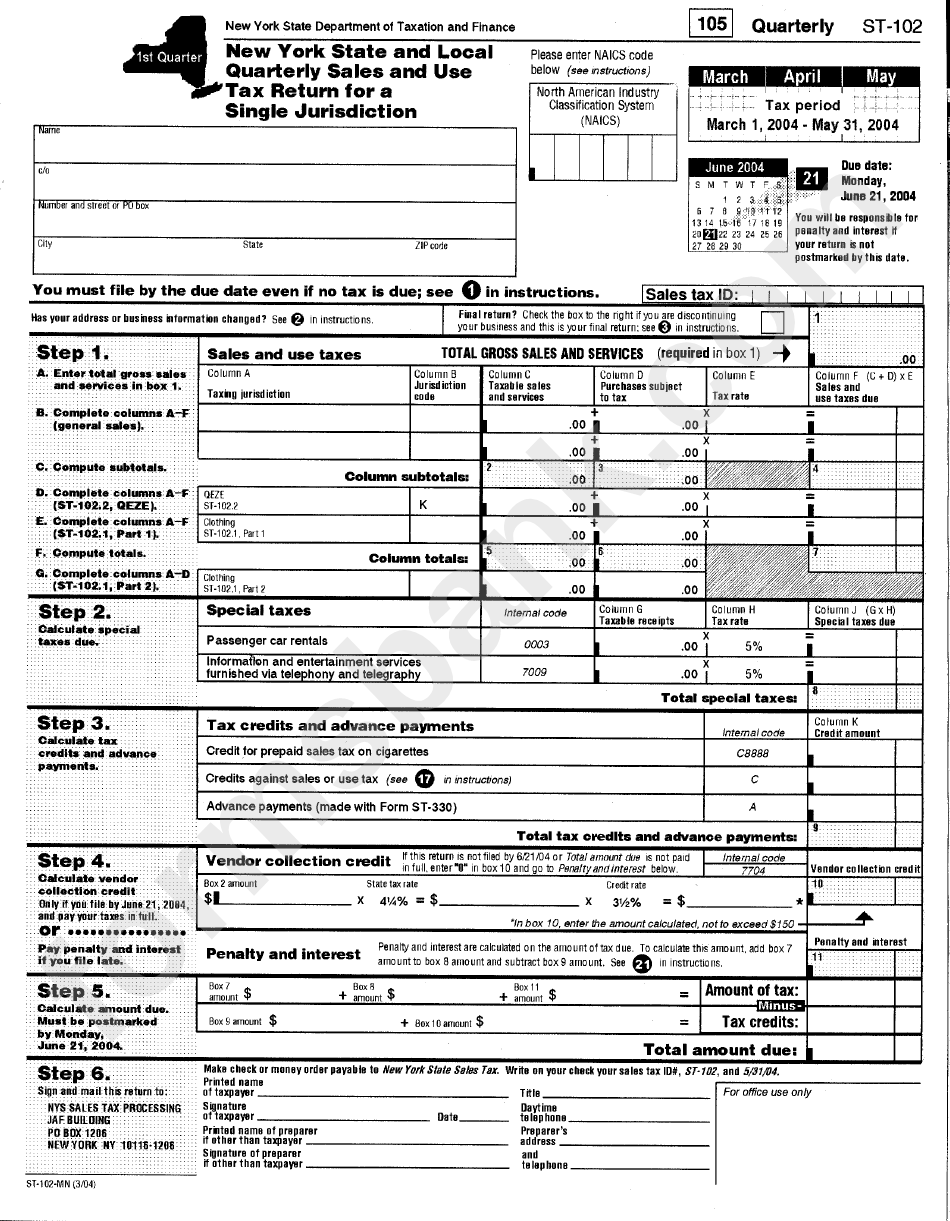

Form St102 New York State And Local Quarterly Sales And Use Tax

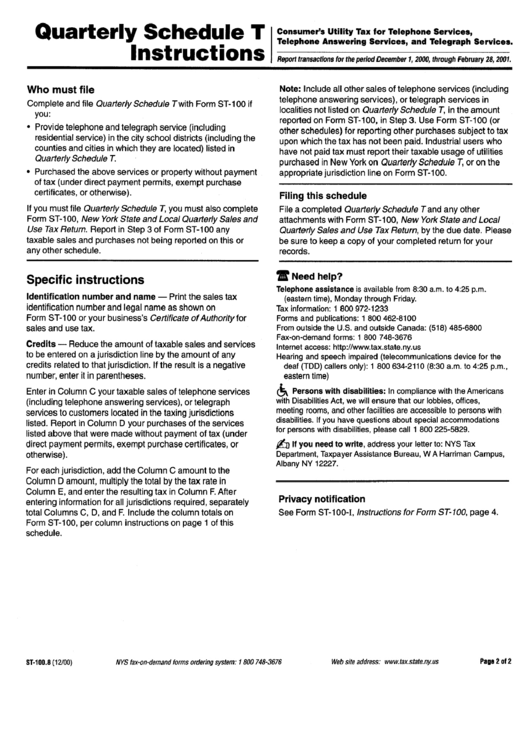

Form St100.b Quarterly Schedule T Instructions State Of New York

Related Post: