Irs.gov Where To File Form 3531

Irs.gov Where To File Form 3531 - The irs is rolling out its pilot of a free direct tax filing program. Use get form or simply click on the template preview to open it in the editor. Starting in 2024, arizona, california,. Guide to head of household; Web it sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal emergency management. Shown is a form 3531. Don't understand what this is all about as i followed all the indications turbo tax. Web the form provides taxpayers with an opportunity to agree or disagree with the proposed changes made by the irs. Lacking that address, i'd suggest sending it top the address specified here:. The irs is rolling out its pilot of a free direct tax filing program. Web level 1 just received same form 3531 with copy of my 2019 taxes i filed online. When it comes to filing tax returns, it\'s important to know where to mail irs form 3531 to ensure timely. Use get form or simply click on the template. Web the internal revenue service is moving ahead with its plan to build its own free tax filing program, announcing tuesday that a pilot version will be available to. Guide to head of household; Form 3531, page 1this represents the front page of form 3531, request for signature. Select the document you want to sign and click upload. Web i. Check the nearest irs offices and their phone numbers for free now. I was trying to find where i need to mail the. Web us treasury secretary janet yellen has said tax filing should be simple. Web it sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Web the letter. Form 3531, page 1this represents the front page of form 3531, request for signature. Owner (under section 6048 (b)) internal revenue service. Contact the irs directly to discuss your situation. Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal emergency management. Use get form or simply click on. Guide to head of household; Web the form provides taxpayers with an opportunity to agree or disagree with the proposed changes made by the irs. Shown is a form 3531. When it comes to filing tax returns, it\'s important to know where to mail irs form 3531 to ensure timely. Web if you are not using the official irs form. Find irs mailing addresses to file forms. Use get form or simply click on the template preview to open it in the editor. Web if the irs wants you to perform some correction to your return before they will process it, they often send form 3531 or letter 143c with their requests for action. I was trying to find where. Web it sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Checking both boxes seems to be contradictory. Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal emergency management. Married filing jointly vs separately; Use get form or. Web it sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Ad we help get taxpayers relief from owed irs back taxes. Contact the irs directly to discuss your situation. Shown is a form 3531. Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for. Web i received a form 3531 request for signature or missing information to complete return. Guide to head of household; I could not find this form on the irs site. Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. Currently, the irs allows taxpayers with. Web the irs on tuesday unveiled more details about direct file, the agency's free electronic tax filing pilot program. Form 3531, page 1this represents the front page of form 3531, request for signature. Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. Web i received. Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. Estimate how much you could potentially save in just a matter of minutes. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. Select the document you want to sign and click upload. Page last reviewed or updated: Owner (under section 6048 (b)) internal revenue service. Web usually form 3531 has an address in the upper left corner to send the form. Web if the irs wants you to perform some correction to your return before they will process it, they often send form 3531 or letter 143c with their requests for action. Use get form or simply click on the template preview to open it in the editor. Married filing jointly vs separately; Start completing the fillable fields. Check the nearest irs offices and their phone numbers for free now. Web the form provides taxpayers with an opportunity to agree or disagree with the proposed changes made by the irs. Guide to head of household; Tax tips & video homepage; Web if you are not using the official irs form to furnish statements to recipients, see pub. Web i received a form 3531 request for signature or missing information to complete return. Web what do i need to do? Web the letter said, that i can send it to the return address, but there is no return address on the mail, the only address written on the upper left of the envelop is (internal revenue. Web 2 days agowhy the irs is testing a free direct file program.Tax Return Filing Under Section 119(2)(b) TAXP

IRS Audit Letter 3531 Sample 1

3.11.3 Individual Tax Returns Internal Revenue Service

Form 3531 what to do and where to send r/IRS

3.11.3 Individual Tax Returns Internal Revenue Service

3.11.3 Individual Tax Returns Internal Revenue Service

IRS Audit Letter 3531 Sample 1

EDGAR Filing Documents for 000100522915000053

3.11.3 Individual Tax Returns Internal Revenue Service

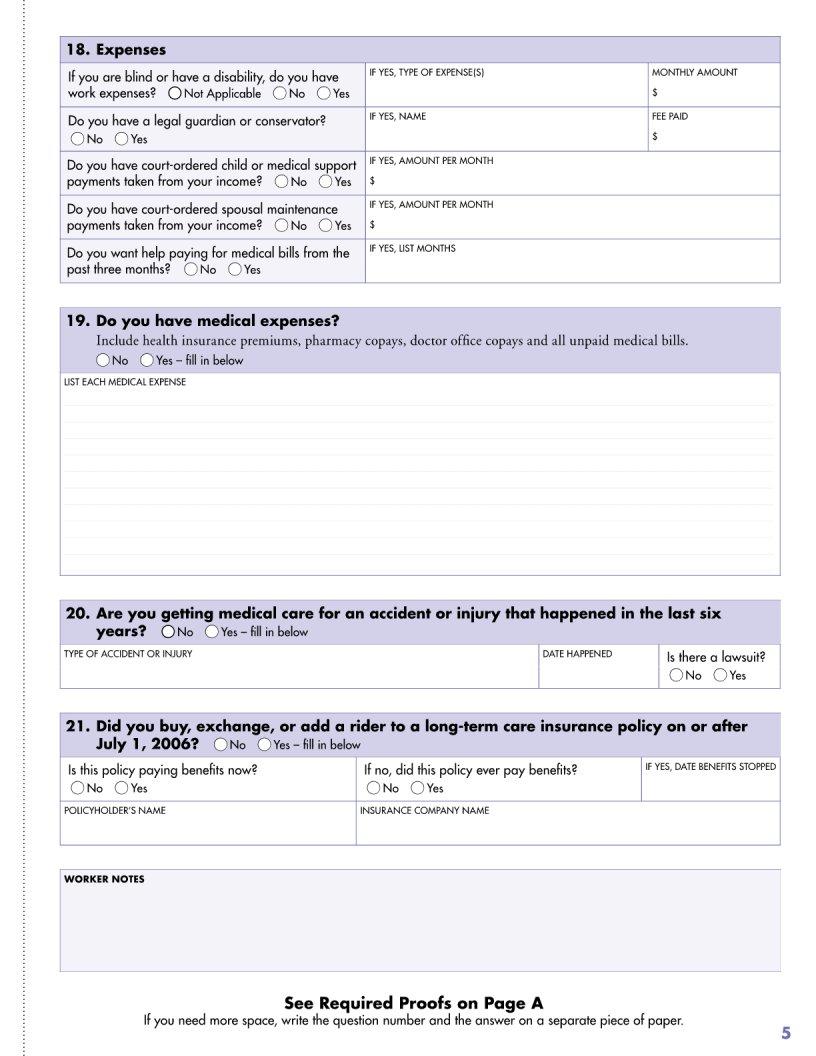

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

Related Post: