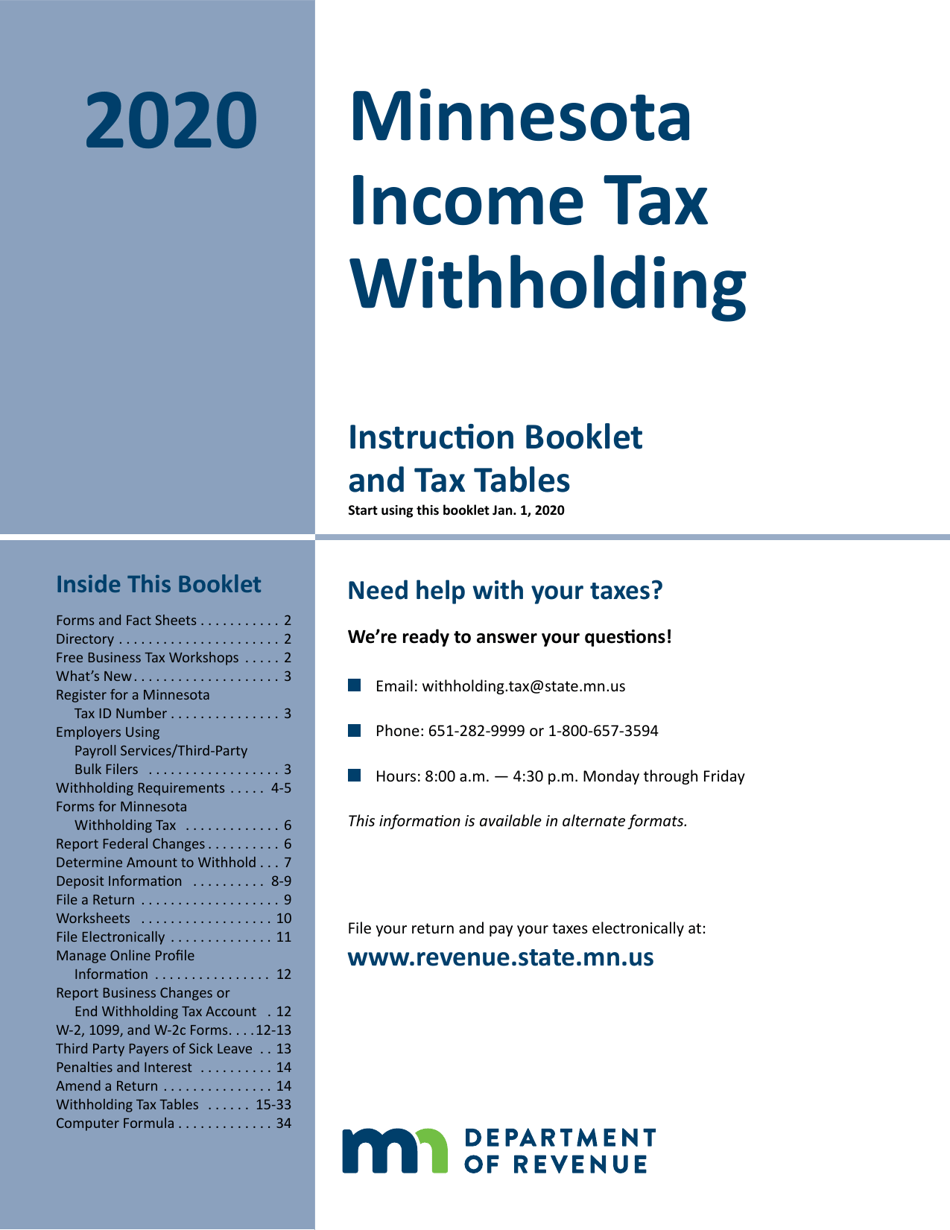

Minnesota Tax Withholding Form

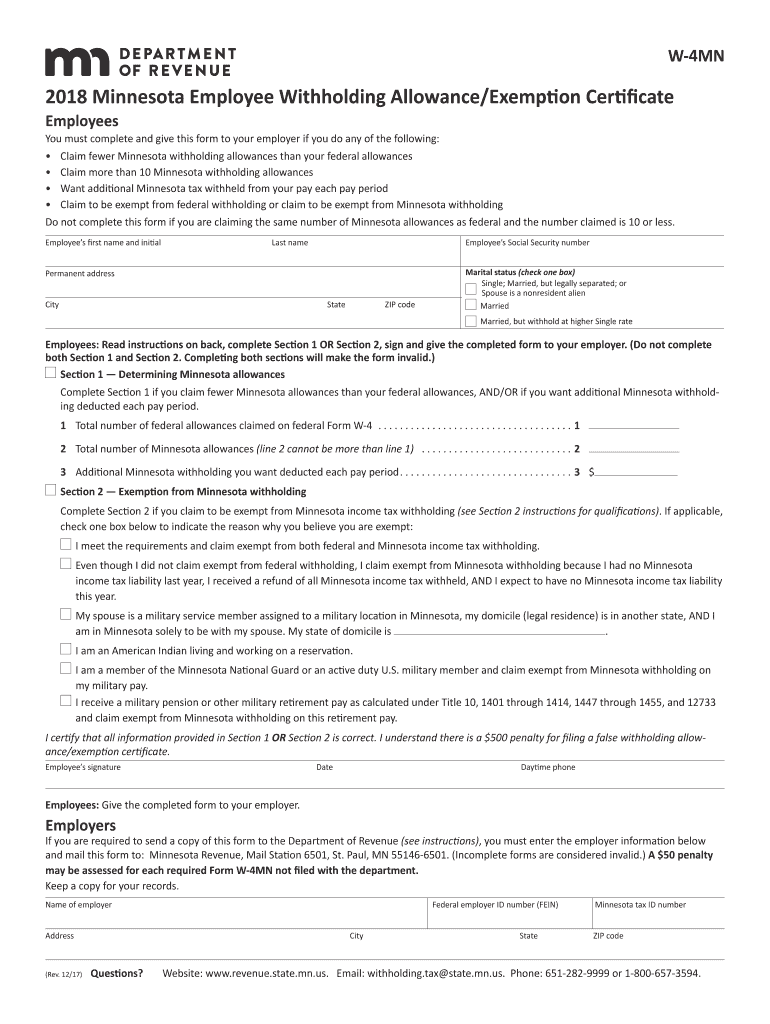

Minnesota Tax Withholding Form - The income tax withholding formula for the state of minnesota includes the following changes: The mn state tax withholding default will be 6.25%. Consider completing a new form. For regular wages, withholding must be based on allowances you. Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. Employees can view and change federal adjustments and state withholding information using self service. Web minnesota taxes are calculated using the minnesota withholding tax tables (pdf). Web starting january 1, 2024: You then send this money as deposits to. Msrs cannot provide advice about how to complete. Web complete section 1 to find your allowances for minnesota withholding tax. Ad gusto.com has been visited by 10k+ users in the past month Upload, modify or create forms. Web starting january 1, 2024: You may not want to claim. Ad approve payroll when you're ready, access employee services & manage it all in one place. Employees can view and change federal adjustments and state withholding information using self service. Hours [+] address [+] last updated. You then send this money as deposits to. Web starting january 1, 2024: Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. For regular wages, withholding must be based on allowances you. Web starting january 1, 2024: Hours [+] address [+] last updated. Try it for free now! The income tax withholding formula for the state of minnesota includes the following changes: You must file withholding tax returns with the minnesota. Pay your team and access hr and benefits with the #1 online payroll provider. Consider completing a new form. You may not want to claim. The mn state tax withholding default will be 6.25%. You must file withholding tax returns with the minnesota. Web complete section 1 to find your allowances for minnesota withholding tax. Employees can view and change federal adjustments and state withholding information using self service. Ad download or email mn 11.1 & more fillable forms, register and subscribe now! If you claim the same number of allowances for both state and federal taxes, you can use the. Web minnesota taxes are calculated using the minnesota withholding tax tables (pdf). Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. Hours [+] address [+] last updated. Web if an employee claims more than. You may not want to claim. Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. The income tax withholding formula for the state of minnesota includes the following changes: Ad download or email mn 11.1 & more fillable forms, register and subscribe now! Ad approve payroll when you're ready, access employee services. Ad gusto.com has been visited by 10k+ users in the past month The mn state tax withholding default will be 6.25%. You must file withholding tax returns with the minnesota. Ad download or email mn 11.1 & more fillable forms, register and subscribe now! Ad approve payroll when you're ready, access employee services & manage it all in one place. You may not want to claim. Consider completing a new form. Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. Employees can view and change federal adjustments and state withholding information using self service. If you claim the same number of allowances for both state and federal taxes, you can use the. Web starting january 1, 2024: The mn state tax withholding default will be 6.25%. The income tax withholding formula for the state of minnesota includes the following changes: You then send this money as deposits to. For regular wages, withholding must be based on allowances you. Msrs cannot provide advice about how to complete. Employees can view and change federal adjustments and state withholding information using self service. Ad download or email mn 11.1 & more fillable forms, register and subscribe now! Web starting january 1, 2024: Ad approve payroll when you're ready, access employee services & manage it all in one place. Web complete section 1 to find your allowances for minnesota withholding tax. You must file withholding tax returns with the minnesota. Ad gusto.com has been visited by 10k+ users in the past month Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. You may not want to claim. Consider completing a new form. Try it for free now! You then send this money as deposits to. For regular wages, withholding must be based on allowances you. Web starting january 1, 2024: The income tax withholding formula for the state of minnesota includes the following changes: If you claim the same number of allowances for both state and federal taxes, you can use the. Data is secured by a user id and password. You can get minnesota tax forms either by mail or in person. Web minnesota taxes are calculated using the minnesota withholding tax tables (pdf).2020 Minnesota Minnesota Tax Withholding Fill Out, Sign Online

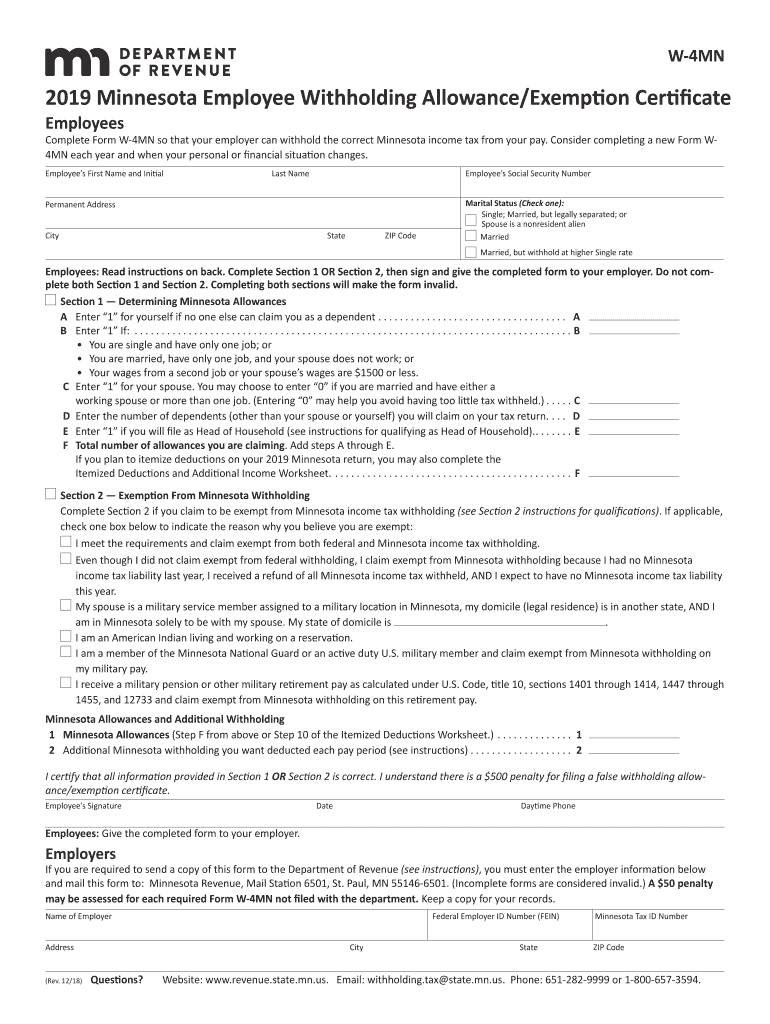

2019 Form MN W4MN Fill Online, Printable, Fillable, Blank pdfFiller

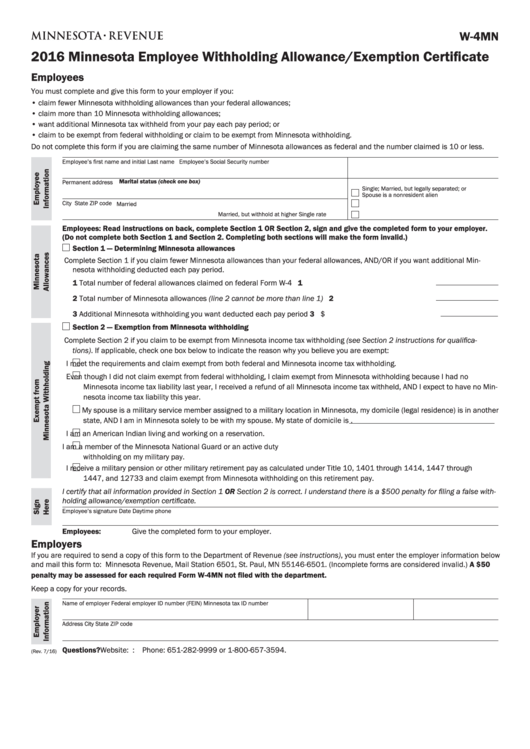

Fillable W4mn, Minnesota Employee Withholding Form printable pdf download

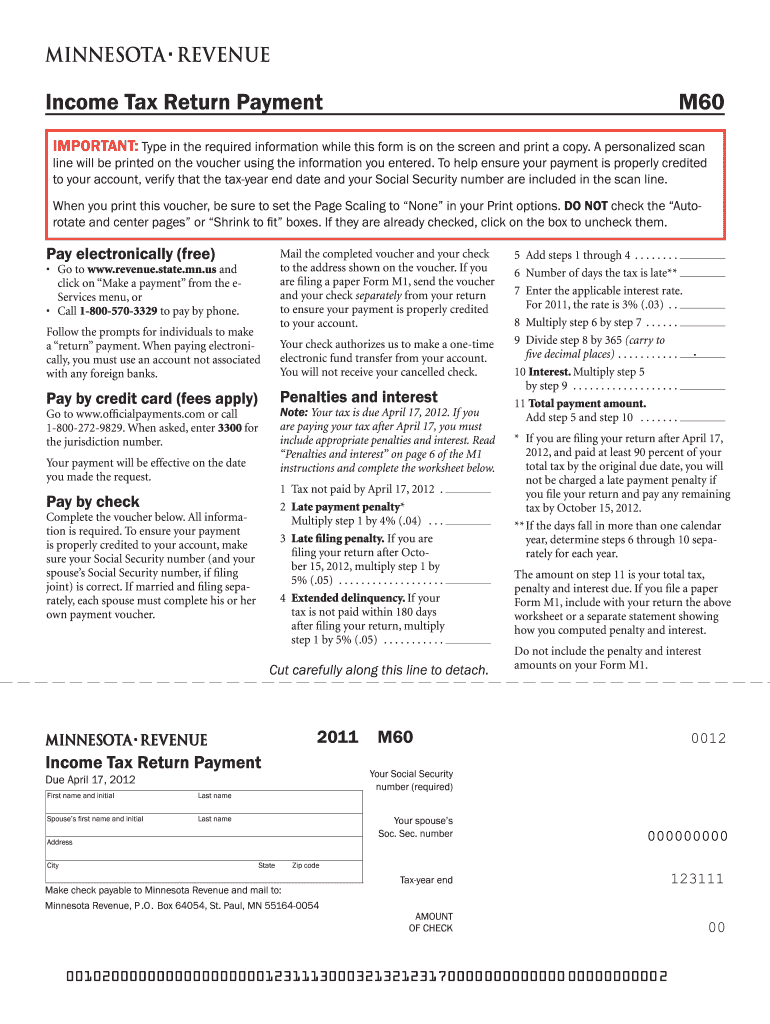

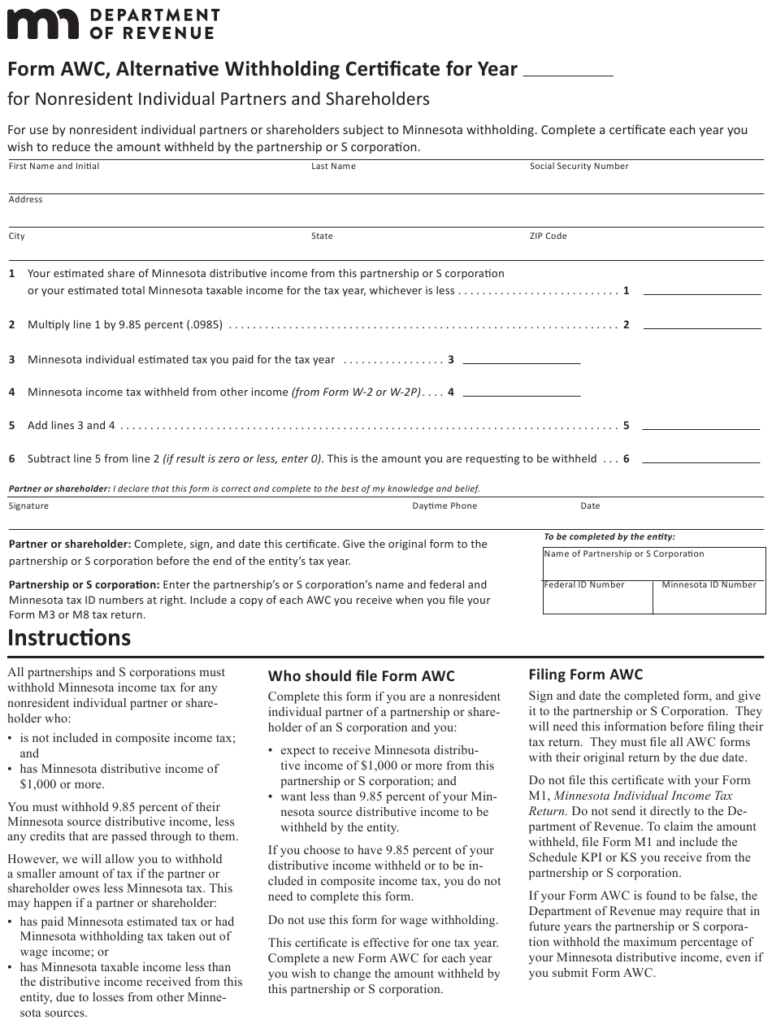

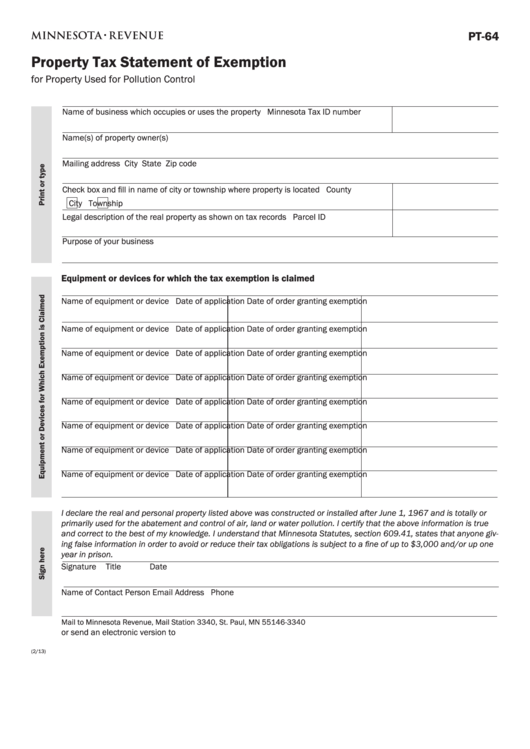

Fill Free fillable Minnesota Department of Revenue PDF forms

MN M1W 20202022 Fill out Tax Template Online US Legal Forms

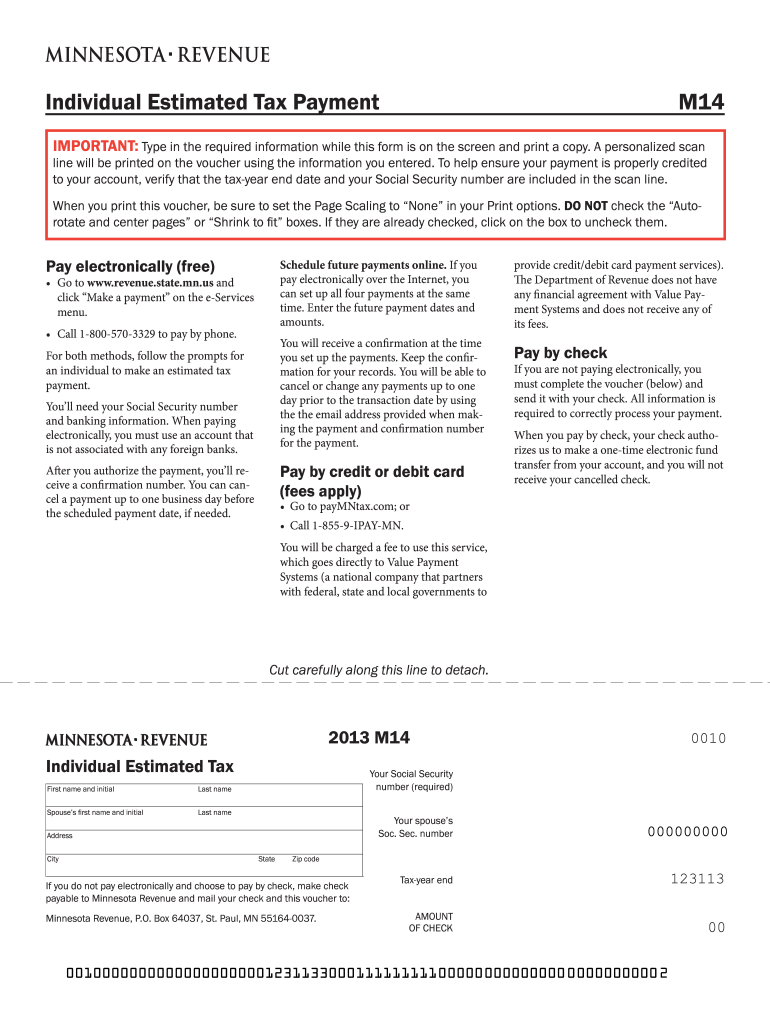

Mn Estimated Tax Form Fill Out and Sign Printable PDF Template signNow

Minnesota Estimated Tax Voucher 2022 Fill Out and Sign Printable PDF

Minnesota State Withholding Form 2021 Federal Withholding Tables 2021

Form W 4mn Minnesota Employee Withholding Allowance Exemption

Form W 4 MN, Minnesota Employee Withholding Allowance Fill Out and

Related Post: