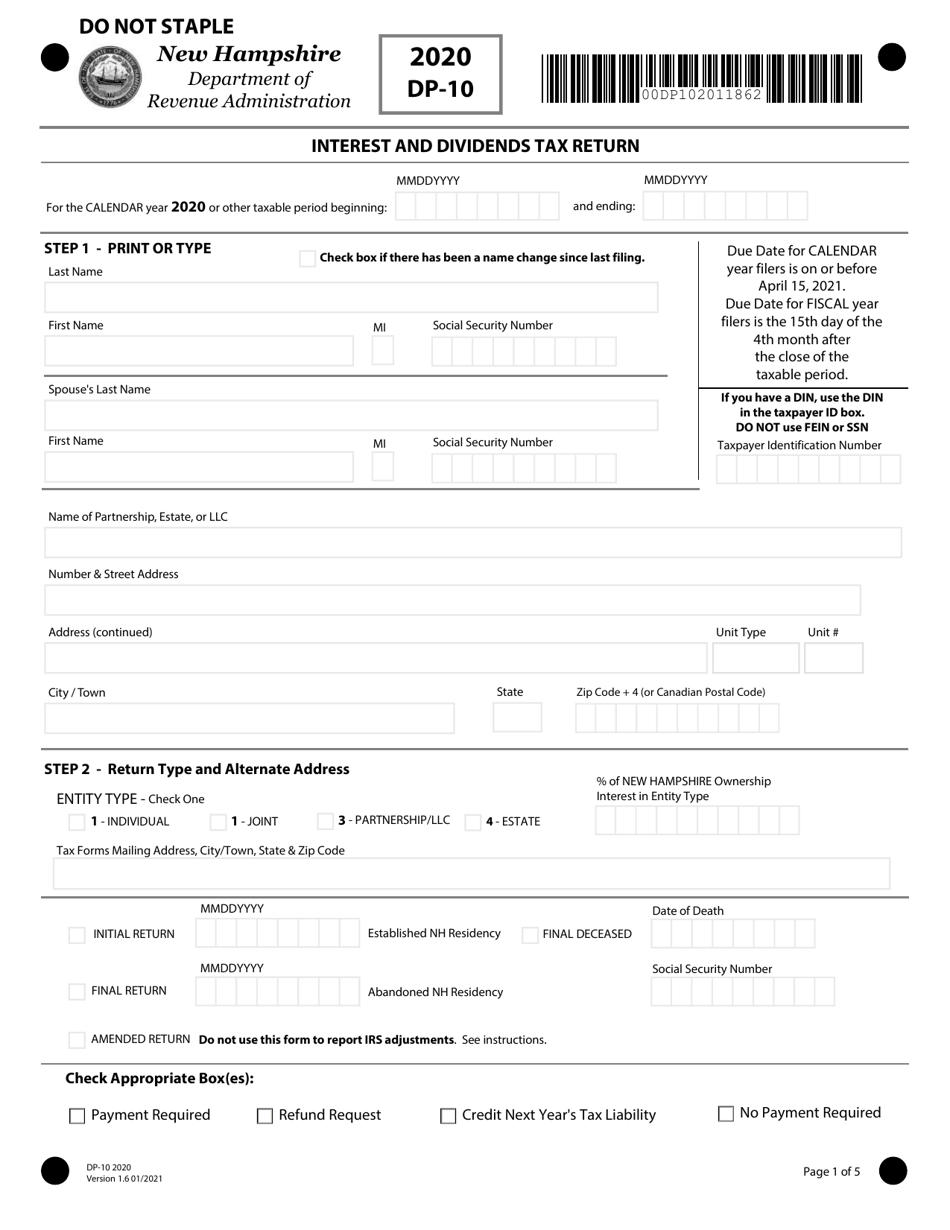

New Hampshire Form Dp-10

New Hampshire Form Dp-10 - Web follow the simple instructions below: (sum of lines 1(a), 1(b) and 1(c)) 1(a) round to. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. New hampshire department of revenue administration. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. We will update this page with a new version of the form for 2024 as soon as it is made available. Using our platform filling out dp10 form requires just a. Try it for free now! Web new hampshire usually releases forms for the current tax year between january and april. Web new hampshire does not have a separate form for amended returns. New hampshire department of revenue administration. Using our platform filling out dp10 form requires just a. This form is for income earned in tax year 2022,. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web 4.8 satisfied 58 votes how to fill out and sign rsa online? New hampshire department of revenue administration. Get your online template and fill it in using progressive features. You do not need to file this. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Married couples and civil union partners may elect to file a joint. We will update this page with a new version of the form for 2024 as soon as it is made available. This form is for income earned in tax year 2022,. New hampshire department of revenue administration. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. (sum of lines 1(a), 1(b) and. You do not need to file this. Get ready for tax season deadlines by completing any required tax forms today. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Enjoy smart fillable fields and interactivity. Web 4.8 satisfied 58 votes how to fill out and sign rsa online? Web new hampshire usually releases forms for the current tax year between january and april. Get your online template and fill it in using progressive features. You do not need to file this. While most taxpayers have income taxes automatically withheld every pay period by their employer,. Web (a) individuals who are inhabitants or residents of this state for any part of the taxable year whose gross interest and dividend income from all sources, including income from a. Experience all the advantages of submitting and completing documents online. Try it for free now! Interest and dividends tax return. Web this form is for income earned in tax. New hampshire department of revenue administration. Web new hampshire usually releases forms for the current tax year between january and april. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. Experience all the advantages of submitting and. Enjoy smart fillable fields and interactivity. We will update this page with a new version of the form for 2024 as soon as it is made available. Upload, modify or create forms. This form is for income earned in tax year 2022,. Get your online template and fill it in using progressive features. New hampshire department of revenue administration. Web (a) individuals who are inhabitants or residents of this state for any part of the taxable year whose gross interest and dividend income from all sources, including income from a. Web follow the simple instructions below: Upload, modify or create forms. It’s a mandatory tax form to file if you received more than. Interest and dividends tax return. Married couples and civil union partners may elect to file a joint. You do not need to file this. Upload, modify or create forms. Web follow the simple instructions below: It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. Interest and dividends tax return. Enjoy smart fillable fields and interactivity. (sum of lines 1(a), 1(b) and 1(c)) 1(a) round to. Web 4.8 satisfied 58 votes how to fill out and sign rsa online? Married couples and civil union partners may elect to file a joint. Web follow the simple instructions below: Try it for free now! Web new hampshire does not have a separate form for amended returns. You do not need to file this. Web new hampshire usually releases forms for the current tax year between january and april. Experience all the advantages of submitting and completing documents online. Upload, modify or create forms. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web (a) individuals who are inhabitants or residents of this state for any part of the taxable year whose gross interest and dividend income from all sources, including income from a. New hampshire department of revenue administration. We will update this page with a new version of the form for 2024 as soon as it is made available. Get ready for tax season deadlines by completing any required tax forms today. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. Using our platform filling out dp10 form requires just a.Form DP10 Download Fillable PDF or Fill Online Interest and Dividends

Free New Hampshire Tax Power of Attorney Form PDF

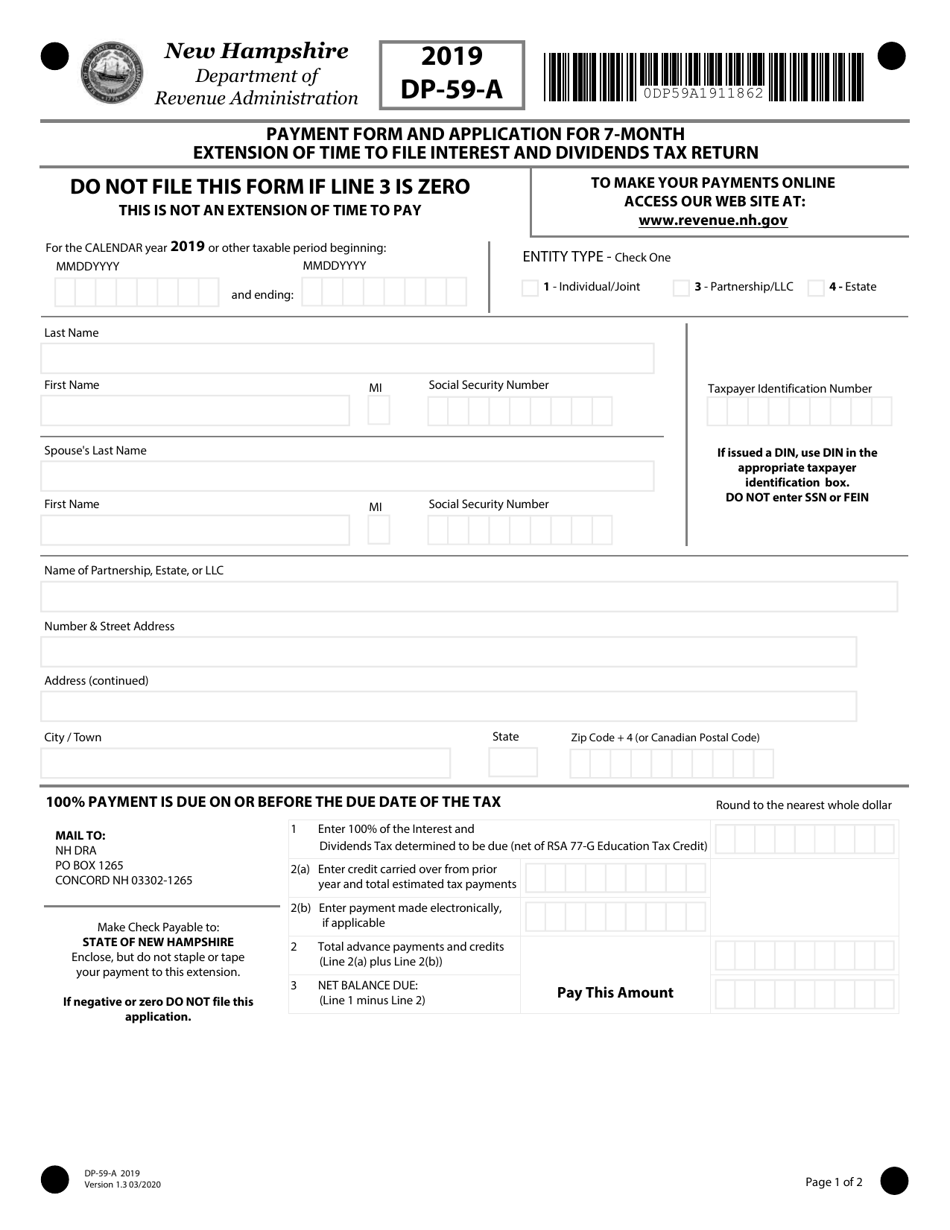

Form DP59A 2019 Fill Out, Sign Online and Download Fillable PDF

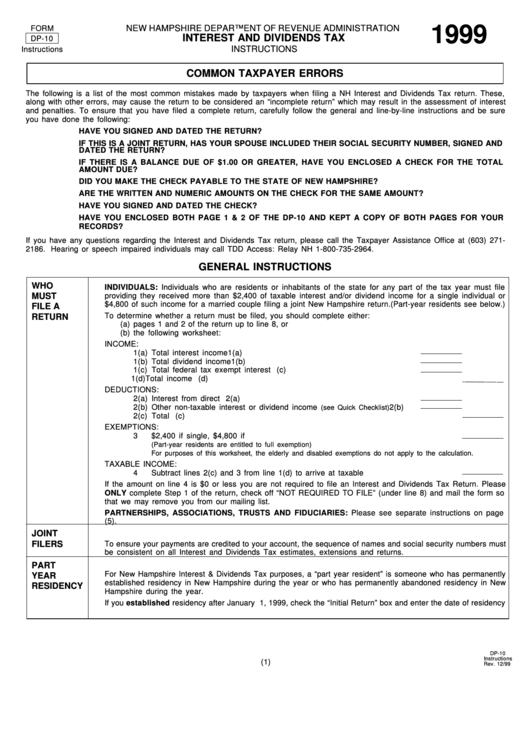

Form Dp10 Interest And Dividends Tax Instructions New Hampshire

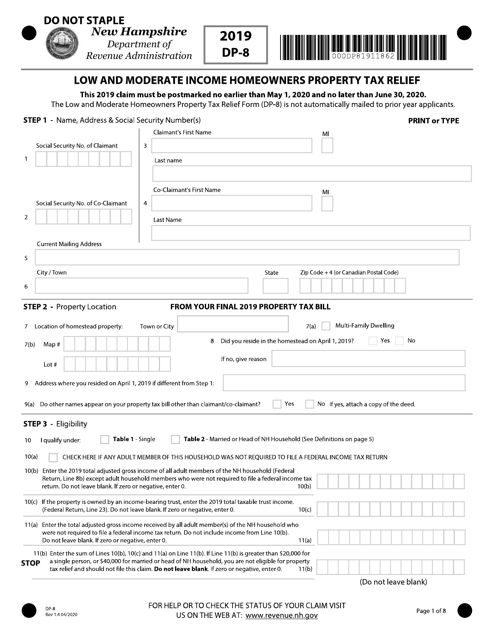

Form DP8 2019 Fill Out, Sign Online and Download Fillable PDF, New

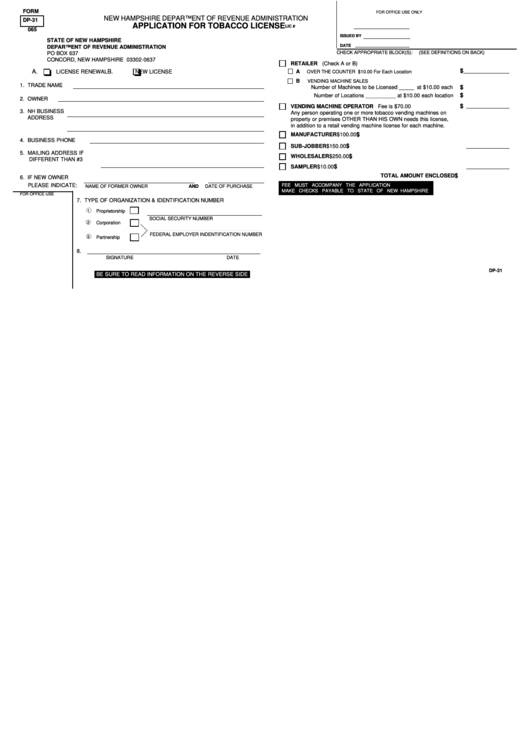

Form Dp31 Application For Tobacco License State Of New Hampshire

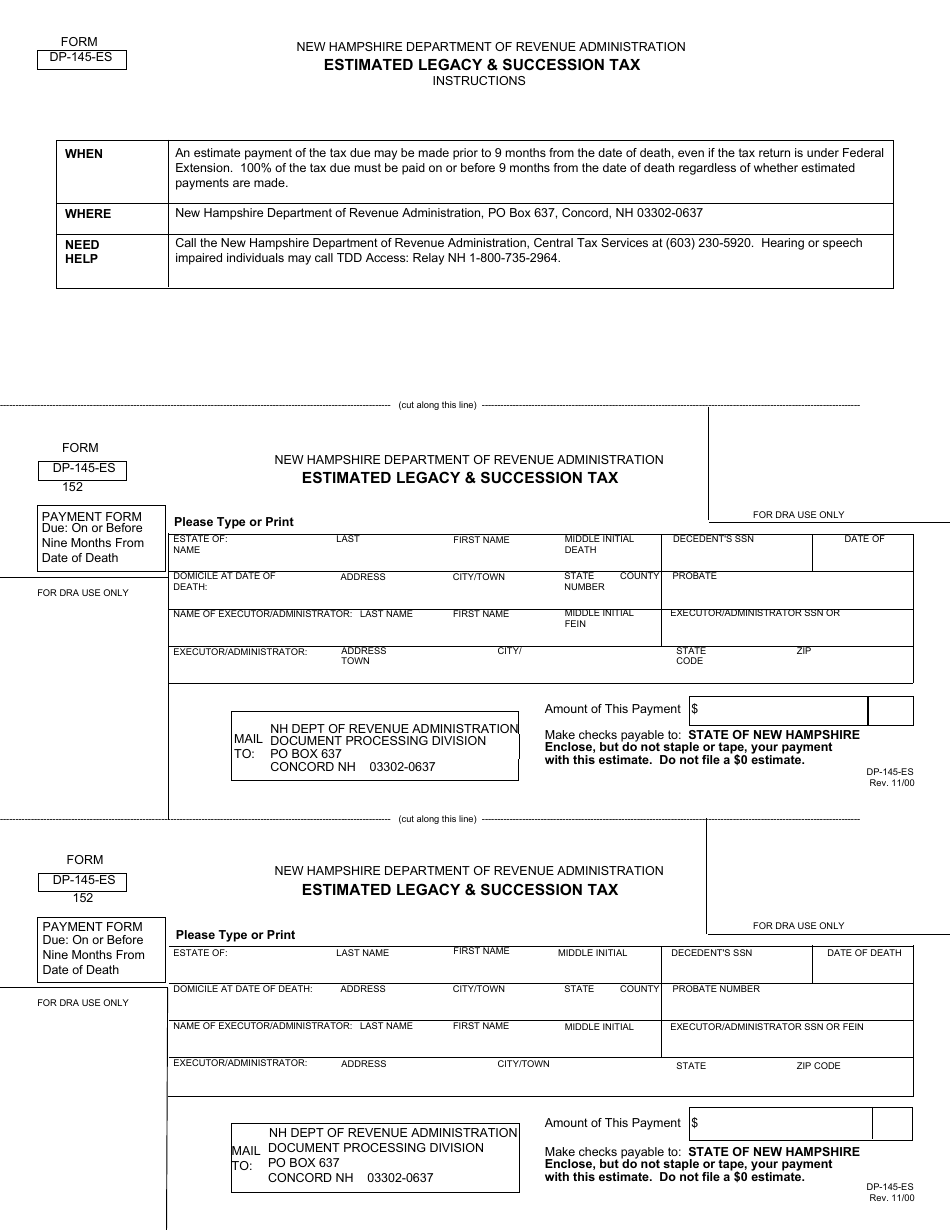

Form DP145ES Download Printable PDF or Fill Online Estimated Legacy

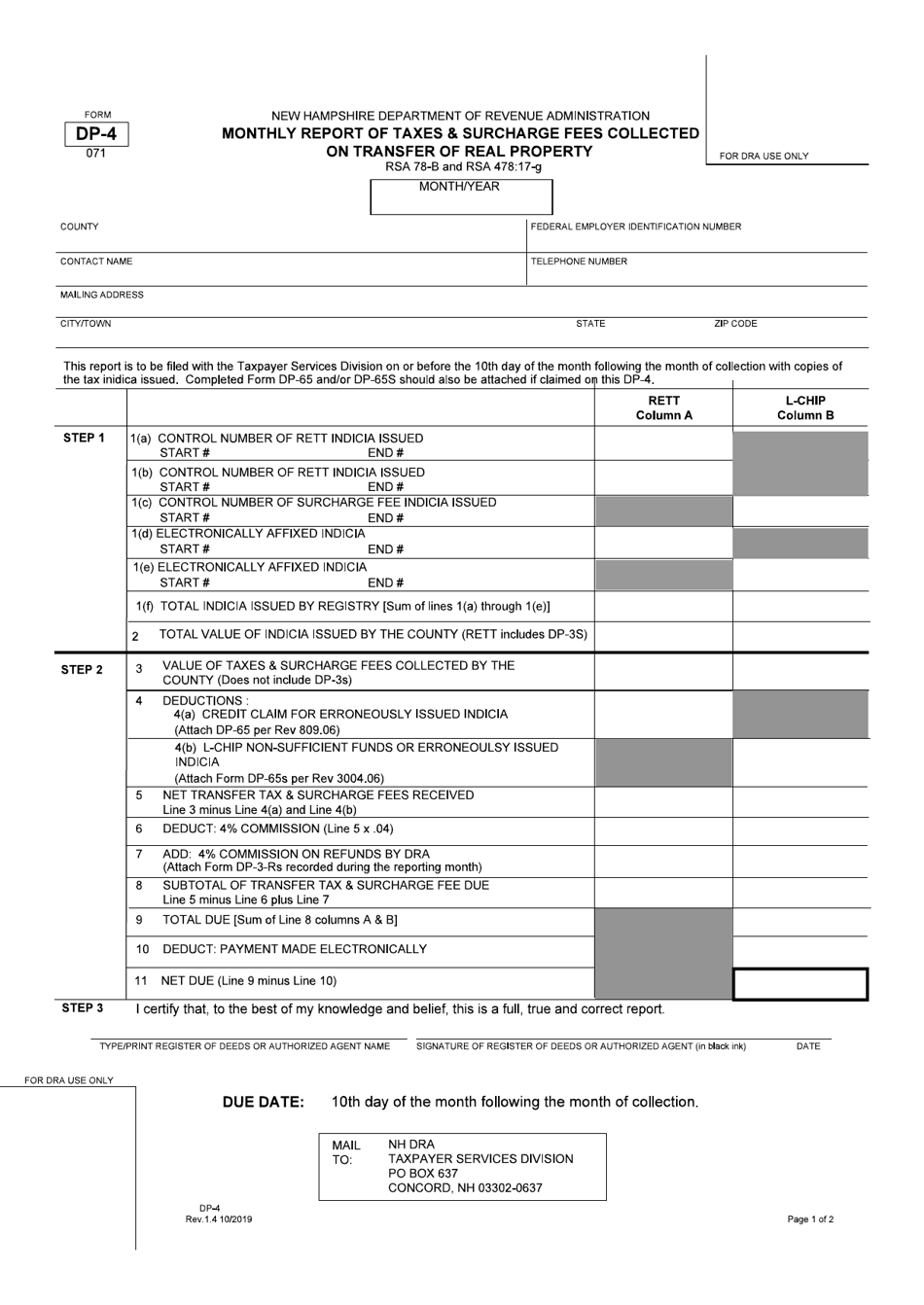

Form DP4 Download Fillable PDF or Fill Online Monthly Report of Taxes

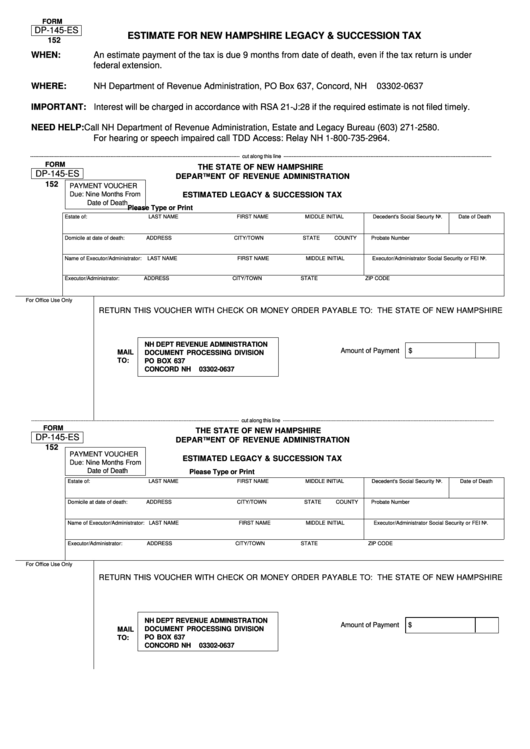

Form Dp145Es Estimate For New Hampshire Legacy & Succession Tax

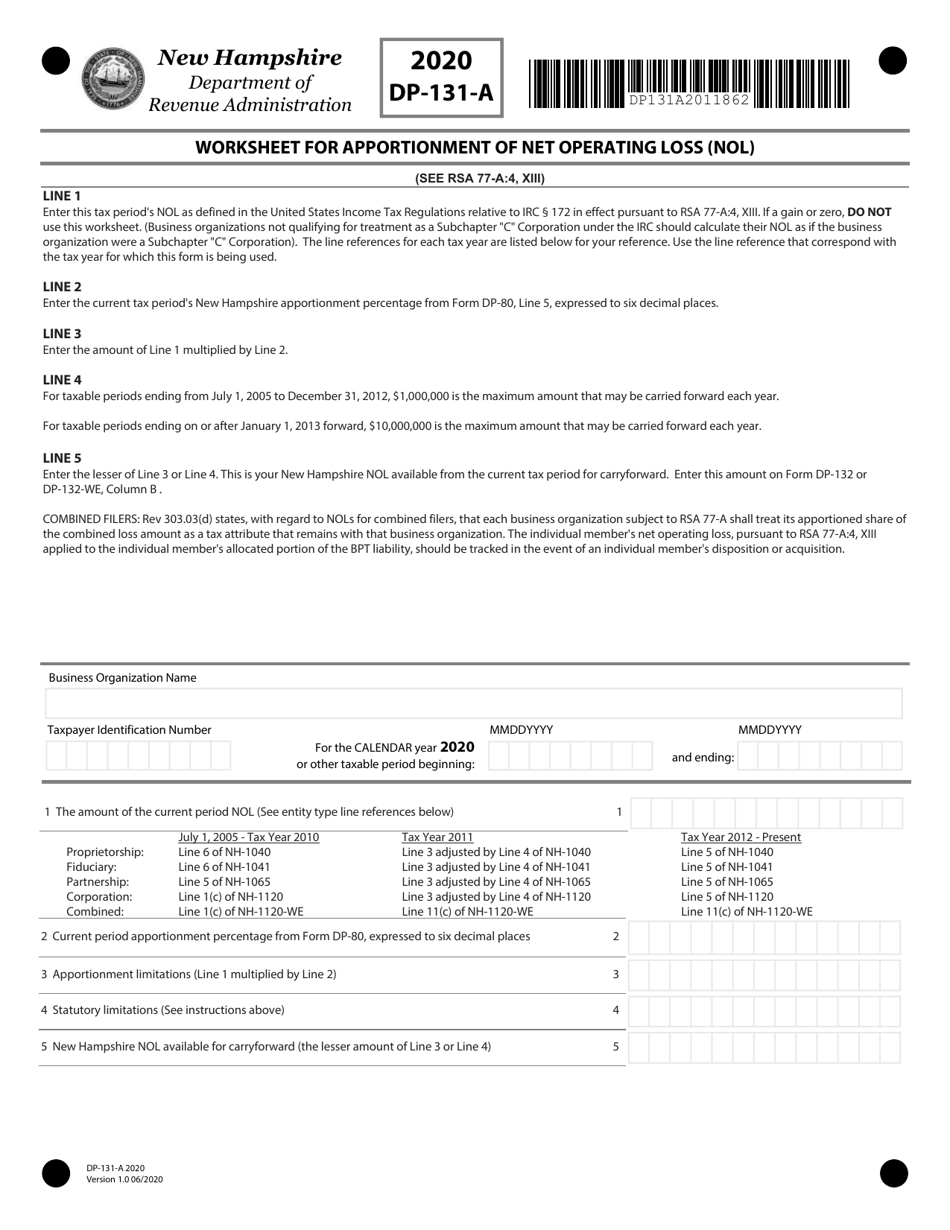

Form DP131A Download Fillable PDF or Fill Online Worksheet for

Related Post: