Irs Form 8752

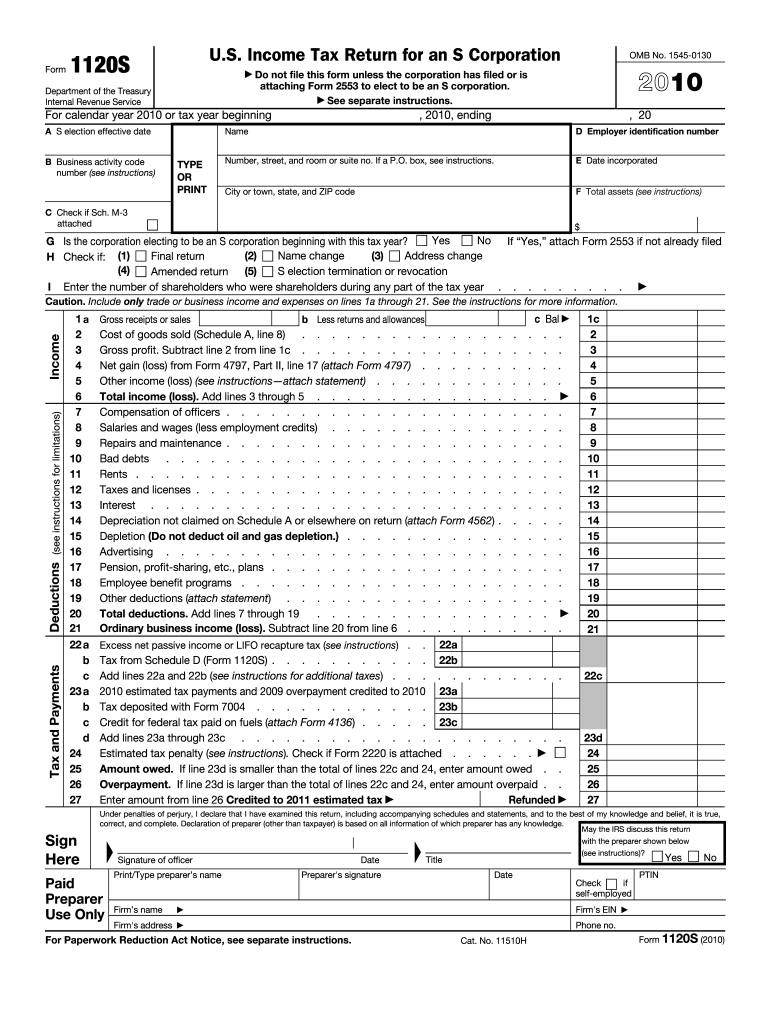

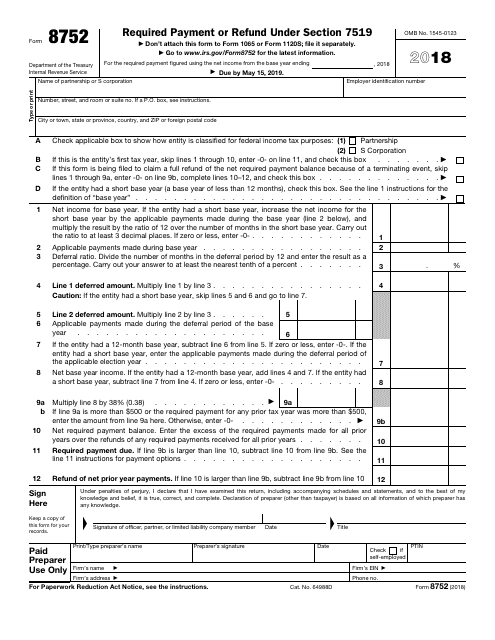

Irs Form 8752 - This form is used to determine if you're due a refund, or have to make a payment on the tax benefits you receive from using a fiscal tax year. Easily sign the form with your finger. For your base year ending in. Web form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Access irs forms, instructions and publications in electronic and print media. Required payment or refund under section 7519. Report the payment required under section 7519 or to obtain a refund of net prior year payments. Web in october, november, and december 2013 the company is still making money but that won’t be reported to the individual shareholders until 2014. Web for applicable election years beginning in 2023, form 8752 must be filed and the required payment made on or before may 15, 2024. Web corporations use form 8752 to figure and. Ad outgrow.us has been visited by 10k+ users in the past month I would not have filled it out the way they. Web form 8752, required payment or refund under section 7519, is a tax form used by partnerships to report required payments or refunds related to the disposition of. Required payment or refund under section 7519. This form is. Web corporations use form 8752 to figure and. Easily sign the form with your finger. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web department of the treasury internal revenue service. Send filled & signed form or save. Web page last reviewed or updated: Form 8816, special loss discount account and special estimated tax payments for insurance companies. First time i completed this form 8752 and in looking at the prior cpas completion of it, i am baffled. The form is used for. So a tax deferral is created. Web in october, november, and december 2013 the company is still making money but that won’t be reported to the individual shareholders until 2014. Web form 8752 is a federal other form. I would not have filled it out the way they. First time i completed this form 8752 and in looking at the prior cpas completion of it, i. Web form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). The form is used for. Send filled & signed form or save. Web internal revenue service. Department of the treasury internal revenue service. Ad outgrow.us has been visited by 10k+ users in the past month Open form follow the instructions. Web form 8752, required payment or refund under section 7519, is a tax form used by partnerships to report required payments or refunds related to the disposition of. Required payment for any prior tax year was more than $500. An entity without a. Web internal revenue service. An entity without a principal office or agency or principal place of business in the united states must file form 8752. Web in october, november, and december 2013 the company is still making money but that won’t be reported to the individual shareholders until 2014. For your base year ending in. Web for applicable election years. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web in october, november, and december 2013 the company is still making money but that won’t be reported to the individual shareholders until 2014. Section 7519 payments are required of. Ad signnow.com has been visited by 100k+. Web file form 8752 by may 15th. Web in october, november, and december 2013 the company is still making money but that won’t be reported to the individual shareholders until 2014. Web corporations use form 8752 to figure and. So a tax deferral is created. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Web corporations use form 8752 to figure and. Department of the treasury internal revenue service. Web form 8752 is a federal other form. Required payment or refund under section 7519. Easily sign the form with your finger. Net income for base year. Easily sign the form with your finger. An entity without a principal office or agency or principal place of business in the united states must file form 8752. For your base year ending in. Open form follow the instructions. Access irs forms, instructions and publications in electronic and print media. Form 8816, special loss discount account and special estimated tax payments for insurance companies. Web form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Web form 8752, required payment or refund under section 7519: Send filled & signed form or save. However, it is always advisable to consult the specific. Web up to $40 cash back the deadline to file form 8752 for the tax year 2023 would typically be on or around march 15, 2024. This form is used to determine if you're due a refund, or have to make a payment on the tax benefits you receive from using a fiscal tax year. The form is used for. Web page last reviewed or updated: Department of the treasury internal revenue service. Required payment for any prior tax year was more than $500. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Web file form 8752 by may 15th. First time i completed this form 8752 and in looking at the prior cpas completion of it, i am baffled.2010 Form IRS 1120SFill Online, Printable, Fillable, Blank pdfFiller

IRS Form 8752 Download Fillable PDF or Fill Online Required Payment or

3.12.249 Processing Form 8752 Internal Revenue Service

3.12.249 Processing Form 8752 Internal Revenue Service

IRS 8752 20202021 Fill out Tax Template Online US Legal Forms

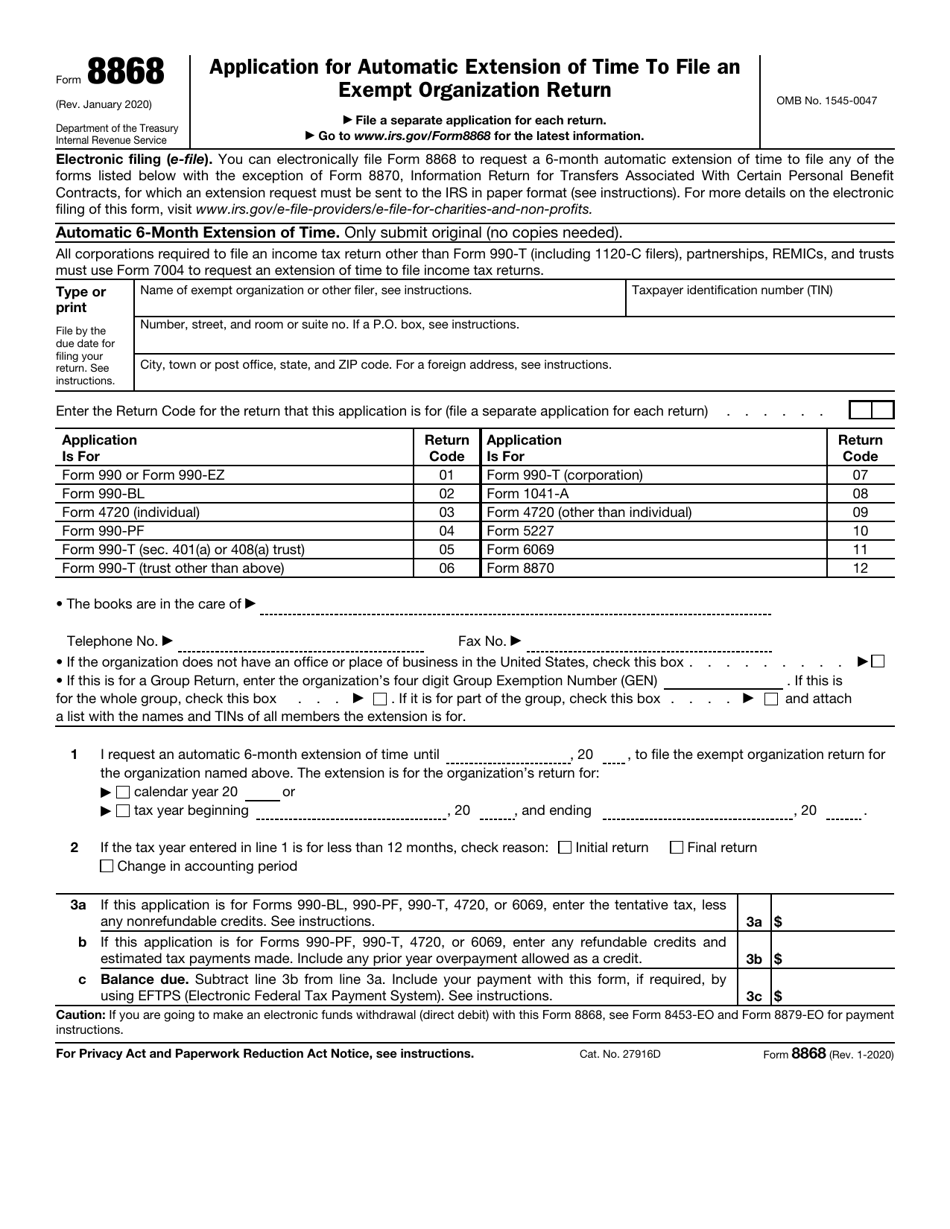

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

U.S. TREAS Form treasirs87521992

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

3.11.249 Processing Form 8752 Internal Revenue Service

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

Related Post: