Form 8867 Due Diligence

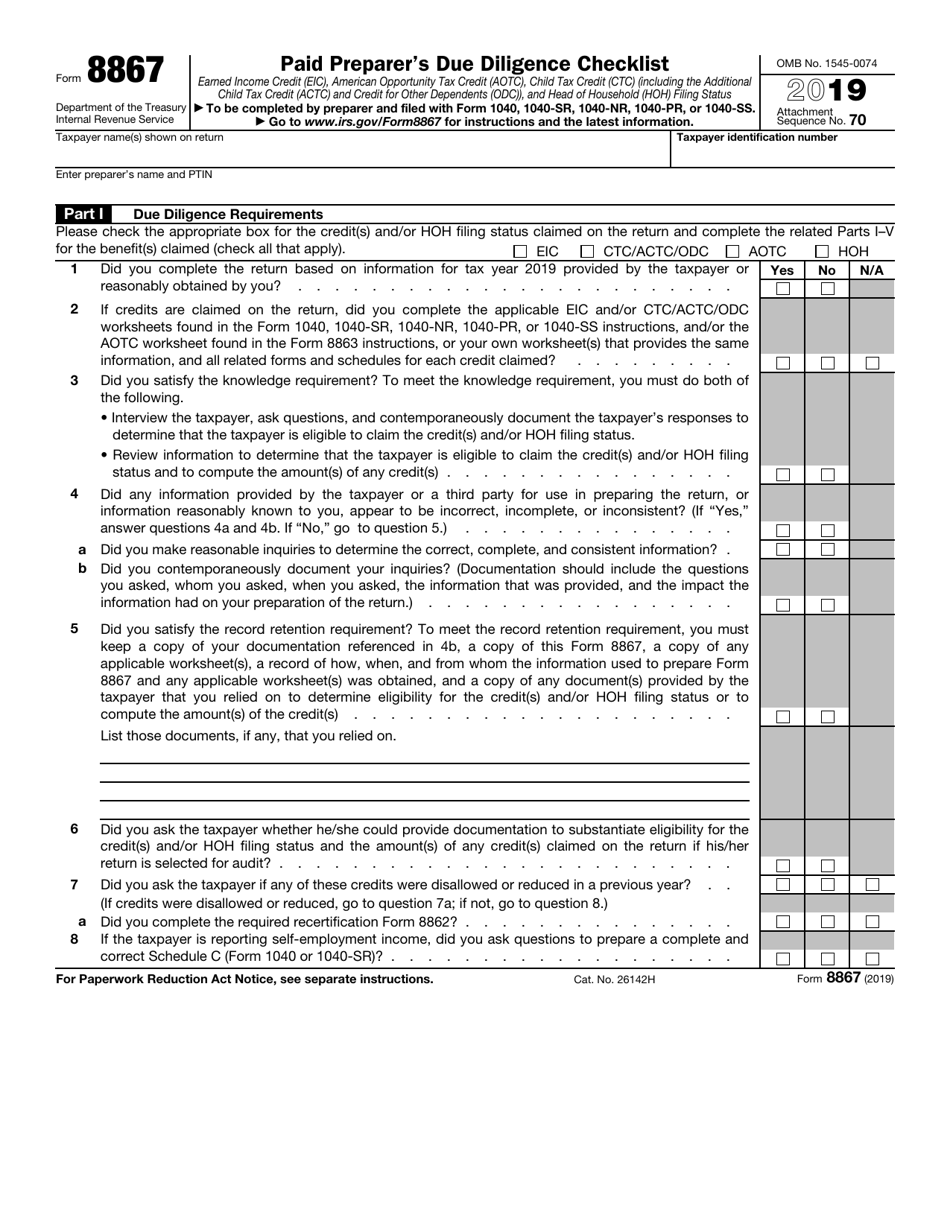

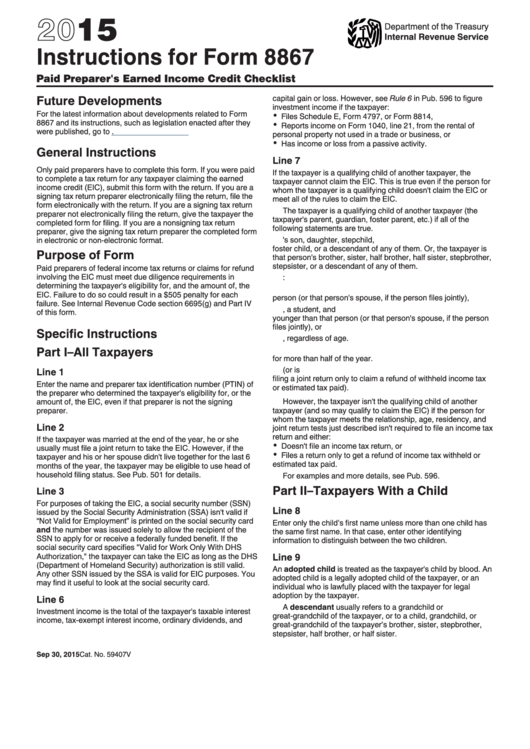

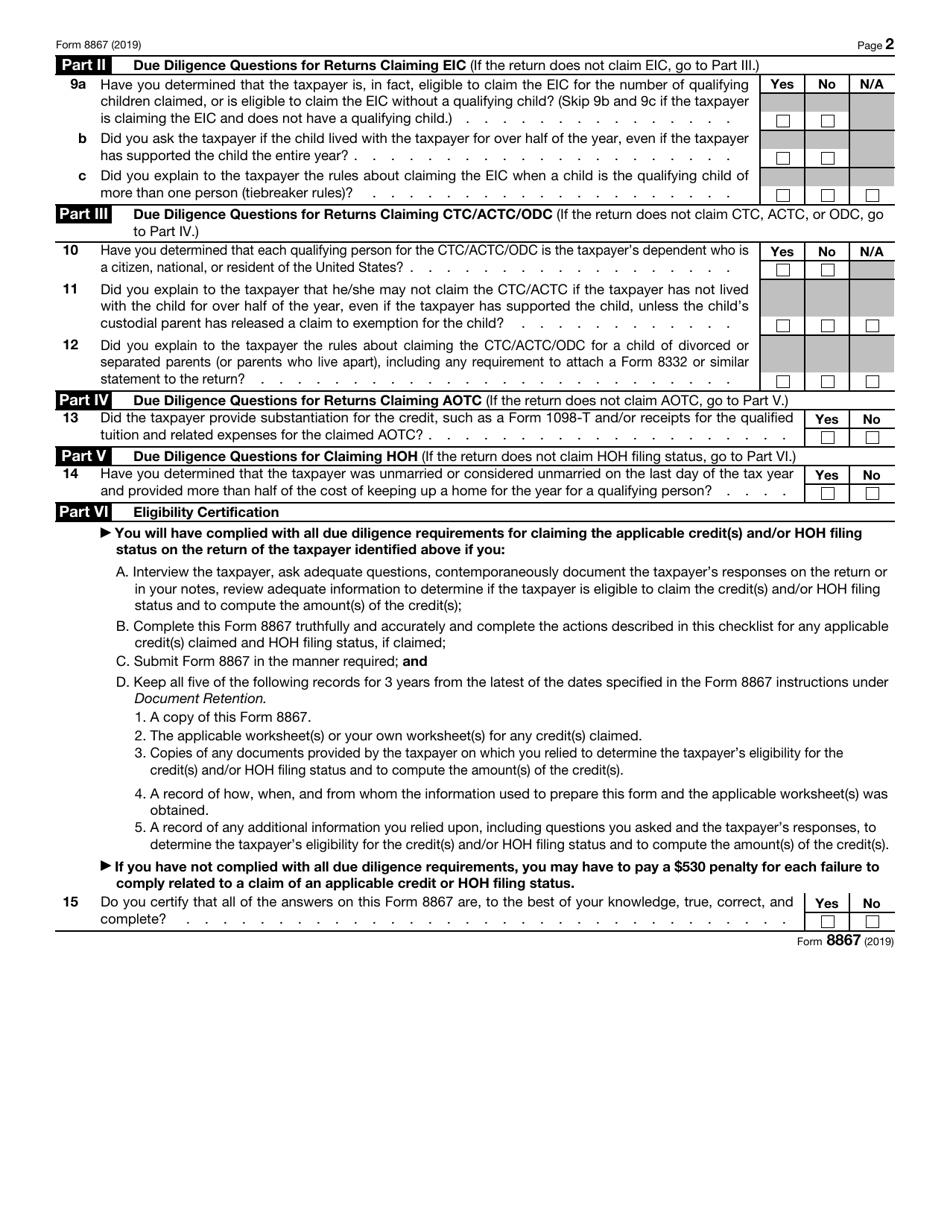

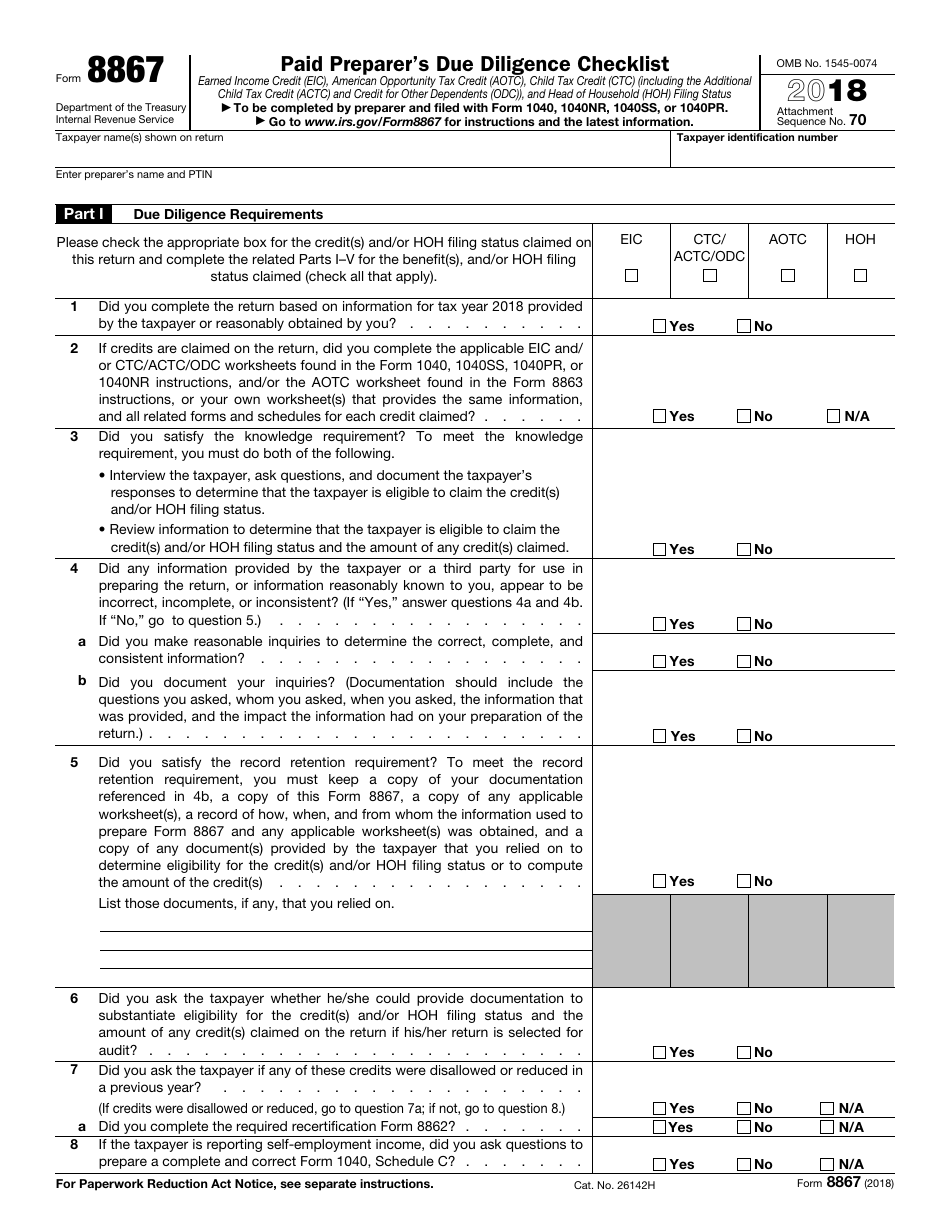

Form 8867 Due Diligence - As a paid tax return preparer, you must exercise due diligence to determine whether a taxpayer. This is a guide on the knowledge requirements for entering due diligence notes to support form 8867 into the taxslayer pro program. Fill, sign, email irs 8867 & more fillable forms, register and subscribe now! Web instructions for form 8867. Due diligence on the go! Consequences of not meeting due diligence requirements. Ad access irs tax forms. Earned income credit (eic), american. Web below, you'll find information about entering form 8867, paid preparer's due diligence checklist, in lacerte. A paid tax return preparer is required to exercise due diligence when preparing a client's tax return or. Web must i use form 8867 as part of the due diligence process? A paid tax return preparer is required to exercise due diligence when preparing a client's tax return or. Earned income credit (eic), american. This is not intended as tax advice. Keep a copy of the worksheets or computations used to compute the amount. Web get ready for form 8867 and related due diligence. Paid preparer’s due diligence checklist. Paid preparer’s due diligence checklist. Web must i use form 8867 as part of the due diligence process? This is a guide on the knowledge requirements for entering due diligence notes to support form 8867 into the taxslayer pro program. Use this section to provide information for and. Web what is form 8867? Earned income credit (eic), american. Completion and submission of form 8867. Web what is form 8867? Web the four due diligence requirements. Paid tax return preparers are required to exercise. By aaron borden, meadows collier, dallas, tx. Paid preparer’s due diligence checklist. Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Complete, edit or print tax forms instantly. This is a guide on the knowledge requirements for entering due diligence notes to support form 8867 into the taxslayer pro program. This is not intended as tax advice. Paid preparer’s due diligence checklist. Web those who prepare returns claiming eic must meet due diligence requirements in four areas: A paid tax return preparer is required to exercise due diligence when preparing a client's tax return or. Department of the treasury internal revenue service. Earned income credit (eic), american. Publication 4687 pdf , paid preparer due. Web get ready for form 8867 and related due diligence. Web what is form 8867? Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Web keep a copy of the completed form 8867, paid preparer's due diligence checklist. Web part iv—due diligence questions for returns claiming aotc. Web instructions for form 8867. Earned income credit (eic), american. Web those who prepare returns claiming eic must meet due diligence requirements in four areas: Consequences of not meeting due diligence requirements. Paid preparer’s due diligence checklist. Fill, sign, email irs 8867 & more fillable forms, register and subscribe now! Paid preparer’s due diligence checklist. This is a guide on the knowledge requirements for entering due diligence notes to support form 8867 into the taxslayer pro program. Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Web must i use form 8867 as part of the due diligence process? Web paid preparers of. Web what is form 8867? Completion and submission of form 8867. A paid tax return preparer is required to exercise due diligence when preparing a client's tax return or. Complete, edit or print tax forms instantly. As a paid tax return preparer, you must exercise due diligence to determine whether a taxpayer. For each student who qualifies for the american opportunity credit, the taxpayer may be able to claim a. Paid preparer’s due diligence checklist. The “paid preparer’s due diligence checklist” (otherwise. Web what is form 8867? Completion and submission of form 8867. Department of the treasury internal revenue service. To document my compliance with due diligence requirements for head of household filing status, the. Paid preparer’s due diligence checklist. Keep a copy of the worksheets or computations used to compute the amount. Paid tax return preparers are required to exercise. Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Consequences of not meeting due diligence requirements. Earned income credit (eic), american. Web what is form 8867? Publication 4687 pdf , paid preparer due. November 2022) paid preparer’s due diligence checklist for the earned income credit,. Web the four due diligence requirements. As a paid tax return preparer, you must exercise due diligence to determine whether a taxpayer. When form 8867 is required, lacerte will generate the. Ad uslegalforms.com has been visited by 100k+ users in the past monthFill Free fillable Form 8867 Paid Preparers Due Diligence Checklist

Paid Preparer's Due Diligence Checklist Form 8867 YouTube

IRS Form 8867 2019 Fill Out, Sign Online and Download Fillable PDF

Fill Free fillable Form 8867 Paid Preparers Due Diligence Checklist

944 Form 2021 2022 IRS Forms Zrivo

EIC Due Diligence (Form 8867) Tax Hound College

8867 Paid Preparers Due Diligence Checklist IRS Tax Forms Fill and

Instructions For Form 8867 Paid Preparer'S Earned Credit

IRS Form 8867 2019 Fill Out, Sign Online and Download Fillable PDF

IRS Form 8867 2018 Fill Out, Sign Online and Download Fillable PDF

Related Post: