Schedule M-3 Form 1120

Schedule M-3 Form 1120 - Web federal net income (loss) reconcilliation for us property and casualty insurance companies with total assets of $10 million or more. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web what is the form used for? Name of corporation (common parent, if consolidated return) employer identification number. Unlike personal income tax returns, the corporate tax return seems similar to a company's financial. Ad access irs tax forms. Web the basic document a domestic corporation must file is form 1120. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Unlike personal income tax returns, the corporate tax return seems similar to a company's financial. Web what is the form used for? Web 1120 mef ats scenario 3: Ad easy guidance & tools for c corporation tax returns. Web what is the form used for? Unlike personal income tax returns, the corporate tax return seems similar to a company's financial. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web the basic document a domestic corporation must file is form 1120. If the total amount of assets exceeds 10 million usd, the corporation. Unlike personal income tax returns, the corporate tax return seems similar to a company's financial. Web preparing a form 1120 for the first time can be a daunting experience. Name of corporation (common parent, if consolidated return) employer identification number. Ad easy guidance & tools for c corporation tax returns. Web federal net income (loss) reconcilliation for us property and. Get ready for tax season deadlines by completing any required tax forms today. Web preparing a form 1120 for the first time can be a daunting experience. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web 1120 mef ats scenario 3: Ad easy guidance & tools for c corporation tax returns. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web the basic document a domestic corporation must file is form 1120. Web preparing a form 1120 for the first time can be a daunting experience. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad access irs tax forms. Unlike personal income tax returns, the corporate tax return seems similar to a company's financial. Income tax return for cooperative associations, that report total assets at tax. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Complete, edit or print tax forms instantly. Name of corporation (common parent, if consolidated return) employer identification number. Unlike personal income tax returns, the corporate tax return seems similar to a company's financial. Income tax return for cooperative associations, that report total. Web federal net income (loss) reconcilliation for us property and casualty insurance companies with total assets of $10 million or more. Income tax return for cooperative associations, that report total assets at tax year end that equal or exceed $10 million must file. Ad access irs tax forms. Web 1120 mef ats scenario 3: Web what is the form used. Name of corporation (common parent, if consolidated return) employer identification number. Ad access irs tax forms. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Ad easy guidance & tools for c corporation tax returns. Web 1120 mef ats scenario 3: Complete, edit or print tax forms instantly. Name of corporation (common parent, if consolidated return) employer identification number. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Ad access irs tax forms. Ad easy guidance & tools for c corporation tax returns. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Web federal net income (loss) reconcilliation for us property and casualty insurance companies with total assets of $10 million or more. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web preparing a form 1120 for the first time can be a daunting experience. Unlike personal income tax returns, the corporate tax return seems similar to a company's financial. Web what is the form used for? Web the basic document a domestic corporation must file is form 1120. Complete, edit or print tax forms instantly. Ad access irs tax forms. Income tax return for cooperative associations, that report total assets at tax year end that equal or exceed $10 million must file. Get ready for tax season deadlines by completing any required tax forms today. Name of corporation (common parent, if consolidated return) employer identification number. Web 1120 mef ats scenario 3:Download Instructions for IRS Form 1120S Schedule M3 Net (Loss

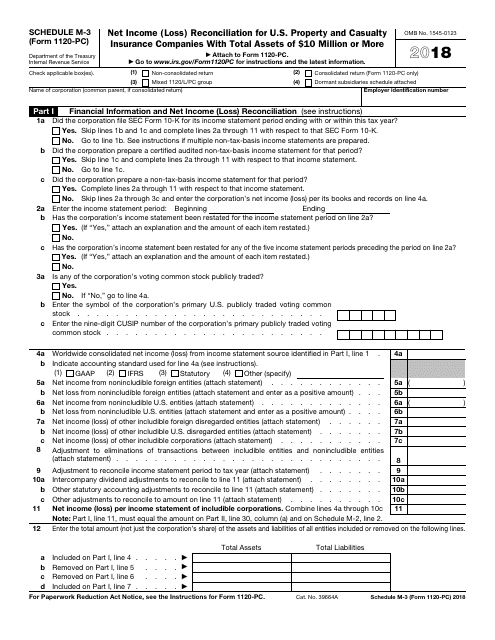

Form 1120PC (Schedule M3) Net Reconciliation for U.S

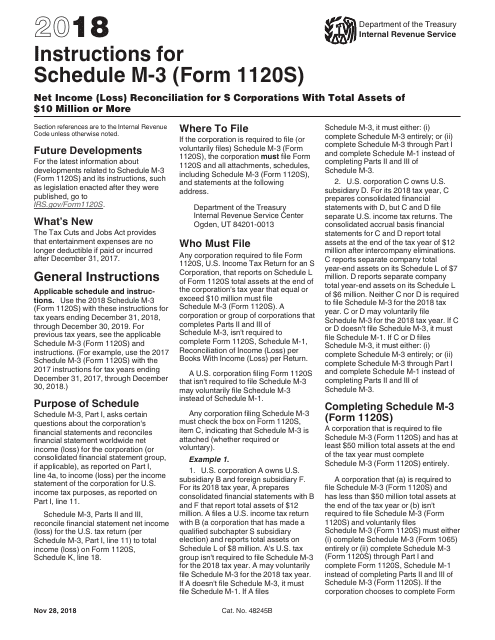

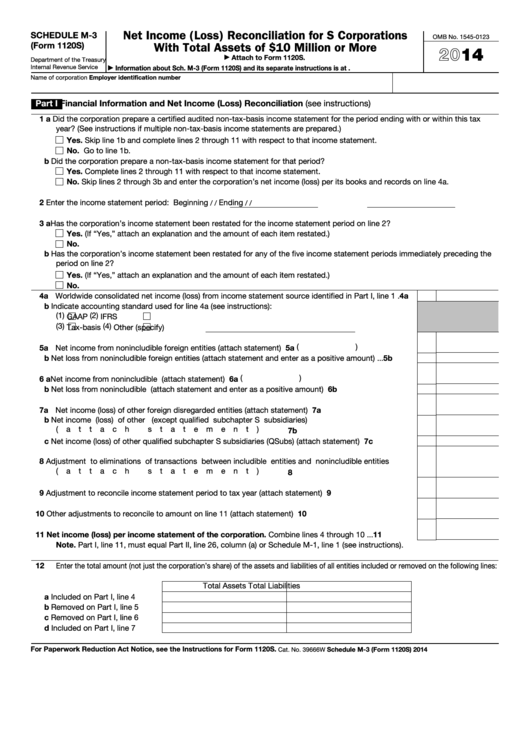

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

Instructions for Schedule M3 (Form 1120L) (2017 IRS.gov Fill

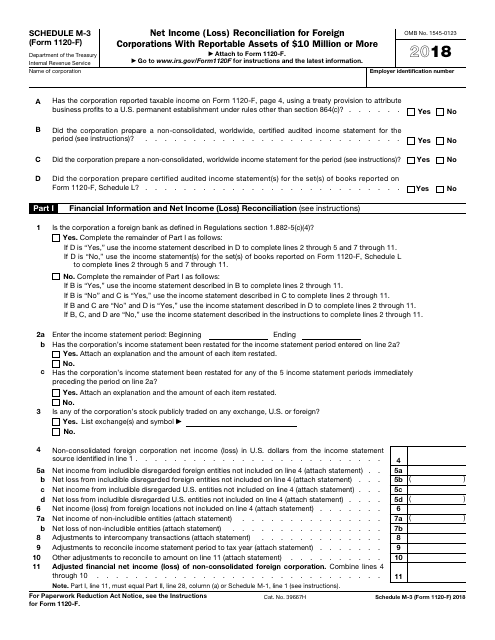

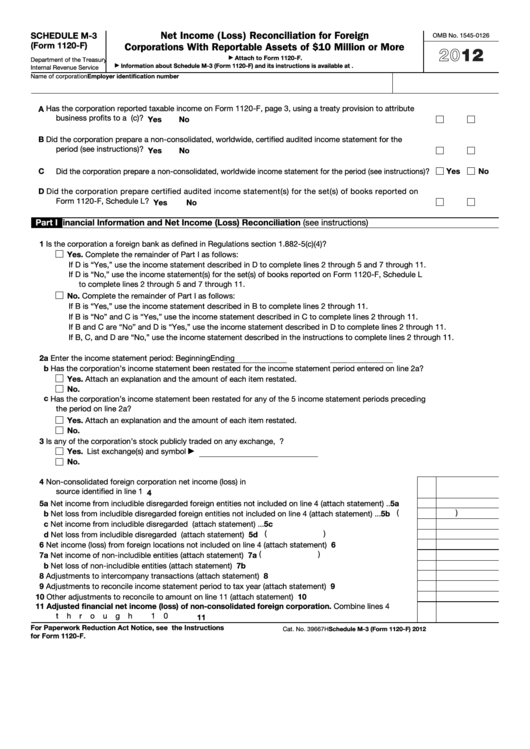

Form 1120F (Schedule M3) Net Reconciliation for Foreign

IRS Form 1120PC Schedule M3 Download Fillable PDF or Fill Online Net

IRS Form 1120F Schedule M3 2018 Fill Out, Sign Online and

Fillable Schedule M3 (Form 1120F) Net (Loss) Reconciliation

Fillable Schedule M3 (Form 1120s) Net (Loss) Reconciliation

Download Instructions for IRS Form 1120F Schedule M3 Net (Loss

Related Post: