Form 2210 Line 8

Form 2210 Line 8 - 110% of prior year tax for taxpayers with prior year agi of more than $150,000 if. Any life or disability insurance policy form, life or disability insurance application form where written application is required and is to be. Web for purposes of figuring the amount includible on line 1 of form 2210 only, you may refigure the amount you reported on form 1041, schedule g, line 3. Web complete lines 8 and 9 below. Web refundable part of the american opportunity credit (form 8863, line 8). Web complete lines 8 and 9 below. You may be subject to net investment income tax (niit). Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Only the payments and credits specified in the irs instructions. Is line 6 equal to or more than line 9? Web for most taxpayers, this is the amount shown on line 8. Web complete lines 8 and 9 below. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. Any. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Web complete lines 8 and 9 below. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. The irs will generally figure your penalty for you and you. Web form 2210 line 8 underpayment penalty hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web net investment income tax. Don’t file form 2210 (but if box e in part ii. Is line 6 equal to or more than line 9? Web net investment income tax. Web complete lines 8 and 9 below. Premium tax credit (form 8962). Is line 6 equal to or more than line 9? Premium tax credit (form 8962). Yes you don’t owe a penalty. Web complete lines 8 and 9 below. Is line 6 equal to or more than line 9? Web complete lines 8 and 9 below. Web failure to make correct estimated payments can result in interest or penalties. Web complete lines 8 and 9 below. Qualified sick and family leave credits. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document. You must file page 1 of form 2210, but you aren’t. Web complete lines 8 and 9 below. Credit for federal tax paid on fuels. Web form 2210 line 8 underpayment penalty hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line. Web complete lines 8 and 9 below. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Web for most taxpayers, this is the amount shown on line 8. You may be subject to net investment income tax (niit). Premium tax credit (form 8962). Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. You may be subject to net investment income tax (niit). Web for purposes of figuring the amount includible on line 1 of form 2210 only, you may refigure the amount you reported on form 1041, schedule g, line 3. Is line 6 equal. About the individual income tax the irs and most states collect a personal income tax, which is. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Qualified sick and family leave credits. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over. Web complete lines 8 and 9 below. Only the payments and credits specified in the irs instructions. Web failure to make correct estimated payments can result in interest or penalties. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. You may be subject to net investment income tax (niit). Form 2210 is typically used by. Premium tax credit (form 8962). Yes you don’t owe a penalty. Yes you don’t owe a penalty. Is line 6 equal to or more than line 9? Credit for federal tax paid on fuels. Learn what the pact act means for your va benefits. Web complete lines 8 and 9 below. The irs will generally figure your penalty for you and you should not file. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Web for purposes of figuring the amount includible on line 1 of form 2210 only, you may refigure the amount you reported on form 1041, schedule g, line 3. Credit for federal tax paid on fuels. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Web lacerte will automatically carry the payments and refundable credits from the tax return to form 2210. You must file page 1 of form 2210, but you aren’t.2210 Fill Out and Sign Printable PDF Template signNow

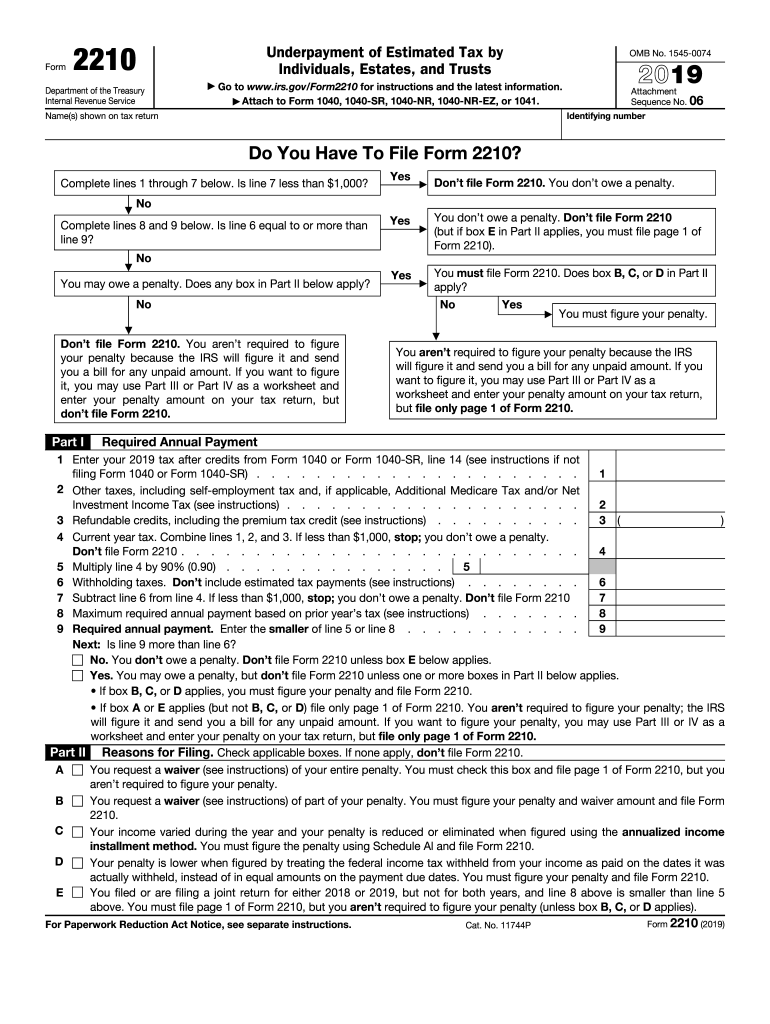

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

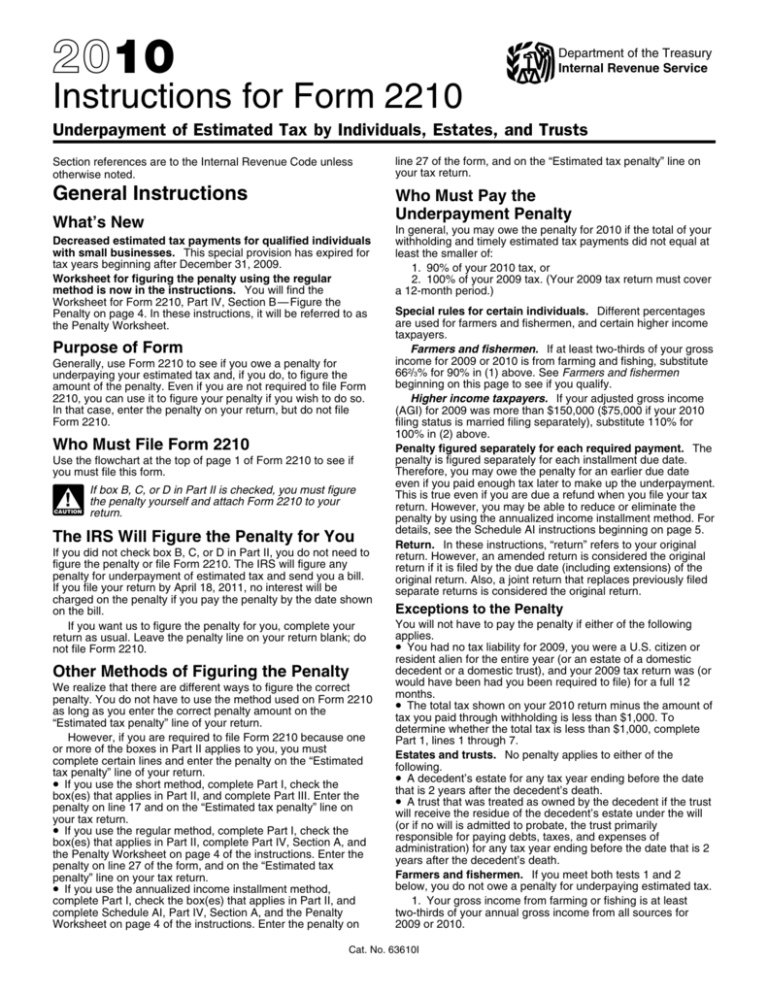

Instructions for Form 2210

2210 Form Fill Out and Sign Printable PDF Template signNow

IRS Form 2210 A Guide to Underpayment of Tax

IRS Form 2210 Download Fillable PDF or Fill Online Underpayment of

IRS Form 2210 A Guide to Underpayment of Tax

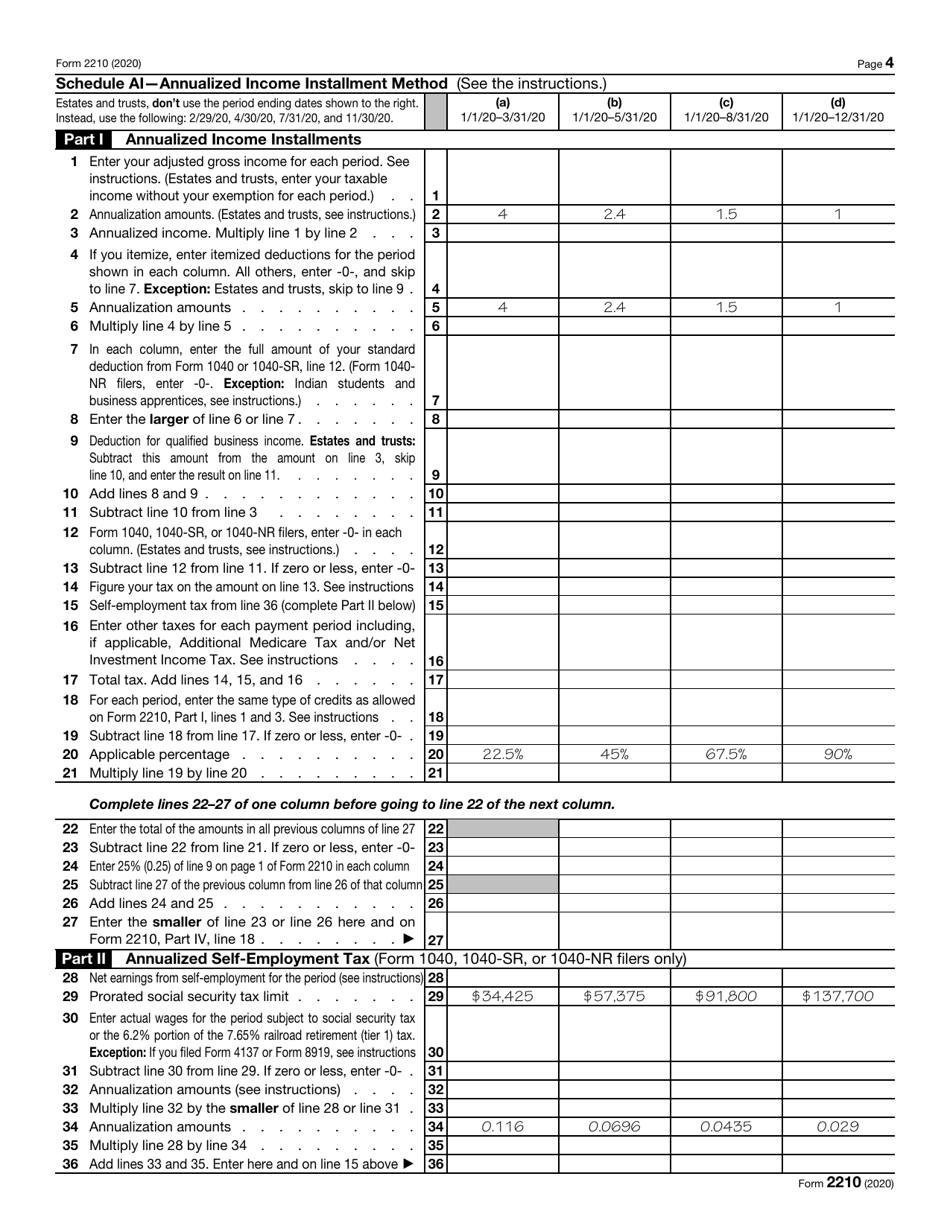

Ssurvivor Irs Form 2210 Ai Instructions

Form 2210 2022 Underpayment of Estimated Tax By Individuals Fill out

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Related Post: