Instructions For Form 1045

Instructions For Form 1045 - Web the irs provides form 1045 so that taxpayers may file for a quick refund of previous years' tax resulting from an nol that was generated on a later year return. A tax agent will answer in minutes! Stephanie glanville | october 12, 2023 | read time: Web irs form 1045 instructions like all other types of the internal revenue service forms, the irs form 1045 is a very sensitive form. Form 1045, net operating loss worksheet. 0 minute (s) | | no comments. Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts. Fill in all the details required in irs 1045, utilizing fillable fields. Web form 1045 is used by an individual, estate, or trust to apply for a quick tax refund resulting from: This form is for when a taxpayer has. Stephanie glanville | october 12, 2023 | read time: Web limitation on excess business losses of noncorporate taxpayers. Instructions for form 1045, application for tentative refund. Web irs form 1045 instructions like all other types of the internal revenue service forms, the irs form 1045 is a very sensitive form. Web form 1045 is an application for a tentative refund,. Separate instructions and additional information are available at. Web the irs provides form 1045 so that taxpayers may file for a quick refund of previous years' tax resulting from an nol that was generated on a later year return. Get ready for tax season deadlines by completing any required tax forms today. For purposes of column (a), if the ale. Save my name, email, and website. If total taxes are $2,500 or more, the amount reported on line 3. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web you simply need to follow these elementary instructions: Web form 1045 2022 application for tentative refund department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. You are expected to fill out. Questions answered every 9 seconds. Web this article will assist you with entering form 1045, application for tentative refund, in the individual module of intuit proconnect. Complete, edit or print tax forms instantly. This form is for when a taxpayer has. Web form 1045 by fax. Instructions for form 1045, application for tentative refund. For purposes of column (a), if the ale member offered. Questions answered every 9 seconds. Ad forms, deductions, tax filing and more. For purposes of column (a), if the ale member offered. Web you simply need to follow these elementary instructions: Add lines 1 and 2. Web form 1045 by fax. Open the document in our advanced pdf editor. Separate instructions and additional information are available at. Form 1045, net operating loss worksheet. Get ready for tax season deadlines by completing any required tax forms today. If total taxes are $2,500 or more, the amount reported on line 3. Open the document in our advanced pdf editor. A tax agent will answer in minutes! Stephanie glanville | october 12, 2023 | read time: Web this article will assist you with entering form 1045, application for tentative refund, in the individual module of intuit proconnect. For purposes of column (a), if the ale member offered. You may only file by fax if you're filing form 1045 to apply for tentative refunds for changes in the nol rules under the cares act. Questions answered every 9 seconds. Web proseries doesn't automatically generate form 1045. For purposes of column (a), if the ale member offered. Web form 1045 is used by an individual, estate, or trust to. Ad forms, deductions, tax filing and more. Stephanie glanville | october 12, 2023 | read time: Web proseries doesn't automatically generate form 1045. Get ready for tax season deadlines by completing any required tax forms today. Open the document in our advanced pdf editor. Web identity theft victims request for copy of fraudulent tax return. Open the document in our advanced pdf editor. Web this article will assist you with entering form 1045, application for tentative refund, in the individual module of intuit proconnect. Most entries will be manual. Stephanie glanville | october 12, 2023 | read time: Web generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right adjustment arose. Complete, edit or print tax forms instantly. Refer to irs instructions for form 1045 for additional information about where. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts. You may only file by fax if you're filing form 1045 to apply for tentative refunds for changes in the nol rules under the cares act. If total taxes are $2,500 or more, the amount reported on line 3. This form is for when a taxpayer has. Fill in all the details required in irs 1045, utilizing fillable fields. Web proseries doesn't automatically generate form 1045. The carryback of a net operating loss (nol), the carryback of an unused general. Form 1045 is used to apply for a refund after. A tax agent will answer in minutes! Ad forms, deductions, tax filing and more. Save my name, email, and website.Fillable Online irs 1995 Instructions for Form 1045 IRS irs Fax

Instructions For Form 1045 Application For Tentative Refund 2008

Instructions For Form 1045 Application For Tentative Refund 2017

Instructions for Form 1045 (2017) Internal Revenue Service

Instructions For Form 1045 Application For Tentative Refund 2000

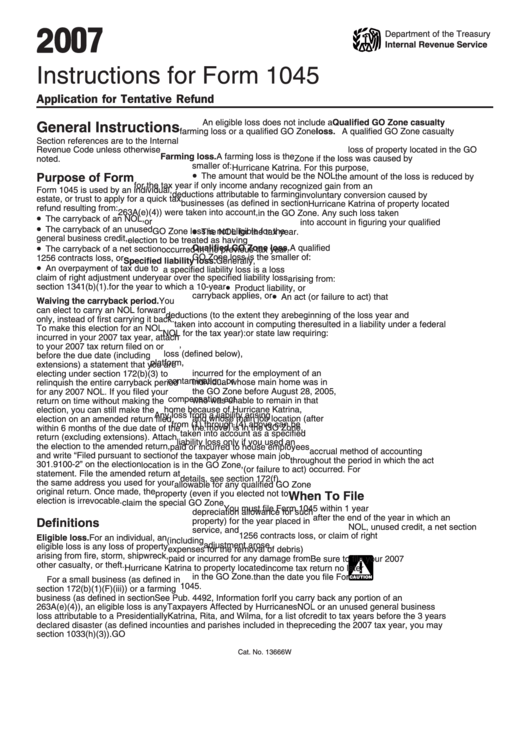

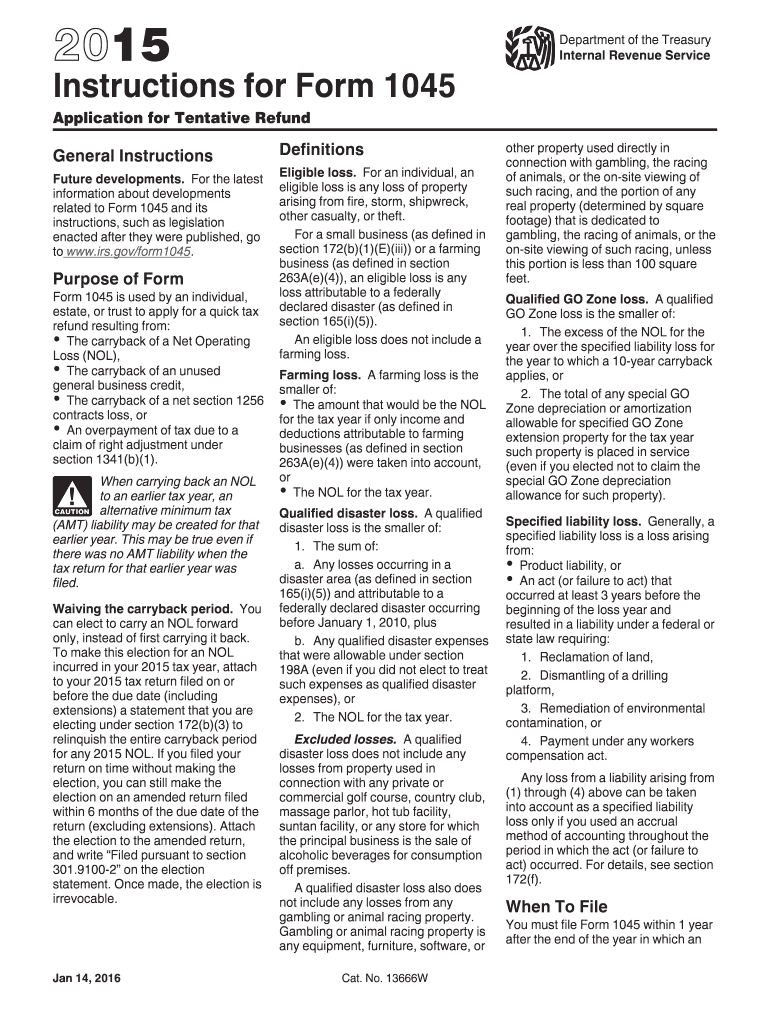

Instructions For Form 1045 Application For Tentative Refund 2007

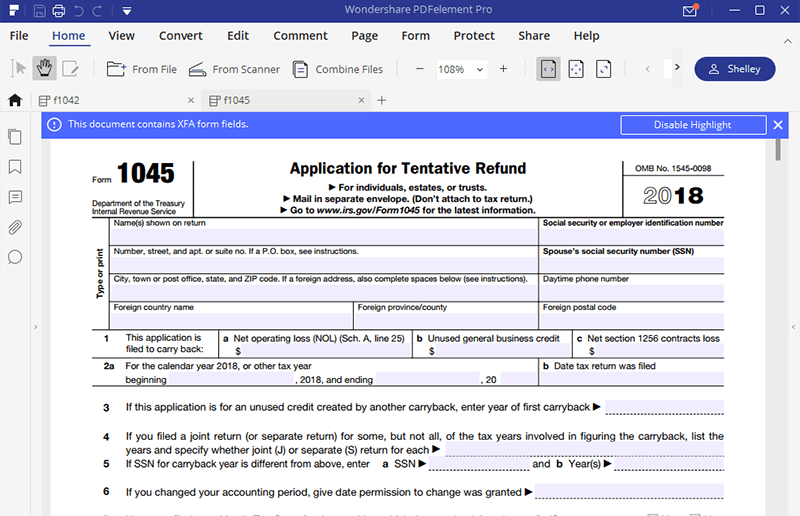

IRS Form 1045 Fill it as You Want

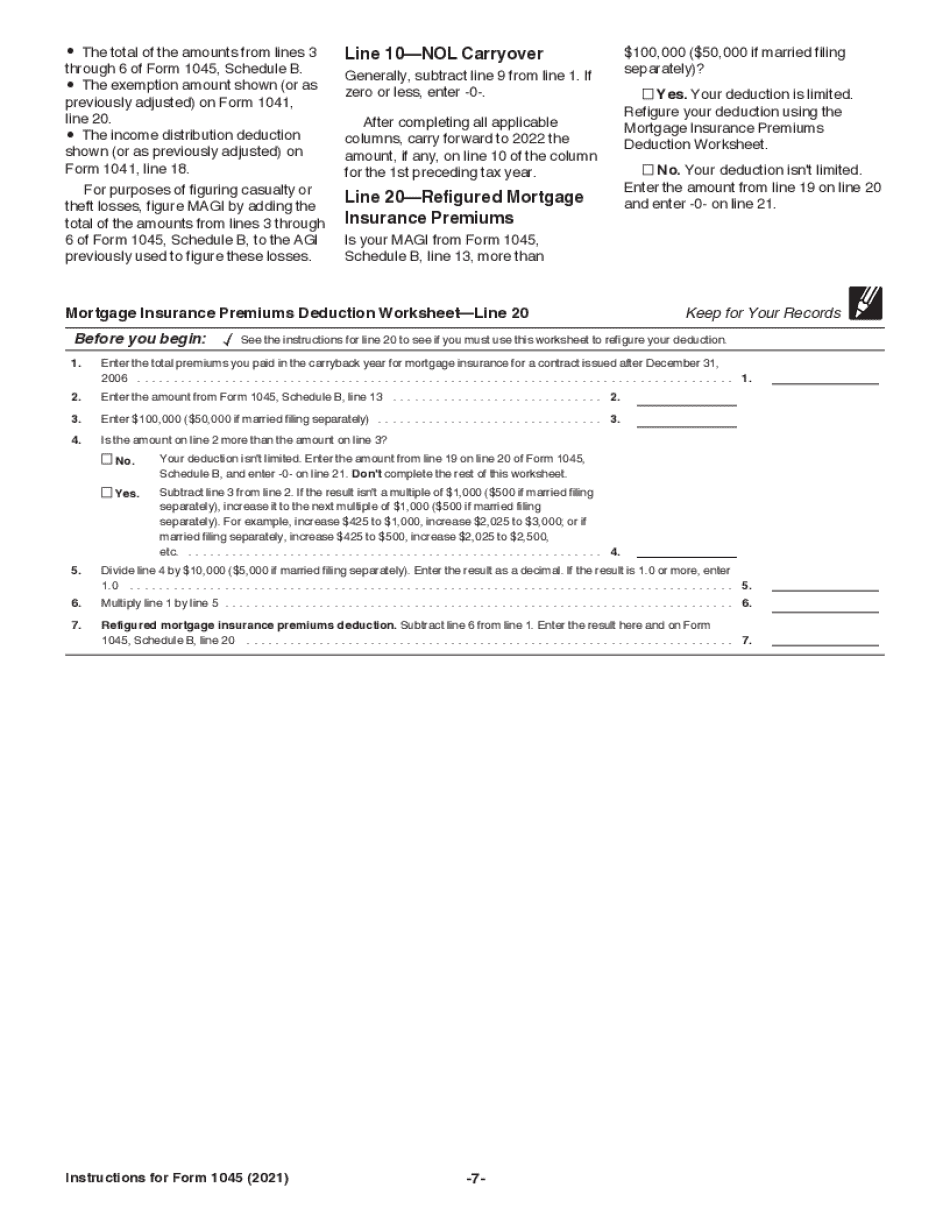

20212023 form 1045 instructions Fill online, Printable, Fillable Blank

Instructions for Form 1045 IRS Gov Irs Fill Out and Sign Printable

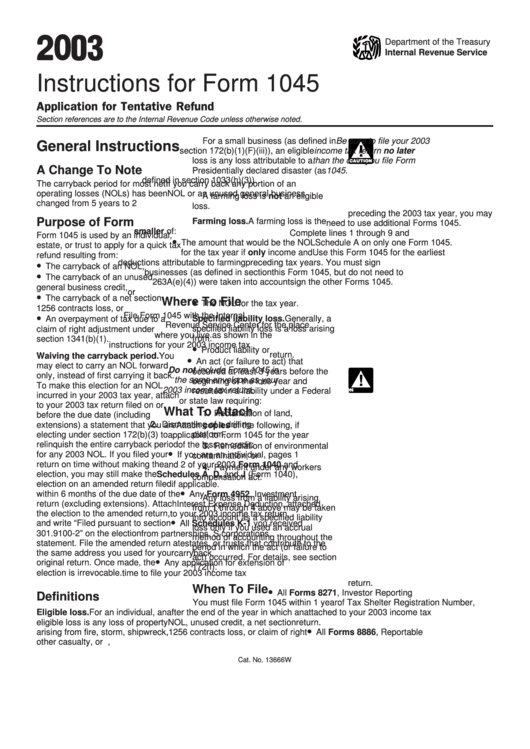

Instructions For Form 1045 2003 printable pdf download

Related Post: