Mn Form M1M

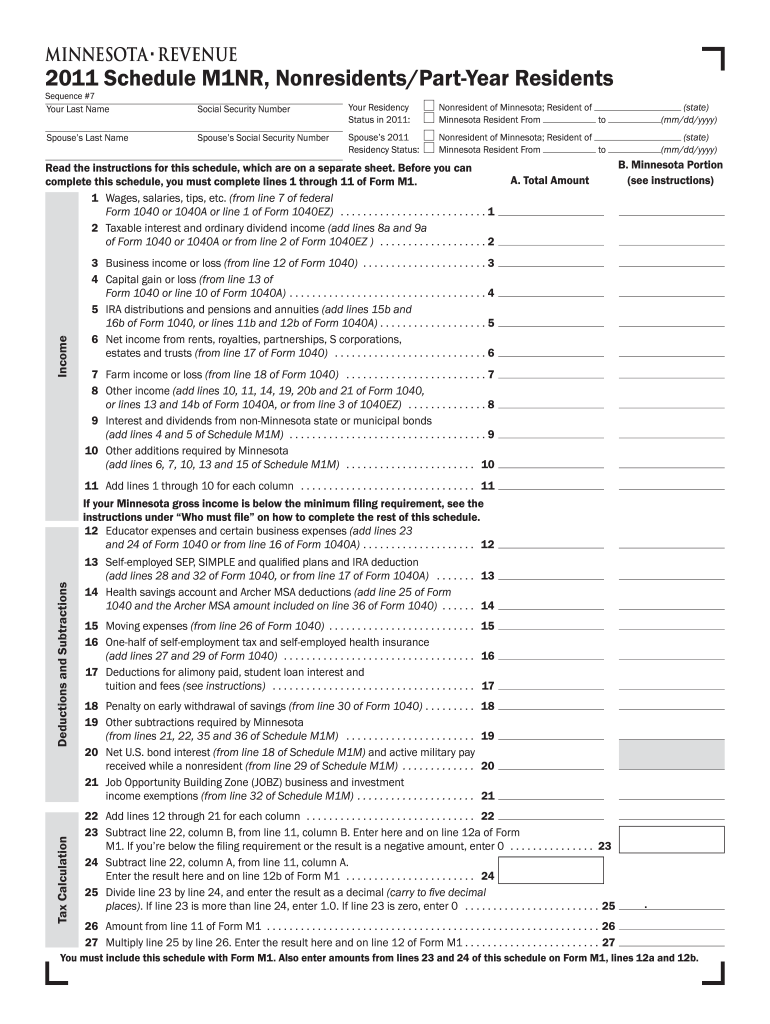

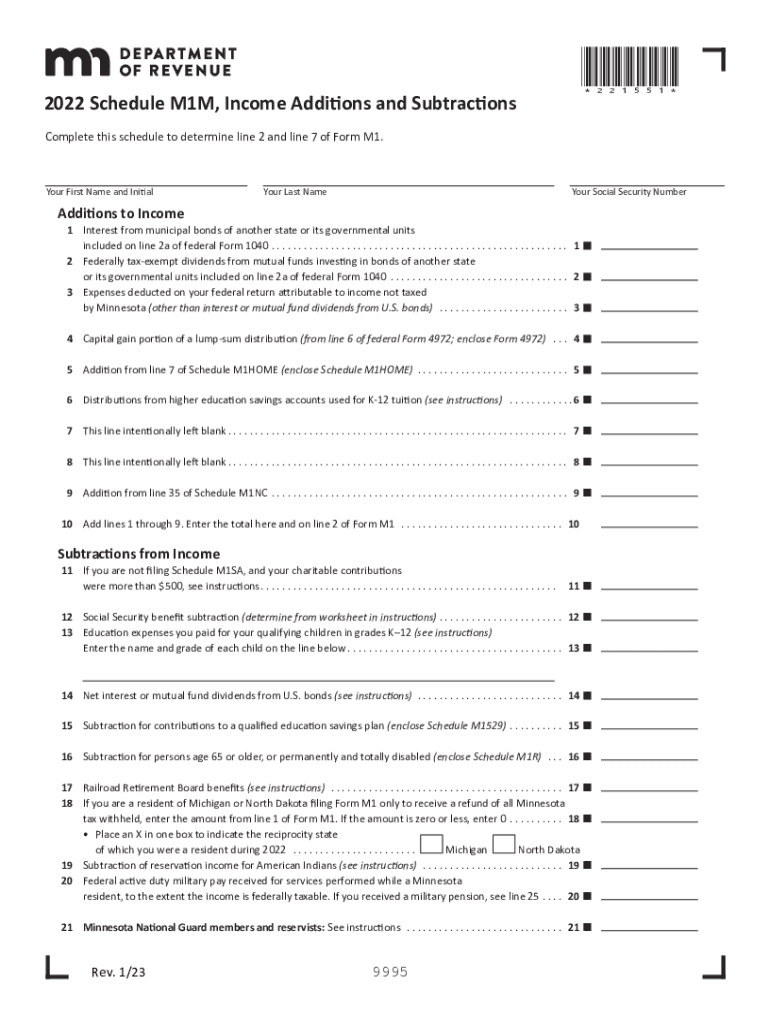

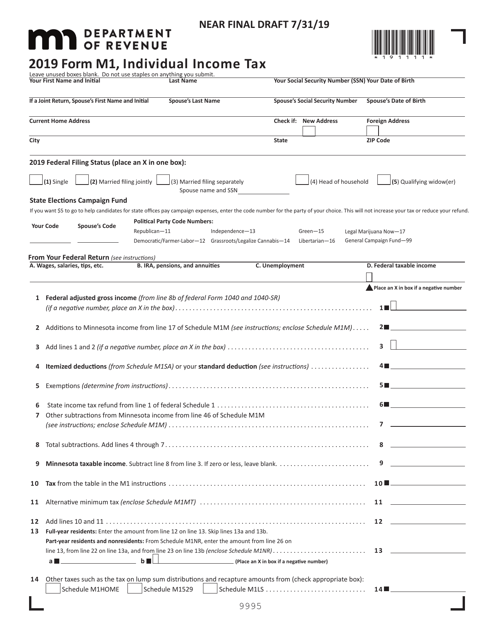

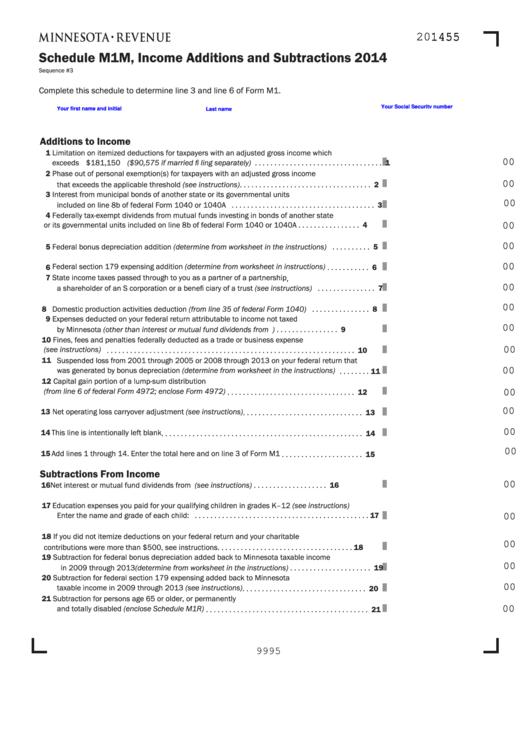

Mn Form M1M - Web fial aft 10223 lines 8 through 13 these lines are intentionally left blank. Web 2018 schedule m1m, income additions and subtractions. These 2021 forms and more are available: If zero or less, leave blank. Web go to www.revenue.state.mn.us to: An amount on line 1 of your. Expenses deducted on your federal tax return that are associated with. M1m line 29 must not be more than. Web expenses relating to income not taxed by minnesota, other than from u.s. You received a federal bonus depreciation subtraction in. This form is for income earned in tax year 2022, with tax returns due in. Web 2022 schedule m1m instructions. M1m line 29 must not be more than. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. Web more. Line 1 — interest from municipal bonds of another state or its governmental units. Web go to www.revenue.state.mn.us to: M1m line 29 must not be more than. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. Complete this schedule. Bond obligations if you deducted expenses on your federal return. Web we last updated minnesota form m1m in december 2022 from the minnesota department of revenue. Web you reported 80 percent of the federal bonus depreciation as an addition to income on your 2014 through 2020 form m1. • recalculate lines 4, 5, 8, 9, 11 and 12 of your. These 2021 forms and more are available: Web of the amount you included (or should have included) on line 2a of federal form 1040, add the interest you received from municipal bonds issued by: M1m line 29 must not be more than. Web fial aft 10223 lines 8 through 13 these lines are intentionally left blank. • recalculate lines 4,. Web plete schedule m1mt to determine if you are required to pay minnesota amt. Bond obligations if you deducted expenses on your federal return. Web if you received a state income tax refund in 2021 and you itemized deductions on federal form 1040 in 2020, you may need to report. Your first name and initial. Wednesday night i filed 2. • recalculate lines 4, 5, 8, 9, 11 and 12 of your minnesota form 4562. From the table in the form m1 instructions. Complete this schedule to determine line 2 and line 7 of form m1. Web 2022 schedule m1m instructions. Web you reported 80 percent of the federal bonus depreciation as an addition to income on your 2014 through. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Web 2022 schedule m1m instructions. We last updated the income additions and subtractions (onscreen version) in december 2022, so this is the. It will help candidates for state offices. Web 2018 schedule m1m, income. This form is for income earned in tax year 2022, with tax returns due in. • recalculate lines 4, 5, 8, 9, 11 and 12 of your minnesota form 4562. Web line 6 — expenses relating to income not taxed by minnesota, other than from u.s. Line 1 — interest from municipal bonds of another state or its governmental units.. Web 2021 schedule m1m, income additions and subtractions. Web 2018 schedule m1m, income additions and subtractions. Web expenses relating to income not taxed by minnesota, other than from u.s. An amount on line 1 of your. We last updated the income additions and subtractions (onscreen version) in december 2022, so this is the. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. Web the 2020 schedule m1m, income addions and subtracons (minnesota department of revenue) form is 2 pages long and contains: Subtract line 8 from line 3. An amount on line 1 of your. Bond obligations if you deducted expenses on your federal. What type of income can i subtract from my minnesota return? An amount on line 1 of your. Your first name and initial. The result on line 12 of. Web you reported 80 percent of the federal bonus depreciation as an addition to income on your 2014 through 2020 form m1. Web 2021 schedule m1m, income additions and subtractions. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. Web if your gross income assignable to minnesota is $12,400 or more, you must file form m1 and schedule m1nr. From the table in the form m1 instructions. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Web of the amount you included (or should have included) on line 2a of federal form 1040, add the interest you received from municipal bonds issued by: Wednesday night i filed 2 returns that bounced on minnesota with the following message: Web 9 minnesota taxable income. Expenses deducted on your federal tax return that are associated with. Web go to www.revenue.state.mn.us to: Web 2022 schedule m1m instructions. Minnesota allows the following subtractions from income on forms m1m and m1mb: We last updated the income additions and subtractions (onscreen version) in december 2022, so this is the. • file and pay electronically • get forms, instructions, and fact sheets • get answers to your questions • check on your refund • get form. Your first name and initial last name.2011 Form MN DoR Schedule M1NR Fill Online, Printable, Fillable, Blank

Mn schedule m1m Fill out & sign online DocHub

2012 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Form M1 2019 Fill Out, Sign Online and Download Printable PDF

Form M1ma Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Schedule M1m Minnesota Additions And Subtractions

2020 Form MN DoR M1Fill Online, Printable, Fillable, Blank pdfFiller

2018 m1w form Fill out & sign online DocHub

M1M taxes.state.mn.us

Fill Free fillable Minnesota Department of Revenue PDF forms

Related Post: