Ct State Withholding Form

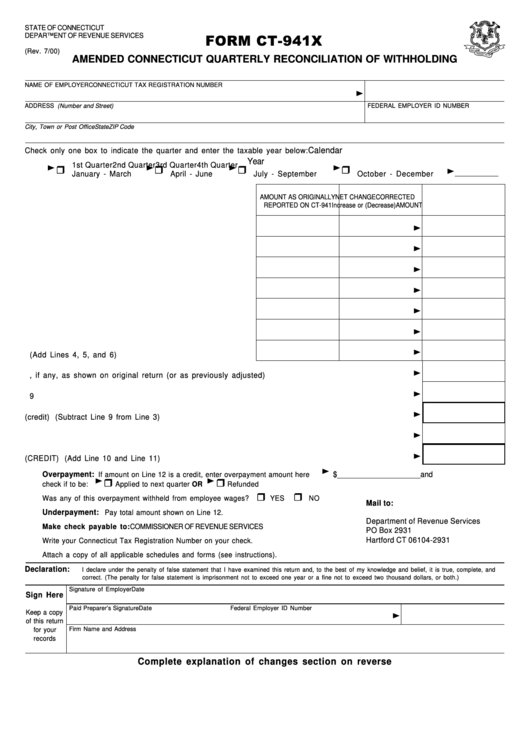

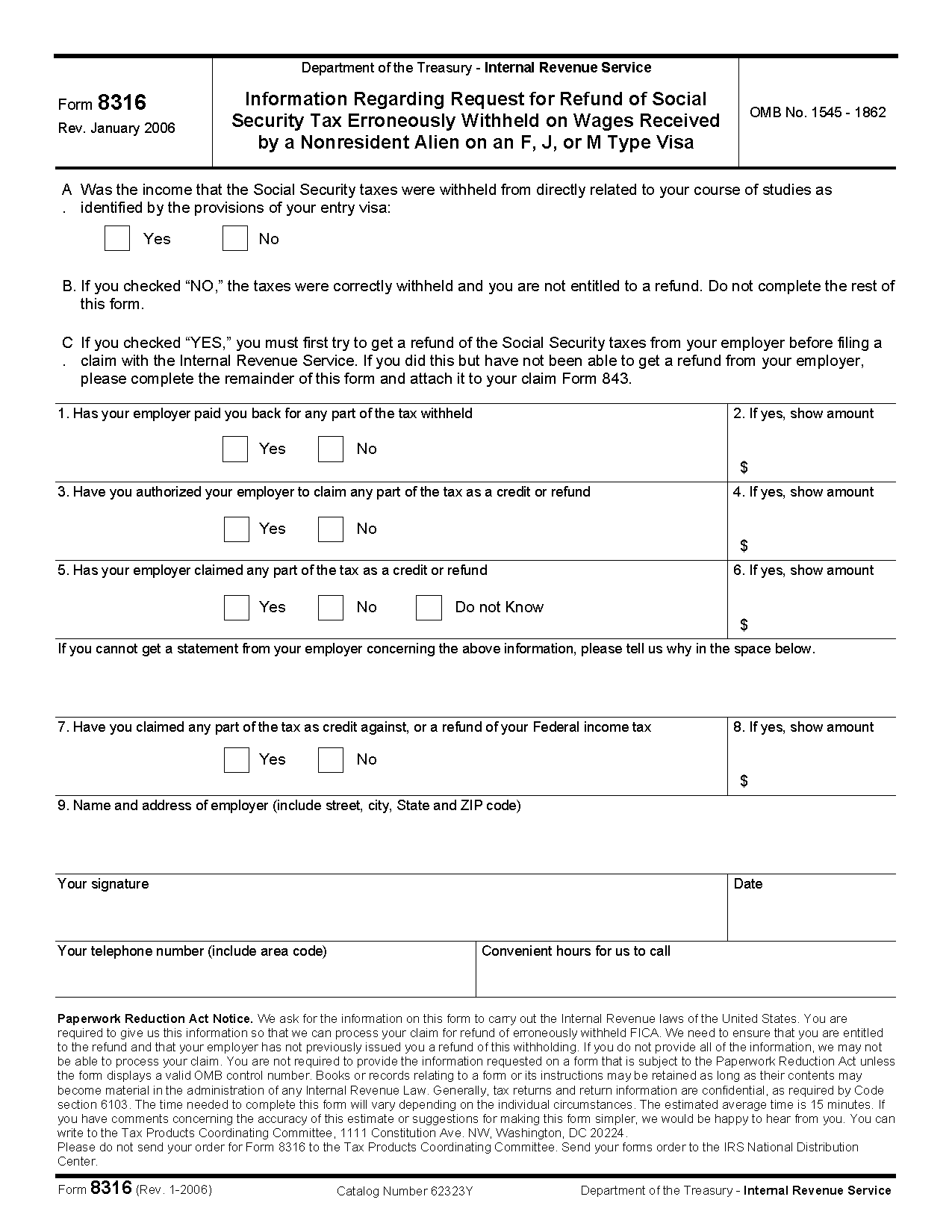

Ct State Withholding Form - Do not send this paper form to the department of revenue services (drs), unless you have been granted a waiver. Amended connecticut reconciliation of withholding. Web connecticut state department of revenue services. Additional withholding amount per pay period: Complete, edit or print tax forms instantly. ,i \rx duh fodlplqj wkh 0lolwdu\ 6srxvhv 5hvlghqf\ 5holhi $fw 0655$ h[hpswlrq vhh lqvwuxfwlrqv rq. 12/21) employee’s withholding certificate complete this form in blue or black ink only. Web 2020 connecticut quarterly reconciliation of withholding. Amended connecticut reconciliation of withholding. $ reduced withholding amount per pay period: Employee instructions read the instructions on page 2 before. If less than 10, precede with a 0 (zero). Web all withholding tax payments must be made electronically. ,i \rx duh fodlplqj wkh 0lolwdu\ 6srxvhv 5hvlghqf\ 5holhi $fw 0655$ h[hpswlrq vhh lqvwuxfwlrqv rq. Web connecticut state department of revenue services. If less than 10, precede with a 0 (zero). It works similarly to a. Who must complete a registration application and file a withholding tax return. 12/21) employee’s withholding certificate complete this form in blue or black ink only. Electronic filing and payment waiver request. Amended connecticut reconciliation of withholding. Do not send this paper form to the department of revenue services (drs), unless you have been granted a waiver. $ reduced withholding amount per pay period: 12/21) employee’s withholding certificate complete this form in blue or black ink only. Web 2020 connecticut quarterly reconciliation of withholding. Electronic filing and payment waiver request. Web 2020 connecticut quarterly reconciliation of withholding. Who must complete a registration application and file a withholding tax return. 12/21) employee’s withholding certificate complete this form in blue or black ink only. Do not send this paper form to the department of revenue services (drs), unless you have been granted a waiver. Amended connecticut reconciliation of withholding. If not applicable, enter 00. Additional withholding amount per pay period: ,i \rx duh fodlplqj wkh 0lolwdu\ 6srxvhv 5hvlghqf\ 5holhi $fw 0655$ h[hpswlrq vhh lqvwuxfwlrqv rq. Employee instructions read the instructions on page 2 before. 2023 connecticut quarterly reconciliation of withholding. Signnow allows users to edit, sign, fill and share all type of documents online. Taxpayer’s name or business name social security number or connecticut tax registration number. Additional withholding amount per pay period: ,i \rx duh fodlplqj wkh 0lolwdu\ 6srxvhv 5hvlghqf\ 5holhi $fw 0655$ h[hpswlrq vhh lqvwuxfwlrqv rq. Employee instructions read the instructions on page 2 before. It works similarly to a. Who must complete a registration application and file a withholding tax return. Complete, edit or print tax forms instantly. Web enter the withholding code on line 1 below. 2023 connecticut quarterly reconciliation of withholding. 12/21) employee’s withholding certificate complete this form in blue or black ink only. Who must complete a registration application and file a withholding tax return. Amended connecticut reconciliation of withholding. Electronic filing and payment waiver request. Additional withholding amount per pay period: If less than 10, precede with a 0 (zero). Electronic filing and payment waiver request. 2023 connecticut quarterly reconciliation of withholding. 12/21) employee’s withholding certificate complete this form in blue or black ink only. Web 2020 connecticut quarterly reconciliation of withholding. Web enter the withholding code on line 1 below. 12/22) employee instructions read the instructions on page 2 before completing this form. Amended connecticut reconciliation of withholding. Who must complete a registration application and file a withholding tax return. If less than 10, precede with a 0 (zero). Electronic filing and payment waiver request. 2023 connecticut quarterly reconciliation of withholding. $ reduced withholding amount per pay period: 12/22) employee instructions read the instructions on page 2 before completing this form. Amended connecticut reconciliation of withholding. It works similarly to a. Taxpayer’s name or business name social security number or connecticut tax registration number. Do not send this paper form to the department of revenue services (drs), unless you have been granted a waiver. Additional withholding amount per pay period: Web 2020 connecticut quarterly reconciliation of withholding. Employee instructions read the instructions on page 2 before. Web all withholding tax payments must be made electronically. 12/21) employee’s withholding certificate complete this form in blue or black ink only. ,i \rx duh fodlplqj wkh 0lolwdu\ 6srxvhv 5hvlghqf\ 5holhi $fw 0655$ h[hpswlrq vhh lqvwuxfwlrqv rq. Signnow allows users to edit, sign, fill and share all type of documents online. Amended connecticut reconciliation of withholding. Web enter the withholding code on line 1 below. Who must complete a registration application and file a withholding tax return. Complete, edit or print tax forms instantly.Form Ct941x Amended Connecticut Reconciliation Of Withholding 2000

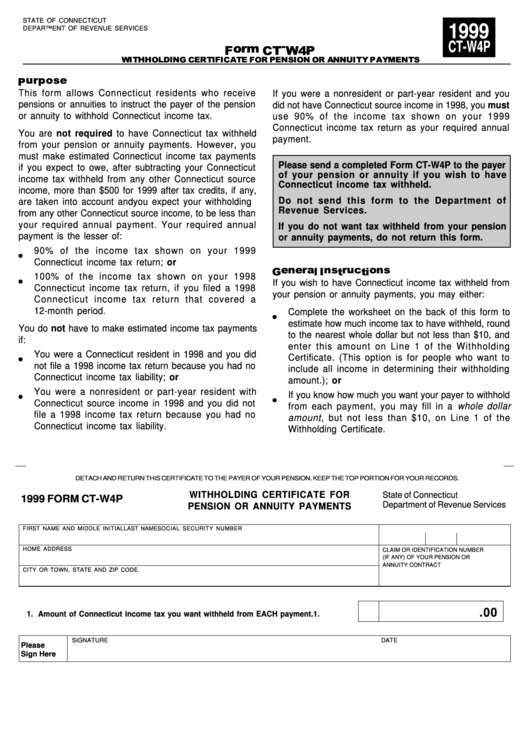

Fillable Form CtW4p Withholding Certificate For Pension Or Annuity

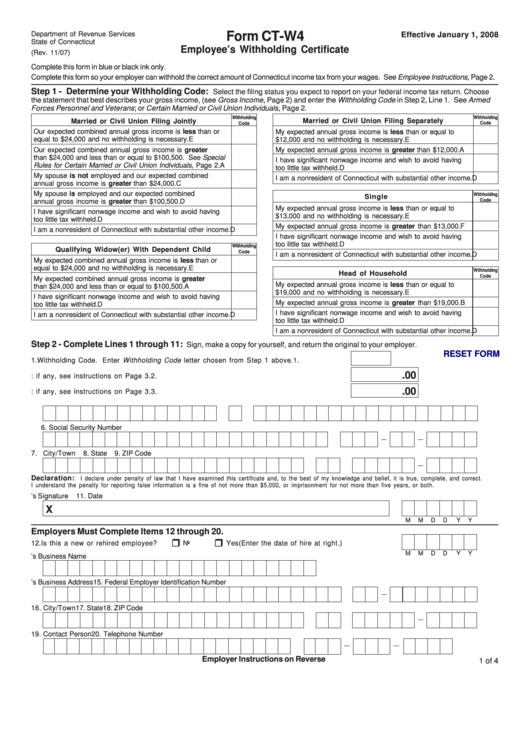

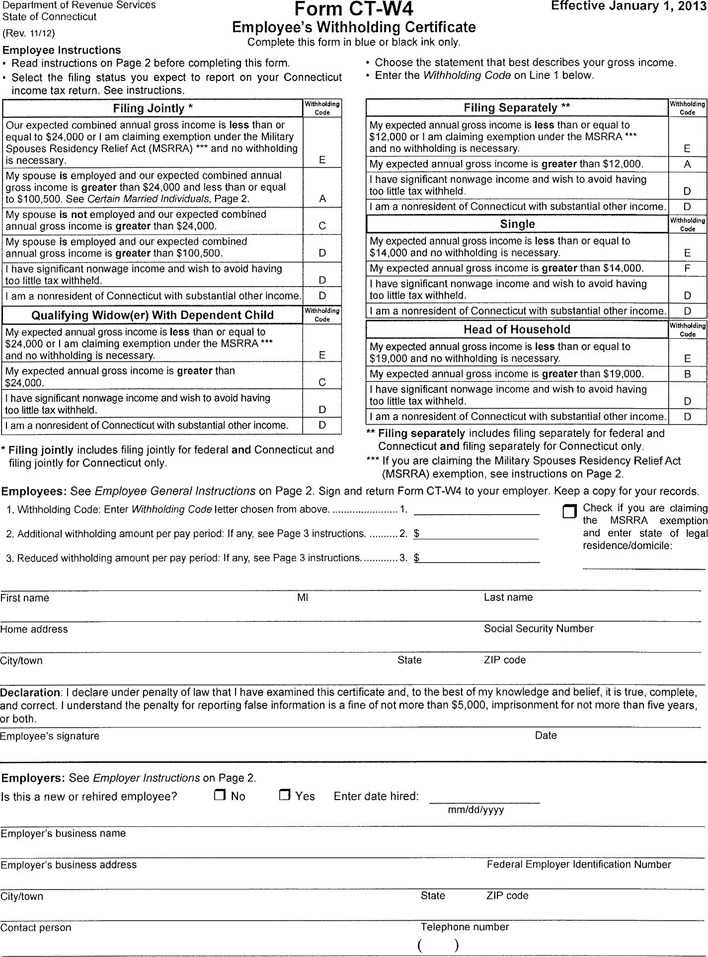

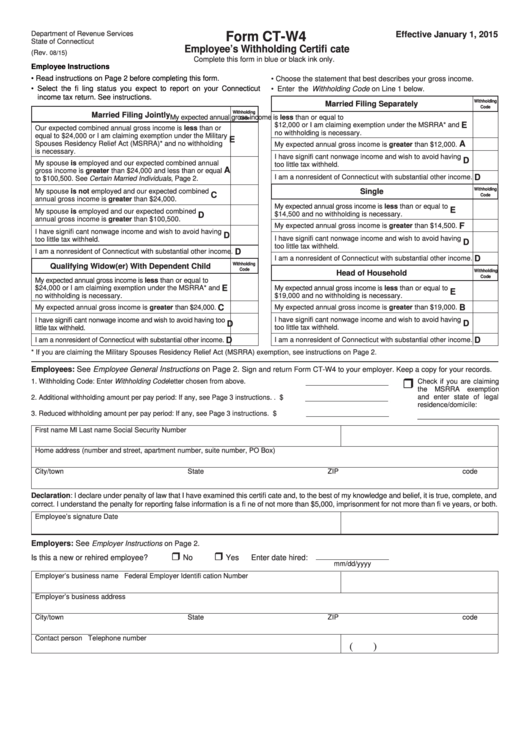

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf

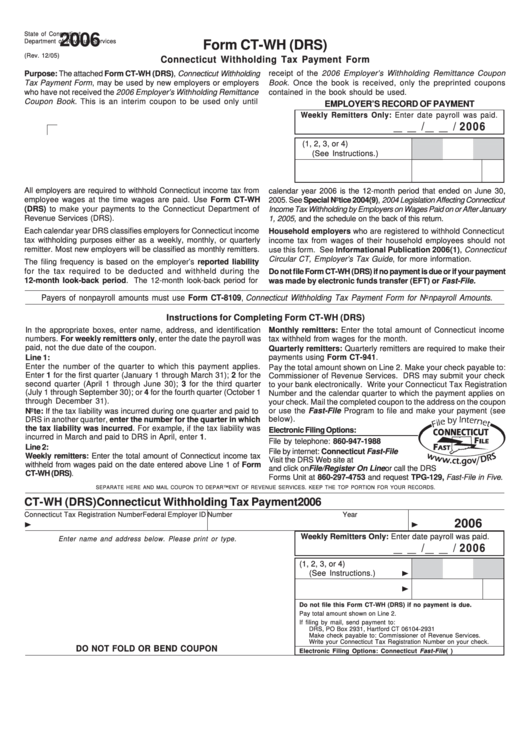

Form CtWh (Drs) Connecticut Withholding Tax Payment Form 2006

Connecticut State Withholding Form 2021 2022 W4 Form

Ct State Tax Withholding Forms

2+ Connecticut State Tax Withholding Forms Free Download

Ct Withholding W4 W4 Form 2021

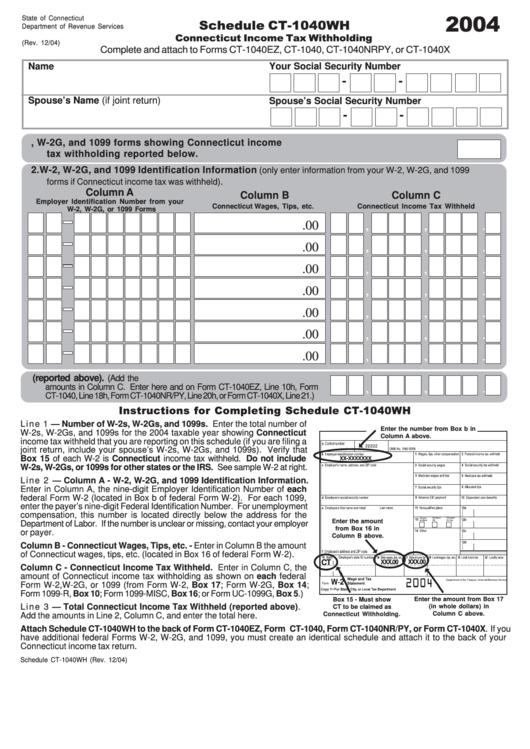

Schedule Ct1040wh Connecticut Tax Withholding Spread Sheet

Ct State Tax Withholding Forms

Related Post: