Michigan Form 5081 Instructions

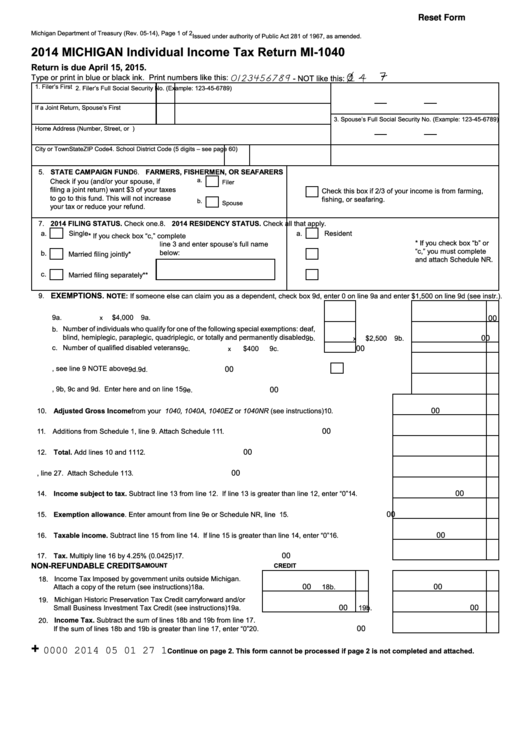

Michigan Form 5081 Instructions - Web instructions for 2019 sales, use and withholding taxes annual return. Instructions for 2022 sales, use and withholding taxes annual. Send out signed 2020 michigan 5081 or print it. Ad download or email mi 5081 & more fillable forms, register and subscribe now! 2022 sales, use and withholding taxes amended annual return: Send filled & signed form or save. Use this option to browse a list of forms by entering a key word or phrase that describes the form you need. 2023 sales, use and withholding taxes annual return instructions for. Reset form michigan department of treasury. Ad download or email mi 5081 & more fillable forms, register and subscribe now! Easily sign the michigan form 5081 with your finger. Form 5081 is available for submission electronically using michigan treasury online (mto) at. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. 2022 sales, use and withholding taxes annual return: Web form number form name; For example, if you know the form. 2015 68 01 27 7 continue on page 2. Web up to $40 cash back 10. Web instructions for 2020 sales, use and withholding taxes annual return. Reset form michigan department of treasury. Please reference michigan’s sales and. Web this form cannot be used as an 5081 (rev. Form 5081 is available for submission electronically using michigan treasury online. Web instructions for 2022 sales, use and withholding taxes annual return. 2022 sales, use and withholding taxes annual return: The address field on this form is required to be completed but will not be used to. 2022 sales, use and withholding. Send out signed 2020 michigan 5081 or print it. Please choose a year from the list below: What makes the michigan form 5081 legally valid? Web 2022 form 5081, page 3 instructions for 2022 sales, use and withholding taxes annual return (form 5081) form 5081 is available for submission electronically using. Please choose a year from the list below: Updated 9 months ago by greg hatfield. Web instructions for 2020 sales, use and withholding taxes annual return. For example, if you know the form. Sends the information securely to the servers. Reset form michigan department of treasury. Web this form cannot be used as an 5081 (rev. Form 5081 is available for submission electronically using michigan treasury online (mto) at. 2022 sales, use and withholding. All liable employers are required by section 13 of the michigan employment security (mes) act,. Please choose a year from the list below: The address field on this form is required to be completed but will not be used to. 2015 form 5081 page 2 11. Updated 9 months ago by greg hatfield. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. Form 5081 is available for submission electronically using michigan treasury online (mto) at. 2015 68 01 27 7 continue on page 2. Web if you are an annual filer, you will need to use form 5081. 2022 sales, use and withholding taxes monthly/quarterly return: Reset form michigan department of treasury. Sends the information securely to the servers. 2022 sales, use and withholding. Updated 9 months ago by greg hatfield. Web this form cannot be used as an 5081 (rev. 2022 sales, use and withholding. Use this option to browse a list of forms by entering a key word or phrase that describes the form you need. Web form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. Form 5081 is available for submission electronically using michigan treasury online.. Easily sign the form with your finger. Open form follow the instructions. Web this form cannot be used as an 5081 (rev. 2022 sales, use and withholding taxes annual return: Updated 9 months ago by greg hatfield. Web michigan treasury online form instructions. What makes the michigan form 5081 legally valid? Web 2022 form 5081, page 3 instructions for 2022 sales, use and withholding taxes annual return (form 5081) form 5081 is available for submission electronically using. Web use this form to correct the 2019 sales, use and withholding taxes annual return (form 5081) that was initially filed for the tax period. For example, if you know the form. Web if you are an annual filer, you will need to use form 5081. Sends the information securely to the servers. Send out signed 2020 michigan 5081 or print it. Web instructions for 2020 sales, use and withholding taxes annual return. This is a return for sales tax, use tax and/or withholding. Instructions for 2022 sales, use and withholding taxes annual. 2023 sales, use and withholding taxes annual return instructions for. Web instructions for 2022 sales, use and withholding taxes annual return. Web instructions for 2019 sales, use and withholding taxes annual return. Get ready for tax season deadlines by completing any required tax forms today.Michigan Sales Use And Withholding Tax Form 5081

Michigan certificate of tax exemption from 3372 Fill out & sign online

2020 Form MI 5081 Instruction Fill Online, Printable, Fillable, Blank

Fill Michigan

Printable Form 5081 Michigan Printable Forms Free Online

Printable State Of Michigan Tax Forms Printable Forms Free Online

Fill Michigan

Information From Nlrb Get Fill Online, Printable, Fillable, Blank

Printable Form 5081 Michigan Printable Forms Free Online

2018 Michigan Homestead Property Tax Credit Claim Mi1040cr

Related Post: