Form 8863 Instruction

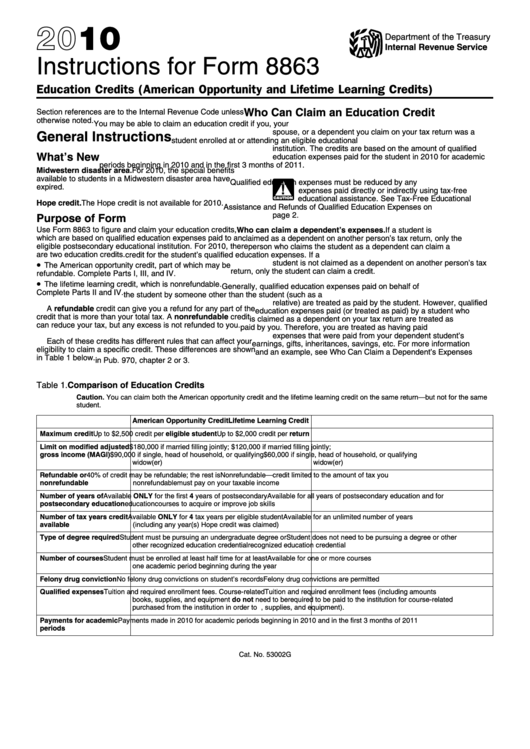

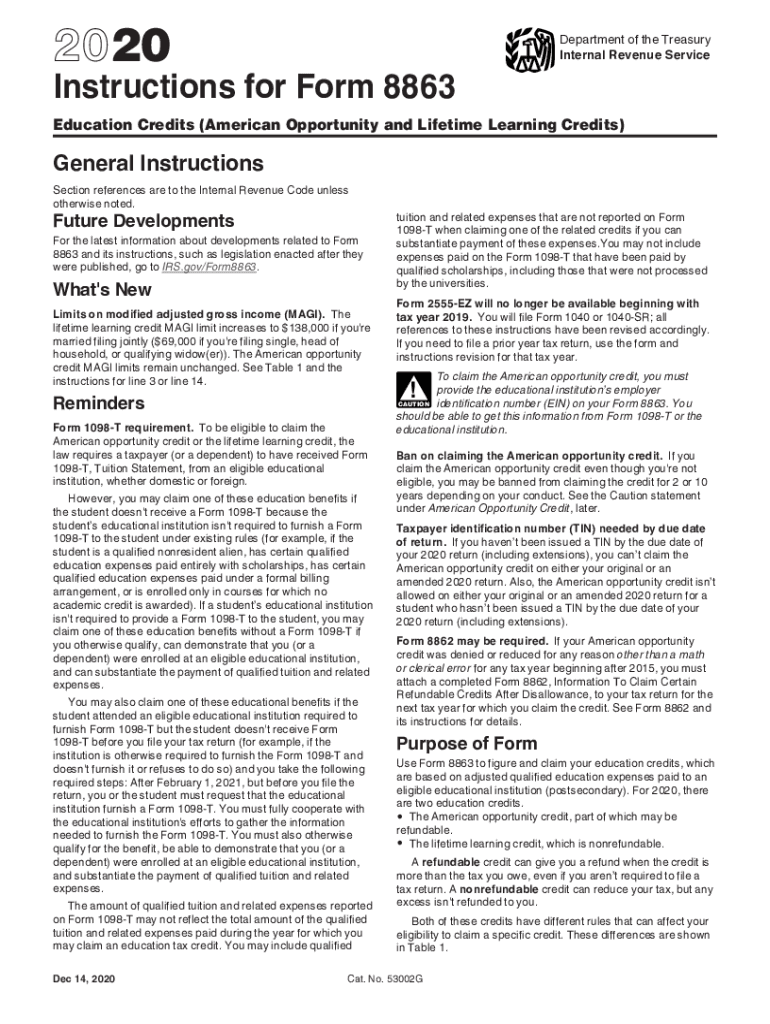

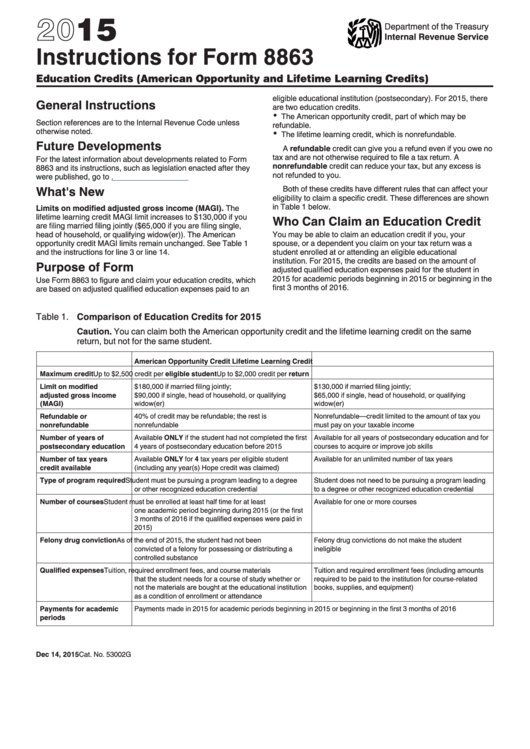

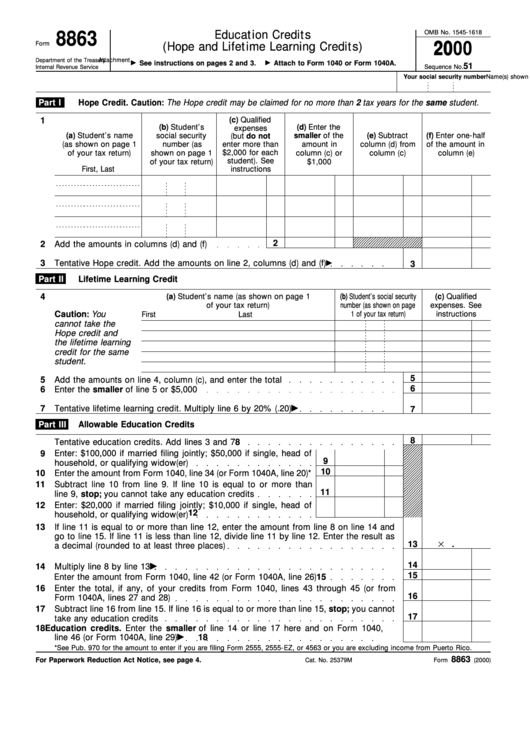

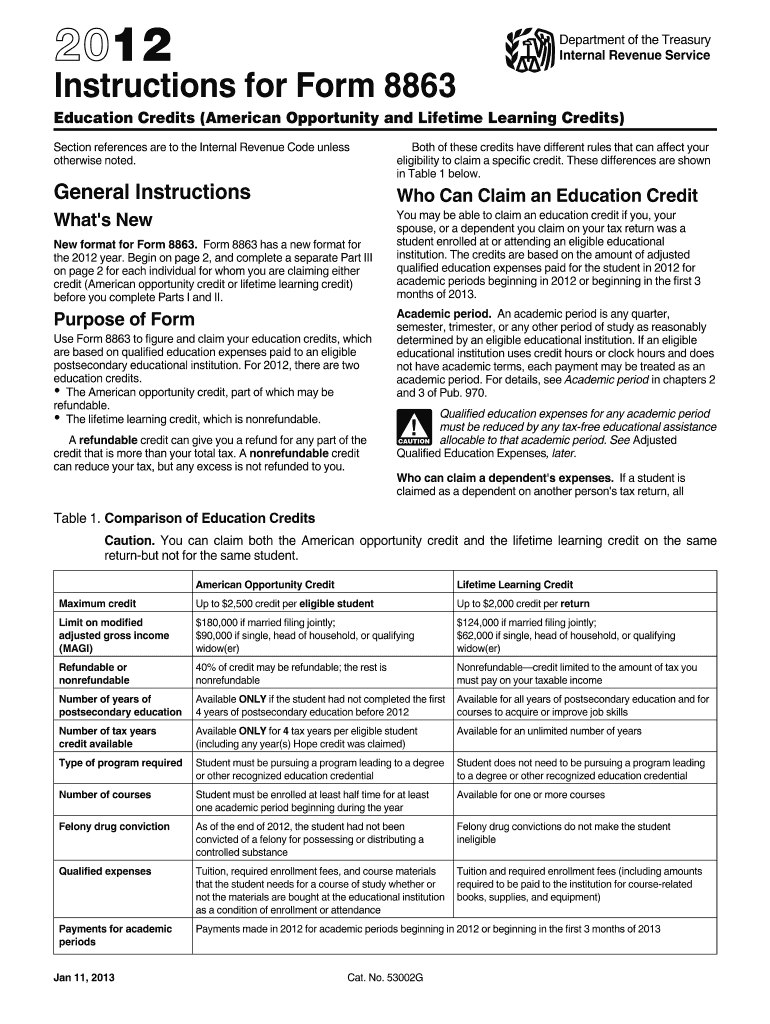

Form 8863 Instruction - Ask a tax professional anything right now. Web instructions for how to complete irs form 8863. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Launch the program, drag and drop the irs form 8863 into pdfelement. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2022 01/13/2023 Web read the irs form 8863 for 2022 instructions before filling out the sample. Add lines 1 and 2. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). If you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web how do i complete irs form 8863? Enter the amount from form 8863, line 18. Web read the irs form 8863 for 2022 instructions before filling out the sample. Ask a tax professional anything right now. Enter the amount from form 8863, line 9. 8863 (2022) form 8863 (2022) page. Enter the amount from form 8863, line 18. Add lines 1 and 2. Enter the amount from form 8863, line 9. These credits can provide a. Web for paperwork reduction act notice, see your tax return instructions. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational. Web instructions for how to complete irs form 8863. These credits can provide a. Read the irs 8863 form instructions carefully. Launch the program, drag and drop the irs form 8863 into pdfelement. Ensure you understand the eligibility criteria, tax credit options, and the sections you must. Web instructions for how to complete irs form 8863. Web you can either fill out the 8863 template or use a sample pdf provided by the irs. Web for paperwork reduction act notice, see your tax return instructions. Ad thousands of highly rated, verified tax professionals. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). They’re available online or in a printable version. 8863 (2022) form 8863 (2022) page. Forms, deductions, tax filing and more. Web use form 8863 to figure and claim your education credits, which are based. It is calculated at 100 percent of the first $2,000 of qualified expenses. Web how do i complete irs form 8863? Web instructions for how to complete irs form 8863. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). These credits can provide. Web how do i complete irs form 8863? Web for paperwork reduction act notice, see your tax return instructions. Web you can either fill out the 8863 template or use a sample pdf provided by the irs. 8863 (2022) form 8863 (2022) page. Ad download or email irs 8863 & more fillable forms, register and subscribe now! Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Web read the irs form 8863 for 2022 instructions before filling out the sample. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web the. Web you can either fill out the 8863 template or use a sample pdf provided by the irs. Enter the amount from form 8863, line 18. These credits can provide a. Use form 8863 to figure and claim your. Forms, deductions, tax filing and more. Enter the amount from form 8863, line 18. Ask a tax professional anything right now. They’re available online or in a printable version. Read the irs 8863 form instructions carefully. If you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web read the irs form 8863 for 2022 instructions before filling out the sample. Web the irs form 8863 determines the amount of this tax credit. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web instructions for how to complete irs form 8863. Web for paperwork reduction act notice, see your tax return instructions. Read the irs 8863 form instructions carefully. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web you can either fill out the 8863 template or use a sample pdf provided by the irs. They’re available online or in a printable version. Ad thousands of highly rated, verified tax professionals. Ensure you understand the eligibility criteria, tax credit options, and the sections you must. For 2022, there are two education credits. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). These credits can provide a. Enter the amount from form 8863, line 9. Launch the program, drag and drop the irs form 8863 into pdfelement. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2022 01/13/2023Instructions For Form 8863 Education Credits (American Opportunity

Form 8863 instructions 2018 Fill out & sign online DocHub

IRS Form 8863 Instructions 📝 Get 8863 Tax Form for 2022 & Credit Limit

Instructions For Form 8863 Education Credits (american Opportunity And

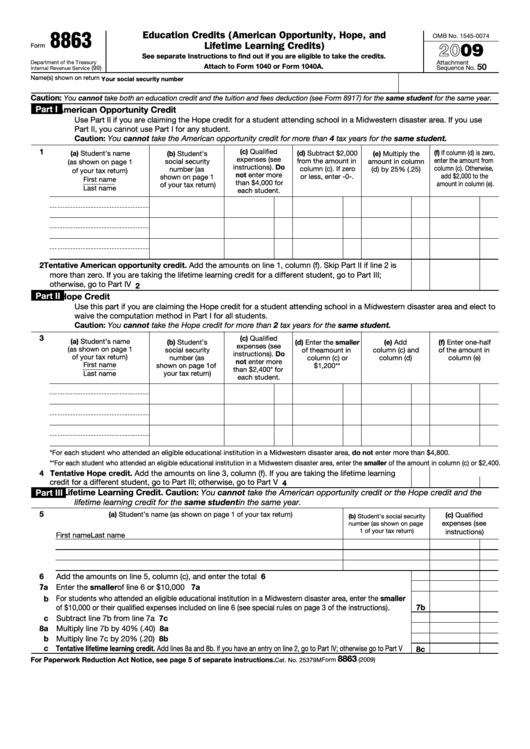

Fillable Form 8863 Education Credits (Hope And Lifetime Learning

Form 8863 Instructions & Information on the Education Credit Form

Learn How to Fill the Form 8863 Education Credits YouTube

Ir's Form 8863 Instructions Fill Out and Sign Printable PDF Template

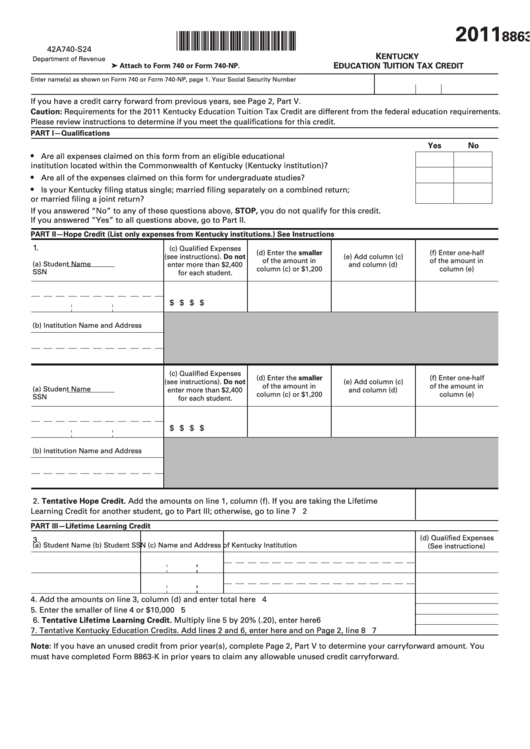

Fillable Form 8863K Kentucky Education Tuition Tax Credit 2011

Fillable Form 8863 Education Credits (American Opportunity, Hope, And

Related Post: