Md Form 502 Instructions

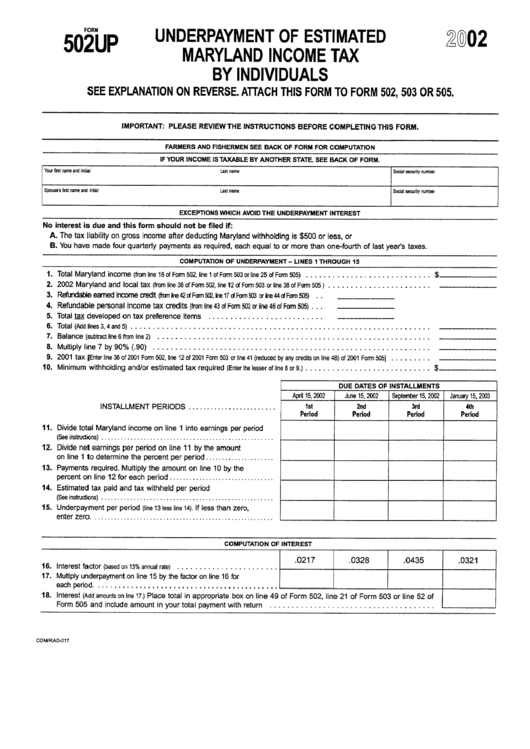

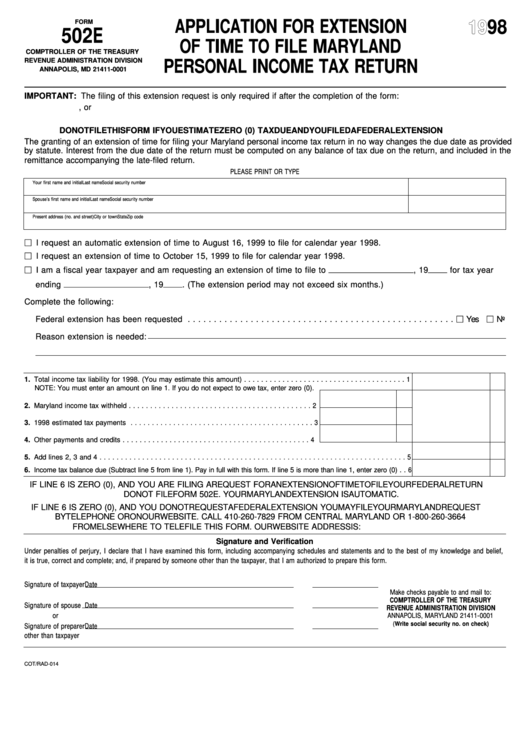

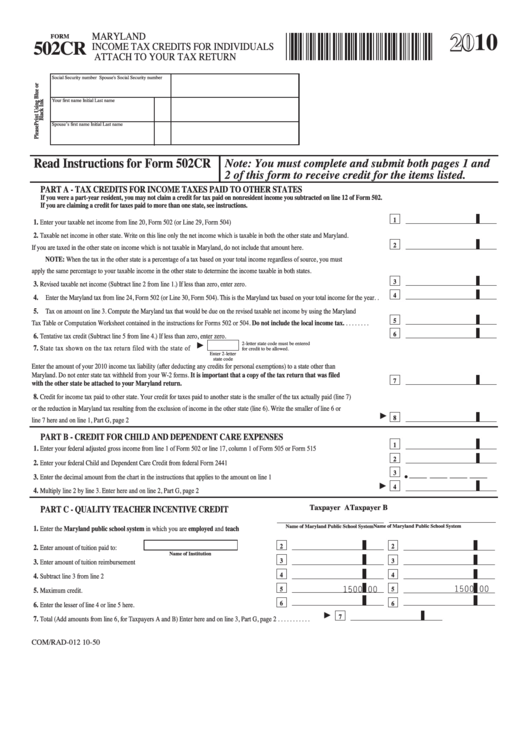

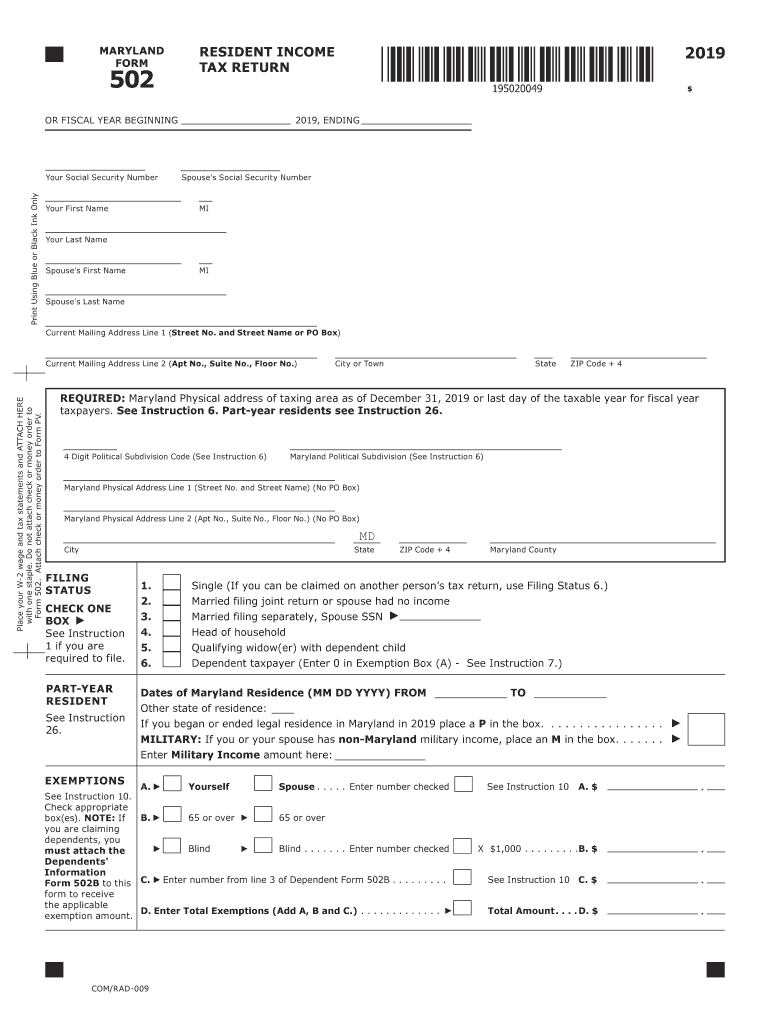

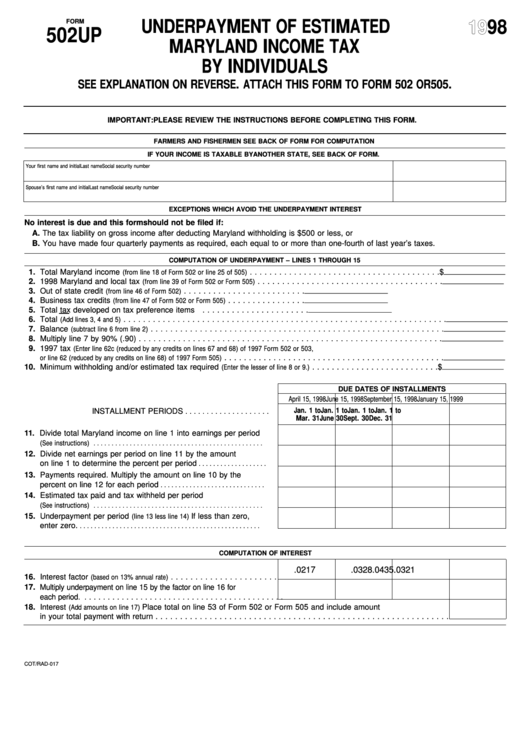

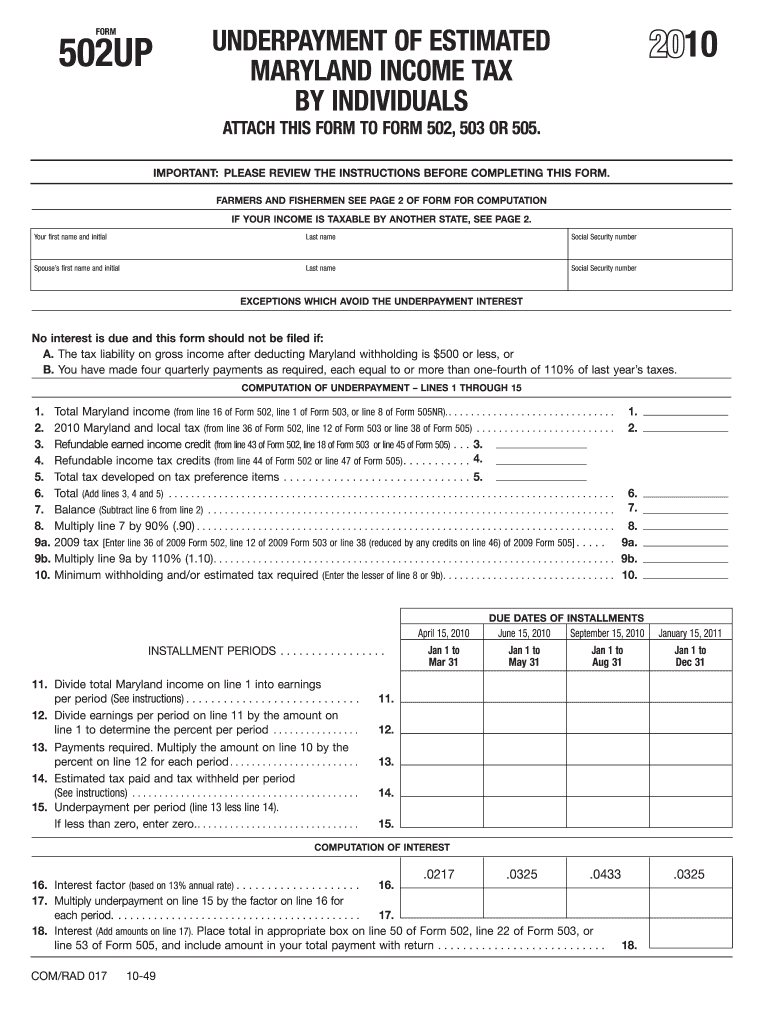

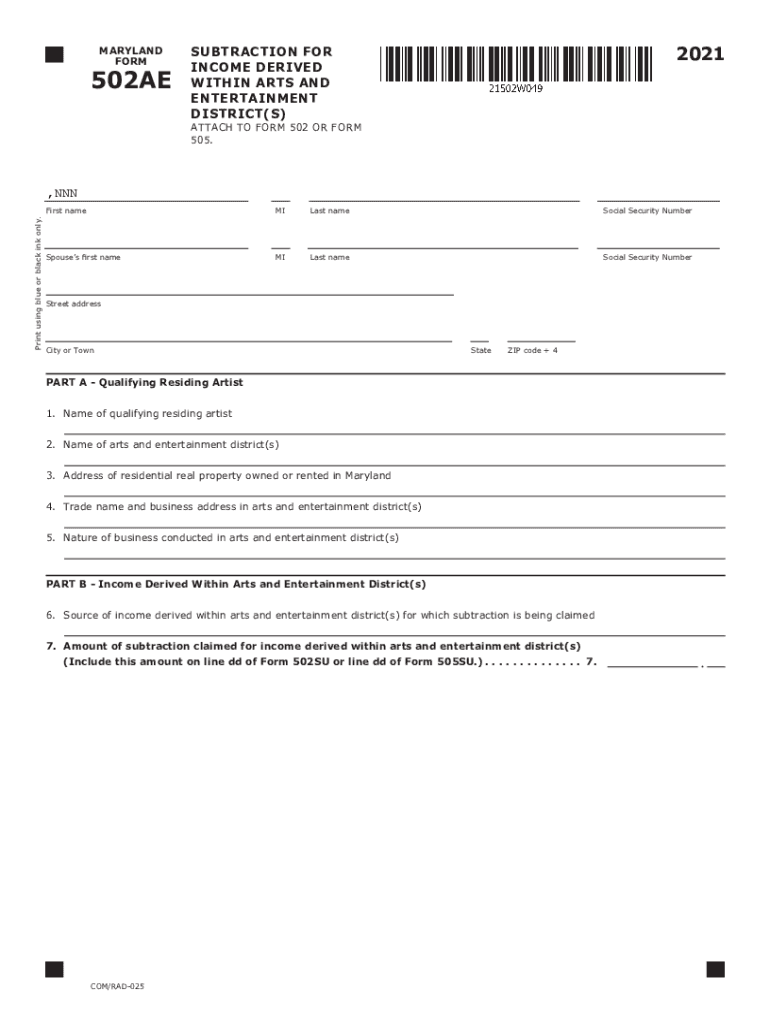

Md Form 502 Instructions - Web maryland income tax form instructions for corporations. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Complete the 502r after adding your 1099r in. Do not attach form pv or check/money order to form 502. Web up to $40 cash back maryland form 502 or fiscal year beginning print using blue or black ink only 2013 resident income tax return $ social security number. Underpayment of estimated income tax by individuals. Web find maryland form 502 instructions at esmart tax today. •form 502 •form pv •form 502lu •form. If you lived in maryland only part of the year, you must file form 502. Do not attach form pv or check/money order to form 502. If you are a nonresident, you must file form 505 and form 505nr. Attach this form to form 502, 505 or 515. Web maryland state and local tax forms and instructions. Web the new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. Do not attach form. If you lived in maryland only part of the year, you must file form 502. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. If you are claiming any dependants, use form 502b. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Web taxpayers. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. To claim a credit for taxes paid to the other state, and/or. Form and instructions for individuals claiming personal income tax. Place form pv. Web taxpayers eligible to subtract unemployment benefits must use maryland form 502lu. If you are a nonresident and need to amend. If you are claiming any dependants, use form 502b. Do not attach form pv or check/money order to form 502. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Underpayment of estimated income tax by individuals. Web married individuals who filed maryland returns with married filing separate status should each complete a separate form 502r. If you lived in maryland only part of the year,. Place form pv with attached check/money order on top of form 502 and mail to: Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Do not attach form pv or check/money order to form 502. Web maryland income tax form instructions for corporations. Do not attach form pv. Web 29.special instructions for military taxpayers. Web the local income tax is calculated as a percentage of your taxable income. Place form pv with attached check/money order on top of form 502 and mail to:. Attach this form to form 502, 505 or 515. Web up to $40 cash back maryland form 502 or fiscal year beginning print using blue. If you lived in maryland only part of the year, you must file form 502. Place form pv with attached check/money order on top of form 502 and mail to: Do not attach form pv or check/money order to form 502. Web 19 rows payment voucher with instructions and worksheet for individuals sending. If you are claiming any dependants, use. Web married individuals who filed maryland returns with married filing separate status should each complete a separate form 502r. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Web up to $40 cash back maryland form 502 or fiscal year beginning print using blue or black ink only 2013 resident income. Web taxpayers eligible to subtract unemployment benefits must use maryland form 502lu. If you are a nonresident, you must file form 505 and form 505nr. Complete the 502r after adding your 1099r in. Web 29.special instructions for military taxpayers. If you are claiming any dependants, use form 502b. Web 19 rows payment voucher with instructions and worksheet for individuals sending. Form and instructions for individuals claiming personal income tax. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Web find maryland form 502 instructions at esmart tax today. Complete the 502r after adding your 1099r in. Web married individuals who filed maryland returns with married filing separate status should each complete a separate form 502r. Underpayment of estimated income tax by individuals. Place form pv with attached check/money order on top of form 502 and mail to: If you are a nonresident and need to amend. Web maryland income tax form instructions for corporations. Web 29.special instructions for military taxpayers. Web the maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement income reported. Place form pv with attached check/money order on top of form 502 and mail to: •form 502 •form pv •form 502lu •form. Do not attach form pv or check/money order to form 502. To claim a credit for taxes paid to the other state, and/or. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Web the local income tax is calculated as a percentage of your taxable income.MD 502UP 20202021 Fill out Tax Template Online US Legal Forms

Form 502up Underpayment Of Estimated Maryland Tax By

Fillable Form 502 E Application For Extension Of Time To File

Fillable Form 502cr Maryland Tax Credits For Individuals

Md 502 instructions 2018 Fill out & sign online DocHub

2013 Form MD 502 Fill Online, Printable, Fillable, Blank pdfFiller

2019 Maryland Form 502 Instructions designshavelife

Form 502 Up Underpayment Of Estimated Maryland Tax By

2010 Form MD 502UP Fill Online, Printable, Fillable, Blank pdfFiller

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Related Post: