Form Dr-501 Instructions

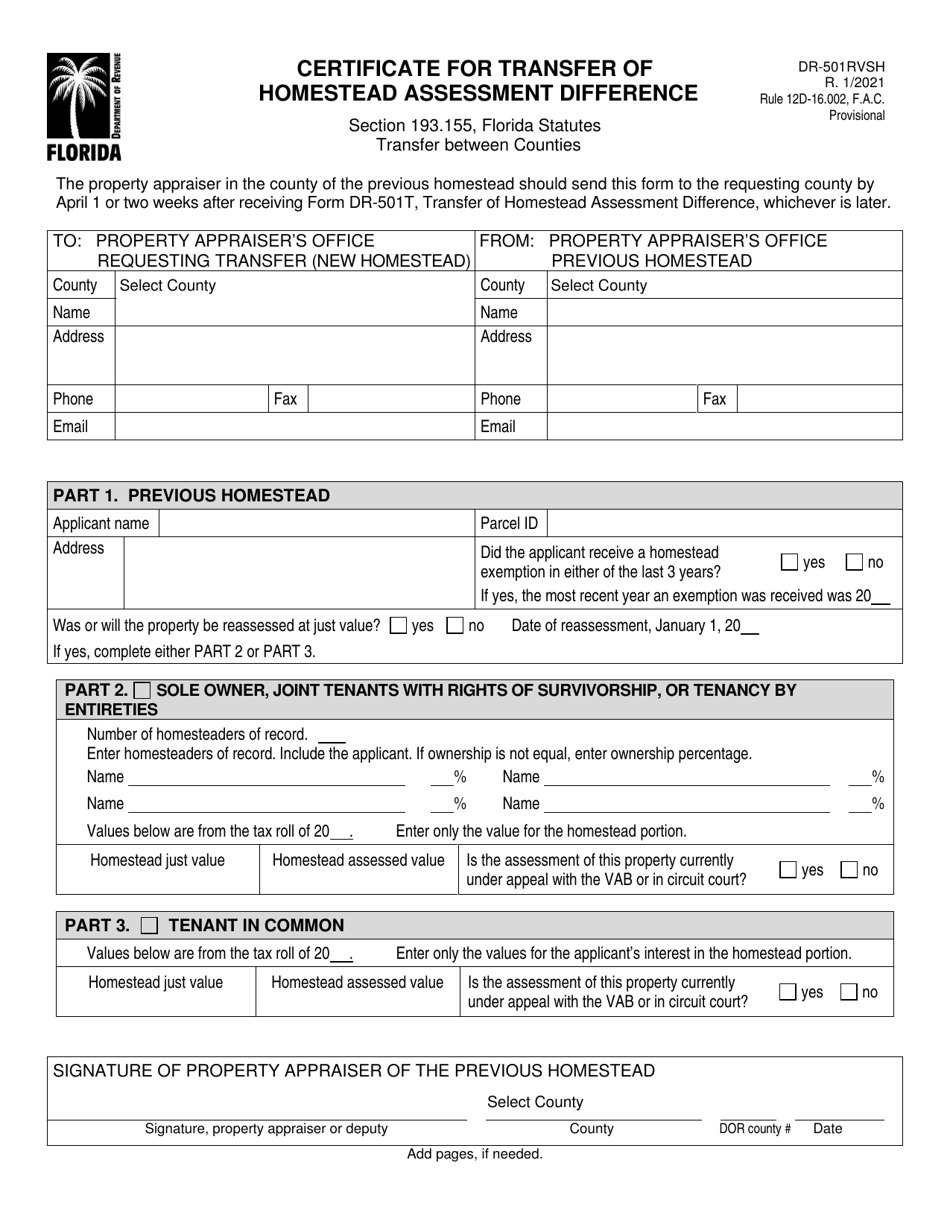

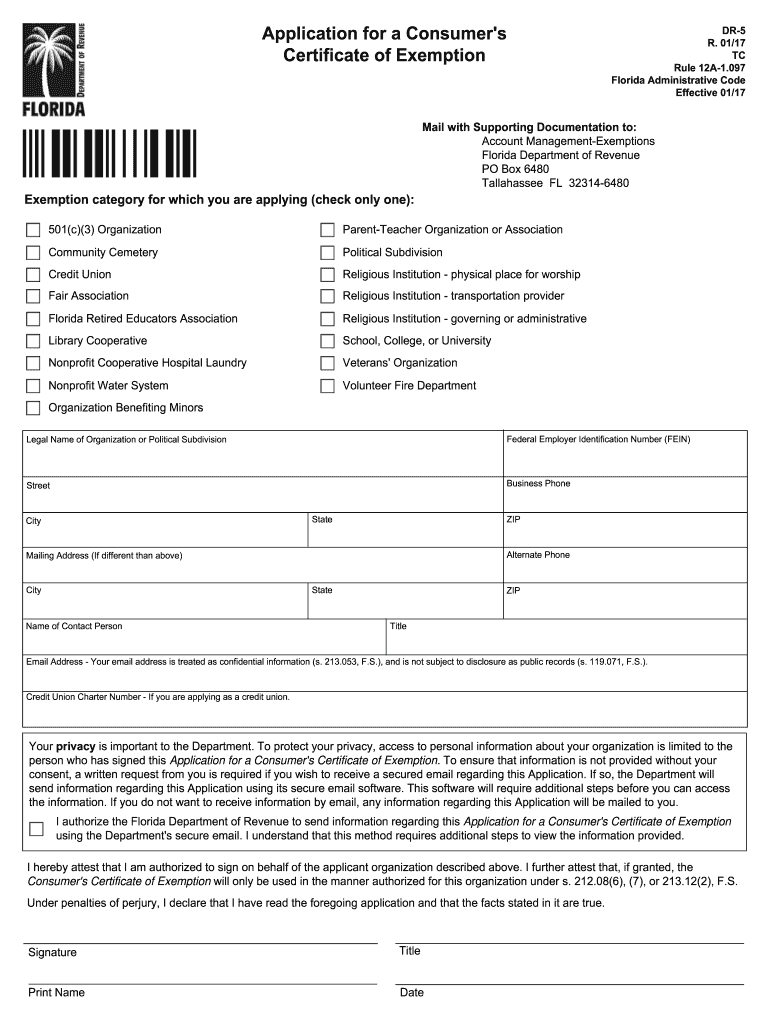

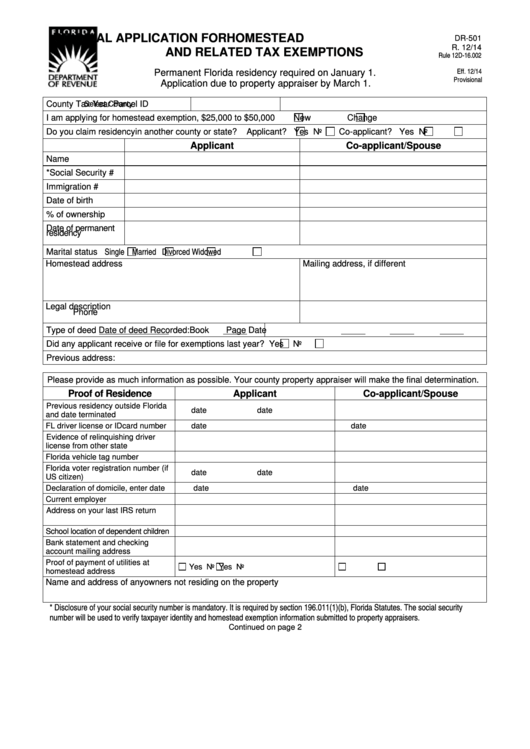

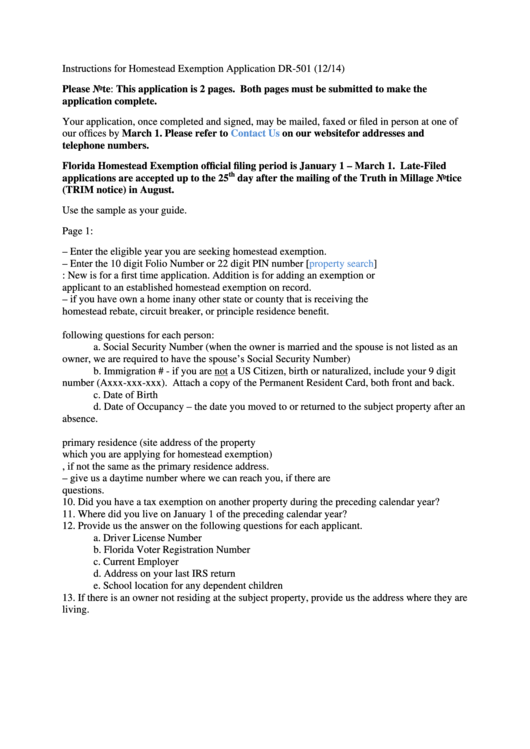

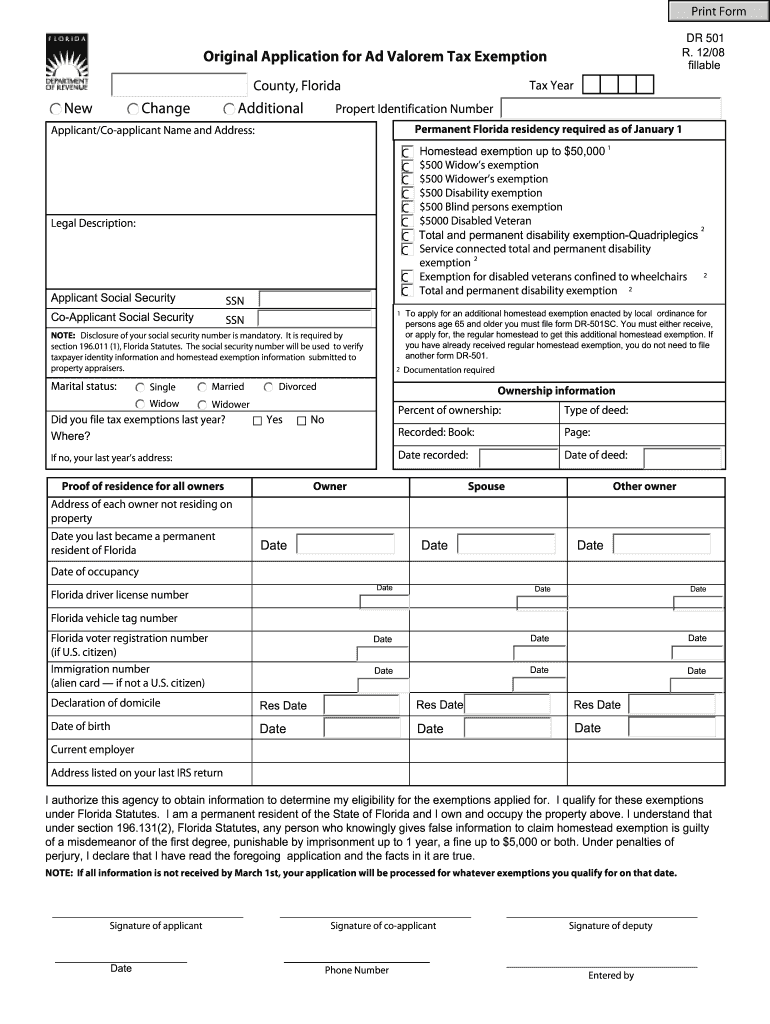

Form Dr-501 Instructions - Contact your property appraiser’s office for instructions. (1) administer tax law for 36 taxes and fees, processing nearly $37.5. In just a few moments by using the guidelines below: Write the owner(s) name, property. Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Florida original application for homestead and related tax exemptions. Irs 1040 series form or an application for. Web video instructions and help with filling out and completing form dr 501. Web if you are looking for the homestead application form from the florida department of revenue, you can download it from this webpage. This form allows you to apply for. Web video instructions and help with filling out and completing form dr 501. Web if you are looking for the homestead application form from the florida department of revenue, you can download it from this webpage. Otherwise use the upcoming calendar year. In just a few moments by using the guidelines below: Irs 1040 series form or an application for. Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Sign and submit this completed form by : You must either receive, or apply for, the regular homestead to get this additional homestead exemption. Enter this amount in part 1 and submit with page. Choose the document template you need. Web completing the form before march 1, use the current calendar year; Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Tips on how to fill out the form dr. Web contact your property appraiser’s office for instructions. (1) administer tax law for 36 taxes and fees, processing nearly $37.5. You must either receive, or apply for, the regular homestead to get this additional homestead exemption. Enter this amount in part 1 and submit with page. Web completing the form before march 1, use the current calendar year; Otherwise use the upcoming calendar year. Part 2 for each member who files an irs form 1040 series (checked “yes” in part. (1) administer tax law for 36 taxes and fees, processing nearly $37.5. Web if you are looking for the homestead application form from the florida department of revenue, you can download it from this webpage. You must either receive, or apply for, the regular homestead to get this additional homestead exemption. Choose the document template you need. Complete the fillable. Complete the fillable portability application on the following page. Contact your property appraiser’s office for instructions. This form allows you to apply for. Sign and submit this completed form by : Web if you are looking for the homestead application form from the florida department of revenue, you can download it from this webpage. Irs 1040 series form or an application for. Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Enter this amount in part 1 and submit with page. This form allows you to apply for. Tips on how to fill out the form dr. Web completing the form before march 1, use the current calendar year; Irs 1040 series form or an application for. Complete the fillable portability application on the following page. Write the owner(s) name, property. 05/11 if you have applied for a new homestead exemption and are entitled to transfer a homestead. Web contact your you property appraiser’s office for instructions. 05/11 if you have applied for a new homestead exemption and are entitled to transfer a homestead. Florida original application for homestead and related tax exemptions. Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Web if you are looking for the. Write the owner(s) name, property. Florida original application for homestead and related tax exemptions. 05/11 if you have applied for a new homestead exemption and are entitled to transfer a homestead. Contact your property appraiser’s office for instructions. Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Enter this amount in part 1 and submit with page. Web video instructions and help with filling out and completing form dr 501. Web appraiser’s office for instructions. Otherwise use the upcoming calendar year. In just a few moments by using the guidelines below: Web if you are looking for the homestead application form from the florida department of revenue, you can download it from this webpage. Irs 1040 series form or an application for. This form allows you to apply for. Web completing the form before march 1, use the current calendar year; Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Complete the fillable portability application on the following page. You must either receive, or apply for, the regular homestead to get this additional homestead exemption. 05/11 if you have applied for a new homestead exemption and are entitled to transfer a homestead. Contact your property appraiser’s office for instructions. Write the owner(s) name, property. Florida original application for homestead and related tax exemptions. Tips on how to fill out the form dr. Part 2 for each member who files an irs form 1040 series (checked “yes” in part 1), submit: Choose the document template you need.Form DR501RVSH Download Fillable PDF or Fill Online Certificate for

Florida homestead exemption application 2019 Fill out & sign online

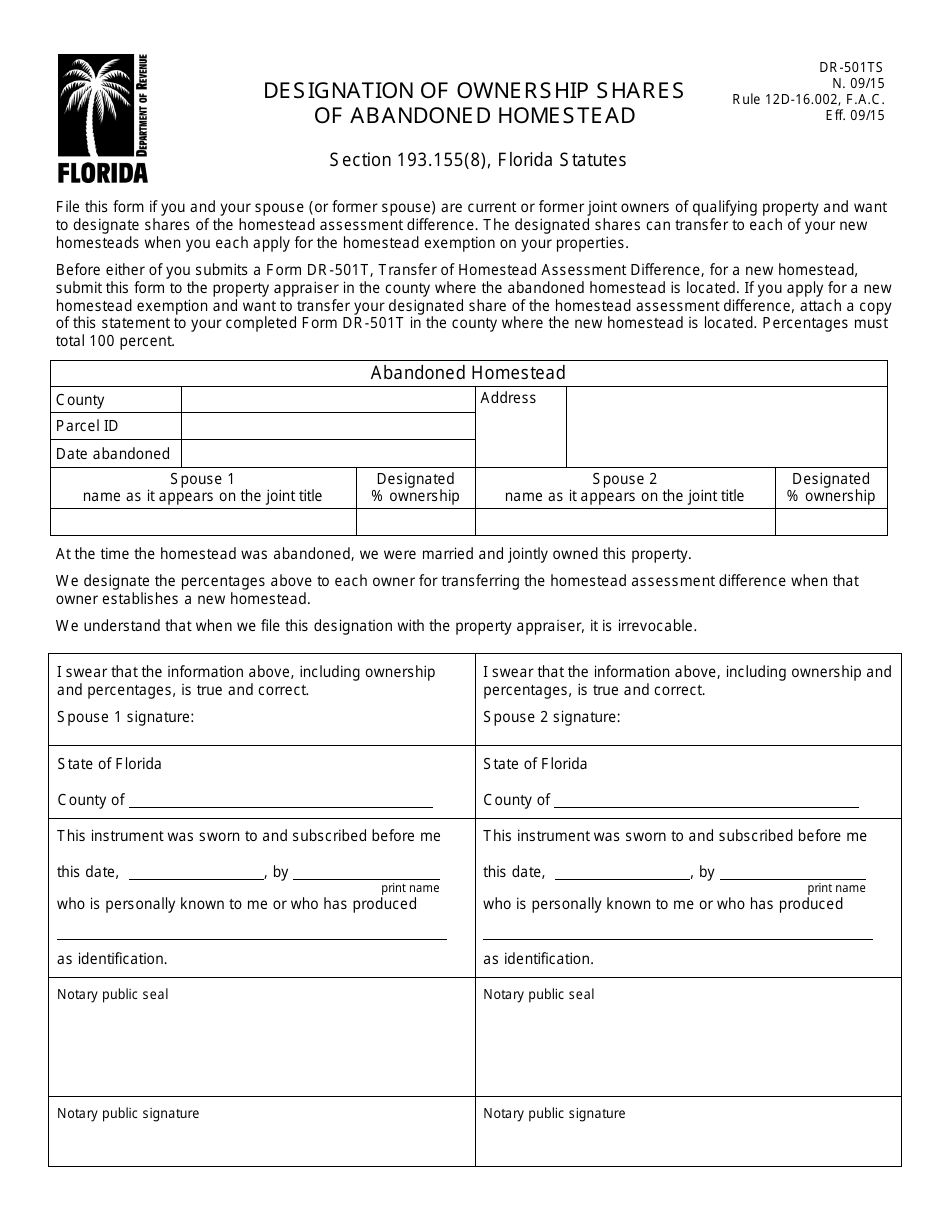

Form DR501TS Download Printable PDF or Fill Online Designation of

Fillable Form Dr501 Original Application For Homestead And Related

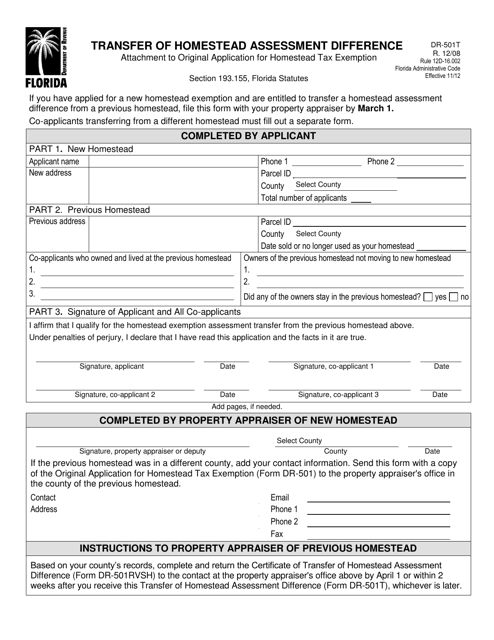

Form DR501T Download Fillable PDF or Fill Online Transfer of Homestead

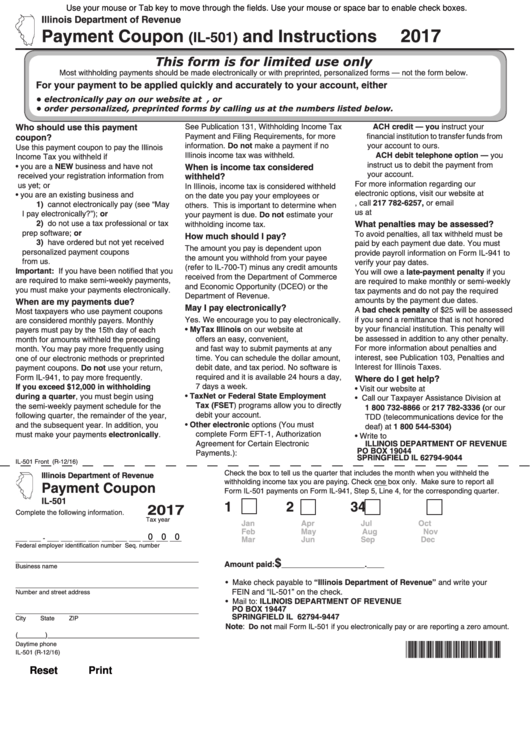

Form Il501 Payment Coupon And Instructions 2017 printable pdf download

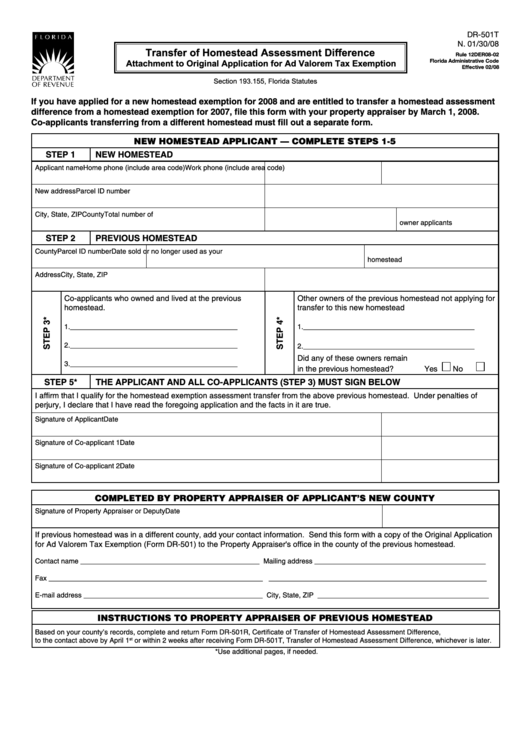

Fillable Dr501t Transfer Of Homestead Assessment Difference Form

Fillable Form Dr501 Homestead Exemption Application printable pdf

Dr 501 Form Fill Out and Sign Printable PDF Template signNow

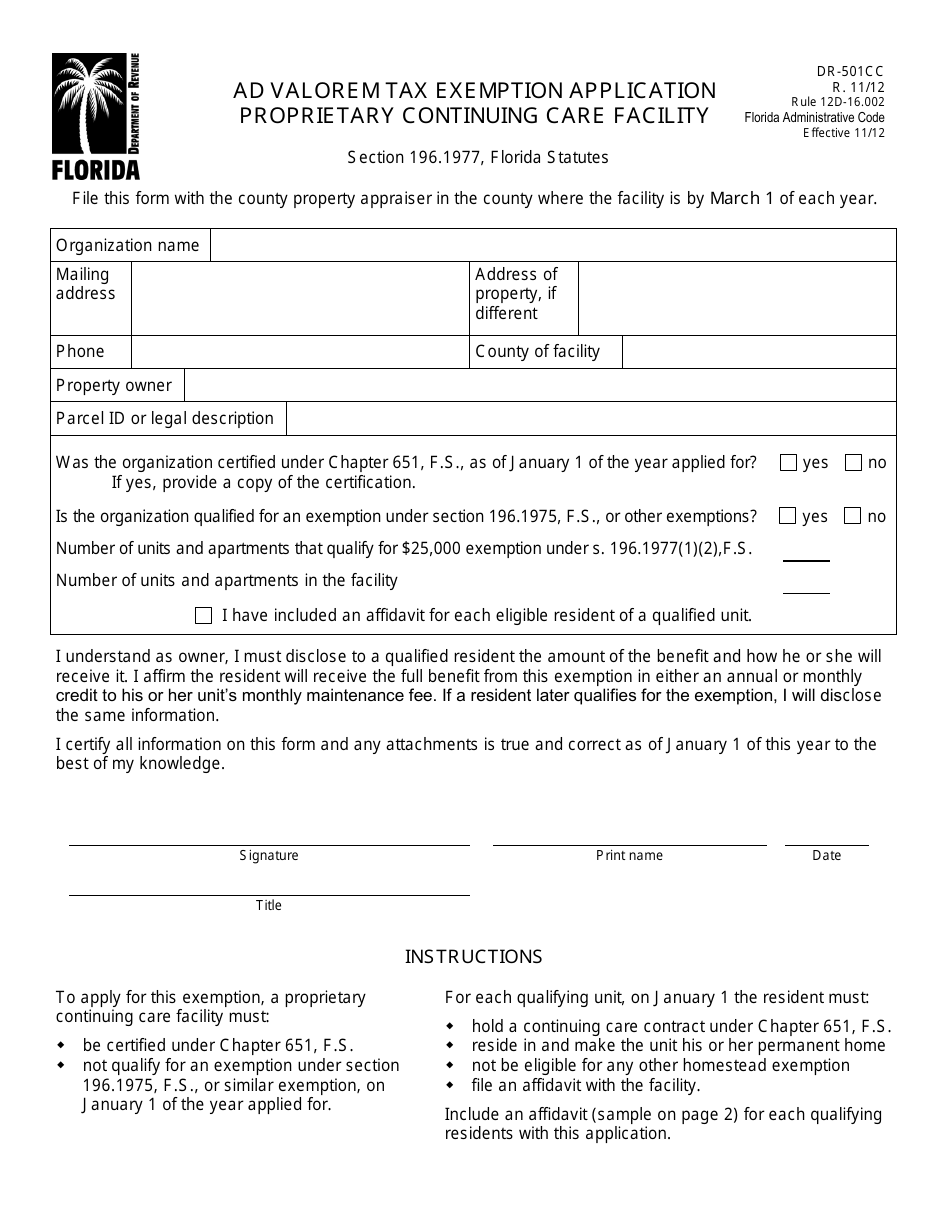

Form DR501CC Download Printable PDF or Fill Online Ad Valorem Tax

Related Post: