Llc Tax Extension Form

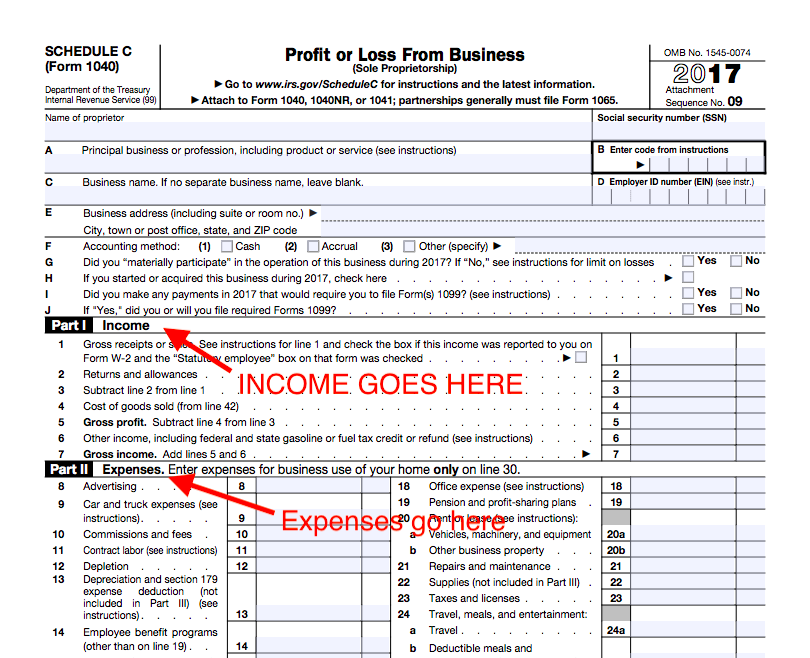

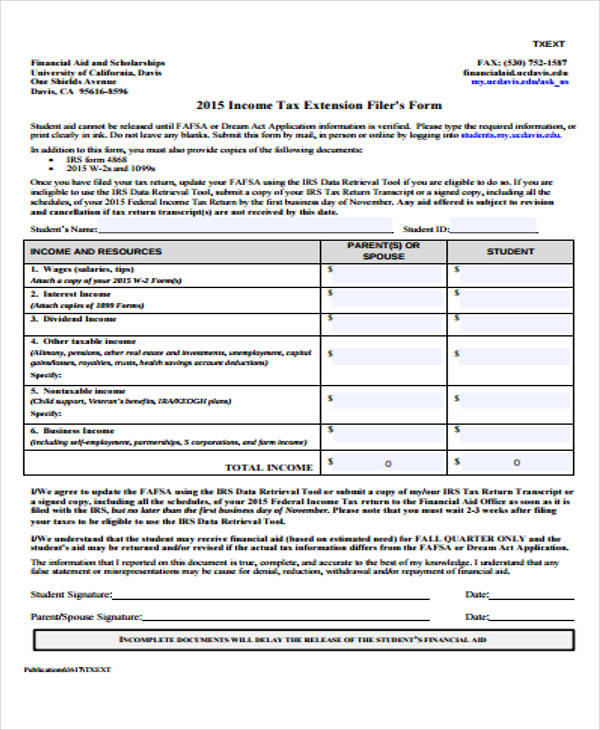

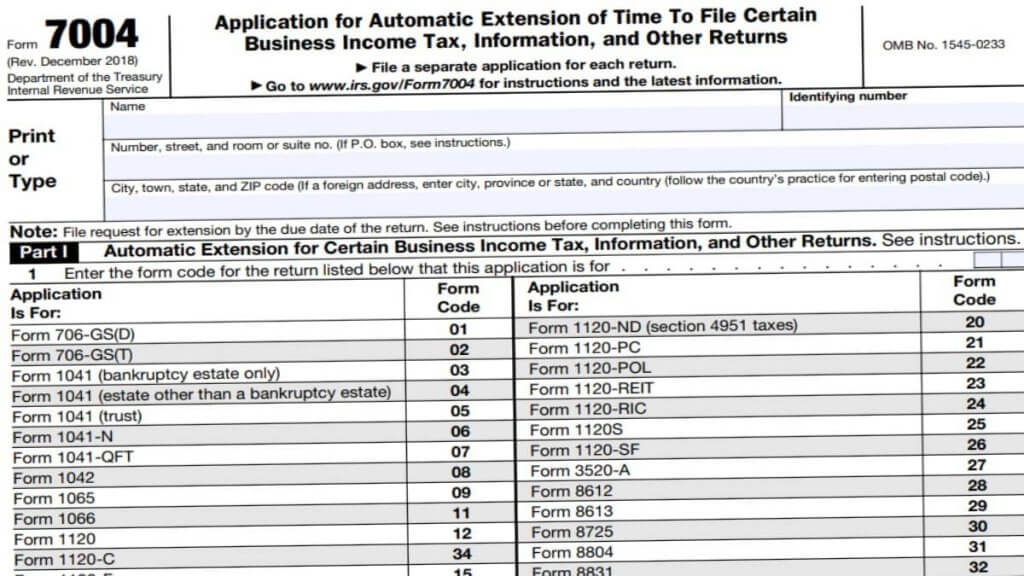

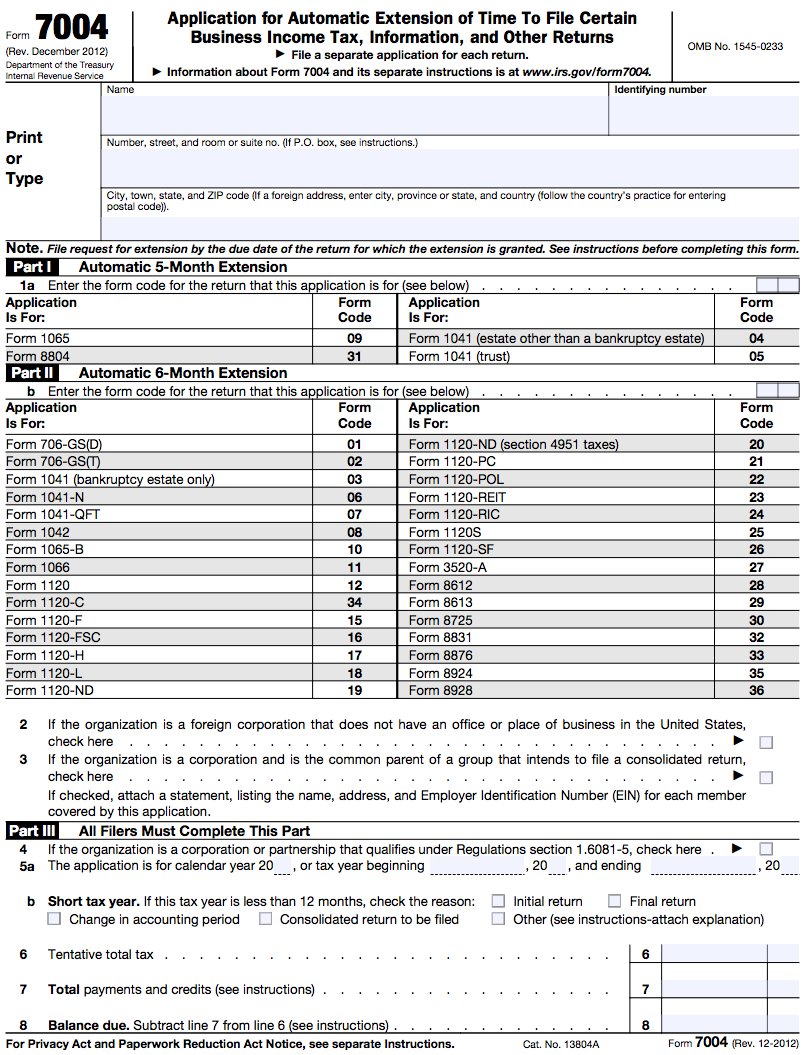

Llc Tax Extension Form - Web extensions of small business taxes for llcs are available by filing irs form 7004 at least 45 days before the end of the tax period. Each form number has its own page with the. Application for automatic extension of time to file certain business income tax information, and other returns. Citizen or resident files this form to request an automatic extension of time to file a u.s. The llc needs to file a 1065 partnership return and. Web application for automatic extension of time to file certain business income tax, information, and other returns. An llc being taxed as a corporation. Web updated oct 05, 2023. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. Get access to the largest online library of legal forms for any state. Web to file an extension for your llc through expressextension, follow the steps below: The llc needs to file a 1065 partnership return and. File request for extension by the due date. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it. Web series limited liability company. Get access to the largest online library of legal forms for any state. Each form number has its own page with the. Ad easy, fast, secure & free to try! To file for an llc extension, file form 7004: Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. With an extension, the deadline for filing is october 17. Get access to the. In the wake of last winter’s. Web purpose of form. Citizen or resident files this form to request an automatic extension of time to file a u.s. To file for an llc extension, file form 7004: Web application for automatic extension of time to file certain business income tax, information, and other returns. An llc being taxed as a corporation. Web purpose of form. Create an account in expressextensin or log in to your existing. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. Get access to the largest online library. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. Ad easy, fast, secure & free to try! Application for automatic extension of. An llc being taxed as a corporation. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. Web series limited. Ad easy, fast, secure & free to try! Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! The llc needs to file a 1065 partnership return and. File request for extension by the due date. Web 20 rows corporate tax forms. With an extension, the deadline for filing is october 17. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. A. Citizen or resident files this form to request an automatic extension of time to file a u.s. Get access to the largest online library of legal forms for any state. Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. Mailing addresses for. A business tax extension gives you more time to file your tax. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! With an extension, the deadline for filing is october 17. Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. An llc must have the same classification for both california and federal tax purposes. Get access to the largest online library of legal forms for any state. Web application for automatic extension of time to file certain business income tax, information, and other returns. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. The llc needs to file a 1065 partnership return and. Web series limited liability company. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Web the taxpayer will be liable for the extension underpayment penalty if at least 90 percent of the tax liability disclosed by the return has not been paid by the original. Citizen or resident files this form to request an automatic extension of time to file a u.s. An llc being taxed as a corporation. Application for automatic extension of time to file certain business income tax information, and other returns. Web for 2022, llcs filing as a c corporation must file form 1120 by april 18 without an extension. Web updated oct 05, 2023. Web extensions of small business taxes for llcs are available by filing irs form 7004 at least 45 days before the end of the tax period. Mailing addresses for all types of returns:LLC tax filing What you need to know as a solo entrepreneur GrowthLab

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

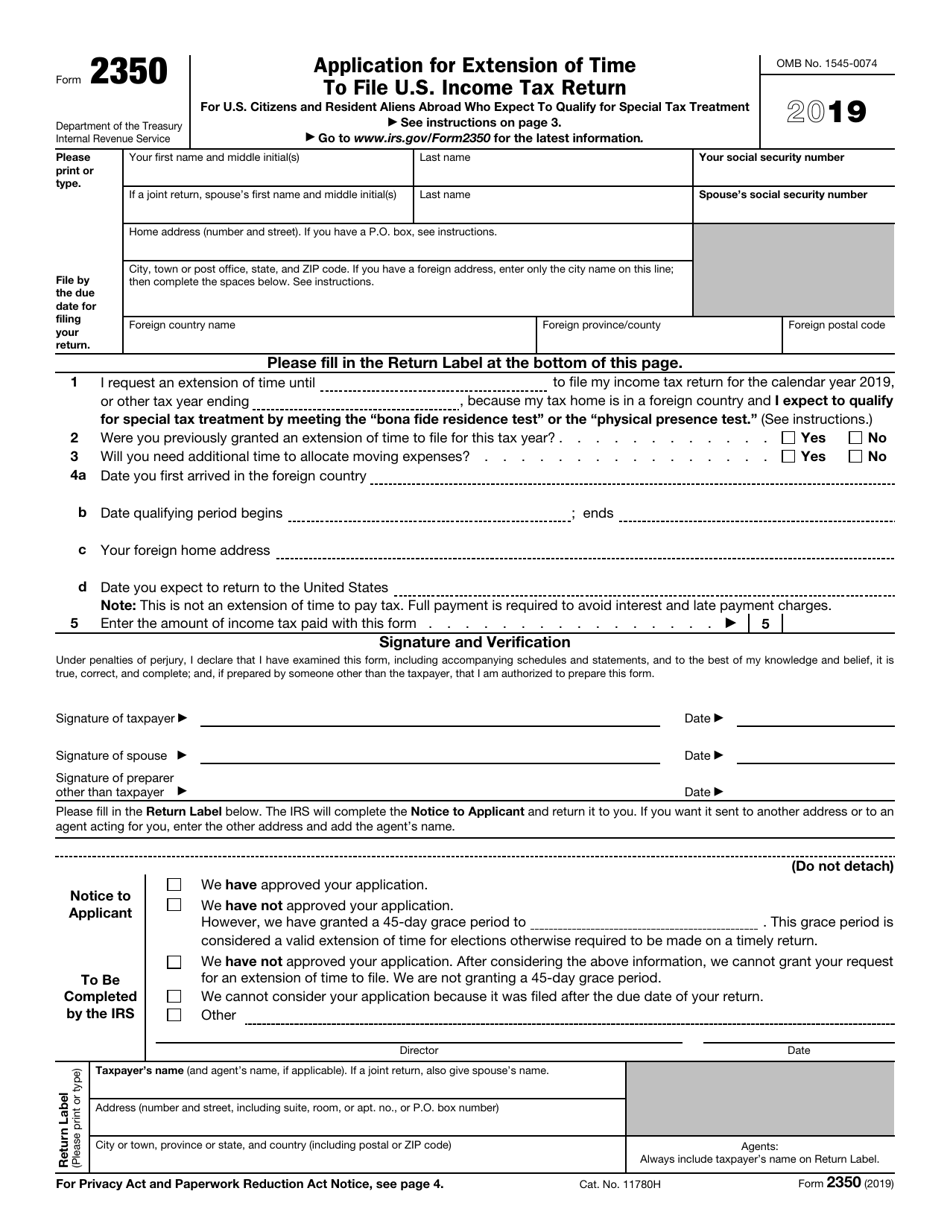

IRS Form 2350 2019 Fill Out, Sign Online and Download Fillable PDF

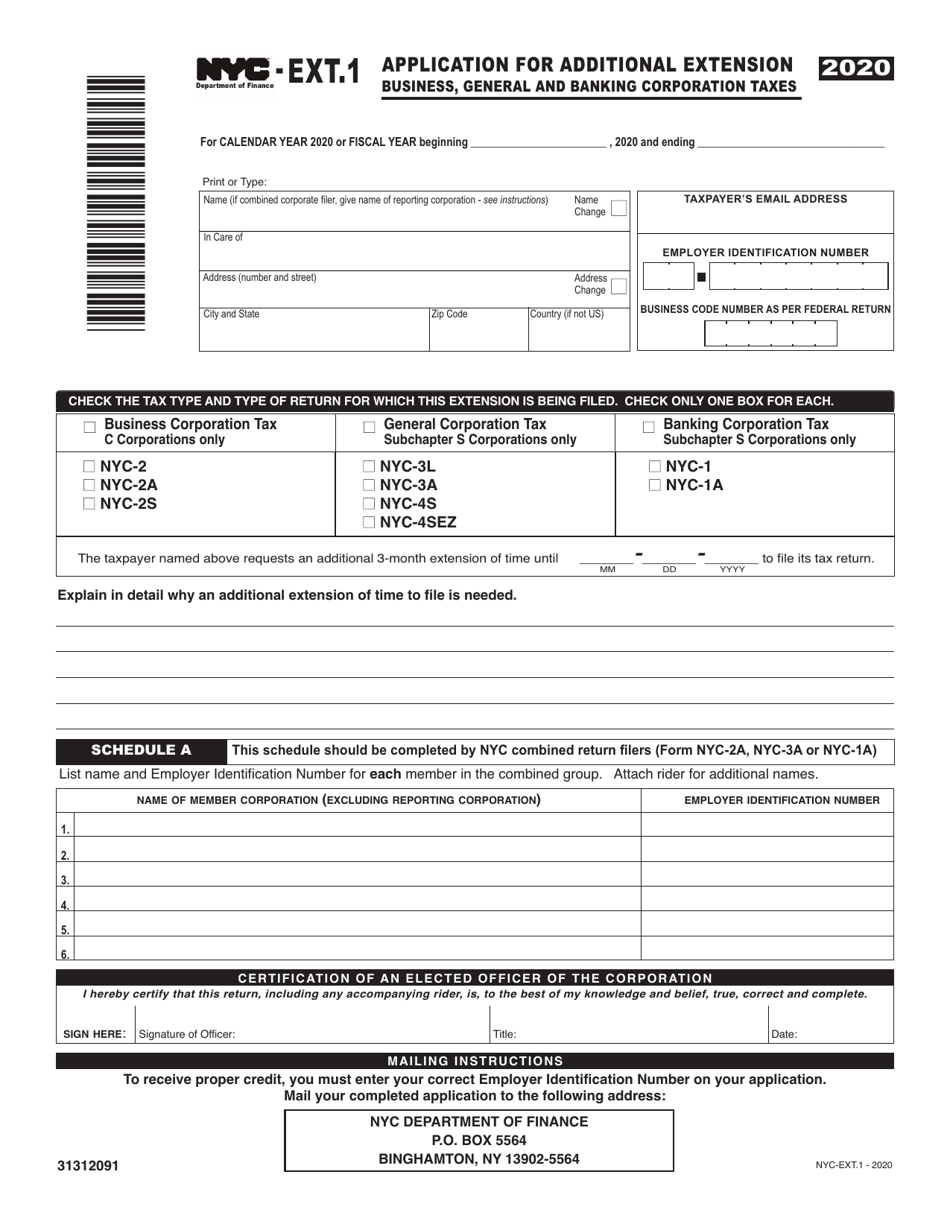

Form NYCEXT.1 Download Printable PDF or Fill Online Application for

Printable Tax Extension Form Printable Form 2022

Business Tax Extension 7004 Form 2023

How to Fill Out IRS Form 7004

IRS Tax Extension Efile Federal Extension

IRS File for Tax Extension how to apply and where to apply to IRS Form

Tax Extension 2021 Form Tax Day 2021 Here's how to file an extension

Related Post: