Ky Farm Exemption Form

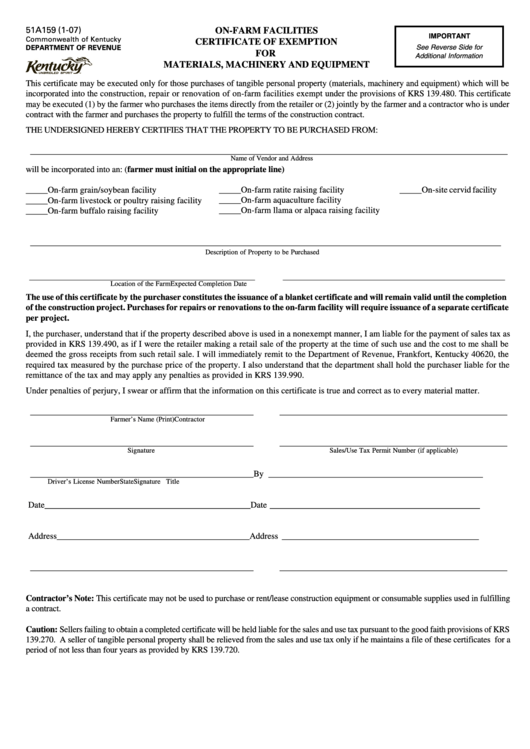

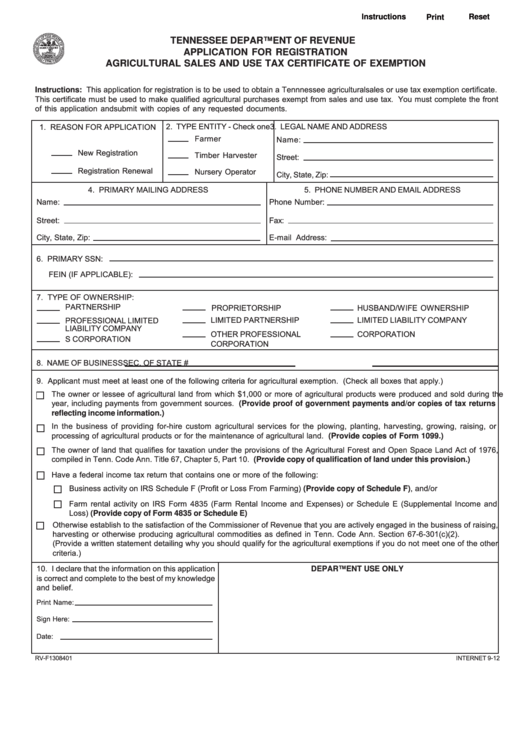

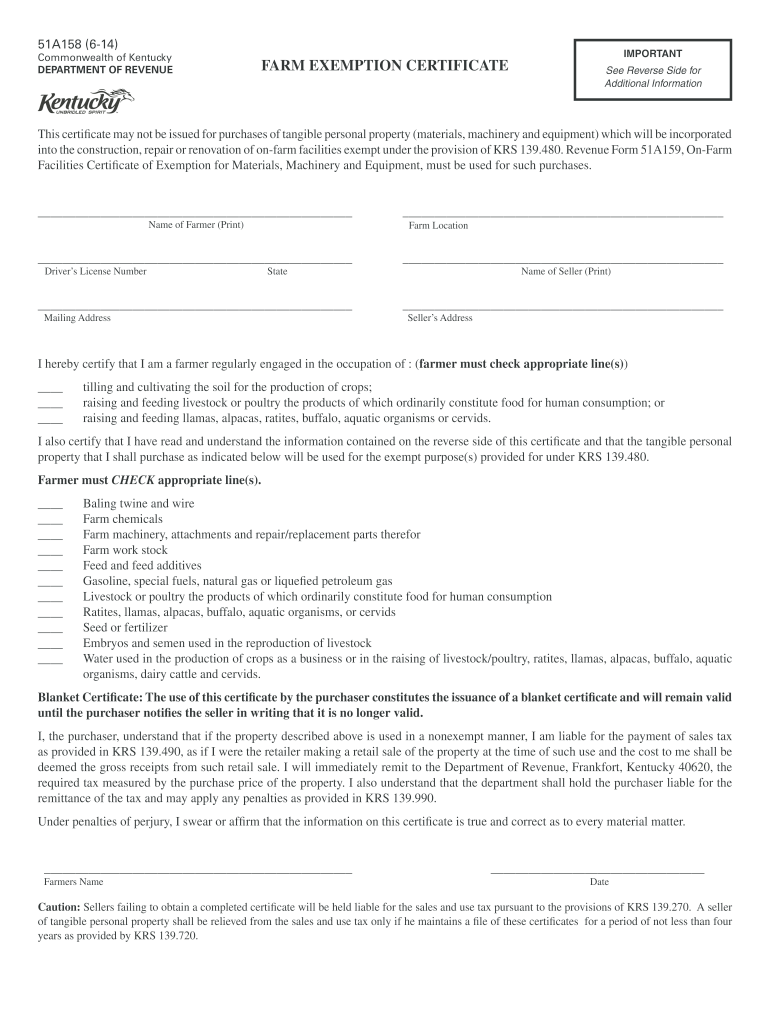

Ky Farm Exemption Form - A farm dwelling together with other farm buildings and structures incident to the operation and maintenance of the. • submit applications via email to. Easily fill out pdf blank, edit, and sign them. _____ in _____ county is exempt from the plumbing code under krs 318.015(3) and that the following statements are true and. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels,. Web up to $40 cash back related to kentucky farm exemption form kentucky farm exemption 51a158 (921)commonweal th of kentucky department of revenueimportan. Ad uslegalforms.com has been visited by 100k+ users in the past month The application form 51a800 is currently available. Complete, edit or print tax forms instantly. The application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Ad uslegalforms.com has been visited by 100k+ users in the past month The deadline for applying for the new agriculture exemption number for current farmers is january 1,. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web what is the application process? Web the application for the agriculture exemption number,. The application for the agriculture exemption number, form 51a800,. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web to qualify for a farmstead exemption the following must be met. The application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Web the deadline. Web to qualify for a farmstead exemption the following must be met. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels,. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web qualified purchases for the. Web qualified purchases for the farm exempt from sales tax. Listeria monocytogenes can grow in a cold environment and lead to high. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. The deadline for applying for the new agriculture exemption number for current farmers is january 1,. Web the deadline to. Complete, edit or print tax forms instantly. • submit applications via email to. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Web the deadline to apply for the new agriculture exemption number. Web up to $40 cash back related to kentucky farm exemption form kentucky farm exemption 51a158 (921)commonweal th of kentucky department of revenueimportan. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels,. The kentucky department of agriculture forms. A farm dwelling together with other. A farm dwelling together with other farm buildings and structures incident to the operation and maintenance of the. Easily fill out pdf blank, edit, and sign them. Unmined coal & other natural resources; Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. • complete the online application for agriculture exemption number,. Web prior to january 1, 2023, a qualified farmer who has not received an ae number may provide the retailer with a fully completed “streamlined sales tax certificate. The kentucky department of agriculture forms. The application for the agriculture exemption number, form 51a800,. Download or email ky 51a126 & more fillable forms, register and subscribe now! The application deadline for. The application for the agriculture exemption number, form 51a800,. Ad uslegalforms.com has been visited by 100k+ users in the past month Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. Web what is the application process? Web to qualify for a farmstead exemption the following must be met. Download or email ky 51a126 & more fillable forms, register and subscribe now! The application for the agriculture exemption number, form 51a800,. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Complete, edit. Web up to $40 cash back related to kentucky farm exemption form kentucky farm exemption 51a158 (921)commonweal th of kentucky department of revenueimportan. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Unmined coal & other natural resources; The agriculture exemption number is valid for three years. _____ in _____ county is exempt from the plumbing code under krs 318.015(3) and that the following statements are true and. Easily fill out pdf blank, edit, and sign them. You must issue a farm. Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. The application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Download or email ky 51a126 & more fillable forms, register and subscribe now! Web what is the application process? • complete the online application for agriculture exemption number, form 51a800. Complete, edit or print tax forms instantly. Listeria monocytogenes can grow in a cold environment and lead to high. Ad uslegalforms.com has been visited by 100k+ users in the past month Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. The application for the agriculture exemption number, form 51a800,. The application form 51a800 is currently available. • submit applications via email to. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022.Kentucky Sales Tax Farm Exemption Form Fill Online, Printable

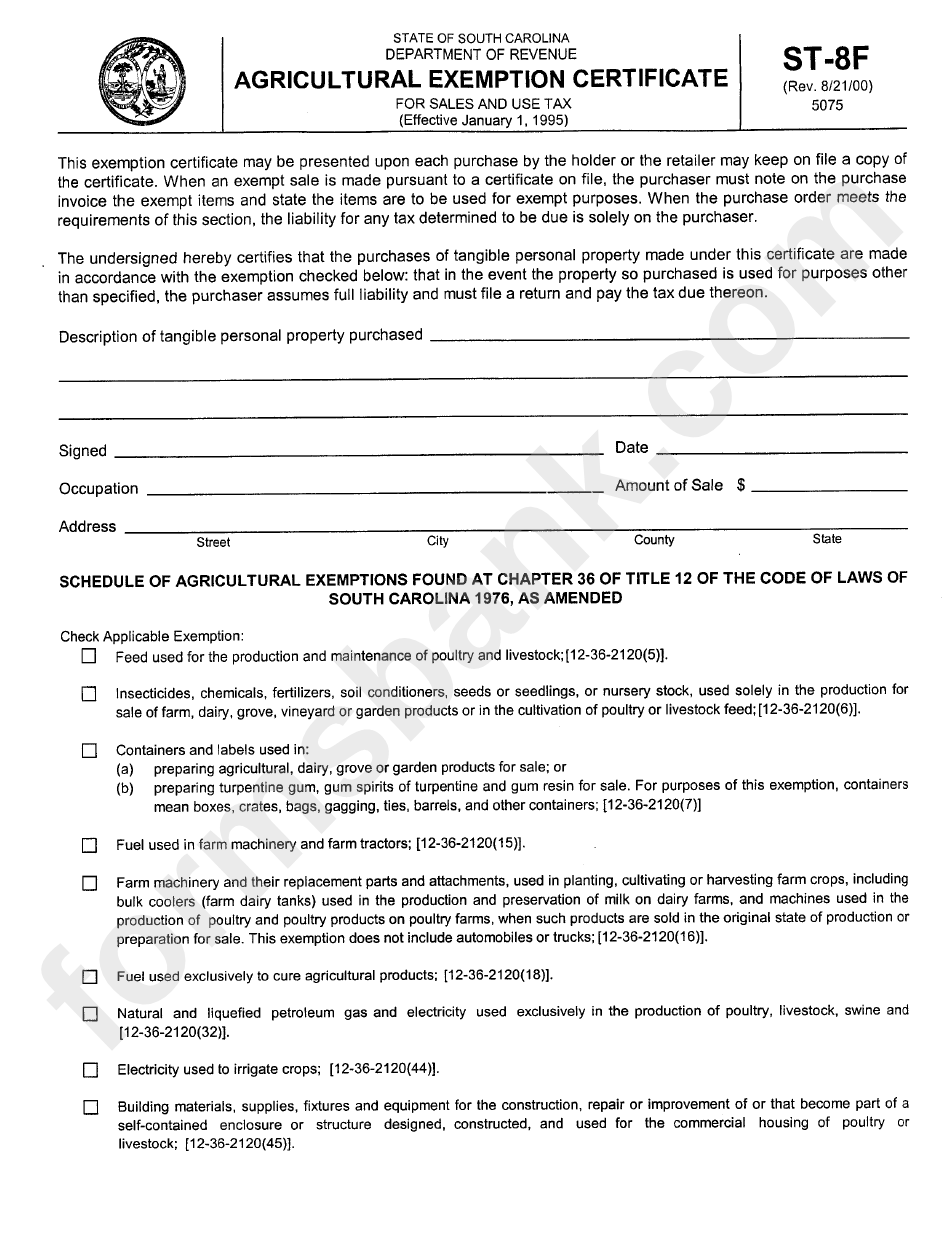

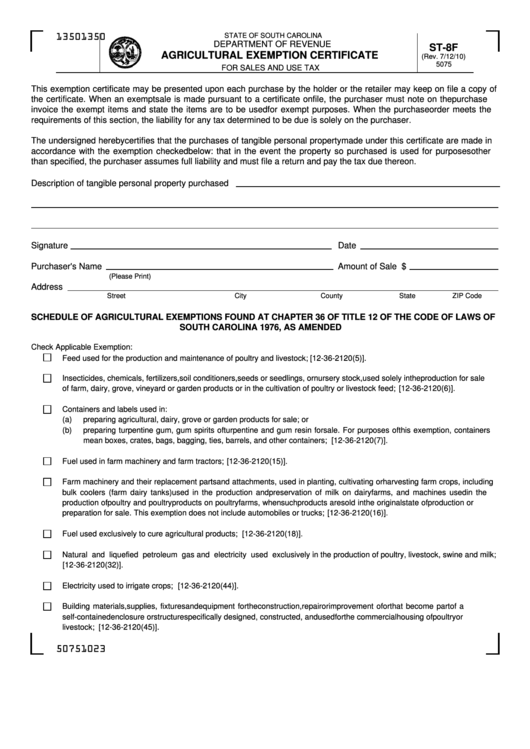

Form St8f Agricultural Exemption Certificate printable pdf download

Form St 8f Agricultural Exemption Certificate Printable Pdf Download

Kansas Legal Forms carfare.me 20192020

Blank Nv Sales And Use Tax Form / Kentucky Sales Tax Farm Exemption

Tax Exempt Form For Agriculture

Form St 8f Agricultural Exemption Certificate Printable Pdf Download

Kentucky farm tax exempt Fill out & sign online DocHub

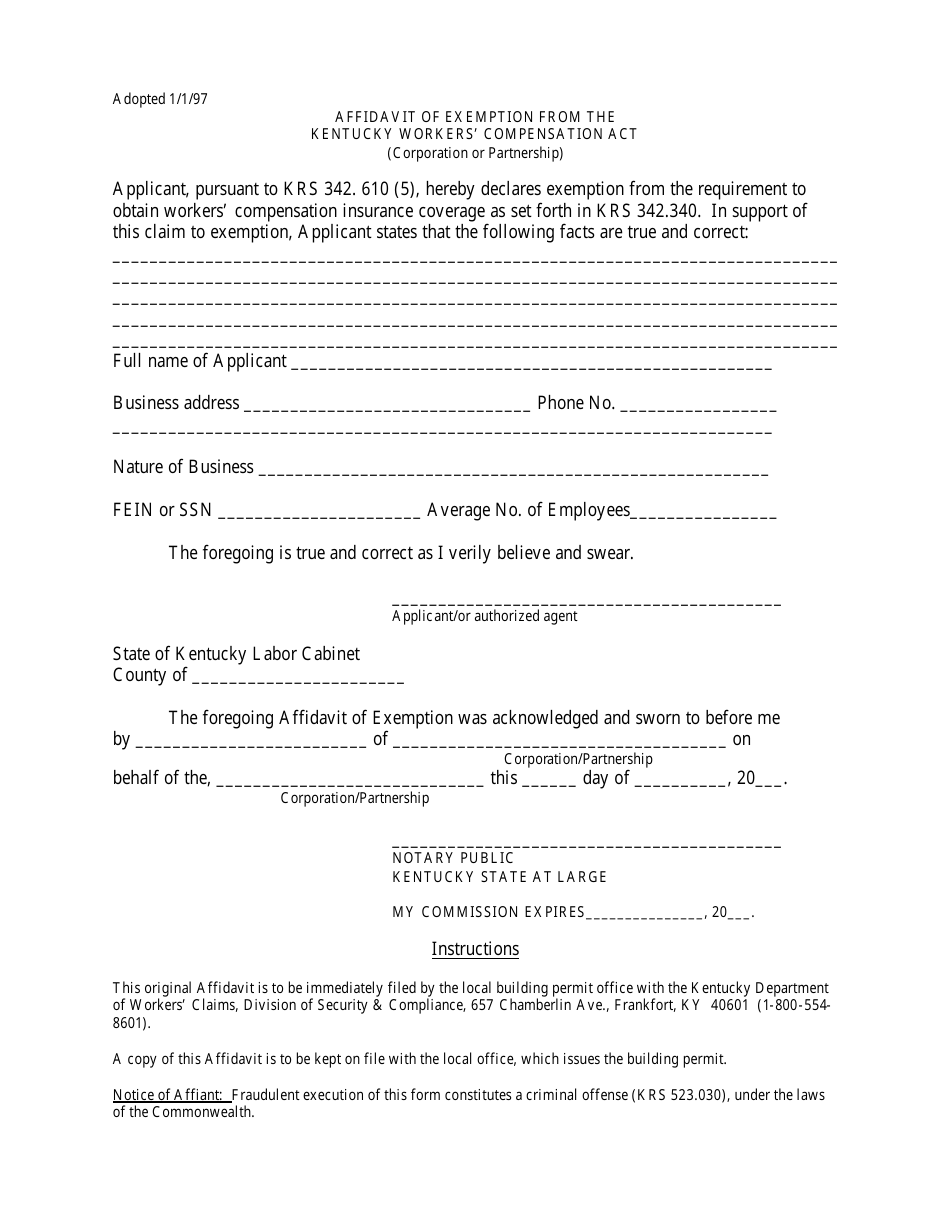

Kentucky Affidavit of Exemption From the Kentucky Workers' Compensation

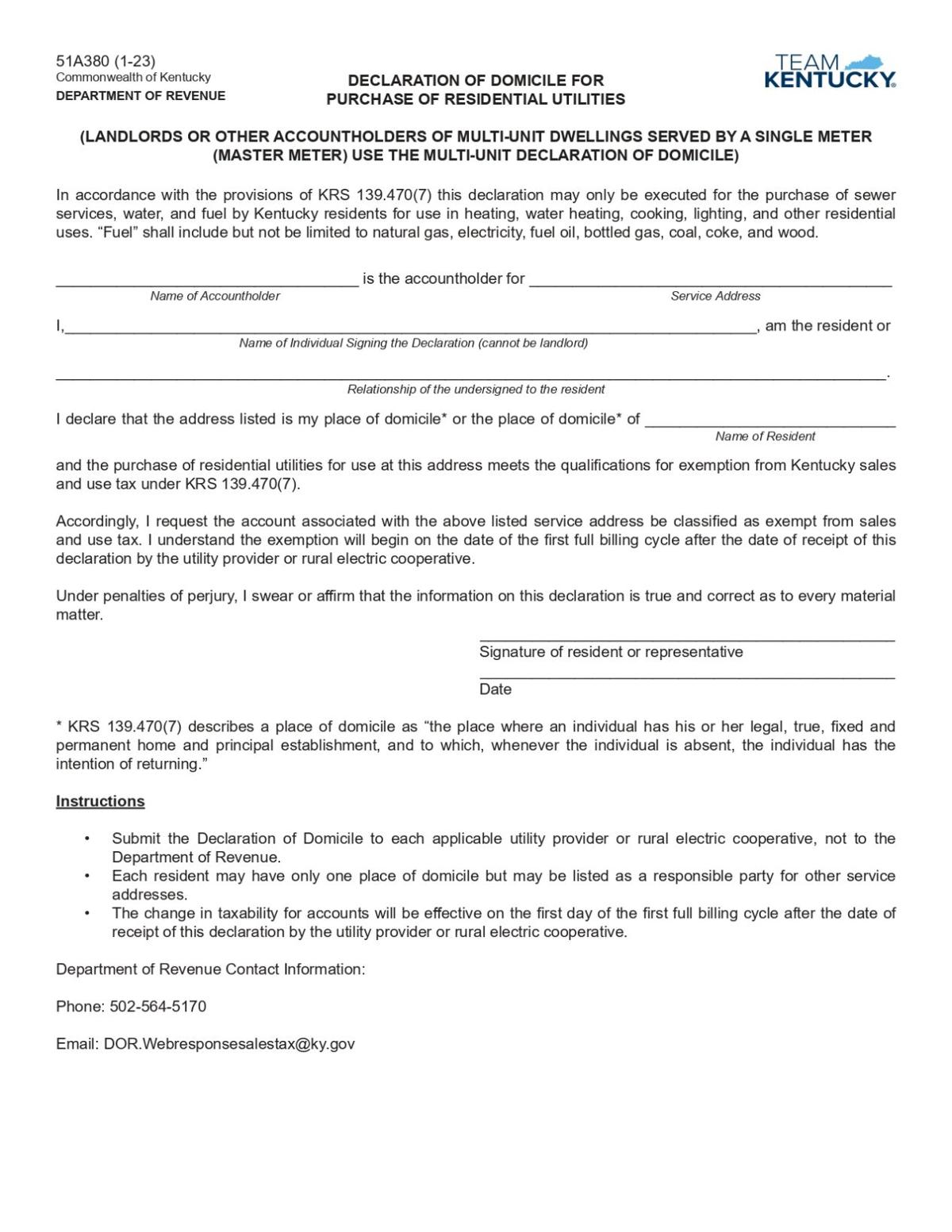

Utility companies ask Kentucky customers to fill out exemption form to

Related Post: