Form 2290 Amendment

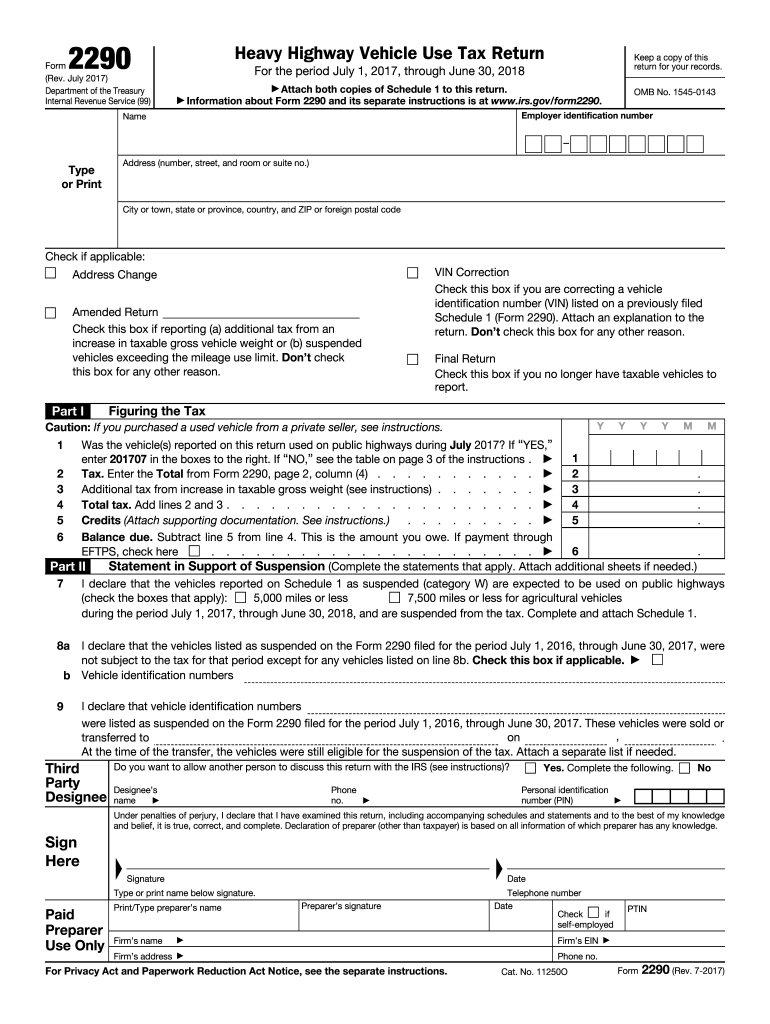

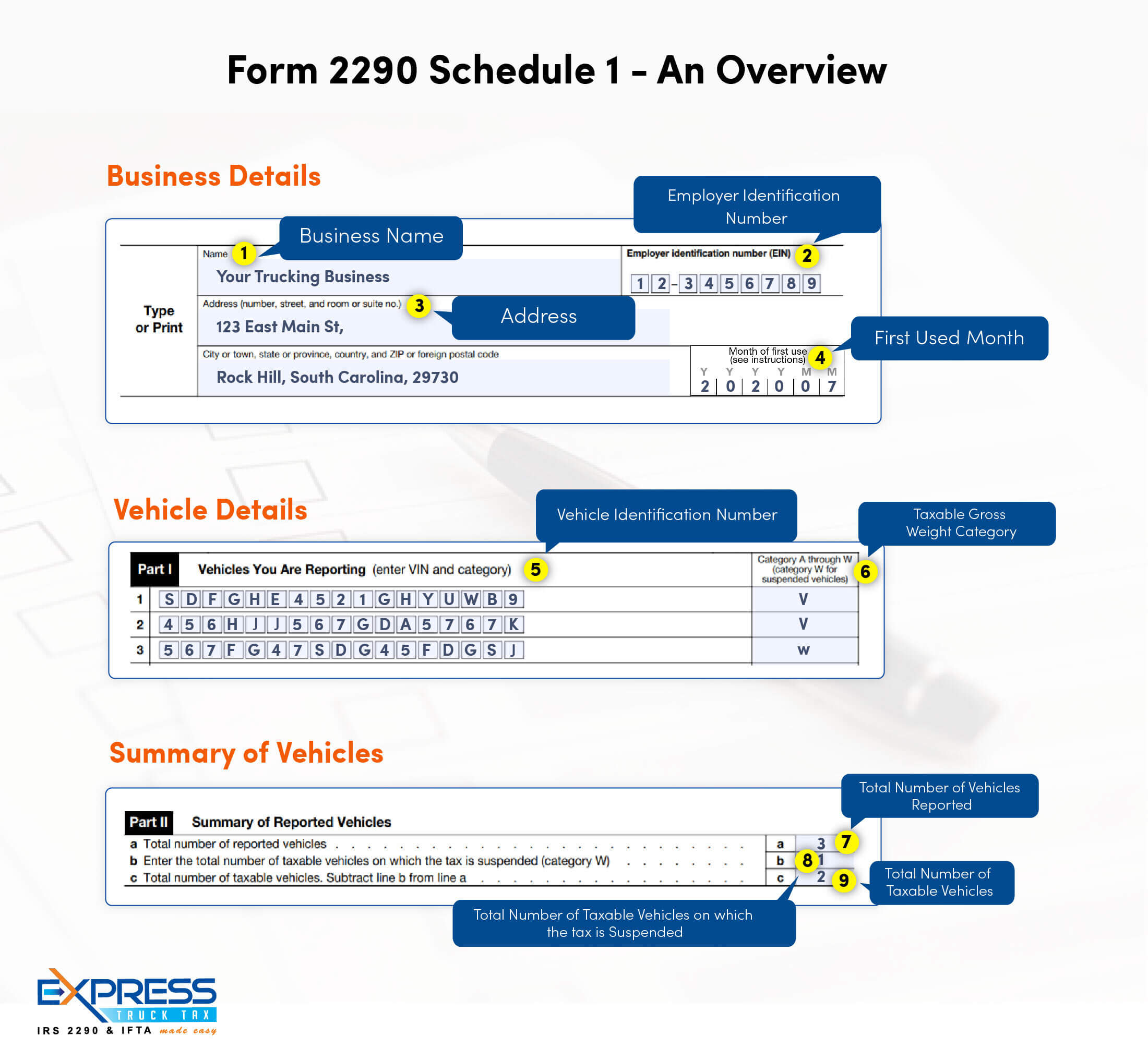

Form 2290 Amendment - Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period. File your 2290 tax online in minutes. Easy, fast, secure & free to try. File your 2290 online & get schedule 1 in minutes. Heavy highway vehicle use tax return. Generally the 2290 taxes are reported from july and. You can easily report form 2290 amendments. Web form 2290 returns can be amended only for the following reasons. Web a form 2290 amendment should be filed when the information for the filed vehicle changes. Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Easy, fast, secure & free to try. Web the irs will stop mailing package 2290 to you. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period. Form 2290 is used to figure and pay the tax. The current period begins july 1, 2023, and ends. How can i amend irs form 2290? We're here to help you. Do your truck tax online & have it efiled to the irs! In any of the following scenarios, you have the option to do amendment for your previously accepted form 2290 returns: Increase in taxable gross weight. You can easily report form 2290 amendments. Web the amendment should be reported with the following month of the first month of increase in taxable gross weight of your vehicle. July 2023) department of the treasury internal revenue service. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles. File your 2290 tax online in minutes. Web you can amend your irs tax form 2290 online at yourtrucktax.com. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period. Web the irs will stop mailing package 2290. How can i amend irs form 2290? Changes can be made to the following sections of form 2290: Web irs form 2290 amendments online. Three events that require form 2290 amendments: Web form 2290 amendment is used for amending certain vehicle information. Changes can be made to the following sections of form 2290: Web you can amend your irs tax form 2290 online at yourtrucktax.com. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. A return is considered an amended return if you. Web requirements of form 2290 amendments there are three types of. Web instantly complete your form 2290 amendment online! Three events that require form 2290 amendments: Changes can be made to the following sections of form 2290: Correcting a vehicle identification number. There are three types of form 2290. For the period july 1, 2023, through june 30, 2024. Web what is form 2290? Web instantly complete your form 2290 amendment online! Ad online 2290 tax filing in minutes. Heavy highway vehicle use tax return. Web entities and individuals alike must file 2290 amendment in a variety of scenarios, where they communicate to the irs about any changes to the vehicle or misreported. The current period begins july 1, 2023, and ends. Ad online 2290 tax filing in minutes. Web form 2290 amendment is used for amending certain vehicle information. For the period july 1,. Web form 2290 amendment is used for amending certain vehicle information. How can i amend irs form 2290? Heavy highway vehicle use tax return. Easy, fast, secure & free to try. Ad online 2290 tax filing in minutes. Web form 2290 amendment is used for amending certain vehicle information. You can easily report form 2290 amendments. Do your truck tax online & have it efiled to the irs! Heavy highway vehicle use tax return. File your 2290 online & get schedule 1 in minutes. Increase in taxable gross weight. Web you can amend your irs tax form 2290 online at yourtrucktax.com. Correcting a vehicle identification number. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period. Web the irs will stop mailing package 2290 to you. Web instantly complete your form 2290 amendment online! Details such as the increase in the gross taxable weight of the vehicle and the vehicle’s. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. When there is an increase in the taxable vehicle’s gross. We're here to help you. If you own a heavy vehicle weighing 55,000 pounds or more and has crossed 5,000 miles in a a given tax year, you are required to file form. Three events that require form 2290 amendments: There are three types of form 2290. For the period july 1, 2023, through june 30, 2024. Generally the 2290 taxes are reported from july and.Irs amendments 2290

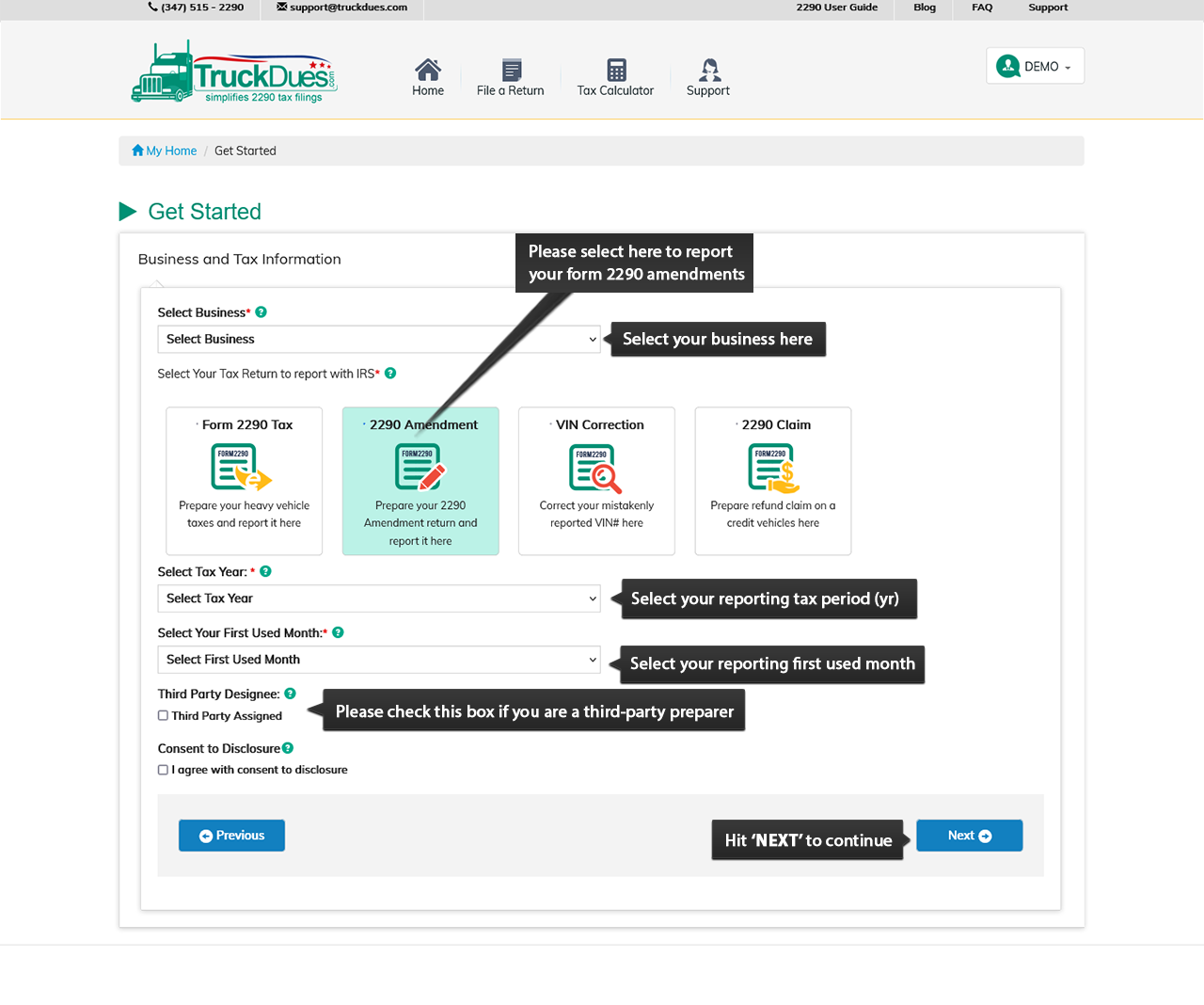

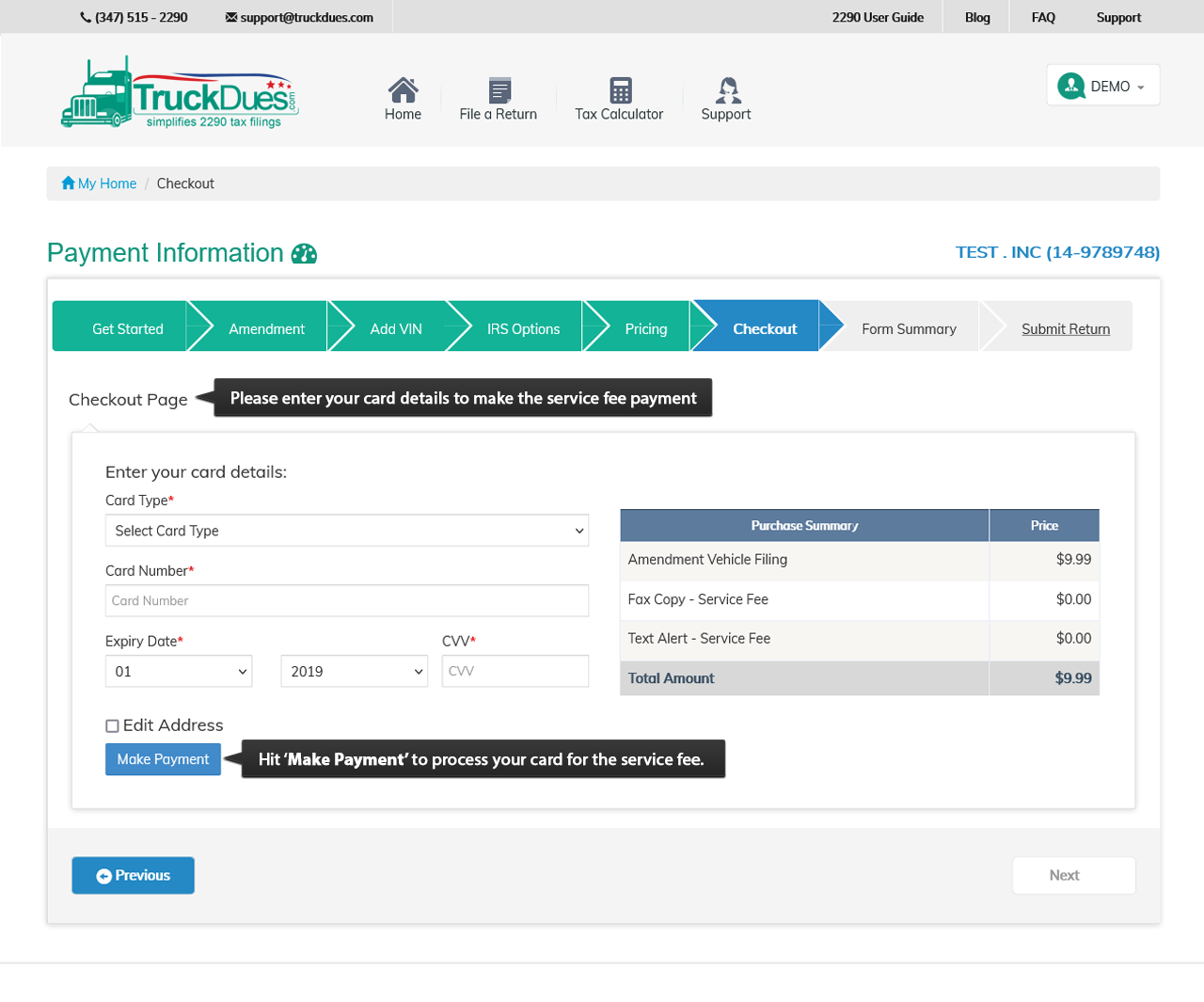

Form 2290 Amendment e File Step by Step Instructions

Irs Form 2290 Status Universal Network

Form 2290 Amendment e File Step by Step Instructions

2290 Form Fill Out and Sign Printable PDF Template signNow

Irs Form 2290 Status Universal Network

Form 2290 Amendment e File Step by Step Instructions

Everything You Need To Know About IRS Form 2290 Amendment Ez2290

Understanding Form 2290 StepbyStep Instructions for 20232024

Form 2290 Amendments What Are They And How Do You File?

Related Post: