Mn Withholding Form

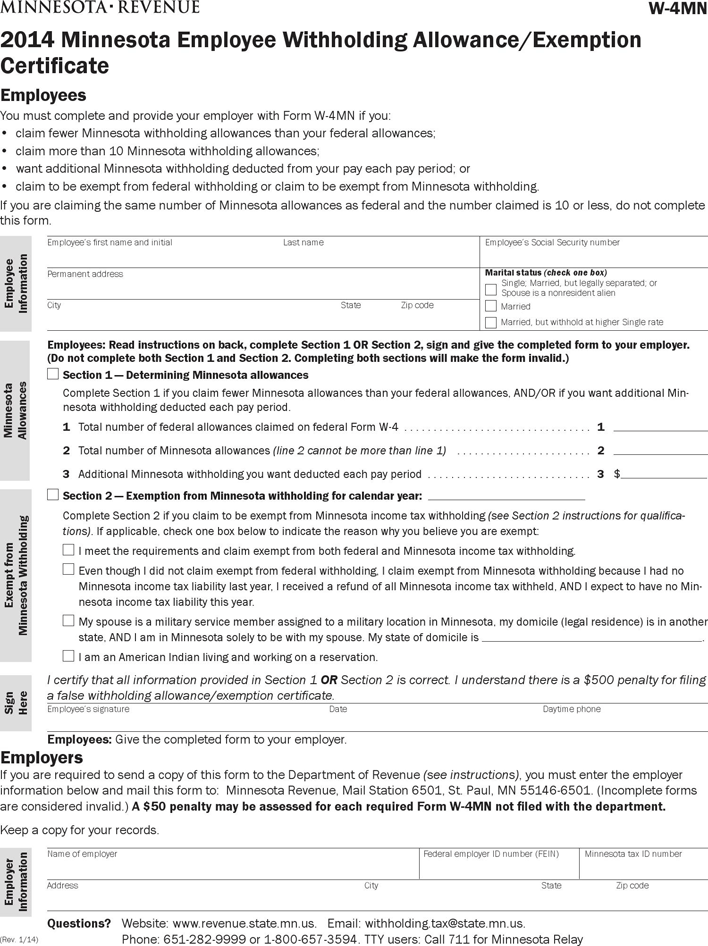

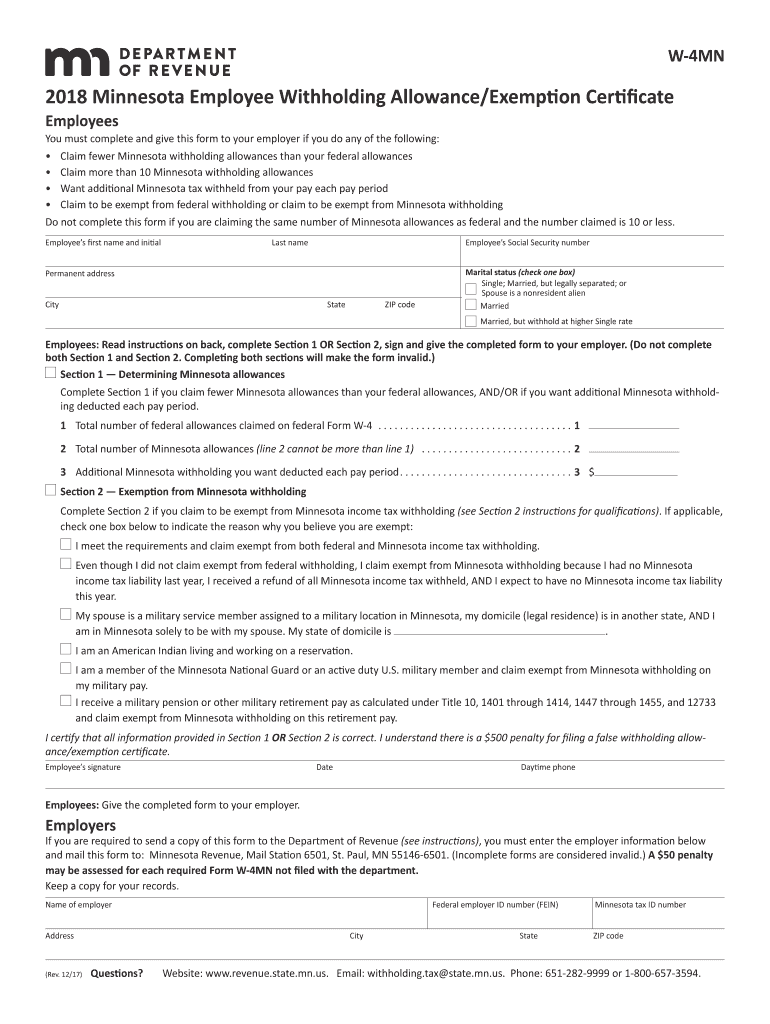

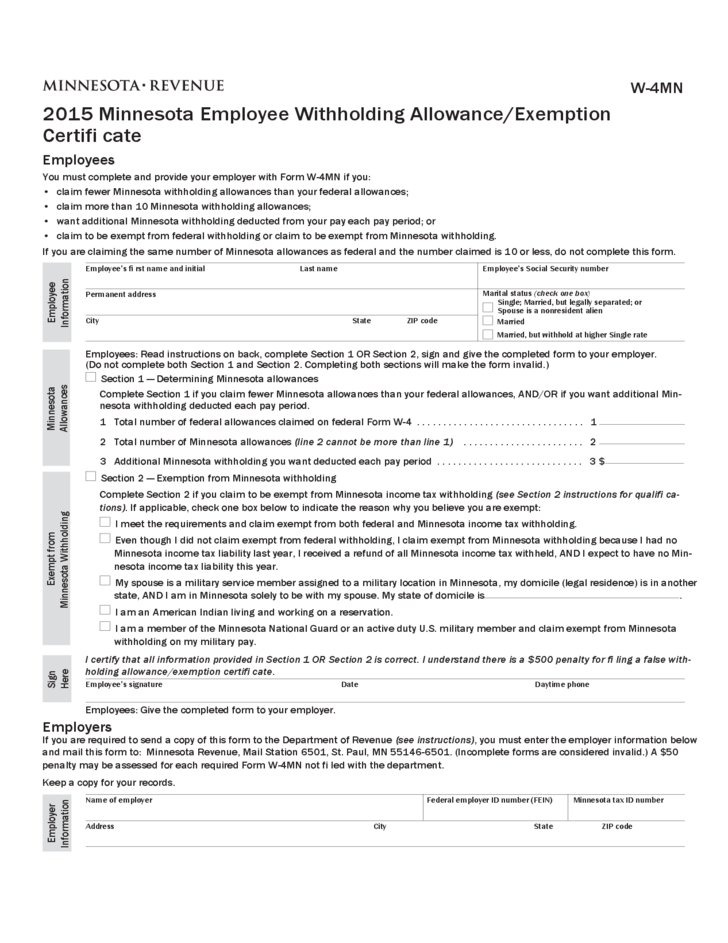

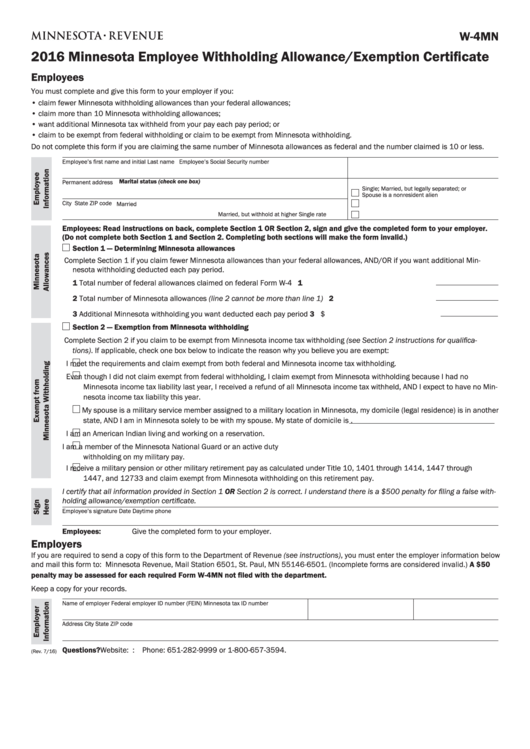

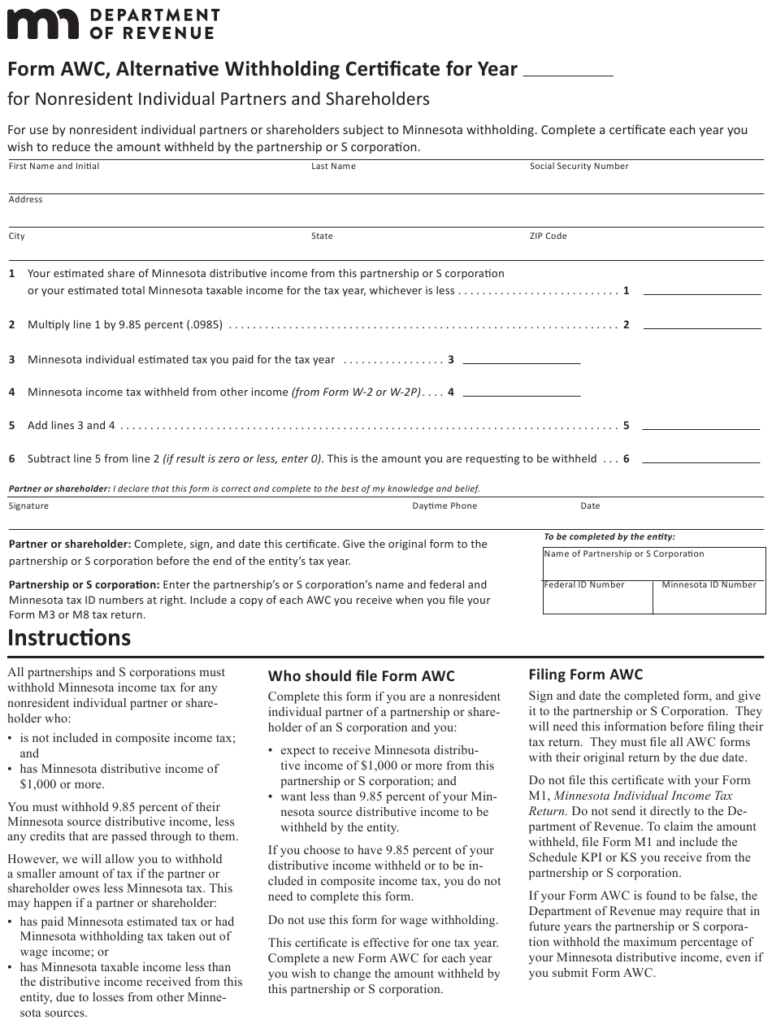

Mn Withholding Form - Get ready for tax season deadlines by completing any required tax forms today. Consider completing a new form. The mn state tax withholding default will be 6.25%. Web minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. You are not required to verify the number of withholding allowances claimed by each employee. Web starting january 1, 2024: Web file a withholding tax return. Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. Web prior tax withholding elections on file with tra will remain in effect unless a new election is made. The mn state tax withholding default will be 6.25%. Minnesota revenue, mail station 6501, st. Complete this form to calculate the amount of minnesota income tax to be withheld from. You are not required to verify the number of withholding allowances claimed by each employee. You may be subject to a $500 penalty if you provide a false. Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. The mn state tax withholding default will be 6.25%. You must file withholding tax returns with the minnesota department of revenue when required. Minnesota revenue, mail station 6501, st. Consider completing a new form. Complete this form to calculate the amount of minnesota income tax to be withheld from. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. Web starting january 1, 2024: Minnesota revenue, mail station 6501, st. Consider completing a new form. You must file withholding tax returns with the minnesota department of revenue when required. Web file a withholding tax return. You withheld minnesota income tax from. Consider completing a new form. Reduce complexity by outsourcing the preparation and filing of sales tax returns to sovos. Consider completing a new form. Web file a withholding tax return. You withheld minnesota income tax from. You may be subject to a $500 penalty if you provide a false. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. Get ready for tax season deadlines by completing any required tax forms today. Web minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. You must file withholding tax returns with the minnesota department of revenue when required. Consider completing a new form. Consider completing a new form. Reduce complexity by outsourcing the preparation and filing of sales tax returns to sovos. You are not required to verify the number of withholding allowances claimed by each employee. Claim fewer minnesota withholding allowances than your federal allowances; Cookies are required to use this site. Web file a withholding tax return. You must file withholding tax returns with the minnesota department of revenue when required. You are not required to verify the number of withholding allowances claimed by each employee. Cookies are required to use this site. Web your browser appears to have cookies disabled. You may be subject to a $500 penalty if you provide a false. Claim fewer minnesota withholding allowances than your federal allowances; You withheld minnesota income tax from. Cookies are required to use this site. Reduce complexity by outsourcing the preparation and filing of sales tax returns to sovos. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. Reduce complexity by outsourcing the preparation and filing of sales tax returns to sovos. Web file a withholding tax return. Claim fewer minnesota withholding allowances than your federal allowances; You are not required to verify the number of withholding allowances claimed by each employee. Web prior tax withholding elections on file with tra will remain in effect unless a new. Reduce complexity by outsourcing the preparation and filing of sales tax returns to sovos. You then send this money as deposits to the minnesota department. Get ready for tax season deadlines by completing any required tax forms today. Claim fewer minnesota withholding allowances than your federal allowances; You are not required to verify the number of withholding allowances claimed by each employee. Your employees must complete form w. You must file withholding tax returns with the minnesota department of revenue when required. Web starting january 1, 2024: Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. The mn state tax withholding default will be 6.25%. You may be subject to a $500 penalty if you provide a false. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. Web your browser appears to have cookies disabled. You withheld minnesota income tax from. Consider completing a new form. Minnesota revenue, mail station 6501, st. Web file a withholding tax return. Web minnesota withholding tax is state income tax you as an employer take out of your employees’ wages. Consider completing a new form. Complete this form to calculate the amount of minnesota income tax to be withheld from.Fillable Form W4 Employee'S Withholding Allowances Minnesota State

State Tax Withholding Forms Template Free Download Speedy Template

Form W 4 MN, Minnesota Employee Withholding Allowance Fill Out and

Notice Of Withholding Form Minnesota

MN M1W 20202022 Fill out Tax Template Online US Legal Forms

Fillable W4mn, Minnesota Employee Withholding Form printable pdf download

Minnesota State Withholding Federal Withholding Tables 2021

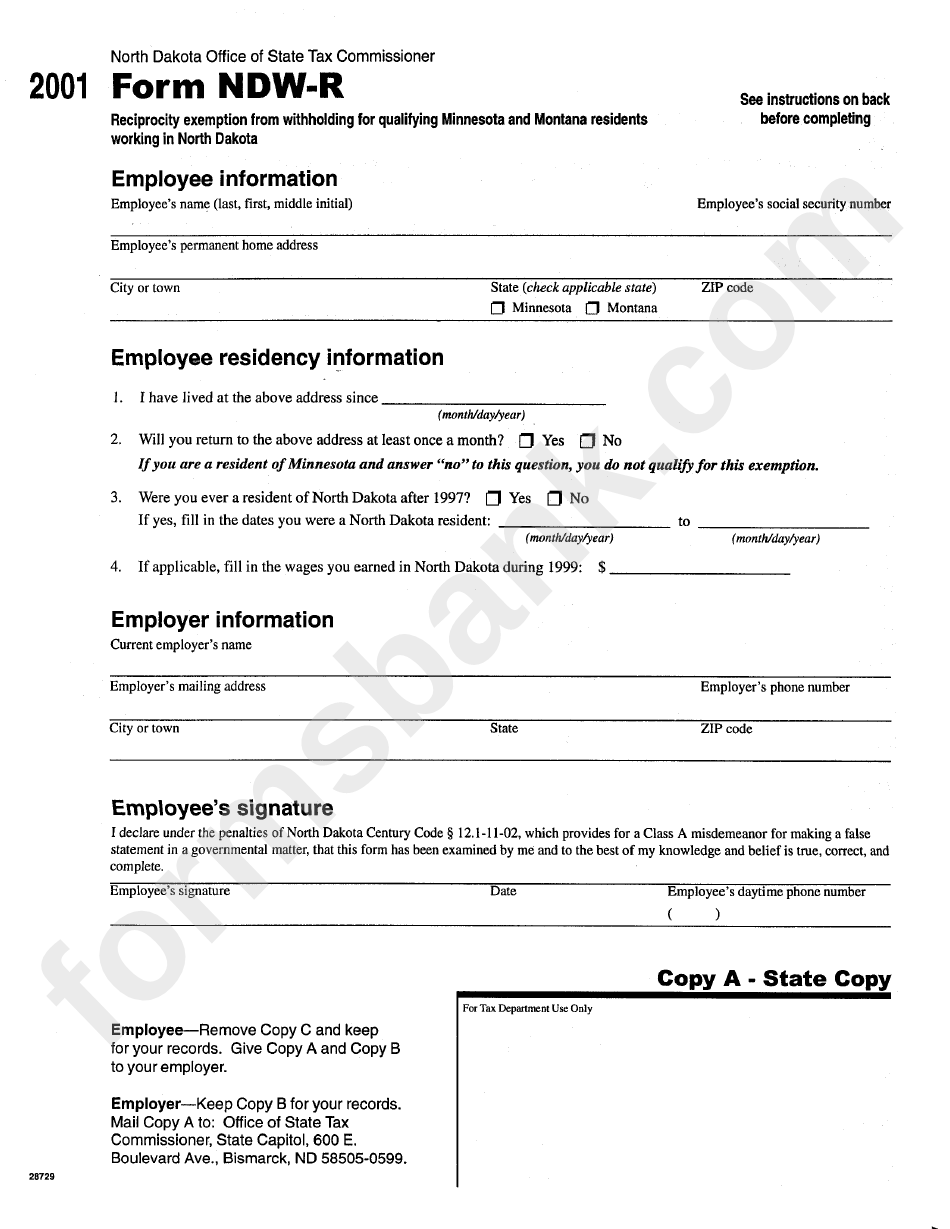

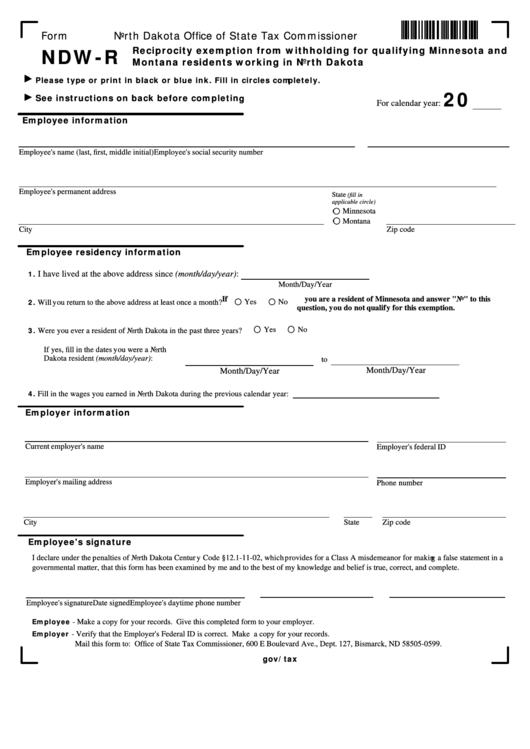

Fillable Form NdwR Reciprocity Exemption From Withholding For

Minnesota State Withholding Form 2021 Federal Withholding Tables 2021

W4 Form 2023 Printable Employee's Withholding Certificate

Related Post: