Idaho Form 65 Instructions

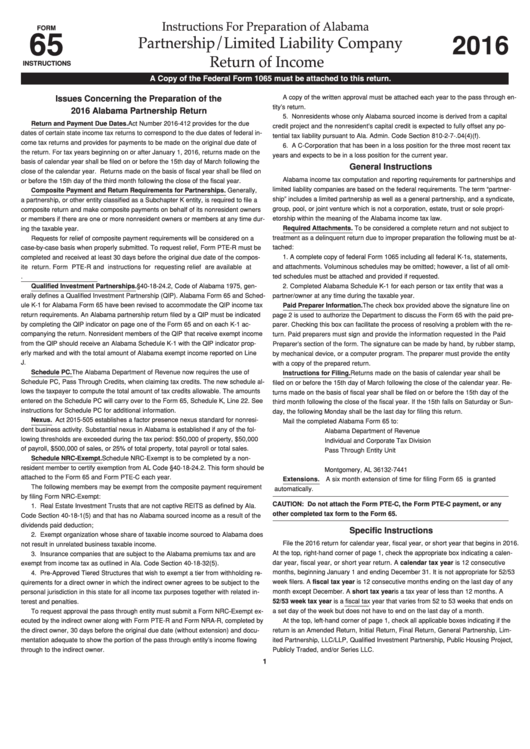

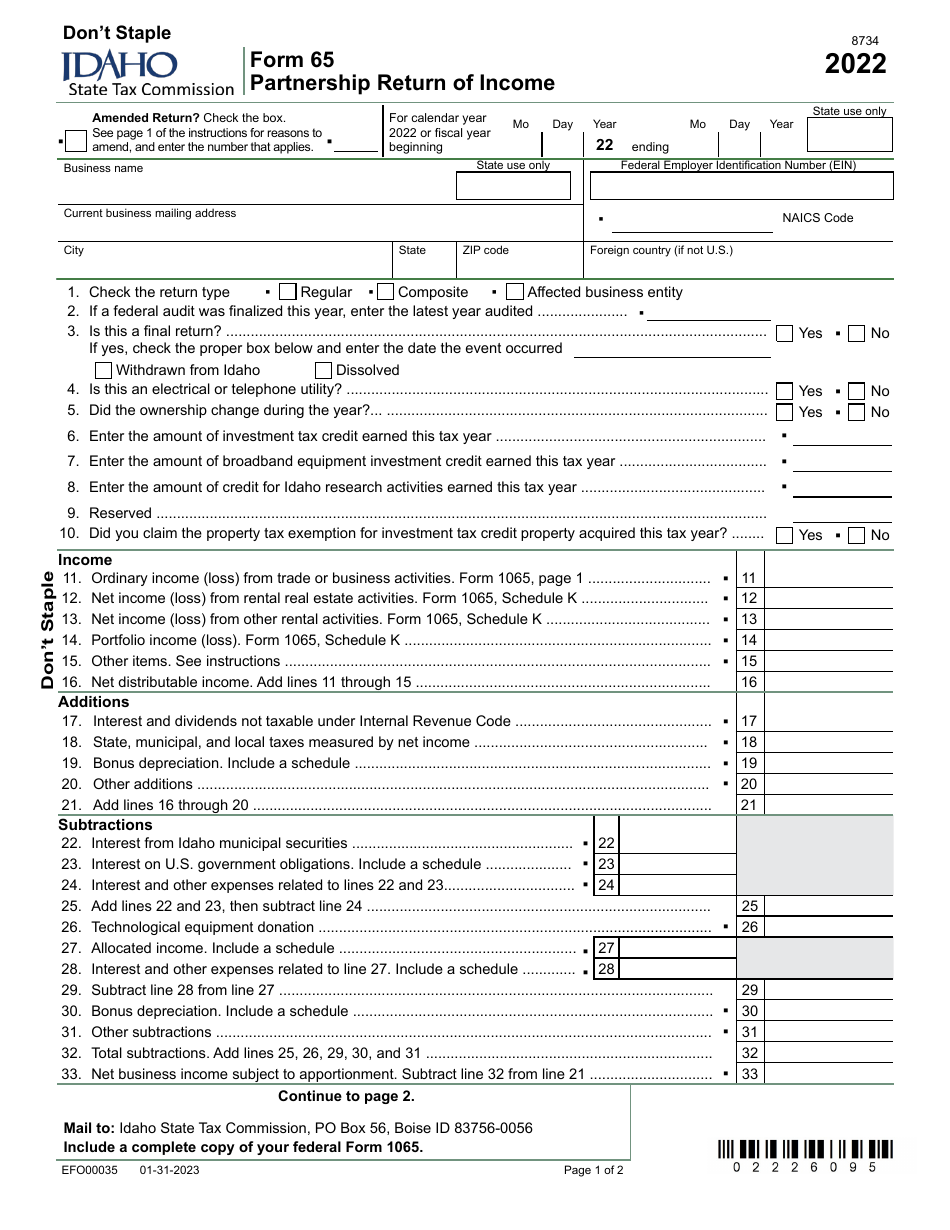

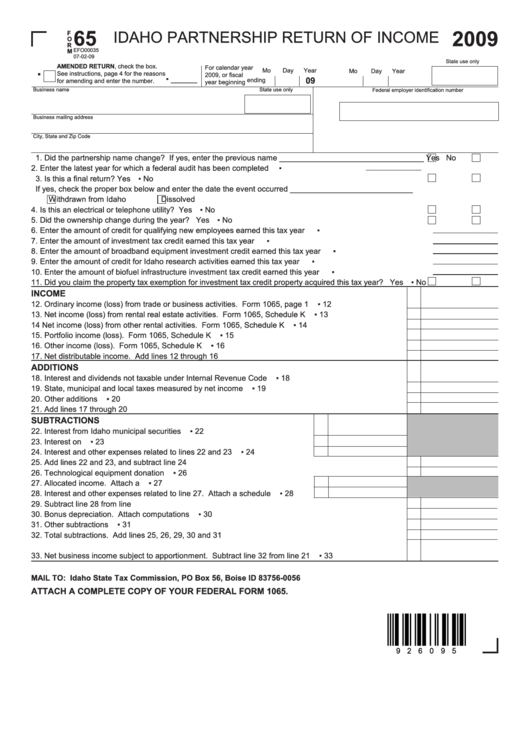

Idaho Form 65 Instructions - Part b idaho adjustments line 1 state, municipal and local taxes measured by net income. Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. The partnership must provide each partner with. Partnership return of income and instructions 2022. Web individual income tax guides. Web form 65 partnership return of income. Web idaho form 65 instructions. Idaho business income tax credits and credit recapture. You’re doing business in idaho. Instead, it relates to idaho law and identifies idaho adjustments, allocation and apportionment amounts,. The partnership must provide each partner with. Special fuels tax refund gasoline tax refund include form 75. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. Web a partnership must file idaho form 65 if either of the following are true: Web who qualifies to use this form you. Web idaho form 65 instructions. Id form 42 instructions 2022. Web individual income tax guides. Web idaho income see instructions, page 16. Include on this line any amounts included. Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. Idaho business income tax credits and credit recapture. Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. The partnership must provide each partner with. Web form 65 partnership return. Form 65, partnership return of income 2018 author: Idaho form 65 due date. Partnership return of income and. Include on this line any amounts included. The partnership must provide each partner. Web who qualifies to use this form you can use this form if all of these are true: Web enter the amount from line 33. Partnership return of income and instructions 2022. Web idaho form 65 instructions. Include on this line any amounts included. The partnership must provide each partner with an idaho. 12 13 net income (loss) from other rental activities. Web heading file the 2010 return for calendar year 2010 or a fiscal year that begins in 2010. Partnership return of income and. Partnership return of income and instructions 2022. See page 1 of the instructions for reasons to amend, and enter the number that applies. Web idaho income see instructions, page 16. Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. Partnership return of income and. Web form 65 — instructions 2022 (continued) to partnerships when paying the. Partnership return of income and. Web who qualifies to use this form you can use this form if all of these are true: Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. Web idaho form 65 instructions. Part b idaho adjustments line 1 state, municipal and local taxes measured. The partnership must provide each partner. Net income (loss) from rental real estate activities. Web enter the amount from line 33. Idaho business income tax credits and credit recapture. You’re doing business in idaho. Part b idaho adjustments line 1 state, municipal and local taxes measured by net income. Instead, it relates to idaho law and identifies idaho adjustments, allocation and apportionment amounts,. Idaho form 65 due date. Web we last updated the idaho income tax instruction booklet in february 2023, so this is the latest version of income tax instructions, fully updated for. Idaho business income tax credits and credit recapture. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. Instead, it relates to idaho law and identifies idaho adjustments, allocation and apportionment amounts,. 12 13 net income (loss) from other rental activities. • you and your spouse were idaho residents for all of 2020 • you and your spouse aren’t required. The partnership must provide each partner with an idaho. Part b idaho adjustments line 1 state, municipal and local taxes measured by net income. The partnership must provide each partner with. Web form 65 partnership return of income. Web form 65 — instructions 2022 (continued) to partnerships when paying the tax for partners. Partnership return of income and instructions 2022. Web form 1065, page 1. See page 1 of the instructions for reasons to amend, and enter the number that applies. Web individual income tax guides. For calendar year 2022 or fiscal year beginning state use only mo day year mo. Partnership return of income and. Special fuels tax refund gasoline tax refund include form 75. Include a schedule identifying each deduction. Idaho form 65 due date. Id form 42 instructions 2022.Form 65 Instructions Partnership/limited Liability Company Return

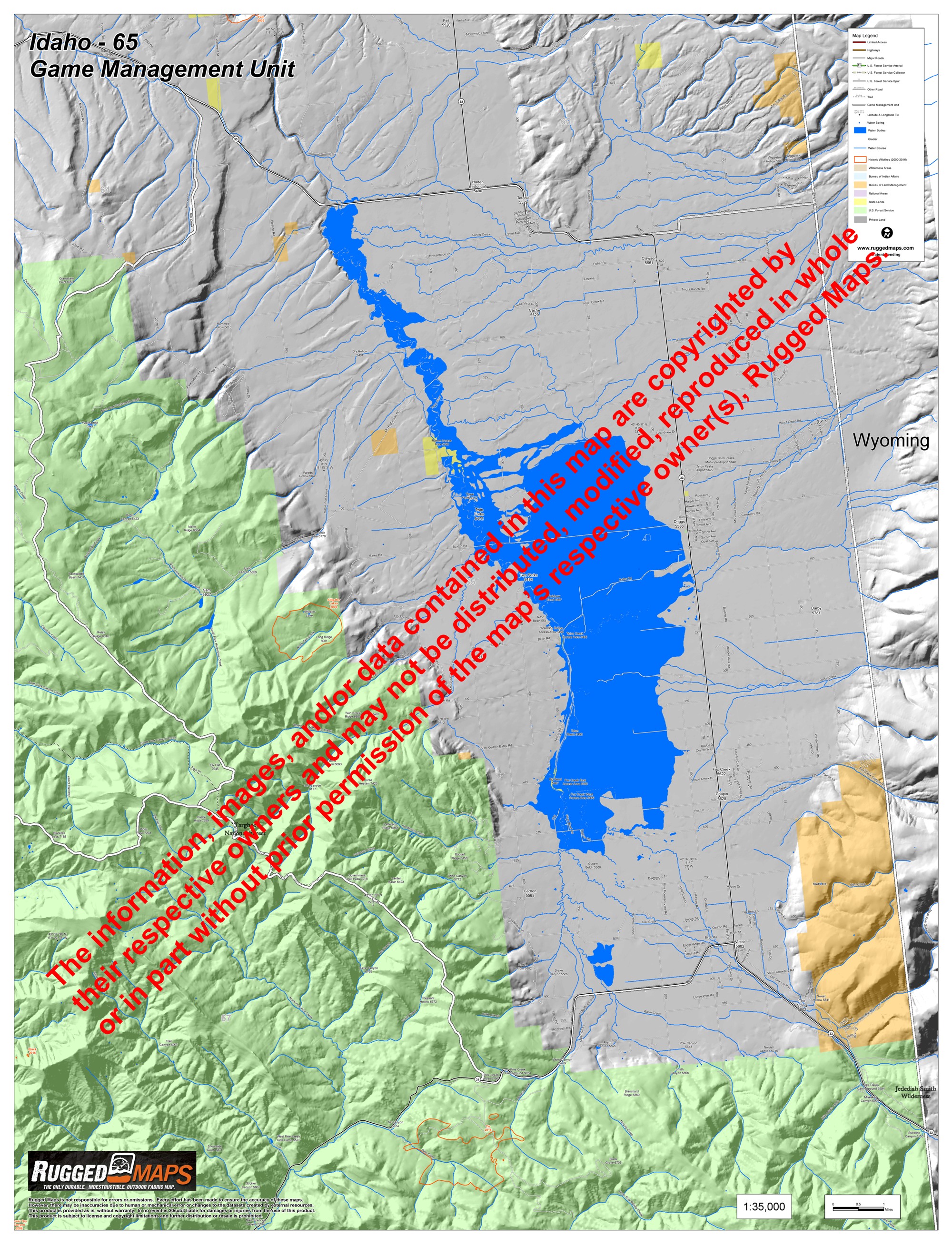

Idaho GMU 65

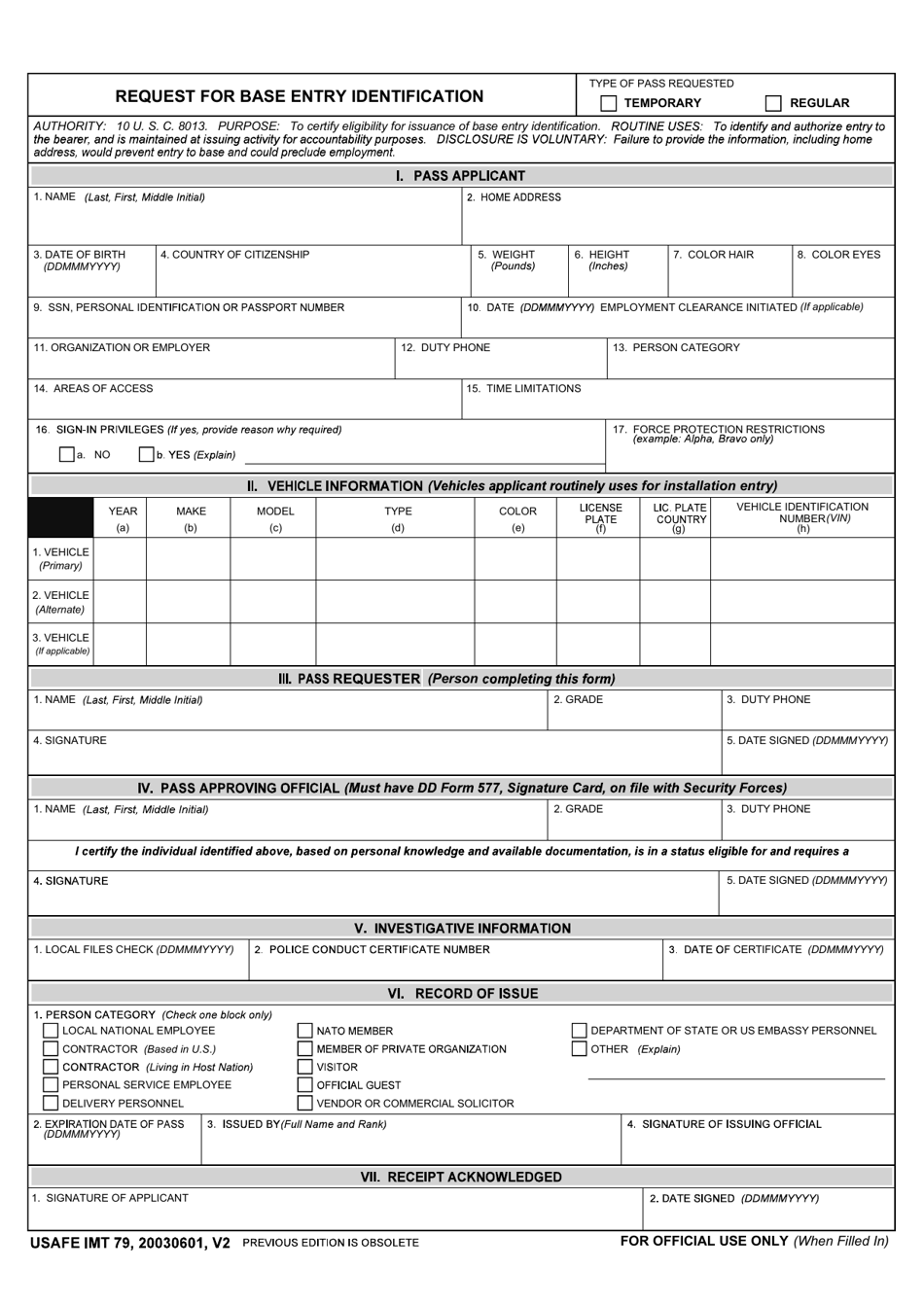

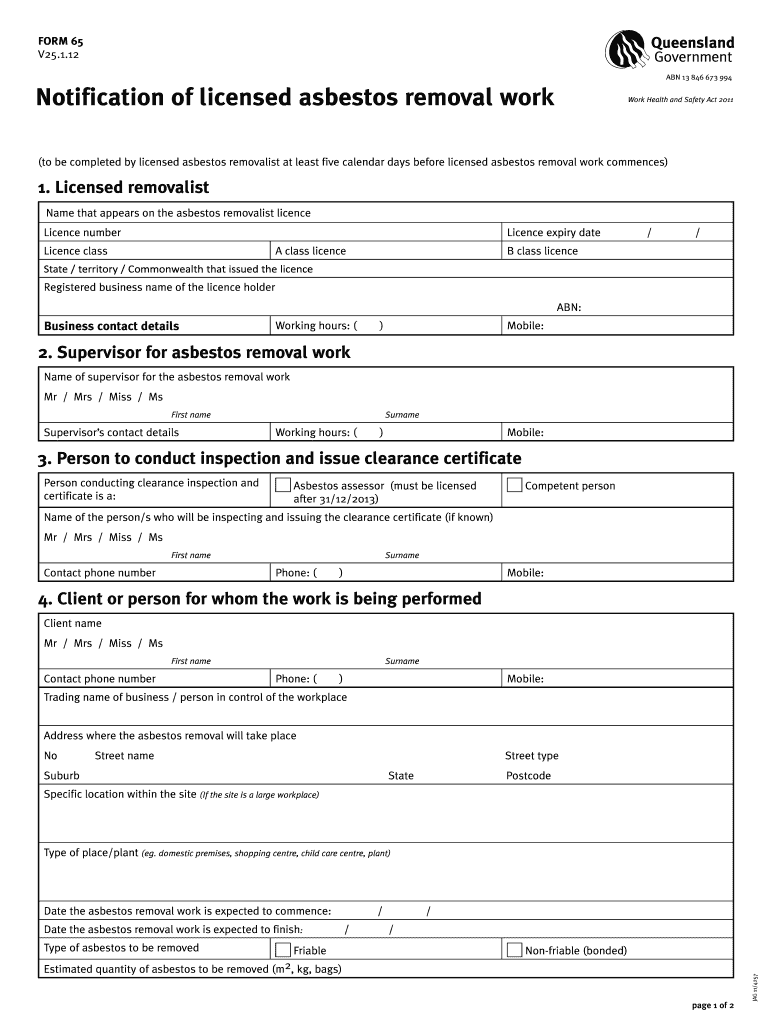

USAFE Form 65 Fill Out, Sign Online and Download Fillable PDF

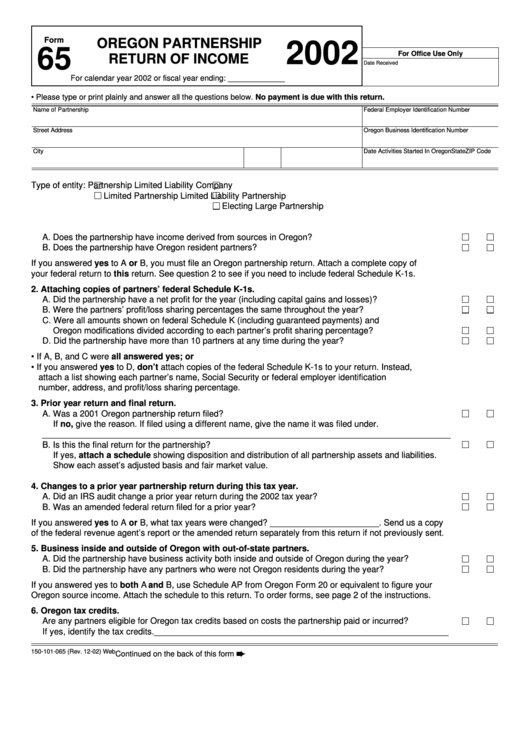

Form 65 Oregon Partnership Return Of 2002 printable pdf download

Form 65 (EFO00035) Download Fillable PDF or Fill Online Partnership

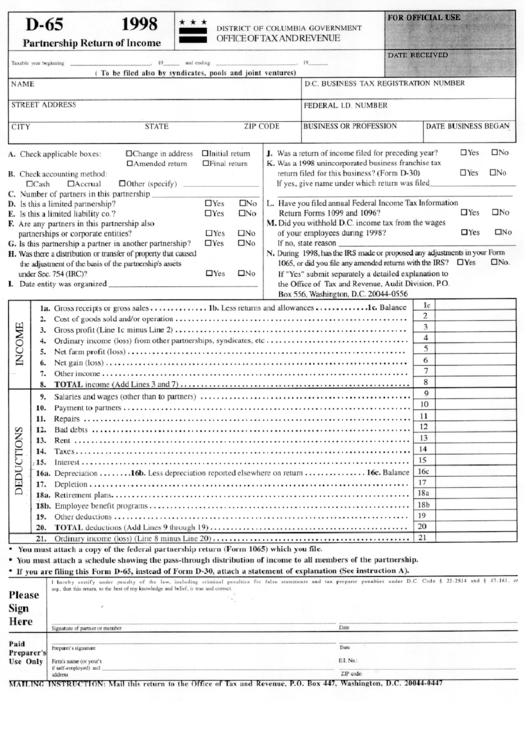

Fillable Form D65 Partnership Return Of District Of

Form 65 Idaho Partnership Return Of Form Id K1 Partner'S

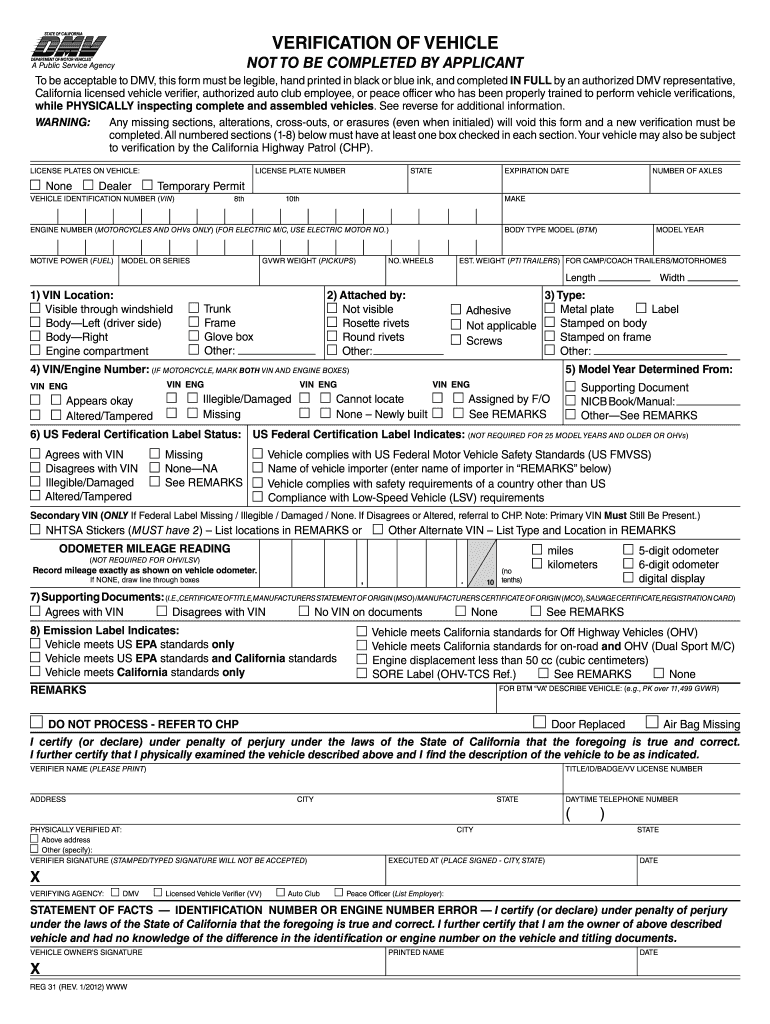

Reg 31 Fill out & sign online DocHub

Form 65 Fill Out and Sign Printable PDF Template signNow

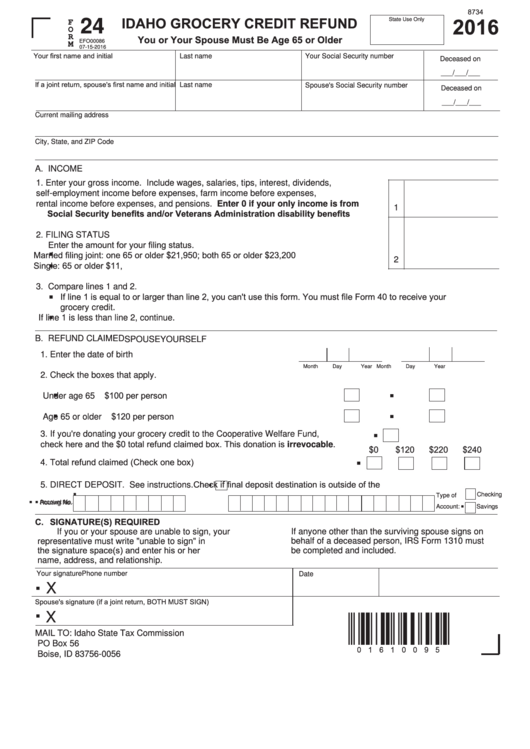

Fillable Form 24 Idaho Grocery Credit Refund 2016 printable pdf

Related Post: