Irs Form 966 Instructions

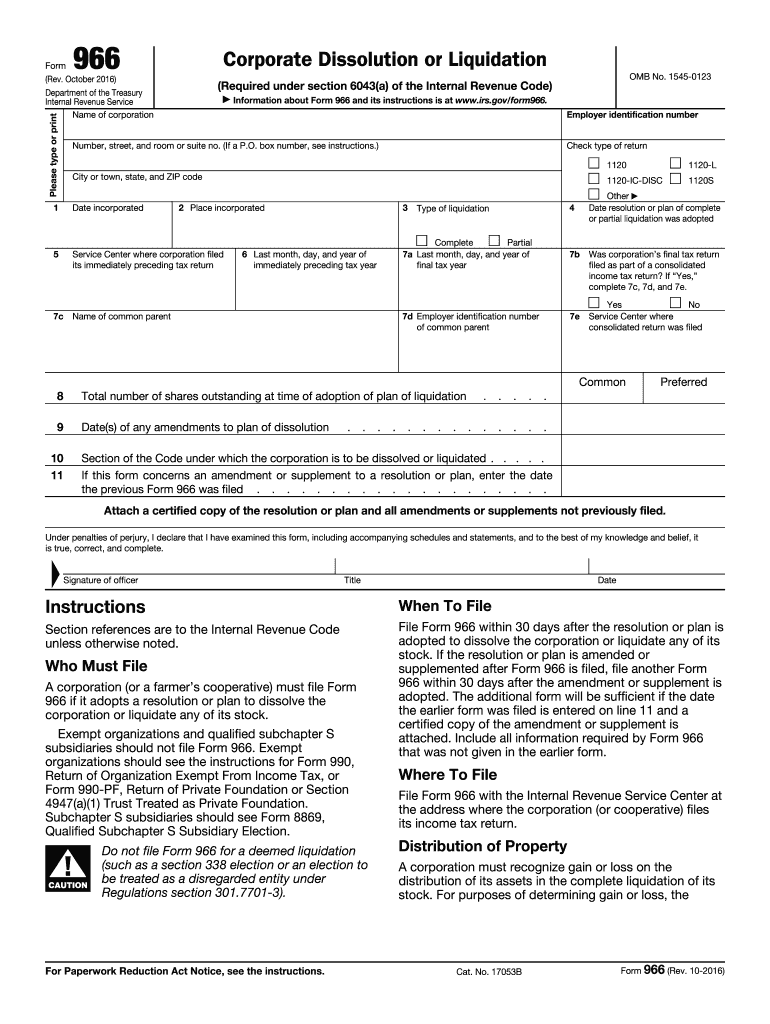

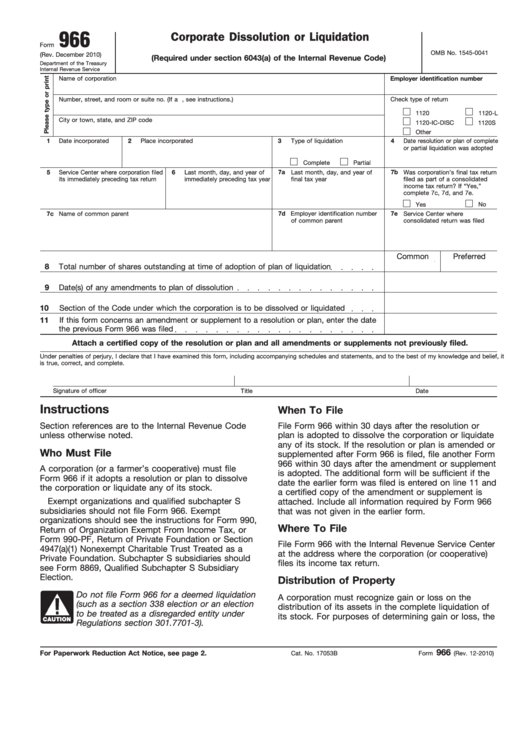

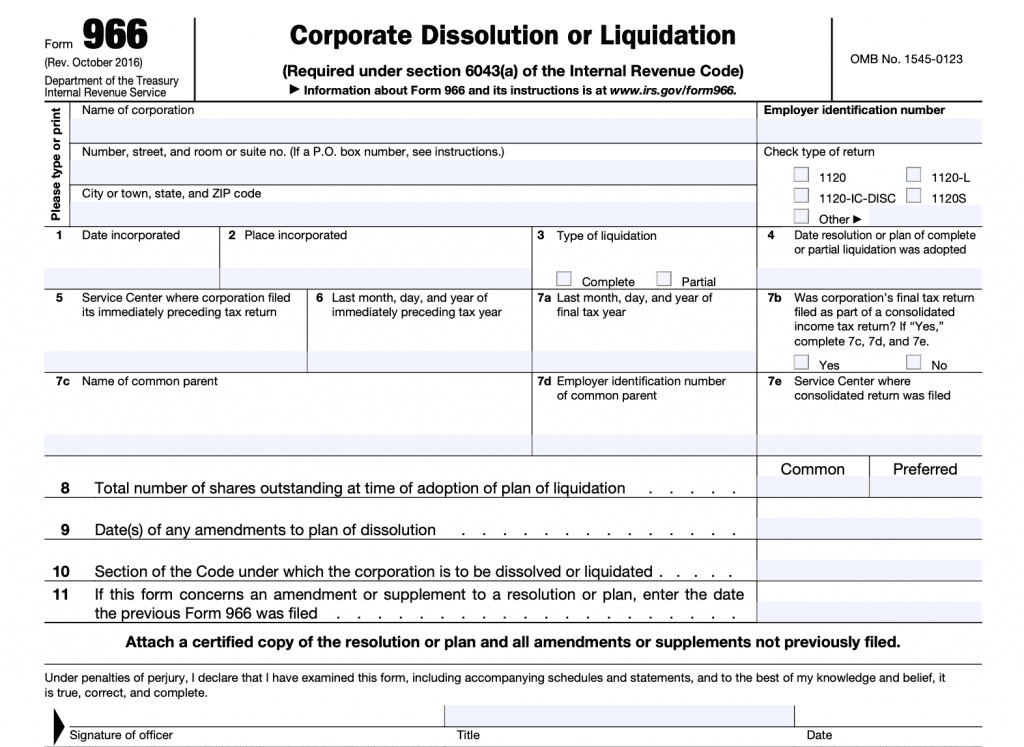

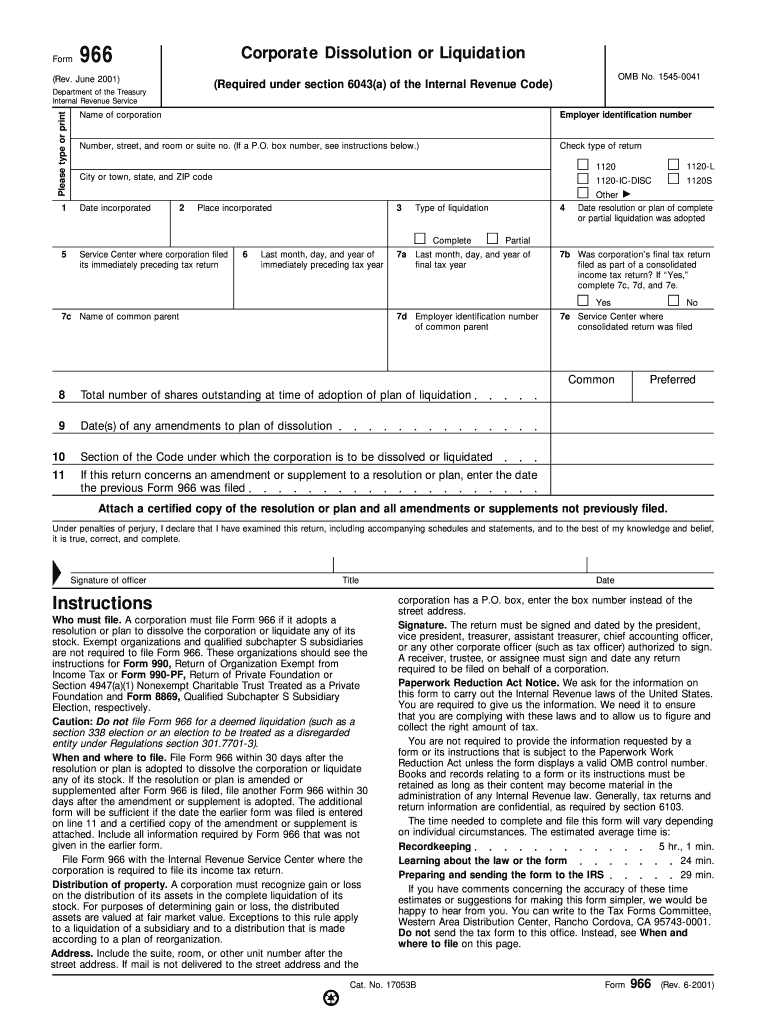

Irs Form 966 Instructions - Web a corporation must file form 966 if its adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. A corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or. For an eftps deposit to be. Form 966 is filed with the. October 2016) department of the treasury internal revenue service. Web the application uses this information to determine the due date for filing form 966. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the. Estimate how much you could potentially save in just a matter of minutes. Web form 8966 or its instructions, such as legislation enacted after they were published, go to irs.gov/form8966. About eftps is also available in pub. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Estimate how much you could potentially save in just a matter of minutes. Complete, edit or print tax forms instantly. Web the application uses this information to determine the due date for filing form 966. Corporate dissolution or liquidation (required under section. The steps to complete this. Solved • by intuit • 7 • updated 1 year ago. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Web completing irs form 966 domestic corporations and foreign corporations that pay taxes in the united states are required to complete irs form 966. Exempt organizations are not required to file. Web information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation. Web form 8966 or its instructions, such as legislation enacted after they were published, go to irs.gov/form8966. Web. Ad access irs tax forms. Web the application uses this information to determine the due date for filing form 966. About eftps is also available in pub. General instructions reminders identifying numbers for paper. General instructions reminders identifying numbers for paper. Once form 966 is filed and you dissolve the corporation, you can then file. Web form 8966 or its instructions, such as legislation enacted after they were published, go to irs.gov/form8966. Web instructions for form 945 annual return of withheld federal income tax department of the treasury. Web form 966 omb no. Web we last updated the corporate dissolution or. You can download or print. About eftps is also available in pub. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. December 2010) (required under section 6043(a) of the internal revenue code) department of the treasury internal revenue service. General instructions reminders identifying. General instructions reminders identifying numbers for paper. Web form 8966 or its instructions, such as legislation enacted after they were published, go to irs.gov/form8966. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. The steps to complete this. Web completing irs form 966 domestic corporations and foreign corporations that pay taxes in the united states are. Solved • by intuit • 7 • updated 1 year ago. October 2016) department of the treasury internal revenue service. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Web form 966 omb no. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully. General instructions reminders identifying numbers for paper. Ad we help get taxpayers relief from owed irs back taxes. A corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or. The steps to complete this. About eftps is also available in pub. A corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or. Web completing irs form 966 domestic corporations and foreign corporations that pay taxes in the united states are required to complete irs form 966. Ad access irs tax forms. In this situation, you are responsible for notifying all. Web. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. In this situation, you are responsible for notifying all. Form 966 is filed with the. Exempt organizations are not required to file form 966. General instructions reminders identifying numbers for paper. You can download or print. Web a corporation must file form 966 if its adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Get ready for tax season deadlines by completing any required tax forms today. Corporate dissolution or liquidation (required under section. Web form 8966 or its instructions, such as legislation enacted after they were published, go to irs.gov/form8966. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Web instructions for form 945 annual return of withheld federal income tax department of the treasury. Solved • by intuit • 7 • updated 1 year ago. Web for instructions and the latest information. Web form 8966 or its instructions, such as legislation enacted after they were published, go to irs.gov/form8966. Ad access irs tax forms. Estimate how much you could potentially save in just a matter of minutes. December 2010) (required under section 6043(a) of the internal revenue code) department of the treasury internal revenue service. Web the instructions for form 966 also indicate that it must be filed if a corporation “adopts a resolution or plan to dissolve the corporation or liquidate any of its stock.” dep’t of treas.,. Instructions for form 8966, fatca report 2022.Form 966 Corporate Dissolution or Liquidation (2010) Free Download

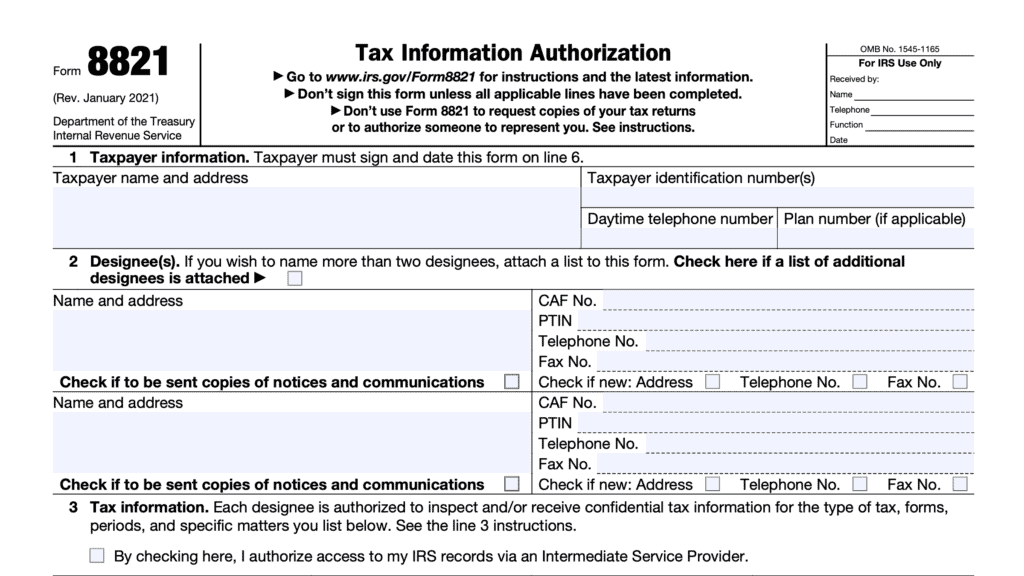

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

Form 966 Fill Out and Sign Printable PDF Template signNow

Fillable Form 966 Corporate Dissolution Or Liquidation printable pdf

U.S. TREAS Form treasirs9662001

IRS Form 966 A Guide to Corporate Dissolution or Liquidation

Form 966 Instructions Fill Out and Sign Printable PDF Template signNow

Related Post: