Irs Form 8910

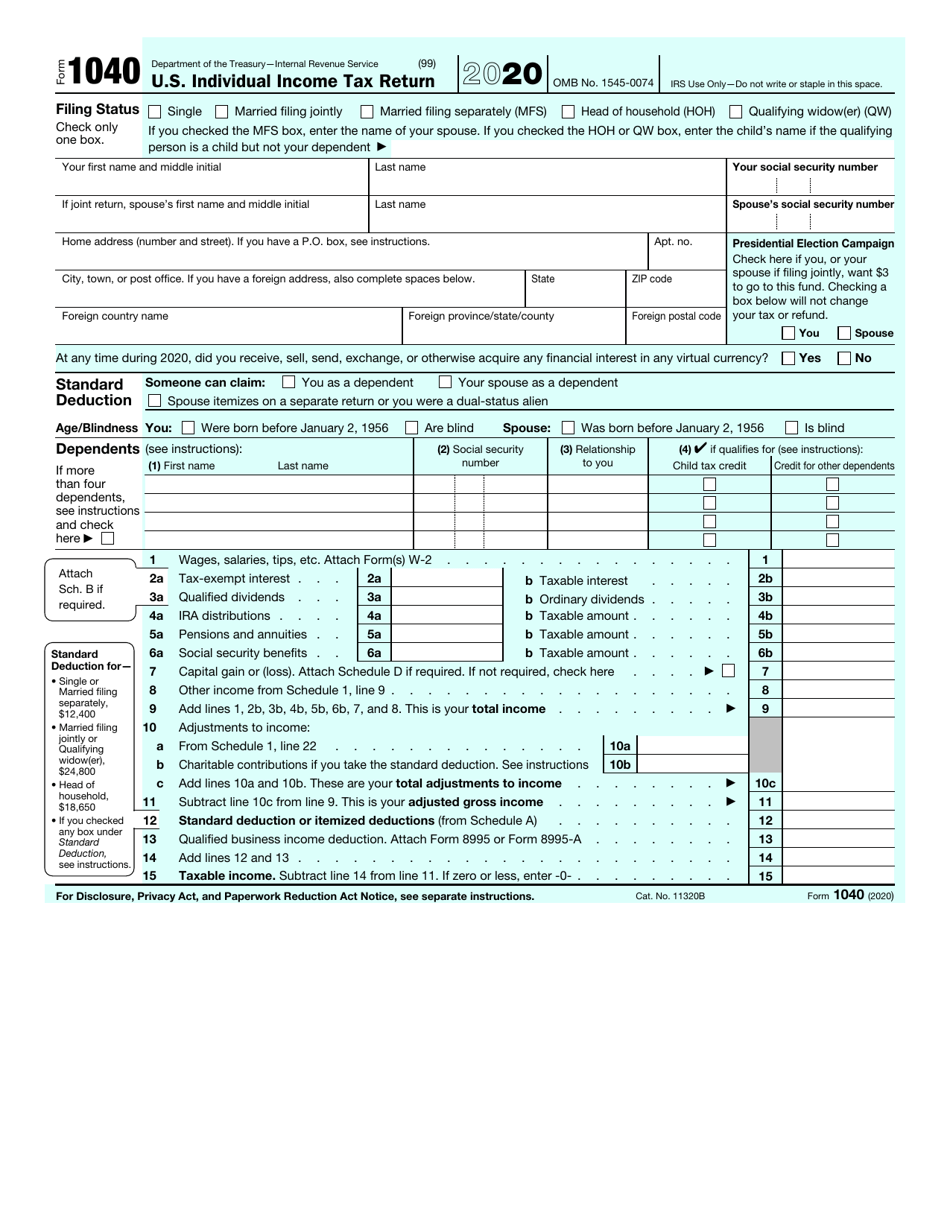

Irs Form 8910 - Access irs forms, instructions and publications in electronic and print media. What's new the alternative motor vehicle credit has been extended. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. The alternative motor vehicle credit expired in 2021. Web use the january 2022 revision of form 8910 for tax years beginning in 2021 or later, until a later revision is issued. Web learn how to claim the irs alternative motor vehicle credit with form 8910. The credit attributable to depreciable property (vehicles. Web if you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable. Web for the latest information about developments related to form 8910 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8910. The credit attributable to depreciable property. Web form 8910 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8910. Maximize your savings with taxacts support for the alternative vehicle credit. Web use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property (refueling. Use form 8910 to figure your credit for alternative motor vehicles. Web per irs instructions for form 8910 alternative motor vehicle credit, page 1: The credit attributable to depreciable property. Web taxpayers file irs form 8910, alternative motor vehicle credit to calculate and claim the credit. Web • use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property (refueling. The credit attributable to depreciable property (vehicles used for. Web • use this form to claim the credit for certain alternative motor vehicles. January 2022) department of the treasury internal revenue service. Web use this form to claim the credit for certain alternative motor vehicles. Click here to check all the information you need for irs offices near you. Web taxpayers file irs form 8910, alternative motor vehicle credit to calculate and claim the credit. The credit attributable to depreciable property (vehicles. Click here to check all the information you need for irs offices near you. Web • use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web if you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable. Click here to check all the information you need for irs offices. Web use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. Attach to your tax return. Web form 8910 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8910. Use form 8910 to figure your credit for alternative motor vehicles you placed in service. We last updated the alternative motor. Estimate how much you could potentially save in just a matter of minutes. What's new the alternative motor vehicle credit has been extended. Maximize your savings with taxacts support for the alternative vehicle credit. Use prior revisions of the form and instructions for earlier tax. The credit attributable to depreciable property (vehicles. Attach to your tax return. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web if you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable.. We last updated the alternative motor. The credit attributable to depreciable property (refueling. Ad learn about the locations, phone numbers of nearby irs offices. The credit attributable to depreciable property. Web if you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable. For tax year 2022, this credit is only available for a. Web use the january 2022 revision of form 8910 for tax years beginning in 2021 or later, until a later revision is issued. The credit attributable to depreciable property (vehicles. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. The credit attributable to depreciable property. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web if you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable. Web use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property (vehicles. We last updated the alternative motor. The alternative motor vehicle credit expired for vehicles purchased. The credit attributable to depreciable property. Web use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. Use prior revisions of the form and instructions for earlier tax. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Estimate how much you could potentially save in just a matter of minutes. Web form 8910 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8910. Web for the latest information about developments related to form 8910 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8910. Web • use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property (vehicles. January 2022) department of the treasury internal revenue service. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. For tax year 2022, this credit is only available for a.IRS Form 1040 Download Fillable PDF or Fill Online U.S. Individual

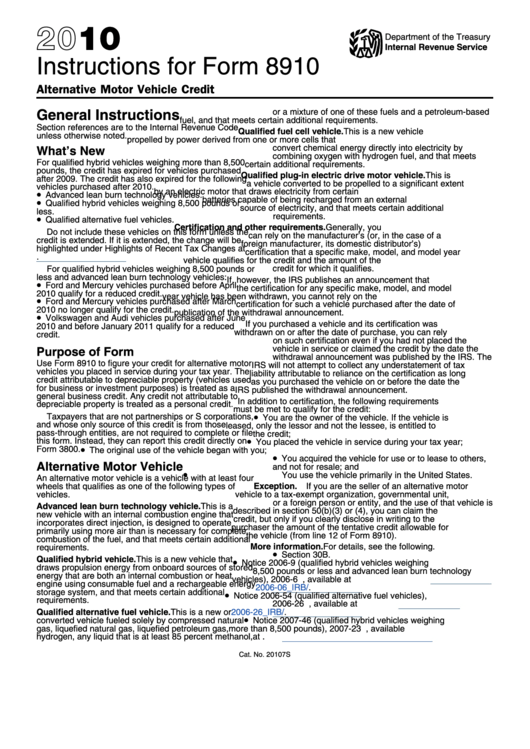

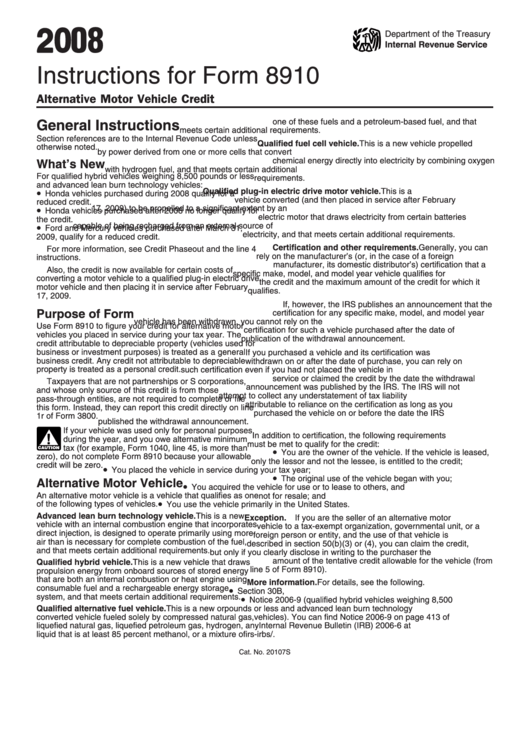

Instructions For Form 8910 Alternative Motor Vehicle Credit 2010

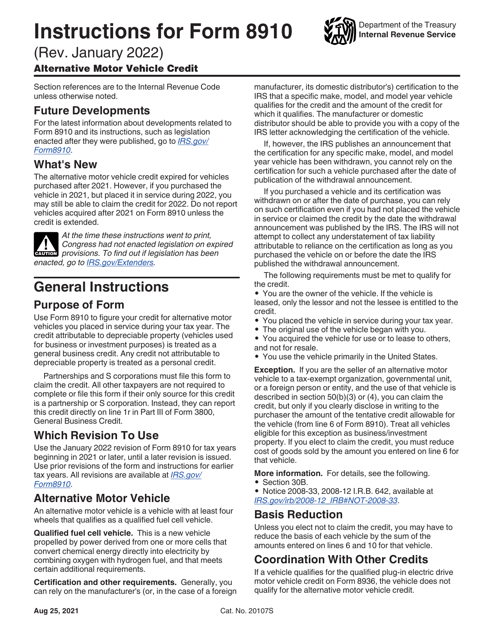

What is Form 8910 alternative motor vehicle credit? Leia aqui What is

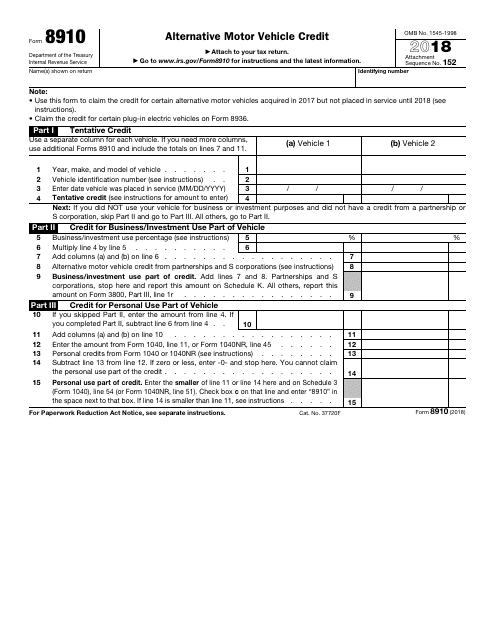

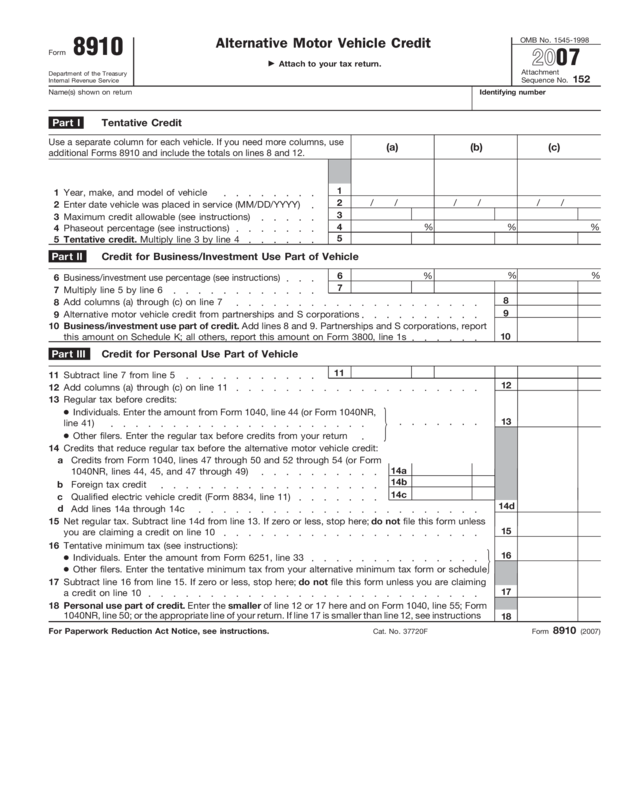

IRS Form 8910 Download Fillable PDF or Fill Online Alternative Motor

Instructions For Form 8910 Alternative Motor Vehicle Credit 2008

2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal

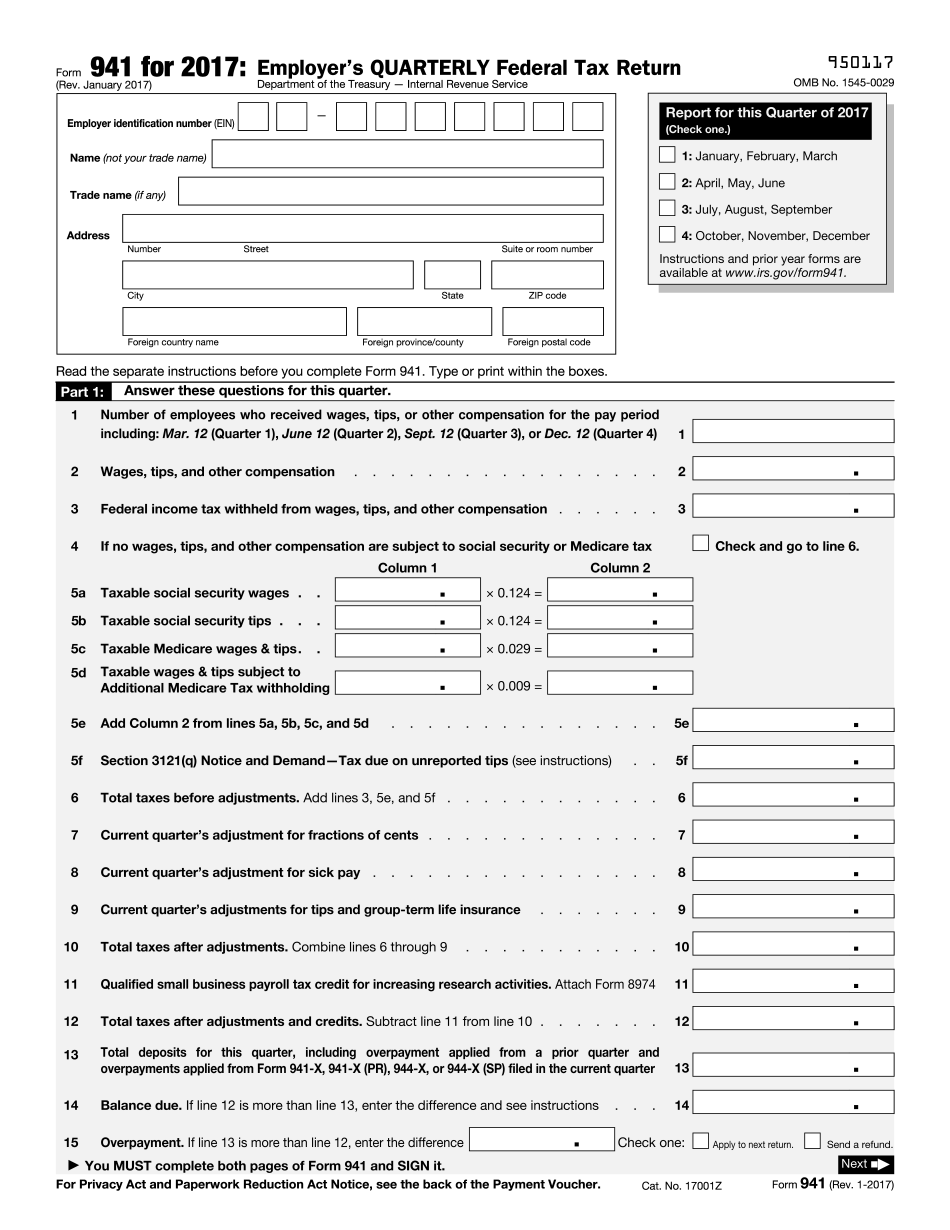

Get IRS 941 Schedule B 20172023 US Legal Forms Fill Online

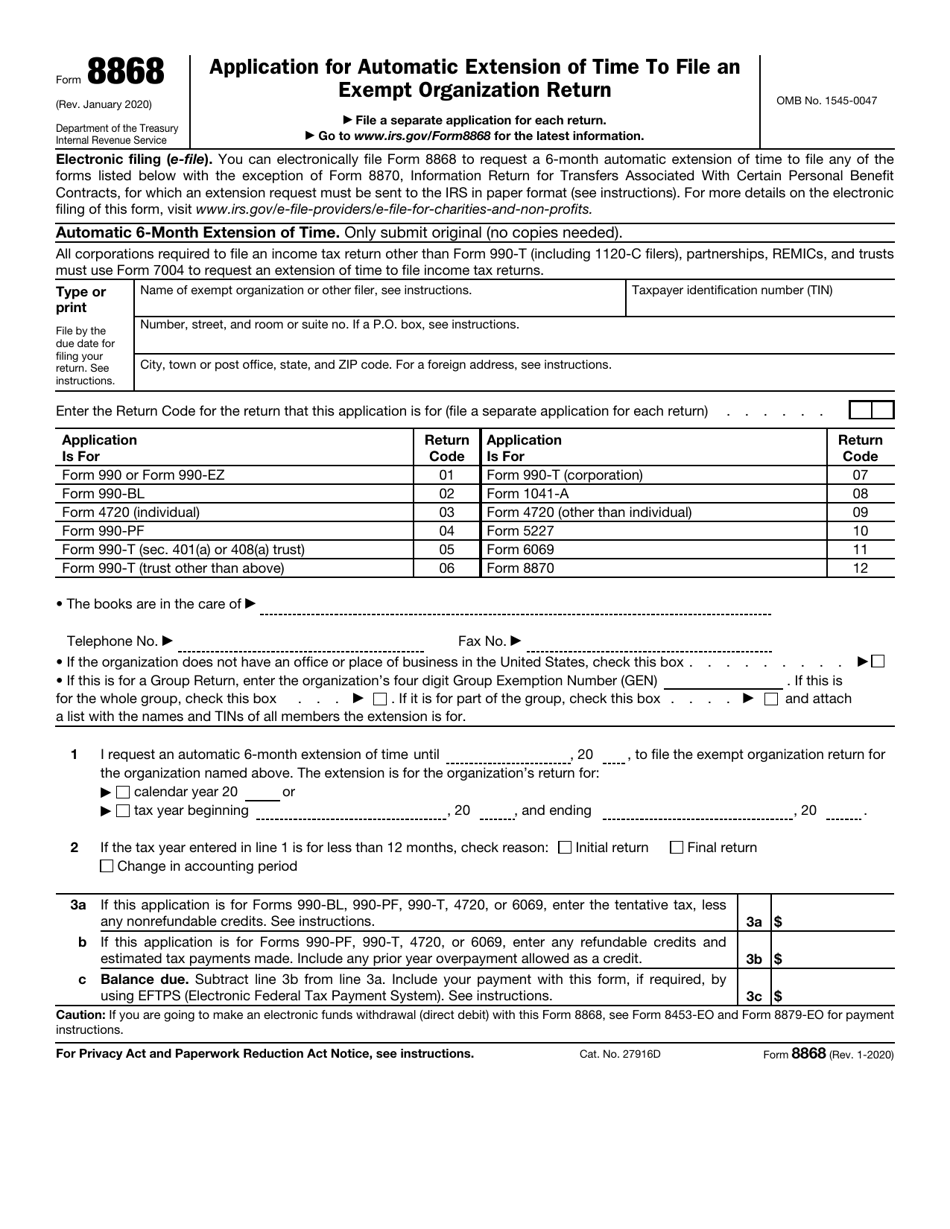

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Form 8910 Edit, Fill, Sign Online Handypdf

Related Post: