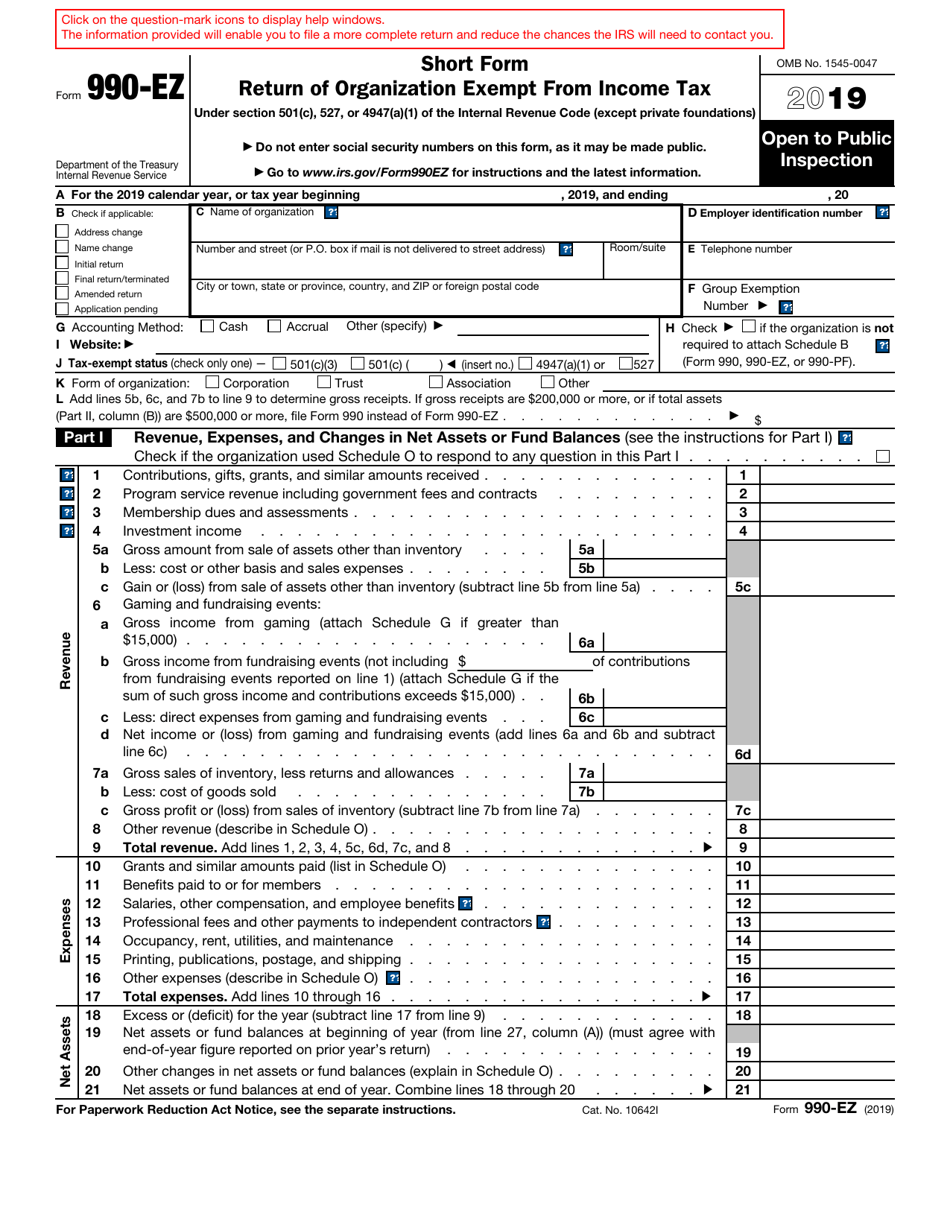

Irs Form 8846

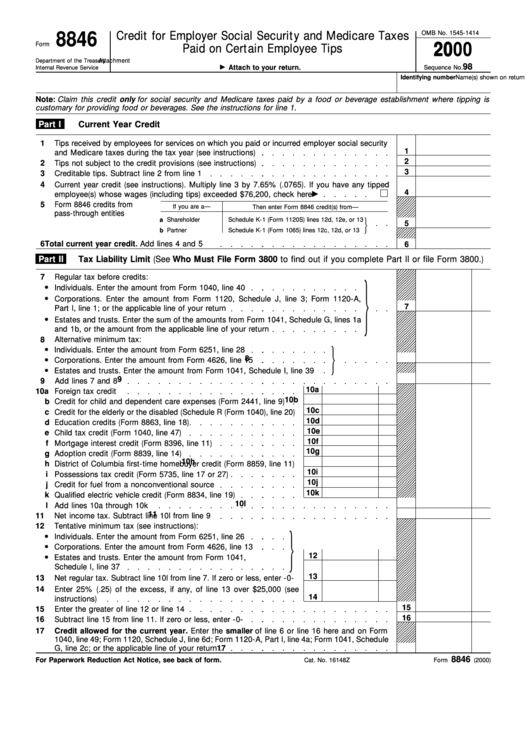

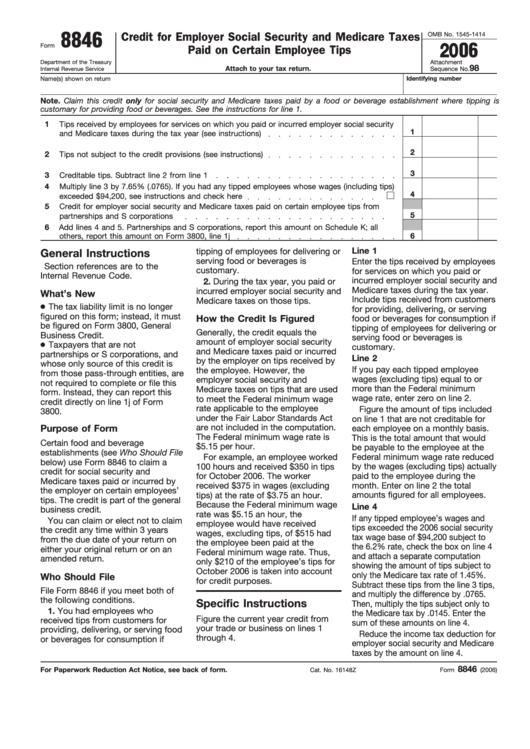

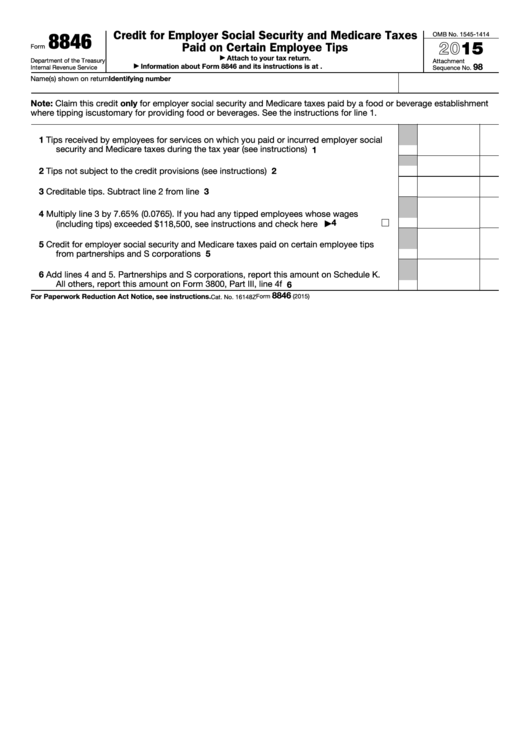

Irs Form 8846 - You had employees who received tips from customers for providing, delivering, or serving food or. Information for form 8846 employer social. Web partnership form 8846 employer social security credit in lacerte. Web information about form 8846, credit for employer social security and medicare taxes paid on certain employee tips, including recent updates, related forms. Web form 8846 (2010) page 2 line 4 if any tipped employee’s wages and tips exceeded the 2010 social security tax wage base of $106,800 subject to the 6.2% rate or were exempt. Credit for employer social security and medicare taxes paid on certain employee tips. Complete, edit or print tax forms instantly. Scroll down to the employer social security credit (8846). Ad outgrow.us has been visited by 10k+ users in the past month Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846,. Web applying for the fica tip tax credit on irs form 8846 if desired; Or on the appropriate line of other income tax returns 14 form 8846 (1994) part i part ii tips reported by. Attach to your tax return. Web to generate form 8846 in the individual module: Web in an individual return, i need to enter information for. Form 1041, schedule g, line 2c; It is reported on irs form 8846,. Filers receive a credit for the social security and. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web we last updated the credit for employer social security and medicare taxes. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web in an individual return, i need to enter information for form 8846, credit for employer social security and medicare taxes paid on certain employee tips. Ensuring that tip reporting for all employees meets the. Or on the appropriate line of other income tax returns 14 form 8846 (1994) part i part ii tips reported by. Web department of the treasury internal revenue service. Web beverage and food establishments can file the credit for employer social security and medicare taxes paid on certain employee tips, form 8846. Credit for employer social security and medicare taxes. Credit for employer social security and medicare taxes paid on certain employee tips. Web information about form 8846, credit for employer social security and medicare taxes paid on certain employee tips, including recent updates, related forms. Web beverage and food establishments can file the credit for employer social security and medicare taxes paid on certain employee tips, form 8846. Credit. Web how to claim and calculate the fica tip tax credit. Information for form 8846 employer social. Web department of the treasury internal revenue service. Web to generate form 8846 in the individual module: Credit for employer social security and medicare taxes paid on certain employee tips. Web how to claim and calculate the fica tip tax credit. Scroll down to the employer social security credit (8846). Ad outgrow.us has been visited by 10k+ users in the past month Web applying for the fica tip tax credit on irs form 8846 if desired; Attach to your tax return. Ensuring that tip reporting for all employees meets the federal minimum threshold of 8% of gross. You had employees who received tips from customers for providing, delivering, or serving food or. Credit for employer social security and medicare taxes paid on certain employee tips. Web below) use form 8846 to claim a credit for social security and medicare taxes paid. Web in an individual return, i need to enter information for form 8846, credit for employer social security and medicare taxes paid on certain employee tips. It is reported on irs form 8846,. Go to screen 34, general bus. Ad outgrow.us has been visited by 10k+ users in the past month Credit for employer social security and medicare taxes paid. Form 1041, schedule g, line 2c; Web form 8846 department of the treasury internal revenue service credit for employer social security and medicare taxes paid on certain employee tips attach to your tax. Web you should only file form 8846 if you meet both of the following conditions: Attach to your tax return. Ad register and subscribe now to work. Web partnership form 8846 employer social security credit in lacerte. Web in an individual return, i need to enter information for form 8846, credit for employer social security and medicare taxes paid on certain employee tips. Web applying for the fica tip tax credit on irs form 8846 if desired; Department of the treasury internal revenue service. Web you should only file form 8846 if you meet both of the following conditions: Complete, edit or print tax forms instantly. Web the fica tip credit report is a part of toast's report library for customers to use when filing irs form 8846 to claim a tip credit. Web form 8846 (2010) page 2 line 4 if any tipped employee’s wages and tips exceeded the 2010 social security tax wage base of $106,800 subject to the 6.2% rate or were exempt. Ad register and subscribe now to work on your irs 8846 form & more fillable forms. Attach to your tax return. Web form 8846 department of the treasury internal revenue service credit for employer social security and medicare taxes paid on certain employee tips attach to your tax. Go to screen 34, general bus. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Information for form 8846 employer social. Web department of the treasury internal revenue service. Web department of the treasury internal revenue service. The credit is part of the general. Credit for employer social security and medicare taxes paid on certain employee tips. Web however, employers cannot claim the credit for taxes on any tips that are used to meet the federal minimum wage rate.” to claim the tip credit, you must fill out. Ensuring that tip reporting for all employees meets the federal minimum threshold of 8% of gross.IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

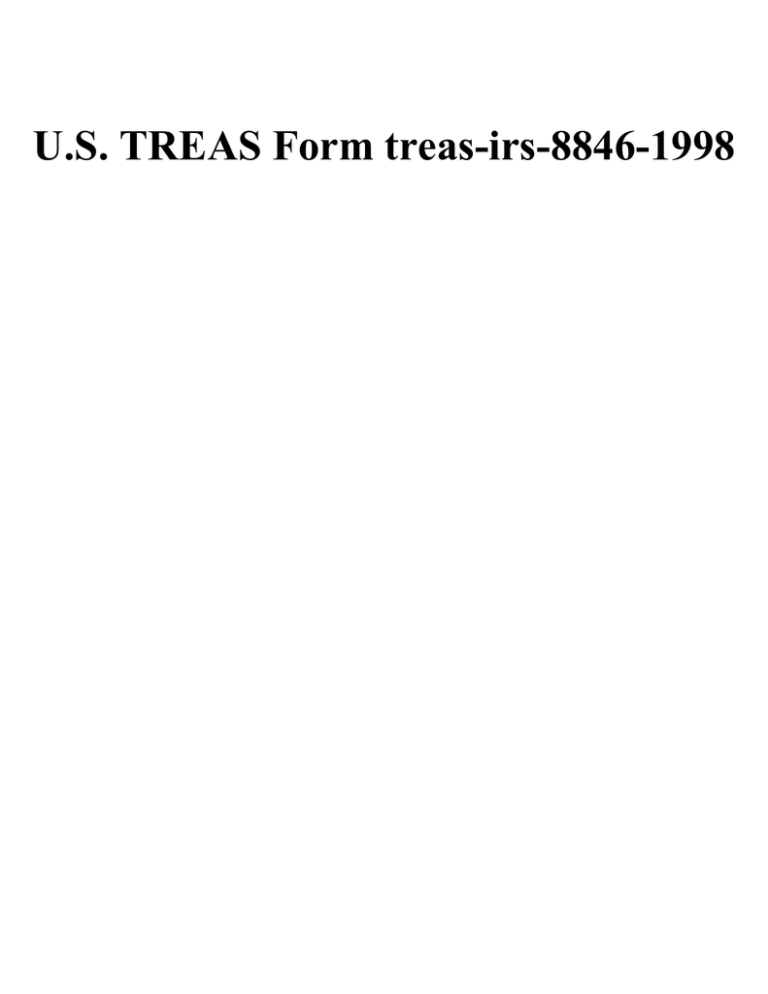

Form 8846 Credit for Employer Social Security and Medicare Taxes

U.S. TREAS Form treasirs88461998

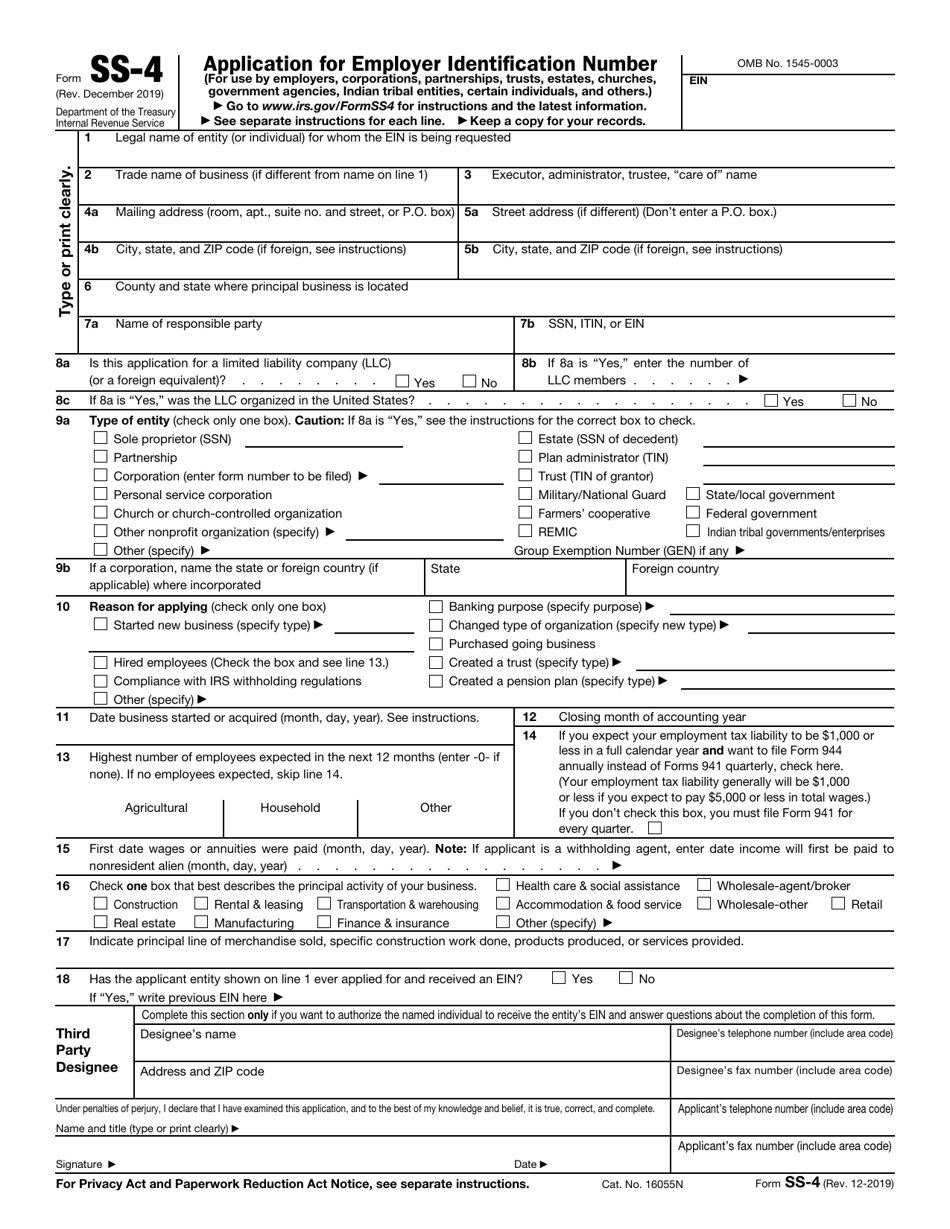

IRS Form SS4 Download Fillable PDF or Fill Online Application for

Credit For Employer Social Security And Medicare Taxes Paid On Certain

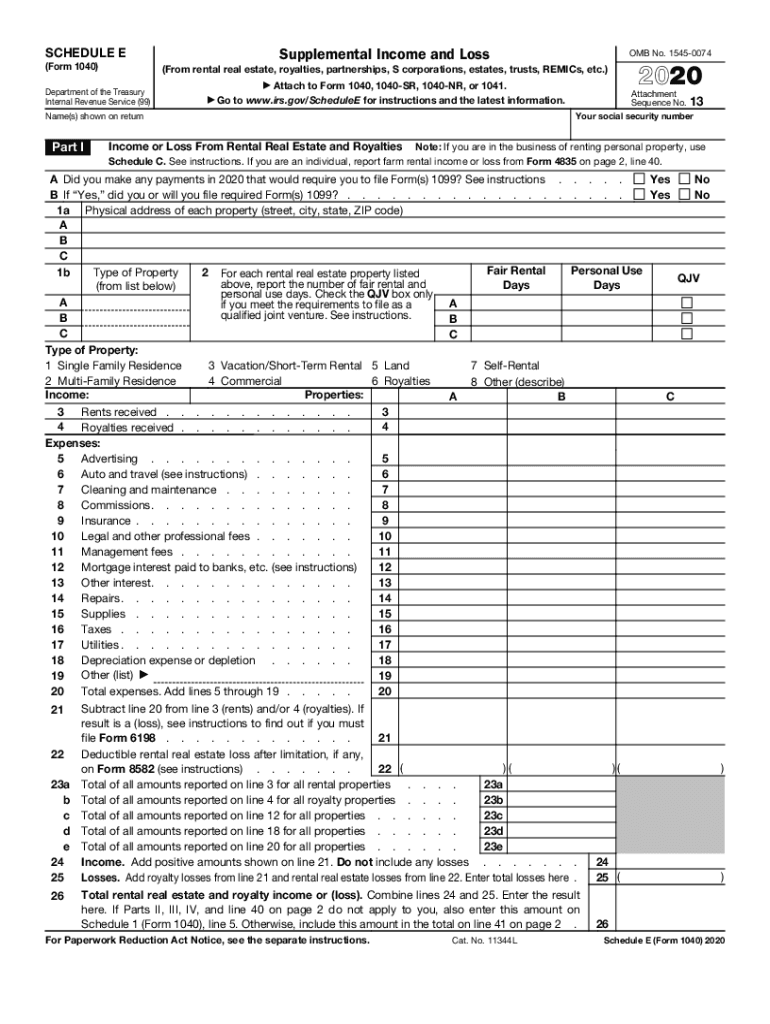

Schedule E Fill Out and Sign Printable PDF Template signNow

IRS Form 4070A Instructions Employee's Daily Record of Tips

Irs Form W4V Printable where do i mail my w 4v form for social

Fillable Form 8846 Credit For Employer Social Security And Medicare

Fillable Form 8846 Credit For Employer Social Security And Medicare

Related Post: