Form 886-A Irs

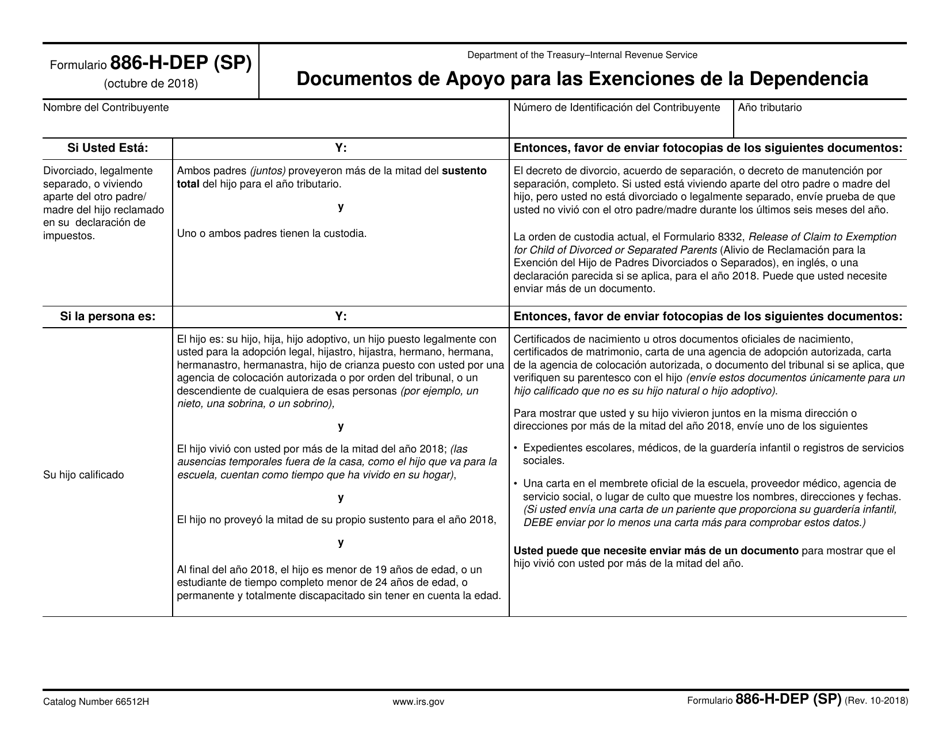

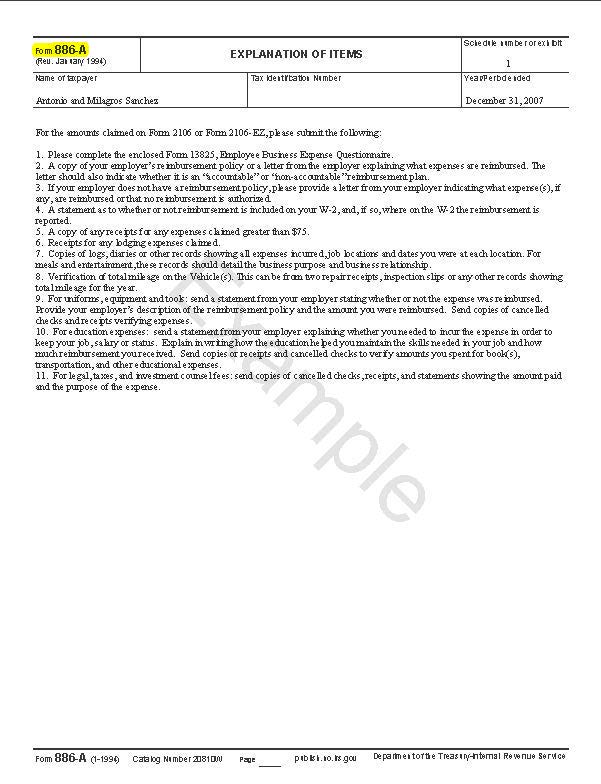

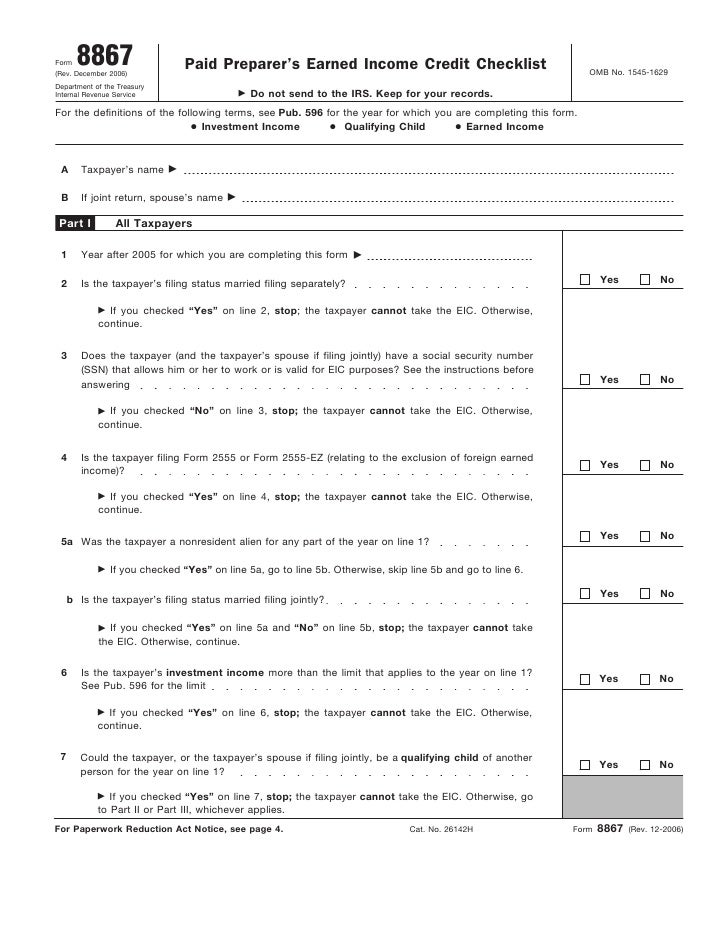

Form 886-A Irs - Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. We need to verify that you. Web supporting documents to prove head of household filing status. In any of the four situations below, you can request an audit reconsideration. Web taxpayers complete form 8862 and attach it to their tax return if: Web forms 886 can assist you. If an adjustment involves a detailed computation, a worksheet will be attached. Complete, edit or print tax forms instantly. Send filled & signed form or save. What are form 886 h dep supporting documents for dependency exemptions? The title of irs form 886a is explanation of items. Web form 886a may include the facts, tax law, your position, the irs’ argument and a conclusion with the proposed adjustment. Web what do i need to know? Web supporting documents to prove head of household filing status. You may qualify for head of household filing status if you meet. Open form follow the instructions. Some of these changes are. Web what do i need to know? The title of irs form 886a is explanation of items. Easily sign the form with your finger. Some of these changes are. What are form 886 h dep supporting documents for dependency exemptions? Documents you need to send. Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the. Web page last reviewed or updated: We need to verify that you. The american rescue plan act of 2021 made several changes to the earned income tax credit. Web form 886a may include the facts, tax law, your position, the irs’ argument and a conclusion with the proposed adjustment. Information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and. Complete, edit or. Send filled & signed form or save. Complete, edit or print tax forms instantly. Learn how to handle an irs audit. A process that reopens your irs audit. To claim a child as a qualifying child for eitc, you must show the child is. Complete, edit or print tax forms instantly. Web taxpayers complete form 8862 and attach it to their tax return if: Ad we help get taxpayers relief from owed irs back taxes. Easily sign the form with your finger. If an adjustment involves a detailed computation, a worksheet will be attached. Web supporting documents to prove head of household filing status. Some of these changes are. Web forms 886 can assist you. Send filled & signed form or save. Web taxpayers complete form 8862 and attach it to their tax return if: Web page last reviewed or updated: Send filled & signed form or save. You may qualify for head of household filing status if you meet the following three tests: If an adjustment involves a detailed computation, a worksheet will be attached. Since the purpose of form 886a is to explain something, the irs uses it for many various. Web what do i need to know? A process that reopens your irs audit. Learn how to handle an irs audit. The title of irs form 886a is explanation of items. If an adjustment involves a detailed computation, a worksheet will be attached. What are supporting documents for irs? Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the. Documents you need to send. The title of irs form 886a is explanation of items. Web request an audit reconsideration: Web taxpayers complete form 8862 and attach it to their tax return if: To claim a child as a qualifying child for eitc, you must show the child is. A process that reopens your irs audit. We need to verify that you. The title of irs form 886a is explanation of items. Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the. Send filled & signed form or save. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Estimate how much you could potentially save in just a matter of minutes. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web what is the 886a explanation of items? Information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and. Since the purpose of form 886a is to explain something, the irs uses it for many various. Web request an audit reconsideration: Web page last reviewed or updated: This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Some of these changes are. If an adjustment involves a detailed computation, a worksheet will be attached. Web what do i need to know? In any of the four situations below, you can request an audit reconsideration.IRS Formulario 886HDEP Download Fillable PDF or Fill Online

️Form 886 A Worksheet Instructions Free Download Gmbar.co

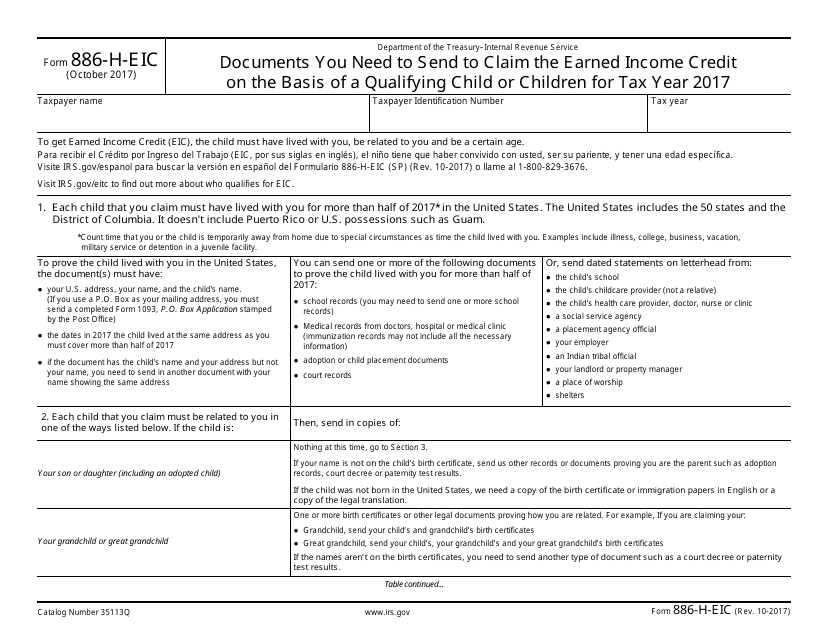

Fill Free fillable Form 886HEIC Documents You Need to Send to (IRS

36 Irs Form 886 A Worksheet support worksheet

IRS Form 886HEIC Fill Out, Sign Online and Download Fillable PDF

Audit Form 886A Tax Lawyer Answer & Response

Irs form 886a may 2023 Fill online, Printable, Fillable Blank

IRS Form 886HEIC 2018 Fill and Sign Printable Template Online US

36 Irs Form 886 A Worksheet support worksheet

36 Irs Form 886 A Worksheet support worksheet

Related Post: