Irs Form 8805

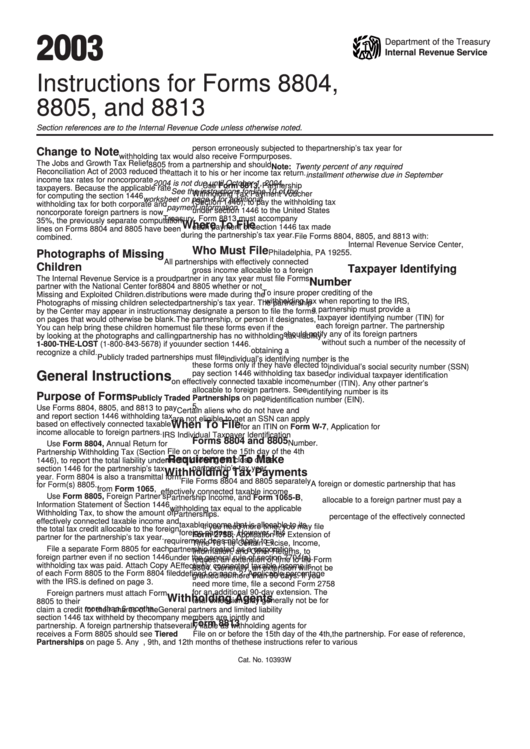

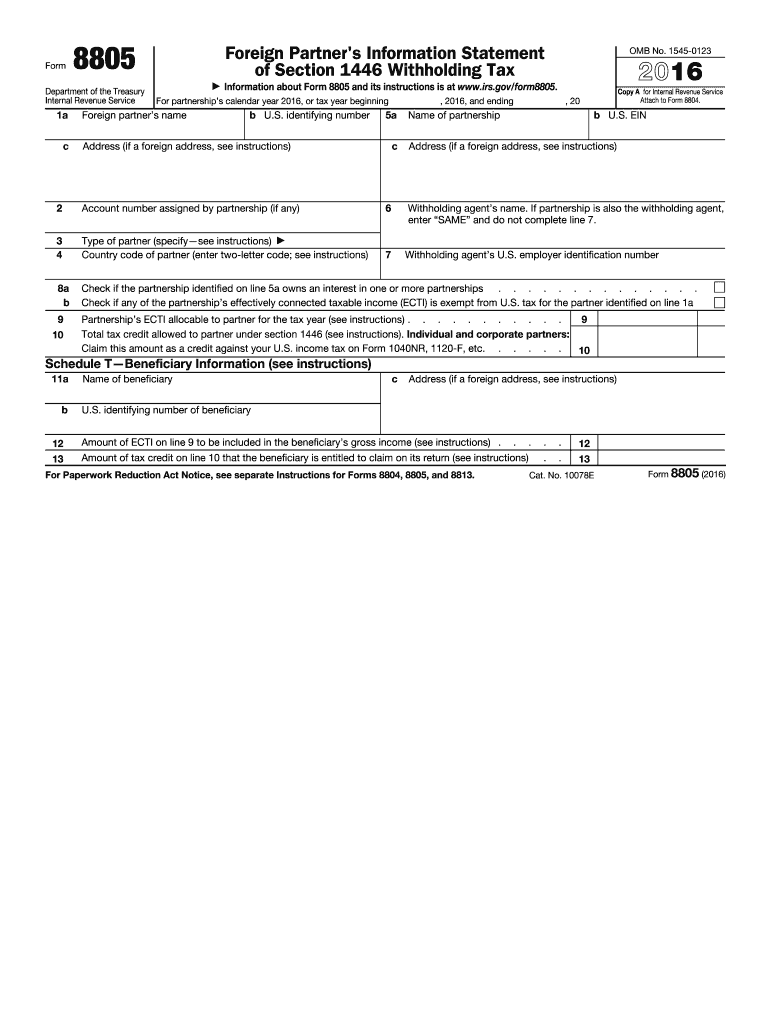

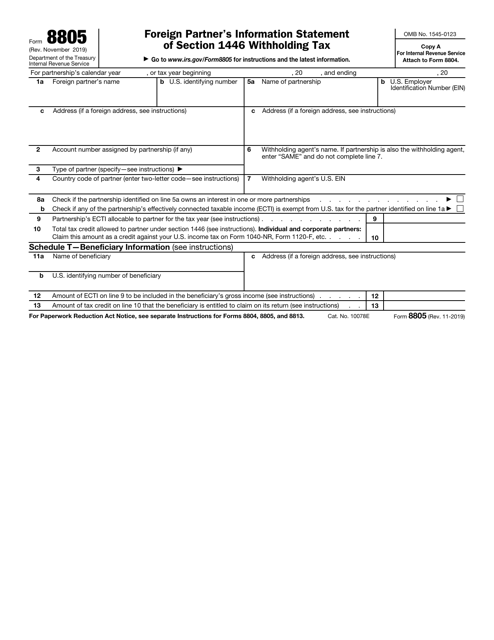

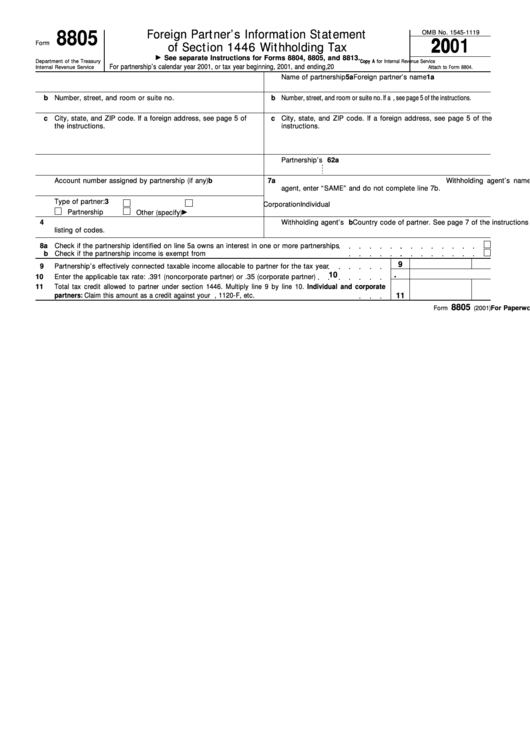

Irs Form 8805 - Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. This is done by filing form 8804 and form 8805. Web if a partnership with a foreign partner has income that is effectively connected with a us business or trade, it must report a partnership withholding tax. Web form 8805, foreign partner's information statement of section 1446 withholding tax. The partnership must also file a form 8805. November 2019) foreign partner’s information statement of section 1446 withholding tax department of the treasury internal revenue service copy a for internal revenue service go to www.irs.gov/form8805 for instructions and the latest. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax year 2022. Access irs forms, instructions and publications in electronic and print media. Instructions for forms 8804, 8805 and 8813 2019 form 8805: This form must be completed by us businesses that have foreign partners or those with an obligation to withhold or collect taxes from. Complete, edit or print tax forms instantly. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Access irs forms, instructions and publications in electronic and print media. This form must be completed by us businesses that have foreign partners or those with an obligation to withhold or collect taxes from.. At the end of the partnership’s tax year, form 8805 must be sent to each foreign partner. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax year 2022. Web instructions for forms 8804, 8805 and 8813 2020 form 8805:. Use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to foreign partners (as defined in section 1446(e)). Web form 8805 is an internal revenue service (irs) tax form that is used to report income allocated to foreign partners. Instructions for forms 8804, 8805 and 8813 2019 form. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. 1446 tax rate for 2015 is generally 39.6% (unless the partner is entitled. Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the. Web form 8805 is used to show the amount of effectively connected taxable income and any withholding tax payments allocable to a foreign partner for the partnership’s tax year. At the end of the partnership’s tax year, form 8805 must be sent to each foreign partner. Form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Use form 8804 to report the total liability under. 1446 tax rate for 2015 is generally 39.6% (unless the partner is entitled. November 2019) foreign partner’s information statement of section 1446 withholding tax department of the treasury internal revenue service copy. Use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to foreign partners (as defined in section 1446(e)). Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Form 8813, partnership withholding tax payment. Withholding tax must be paid on foreign partners’ share of effectively connected income, even if you never make any cash distributions to the. Use form 8804 to report the total liability under. Web form 8805 is used to show the amount of effectively connected taxable income and any withholding tax payments allocable to a foreign partner for the partnership’s tax. Form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete the forms and file them ny mail to the address specific. November 2019) foreign partner’s information statement of section 1446 withholding tax department of the treasury internal revenue service copy a for internal revenue service go to www.irs.gov/form8805 for instructions and the latest. At the end. Ad access irs tax forms. This is a somewhat complicated area of us tax law, but don’t worry! This form is used to show the amount of effectively connected taxable income (ecti) and the total tax credit allocable to the foreign partner for the partnership's. The partnership must also file a form 8805. Withholding tax must be paid on foreign. Web about form 8805, foreign partner's information statement of section 1446 withholding tax. Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership’s tax year. Web up to $40 cash back form 8805 foreign partner's name foreign partner's information statement of section 1446 withholding tax omb no. 1446 tax rate for 2015 is generally 39.6% (unless the partner is entitled. Access irs forms, instructions and publications in electronic and print media. Foreign partner's information statement of section 1446 withholding tax 2019 inst 8804, 8805 and 8813: Form 8804 is used by partnerships to report the total liability under section 1446, and as a transmittal. Ad access irs tax forms. November 2019) foreign partner’s information statement of section 1446 withholding tax department of the treasury internal revenue service copy a for internal revenue service go to www.irs.gov/form8805 for instructions and the latest. This form is used to show the amount of effectively connected taxable income (ecti) and the total tax credit allocable to the foreign partner for the partnership's. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax year 2022. Instructions for forms 8804, 8805 and 8813 2019 form 8805: Web form 8805, which also must be filed with the irs, is provided to each foreign partner for his or her tax and filing information. Web download form 8805. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. This form must be completed by us businesses that have foreign partners or those with an obligation to withhold or collect taxes from. We help get taxpayers relief from owed irs back taxes. Web if a partnership with a foreign partner has income that is effectively connected with a us business or trade, it must report a partnership withholding tax. Ad tax advocates can provide immediate tax relief. Web instructions for forms 8804, 8805 and 8813 2020 form 8805:Instructions For Forms 8804, 8805, And 8813 2003 printable pdf download

Partnership Withholding All About US Tax Forms 8804 & 8805

2016 Form IRS 8805 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8805 Foreign Partner's Information Statement of Section 1446

IRS Form 8805 Download Fillable PDF or Fill Online Foreign Partner's

How to Fill Out IRS Form 8804 & 8805 for Foreign Partners YouTube

Form 8805 Foreign Partner'S Information Statement Of Section 1446

Partnership Withholding All About US Tax Forms 8804 & 8805

Understanding Key Tax Forms What investors need to know about Schedule

3.21.15 Withholding on Foreign Partners Internal Revenue Service

Related Post: