Mn M1 Form

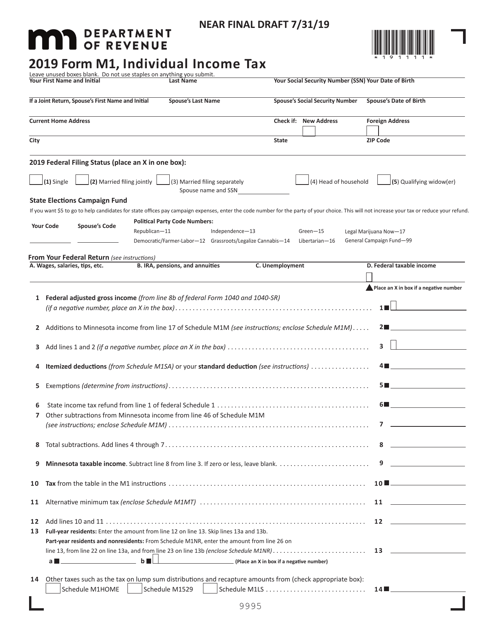

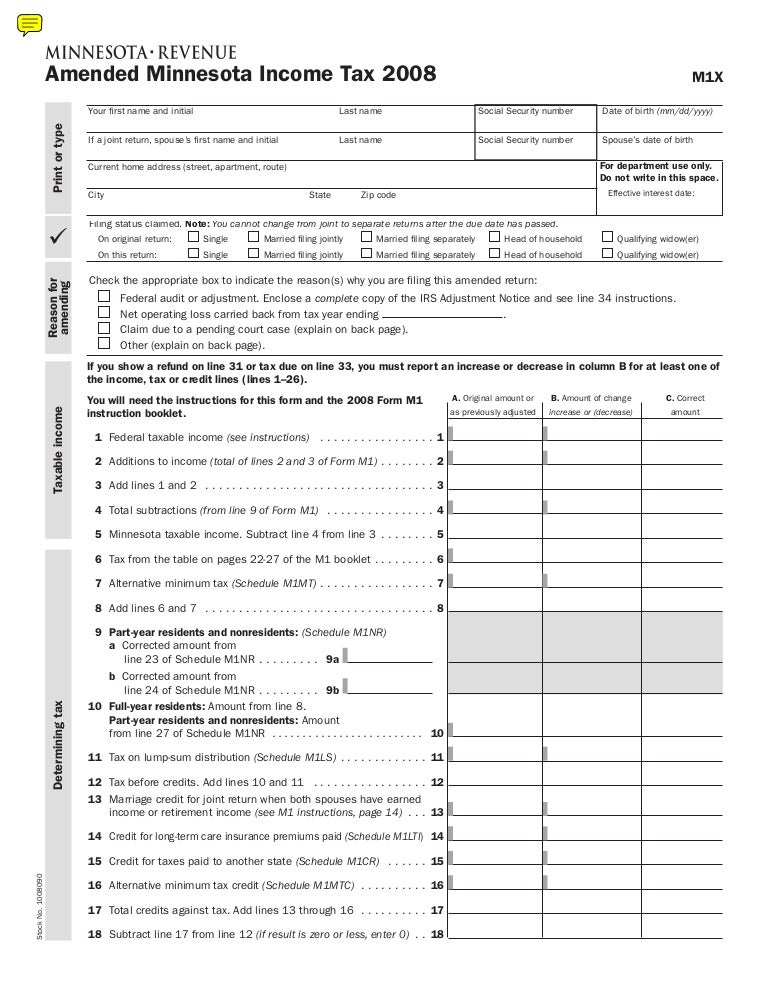

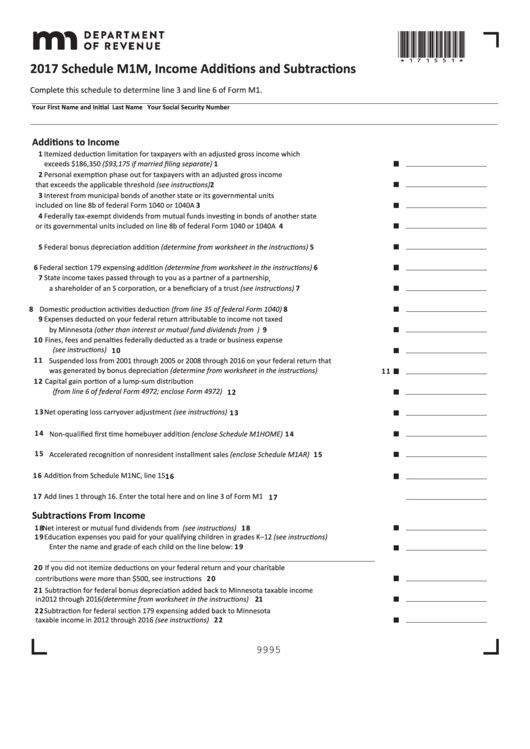

Mn M1 Form - Web form m1 is the most common individual income tax return filed for minnesota residents. Web file an income tax return. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. The state income tax table can be found inside the minnesota. It appears you don't have a pdf plugin. We last updated the individual income tax return in. Web download or print the latest version of form m1 instructions for tax year 2022, which contains the minnesota individual income tax forms and instructions. Form m1 is the most common individual income tax return filed for minnesota residents. Web download the official 2021 form m1, individual income tax for minnesota residents and nonresidents. • file and pay electronically • get forms, instructions, and fact sheets • get answers to your questions • check on your refund • get form. We last updated the individual income tax return in. Web the minnesota income tax rate for tax year 2022 is progressive from a low of 5.35% to a high of 9.85%. Web go to www.revenue.state.mn.us to: Form m1 is the most common individual income tax return filed for minnesota residents. Free income tax filing and help. Find free tax preparation help. Web minnesota — homestead credit refund (for homeowners) and renters property tax refund. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Browse for the minnesota m1. The current tax year is. Free income tax filing and help. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Web learn how to fill out the 2022 form m1, individual income tax, with your personal details, federal tax return, and state tax refund. The state income tax. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Web printable minnesota income tax form m1. The state income tax table can be found inside the minnesota. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income.. The state income tax table can be found inside the minnesota. To compute minnesota income tax, the proprietor uses form m1, the individual. Web there is no separate form for reporting sole proprietorship income on the minnesota tax return. Web download the official 2021 form m1, individual income tax for minnesota residents and nonresidents. Web learn how to fill out. Web download the official 2021 form m1, individual income tax for minnesota residents and nonresidents. The current tax year is. Web 2020 form m1, individual income tax (minnesota department of revenue) 2019 form m1x, amended minnesota income tax (minnesota department of. Web renter's refund — starting with rent paid in 2024: Browse for the minnesota m1. Browse for the minnesota m1. Web file an income tax return. Use a minnesota m1 instructions template to make your document workflow more streamlined. This form is for income earned in tax year 2022, with tax. Web there is no separate form for reporting sole proprietorship income on the minnesota tax return. Free income tax filing and help. Web 2020 form m1, individual income tax (minnesota department of revenue) 2019 form m1x, amended minnesota income tax (minnesota department of. Find free tax preparation help. Use a minnesota m1 instructions template to make your document workflow more streamlined. Web renter's refund — starting with rent paid in 2024: A state other than minnesota. Owners and managing agents must provide a. You must file yearly by april 17. Additions, credits, and subtractions [+] individual income tax. Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. Web if you received a state income tax refund in 2021 and you itemized deductions on federal form 1040 in 2020, you may need to report. Free income tax filing and help. Web printable minnesota income tax form m1. Web download or print the latest version of form m1 instructions for tax year 2022, which contains the minnesota individual income. Web printable minnesota income tax form m1. Web the minnesota income tax rate for tax year 2022 is progressive from a low of 5.35% to a high of 9.85%. Web there is no separate form for reporting sole proprietorship income on the minnesota tax return. To compute minnesota income tax, the proprietor uses form m1, the individual. Free income tax filing and help. The current tax year is. Web download or print the latest version of form m1 instructions for tax year 2022, which contains the minnesota individual income tax forms and instructions. Minnesota individual income tax, mail station 0010, 600 n. You are a minnesota resident if either of these apply: You must file yearly by april 15. You must file yearly by april 17. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. • file and pay electronically • get forms, instructions, and fact sheets • get answers to your questions • check on your refund • get form. Web of the amount you included (or should have included) on line 2a of federal form 1040, add the interest you received from municipal bonds issued by: This form is used to report your federal and state income, deductions,. A state other than minnesota. Web go to www.revenue.state.mn.us to: Additions, credits, and subtractions [+] individual income tax. We last updated the individual income tax return in. Web 2020 form m1, individual income tax (minnesota department of revenue) 2019 form m1x, amended minnesota income tax (minnesota department of.Form M1 Individual Tax Printable YouTube

Minnesota Tax Table M1 Instructions 2020

MN DoR M1 2018 Fill out Tax Template Online US Legal Forms

Minnesota Tax Table M1 Instructions 2021

M1MT taxes.state.mn.us

Form M1 2019 Fill Out, Sign Online and Download Printable PDF

Fill Free fillable Minnesota Department of Revenue PDF forms

MN M1W 2019 Fill out Tax Template Online US Legal Forms

M1X taxes.state.mn.us

Fillable Schedule M1m Additions And Subtractions 2017

Related Post: