Irs Form 8801

Irs Form 8801 - Department of the treasury internal revenue service. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web irs form 8801. Ad we help get taxpayers relief from owed irs back taxes. Below are solutions to frequently asked questions about form. Purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative. Form instructions 8801, also known as the credit for. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. The alternative minimum tax credit is only. Web you can calculate the amount of the credit on irs form 8801, credit for prior year minimum tax — individuals, estates, and trusts. Web you can calculate the amount of the credit on irs form 8801, credit for prior year minimum tax — individuals, estates, and trusts. Access irs forms, instructions and publications in electronic and print media. Ad get your federal taxid number today. Ad we help get taxpayers relief from owed irs back taxes. A b total number of archer msas. Web you can calculate the amount of the credit on irs form 8801, credit for prior year minimum tax — individuals, estates, and trusts. Web we last updated the credit for prior year minimum tax—individuals, estates, and trusts in february 2023, so this is the latest version of form 8801, fully updated for tax year. Ad learn about the locations,. Below are solutions to frequently asked questions about form. Web you can calculate the amount of the credit on irs form 8801, credit for prior year minimum tax — individuals, estates, and trusts. Form 8801 is used to calculate the minimum tax credit, if any, for alternative. Web common questions about entering form 8801 in lacerte. Form instructions 8801, also. Access irs forms, instructions and publications in electronic and print media. Web use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax years and to figure any. Web use form 8801 if you are an individual, estate, or trust to figure. Web what is the purpose of irs form 8801? In this article, we’ll walk you. Web use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax years and to figure any. Instructions for form 8801, credit for prior year minimum tax.. Web common questions about entering form 8801 in lacerte. Web irs form 8801. Web about form instructions 8801. Ad we help get taxpayers relief from owed irs back taxes. Access irs forms, instructions and publications in electronic and print media. Go to screen 38.2, recovery rebate, eic, residential energy, other credits. Fast, easy and secure application. Web form 8851 department of the treasury internal revenue service this report is for the period january 1 through: Paying the amt today means you might be able to apply that amount as credit to future tax filing years. Instructions for form 8801, credit. Ad we help get taxpayers relief from owed irs back taxes. Web about form instructions 8801. In this article, we’ll walk you. If you paid alternative minimum tax, otherwise known as amt, in prior years, then this article is of importance to you. Web you can calculate the amount of the credit on irs form 8801, credit for prior year. Web about form instructions 8801. Form instructions 8801, also known as the credit for. Go to screen 38.2, recovery rebate, eic, residential energy, other credits. Purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative. Web use form 8801 if you are an individual, estate, or. Web irs form 8801. Ad learn about the locations, phone numbers of nearby irs offices. Web you can calculate the amount of the credit on irs form 8801, credit for prior year minimum tax — individuals, estates, and trusts. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web common questions. Below are solutions to frequently asked questions about form. Go to screen 38.2, recovery rebate, eic, residential energy, other credits. The alternative minimum tax credit is only. In this article, we’ll walk you. Ad we help get taxpayers relief from owed irs back taxes. Purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative. Ad get your federal taxid number today. Instructions for form 8801, credit for prior year minimum tax. Web what is the purpose of irs form 8801? You may be eligible for a tax. Paying the amt today means you might be able to apply that amount as credit to future tax filing years. Web use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax years and to figure any. Fast, easy and secure application. Credit for prior year minimum tax— individuals, estates, and trusts. Web you can calculate the amount of the credit on irs form 8801, credit for prior year minimum tax — individuals, estates, and trusts. Web form 8851 department of the treasury internal revenue service this report is for the period january 1 through: Form 8801 is used to calculate the minimum tax credit, if any, for alternative. A b total number of archer msas (see. Form instructions 8801, also known as the credit for. If you paid alternative minimum tax, otherwise known as amt, in prior years, then this article is of importance to you.What is the AMT Credit (IRS Form 8801)? Equity Simplified

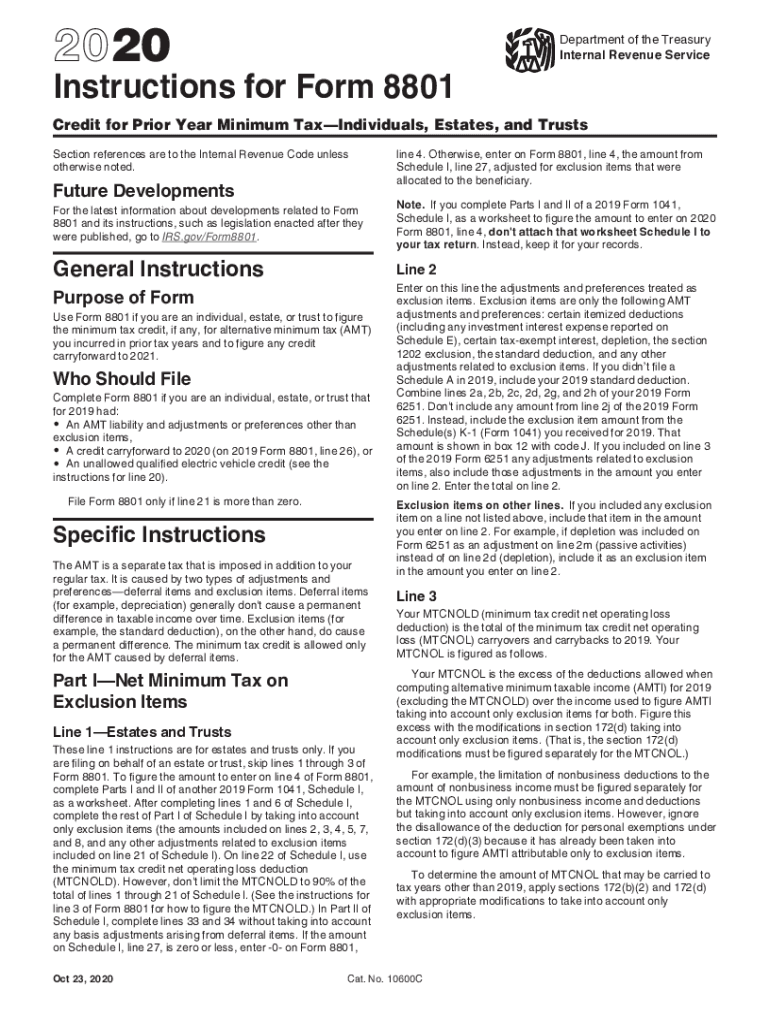

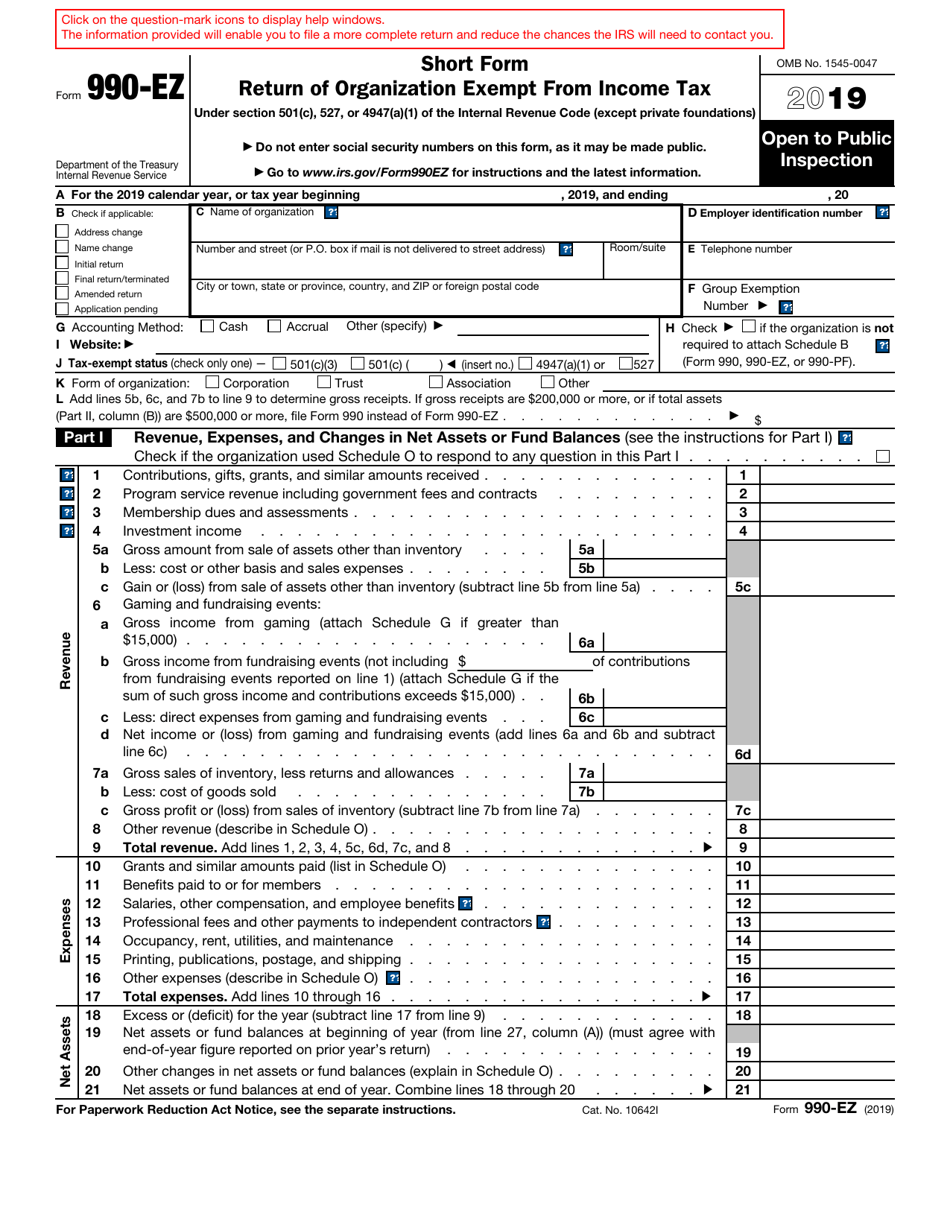

IRS 8801 Instructions 2020 Fill out Tax Template Online US Legal Forms

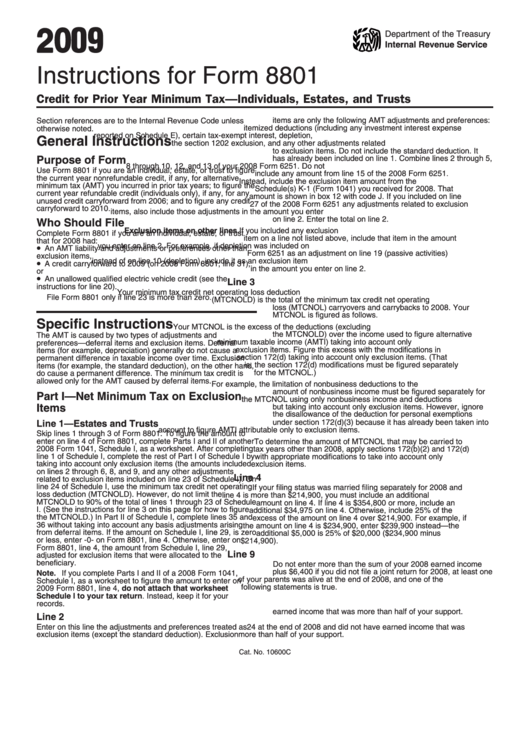

Instructions For Form 8801 2009 printable pdf download

Form 8801Credit for Prior Year Minimum Tax Individuals, Estates, a…

Irs 8801 Printable Form Printable Forms Free Online

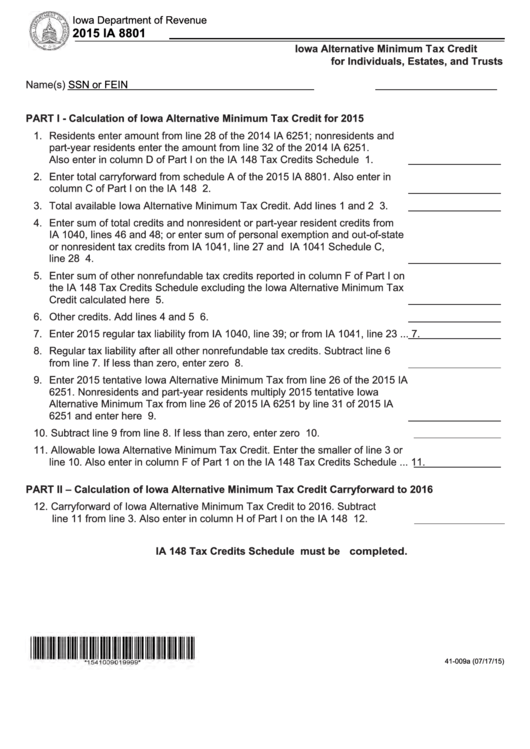

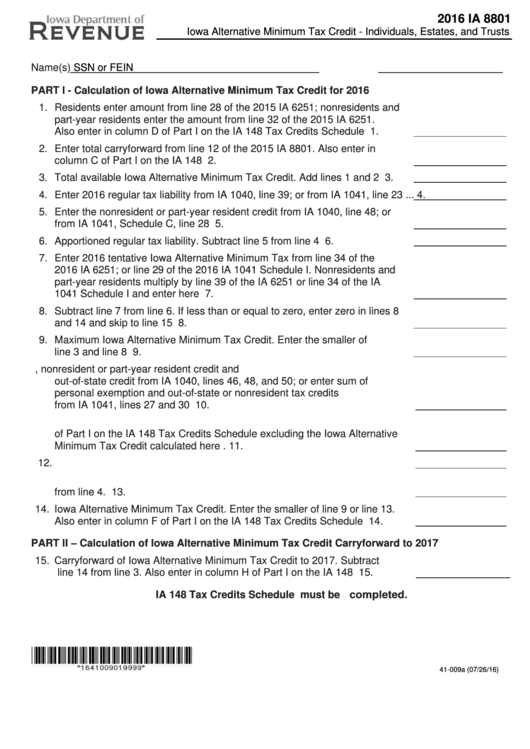

Fillable Form Ia 8801 Iowa Alternative Minimum Tax Credit For

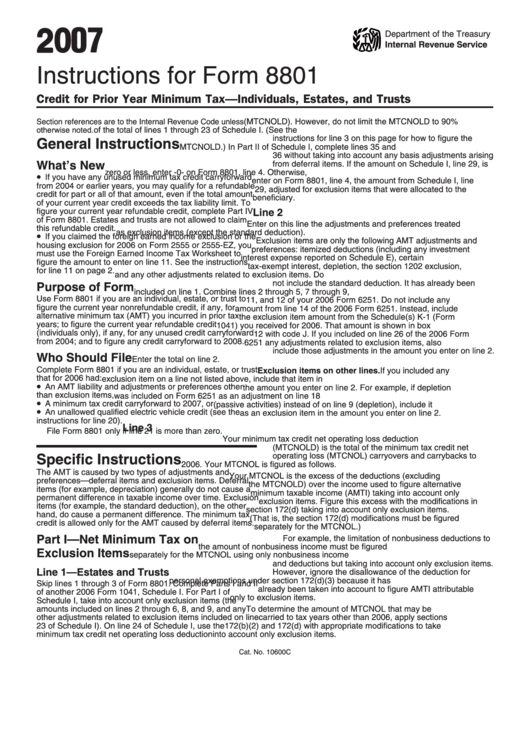

Instructions For Form 8801 Credit For Prior Year Minimum Tax

Irs Form W4V Printable where do i mail my w 4v form for social

8801 irs JWord サーチ

Fillable Form Ia 8801 Iowa Alternative Minimum Tax Credit

Related Post: