Form 8814 Turbotax

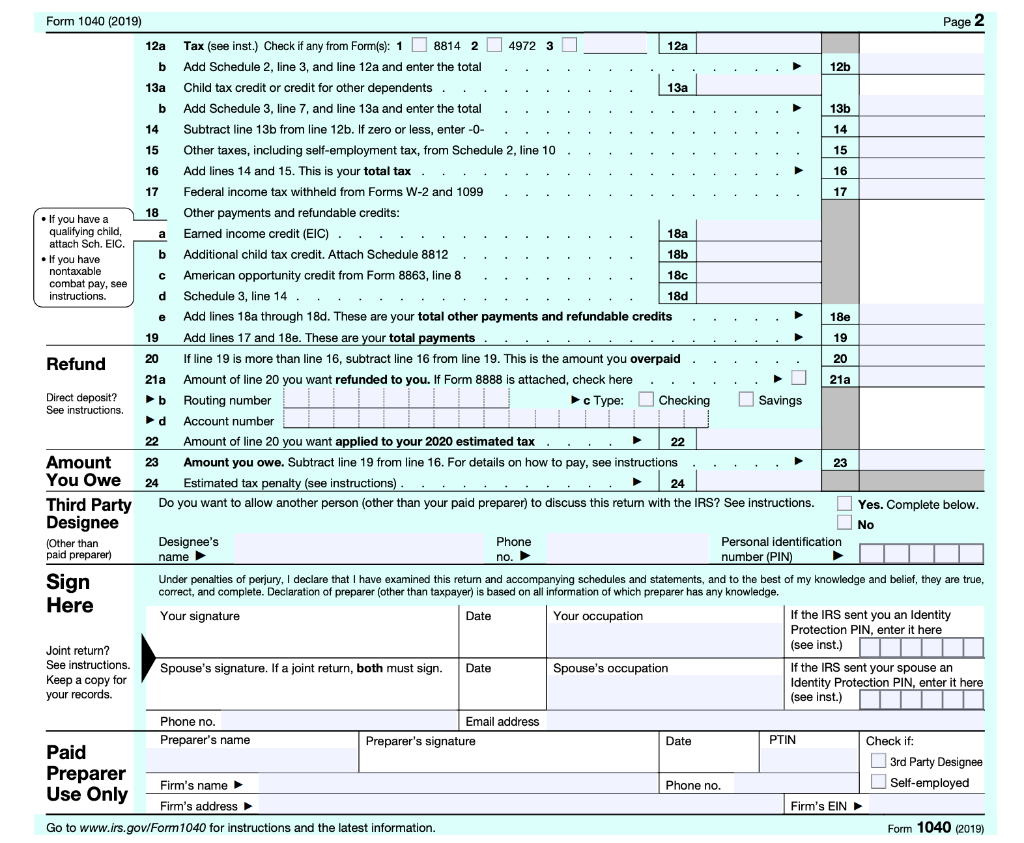

Form 8814 Turbotax - Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Complete, edit or print tax forms instantly. Ask a tax professional anything right now. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web use this form if you elect to report your child’s income on your return. Web form 8814 is for parents who elect to report their child's interest and dividends. The choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return. Web parents can use irs form 8814 to elect to report their child’s income on their tax return instead of the child filing their own return. 2) click on wages and income. Form 8814, parents’ election to report child’s interest and dividends. Complete line 7b if applicable. If you file form 8814 with your income tax return to report. Web parents can use irs form 8814 to elect to report their child’s income on their tax return instead of the child filing their own return. Web form 8814 is for parents who elect to report their child's interest and dividends. Easily sort. 2) click on wages and income. You can make this election if your child meets. When a child has investment income above a certain threshold, they. Complete, edit or print tax forms instantly. Web you can get form 8814 by performing the following steps: Parents’ election to report child’s interest and dividends. Download or email irs 4952 & more fillable forms, register and subscribe now! According to the form instructions, you should also include this amount on schedule d, line 13, as well as line. Ad thousands of highly rated, verified tax professionals. Web enter “form 8814” on the dotted line next to line. If you choose this election, your child may not have to file a return. If you do, your child will not have to file a return. You cannot make this election for such a child. Parents may elect to include their child's income from interest,. Pay the lowest amount of taxes possible with strategic planning and preparation Ad save time and money with professional tax planning & preparation services. Web use this form if you elect to report your child’s income on your return. Parents’ election to report child’s interest and dividends. Forms, deductions, tax filing and more. When a child has investment income above a certain threshold, they. Web parents can use irs form 8814 to elect to report their child’s income on their tax return instead of the child filing their own return. If you file form 8814 with your income tax return to report. How to make the election. Web this form is for income earned in tax year 2022, with tax returns due in april. Web you can get form 8814 by performing the following steps: Web use this form if you elect to report your child’s income on your return. Parents may elect to include their child's income from interest,. Web parents can use irs form 8814 to elect to report their child’s income on their tax return instead of the child filing their. We will update this page with a new version of the form for 2024 as soon as it is made available. Parents’ election to report child’s interest and dividends. Ad access irs tax forms. How to make the election. Complete line 7b if applicable. Parents may elect to include their child's income from interest,. Ad thousands of highly rated, verified tax professionals. Ad save time and money with professional tax planning & preparation services. Web parents can use irs form 8814 to elect to report their child’s income on their tax return instead of the child filing their own return. Web the irs website. This article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's income. 2) click on wages and income. If you do so, your child does not have to file a return. If you choose this election, your child may not have to file a return. Web multiply line 6 by. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. You cannot make this election for such a child. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Complete, edit or print tax forms instantly. Web form 8814 is a tax form used to report a child's investment income on a parent's tax return. Web multiply line 6 by line 8. Web form 8814 is for parents who elect to report their child's interest and dividends. Web continue with the interview process to enter your information. 2) click on wages and income. 1) click on the personal or federal tab to the left of your screen. The choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return. Note that any link in the information above is. You can make this election if your child meets. If you file form 8814 with your income tax return to report. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. To make this election, the. Forms, deductions, tax filing and more. Web the irs website shows that the 2021 form 8814 has been finalized and the form appears to have been finalized in lacerte on january 19, 2022 according to. Ad access irs tax forms. If you choose this election, your child may not have to file a return.Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

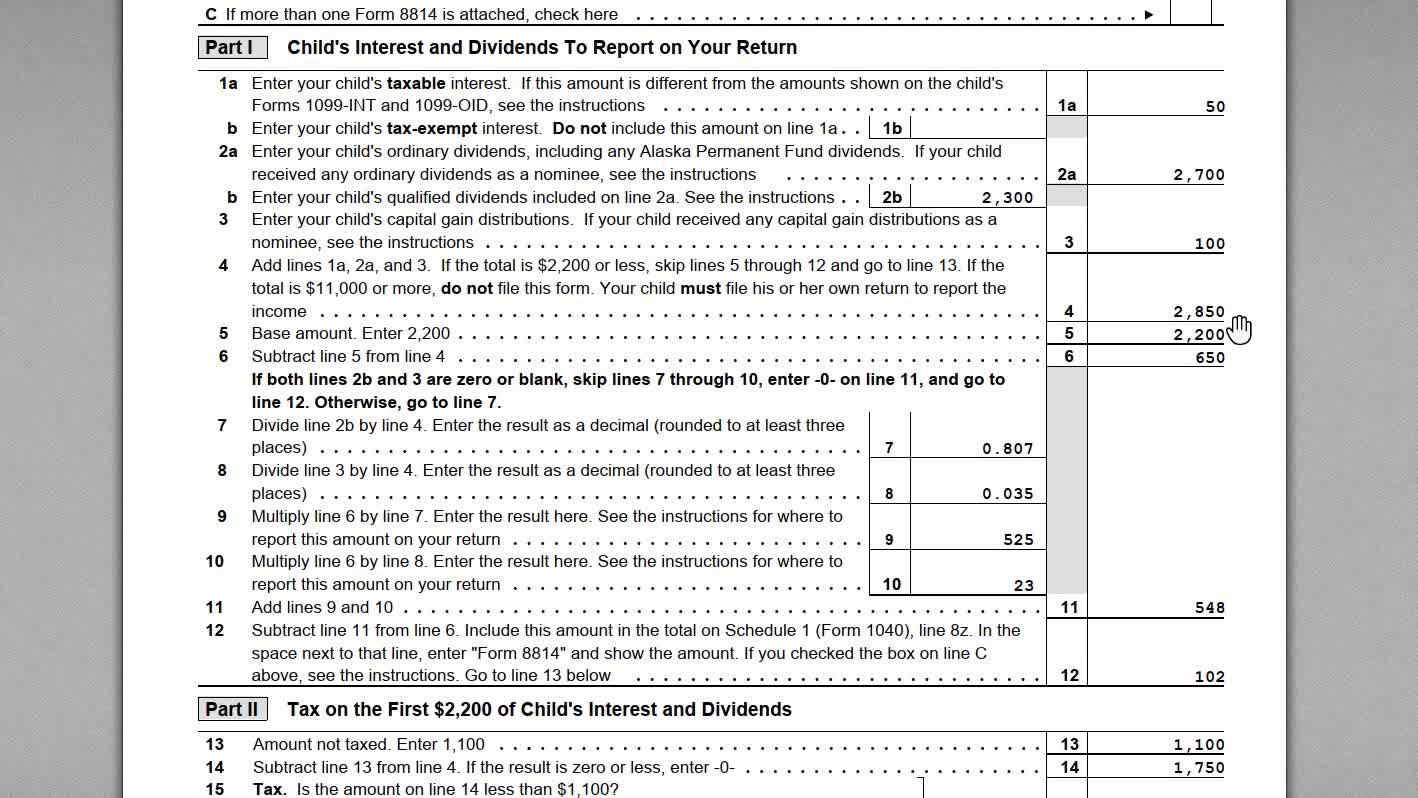

Form 8814 Parent's Election to Report Child's Interest and Dividends

8814 Form 2023

2019 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

How To File Form 1099nec On Turbotax Paul Johnson's Templates

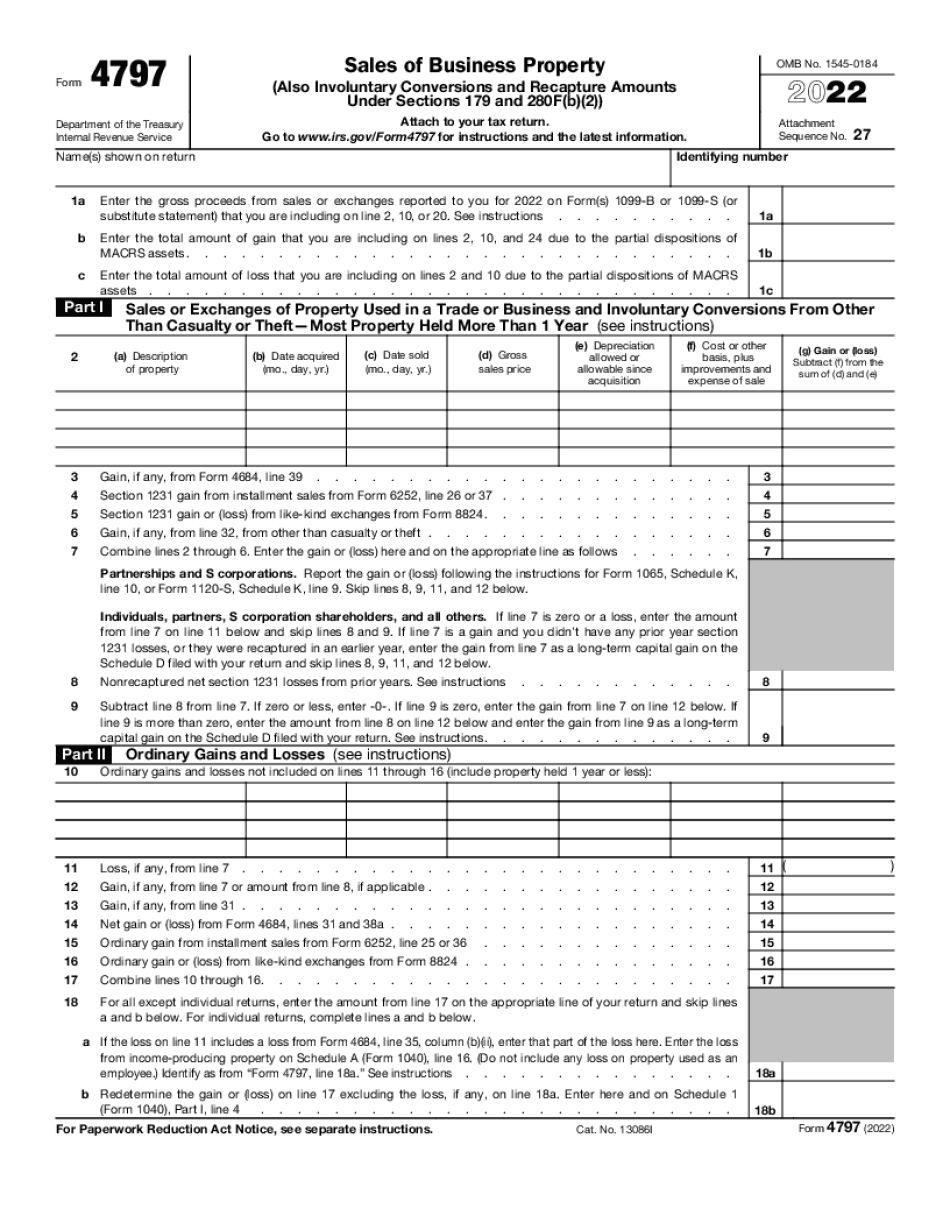

Form 4797 turbotax Fill online, Printable, Fillable Blank

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

How to Fill Out IRS Form 8814 (Election to Report Child's Interest

Solved Department of the TreasuryInternal Revenue Service

1095 C Form Turbotax Form Resume Examples EQBD32okXn

Related Post: