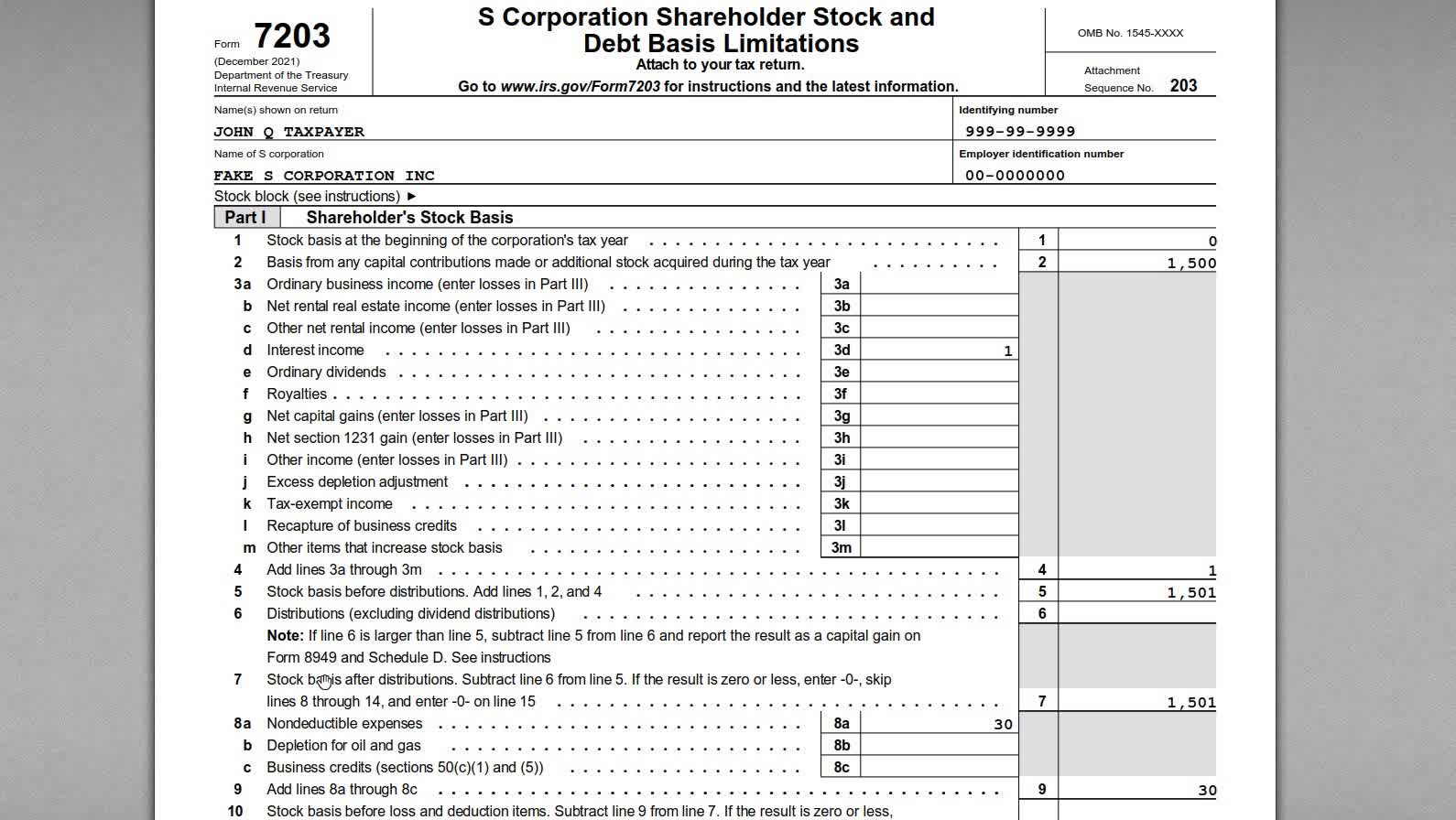

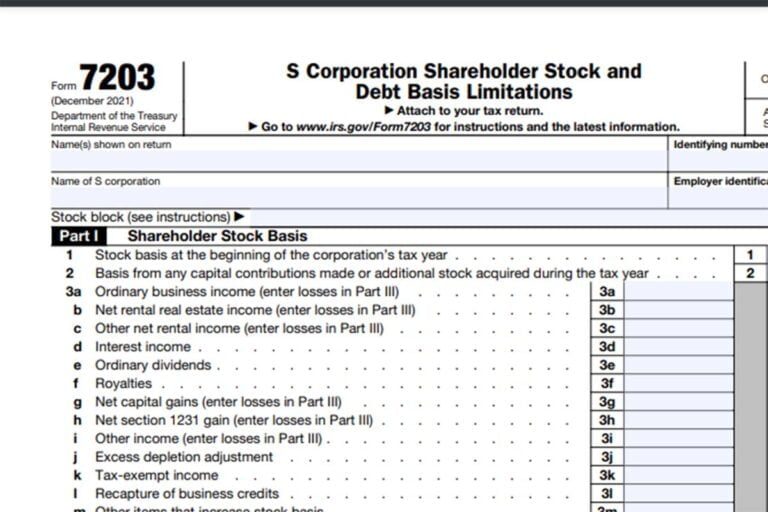

Irs Form 7203 Example

Irs Form 7203 Example - A stock block refers to the group of stocks you purchase each time. Get deals and low prices on irs tax forms at amazon Web you will enter 1 for the stock block if you have only purchased 1 block of stocks. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. In order to see this. In the information below, use of the word entry in bold means the preparer must enter the amount that goes on this line if it's. Complete, edit or print tax forms instantly. You can still force form 7203 to print. For example, the form 1040 page is at. The draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Net rental real estate income. You can still force form 7203 to print. Web shareholders should be sure to maintain records of their basis yearly, both for their own records and to keep a consistent calculation for the years that they will have. Web while the taxact program does not support form 7203 for 1040 returns, we do support the. Ad grab great deals and offers on forms & recordkeeping items at amazon. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. For example, the form 1040 page is at. Web shareholders should be sure to maintain records of their basis yearly, both for their own records. Web there are potential limitations on corporate losses that you can deduct on your return. Once the form is saved to your computer, go to the tab and click on the critical. Web forms, instructions and publications search. Web form 7203 is required when a shareholder of an s corporation sells shares, receives a payout, or receives a loan repayment. These limitations and the order in which you must apply them are as follows: The new form replaces the worksheet. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. Web there are potential limitations on corporate losses that you can deduct on your return. Web s corporation. A stock block refers to the group of stocks you purchase each time. Almost every form and publication has a page on irs.gov with a friendly shortcut. The draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Web form 7203 was released by the irs in december 2021 to keep track of stock and. These limitations and the order in which you must apply them are as follows: The form will open in a new tab, where you can save it to your computer. Almost every form and publication has a page on irs.gov with a friendly shortcut. The new form replaces the worksheet. Web s corporation shareholders use form 7203 to figure the. Web there are potential limitations on corporate losses that you can deduct on your return. Web up to 10% cash back draft form 7203 for 2022 includes few changes. For example, the form 1040 page is at. Web you will enter 1 for the stock block if you have only purchased 1 block of stocks. The new form replaces the. Web s corporation income taxation distributions & shareholder basis editor: Web instructions, and pubs is at irs.gov/forms. A ordinary business income (enter losses in part iii). Once the form is saved to your computer, go to the tab and click on the critical. Get deals and low prices on irs tax forms at amazon Web you will enter 1 for the stock block if you have only purchased 1 block of stocks. Web form 7203 is required when a shareholder of an s corporation sells shares, receives a payout, or receives a loan repayment from the company. The new form replaces the worksheet. A ordinary business income (enter losses in part iii). Web basis. The form will open in a new tab, where you can save it to your computer. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. A ordinary business income (enter losses in part iii). Web you will enter 1 for the stock block if you have only purchased. A stock block refers to the group of stocks you purchase each time. Ad grab great deals and offers on forms & recordkeeping items at amazon. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. Web you will enter 1 for the stock block if you have only purchased 1 block of stocks. For example, the form 1040 page is at. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web up to 10% cash back draft form 7203 for 2022 includes few changes. Web while the taxact program does not support form 7203 for 1040 returns, we do support the ability to attach the shareholder’s basis worksheet when required. Net rental real estate income. Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. In the information below, use of the word entry in bold means the preparer must enter the amount that goes on this line if it's. The draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Get deals and low prices on irs tax forms at amazon Try it for free now! Web shareholders should be sure to maintain records of their basis yearly, both for their own records and to keep a consistent calculation for the years that they will have. The irs recently released draft form 7203, s corporation. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Once the form is saved to your computer, go to the tab and click on the critical. The new form replaces the worksheet.How to Complete IRS Form 7203 S Corporation Shareholder Basis YouTube

National Association of Tax Professionals Blog

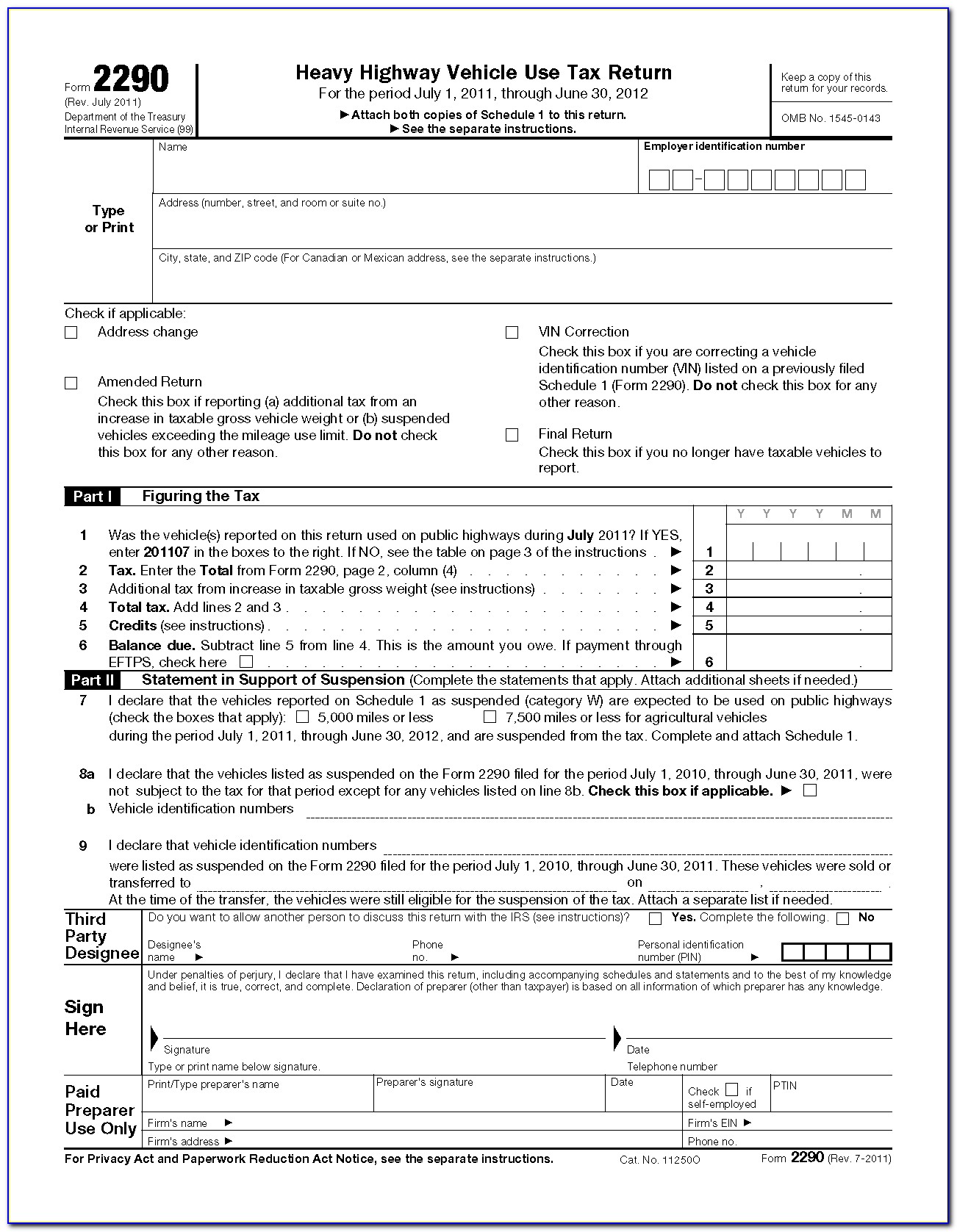

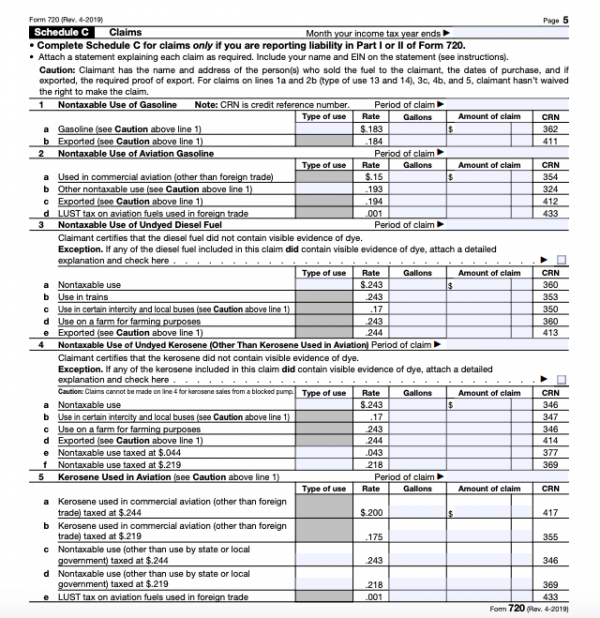

IRS Form 720 Instructions for the PatientCentered Research

Form 720 Instructions Where to Get IRS Form 720 and How to Fill It Out

S Corp Basis 7203 NEW IRS Form 7203 [S Corporation] Shareholder Stock

How to Complete IRS Form 7203 S Corporation Shareholder Basis

IRS Form 7203 Multiple Blocks of S Corporation Stock YouTube

Irs.gov Forms 941 Instructions Form Resume Examples Bw9jr5n97X

Irs Form 2290 Questions Form Resume Examples o86O7KlOBR

More Basis Disclosures This Year for S corporation Shareholders Need

Related Post:

![S Corp Basis 7203 NEW IRS Form 7203 [S Corporation] Shareholder Stock](https://i.ytimg.com/vi/EaPvB98yCZQ/maxresdefault.jpg)