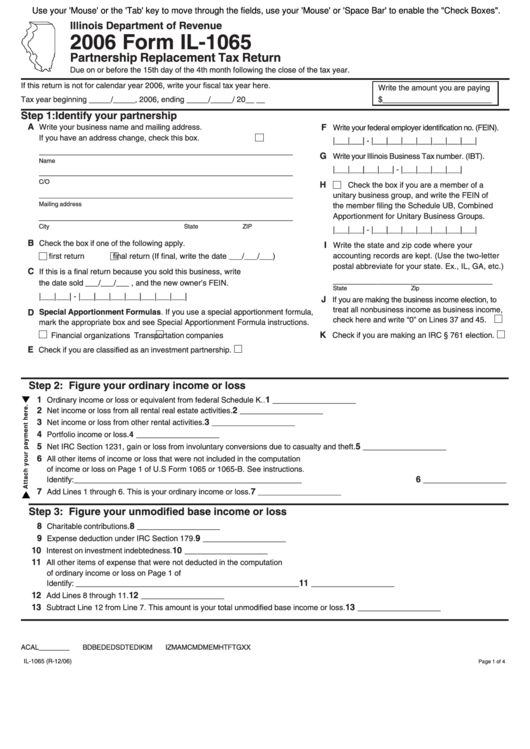

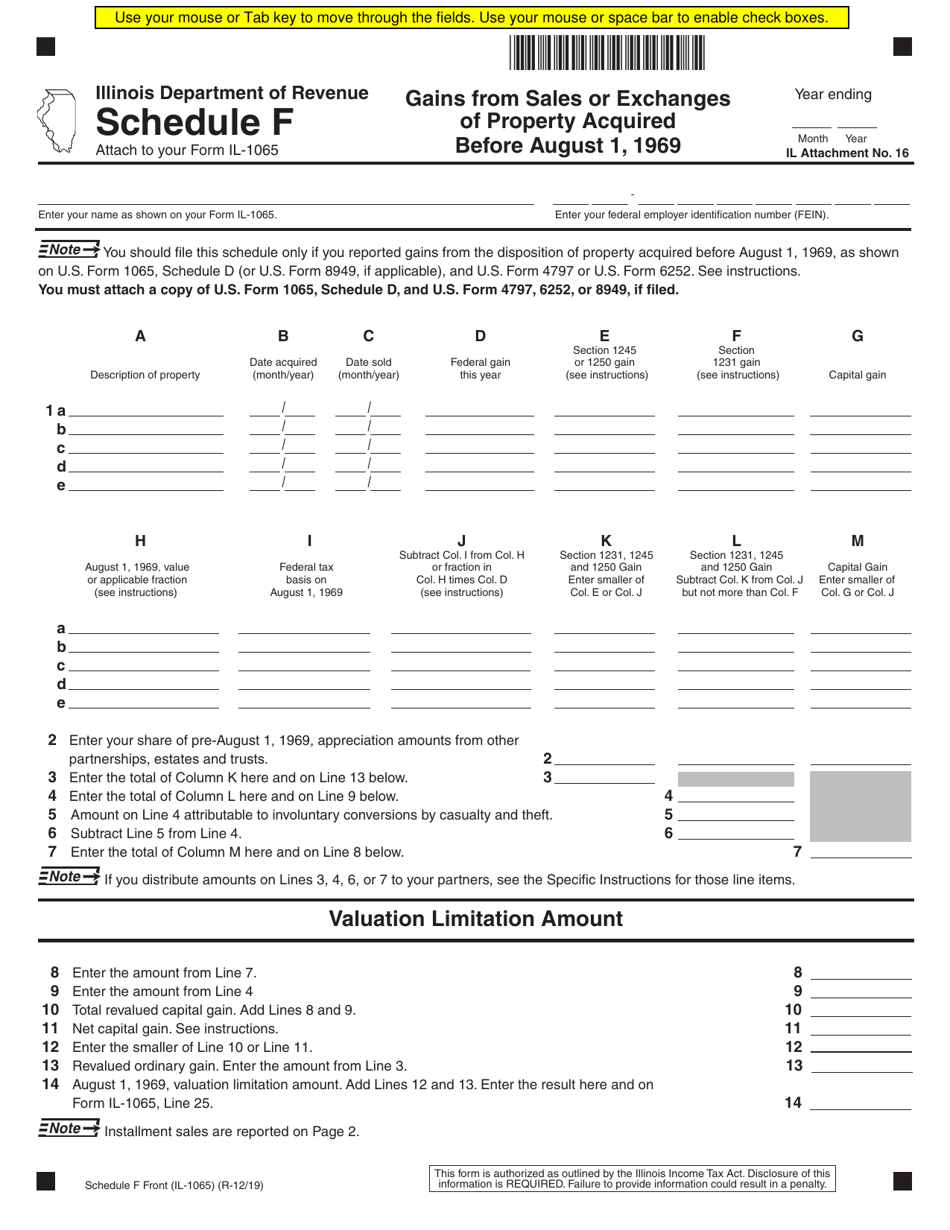

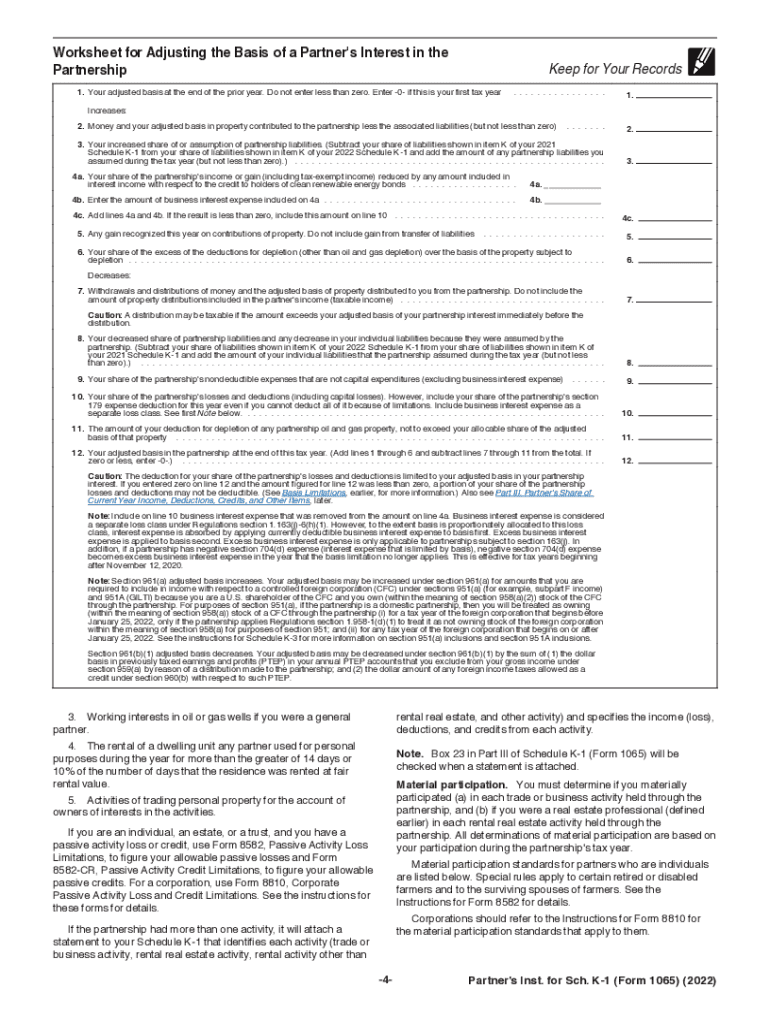

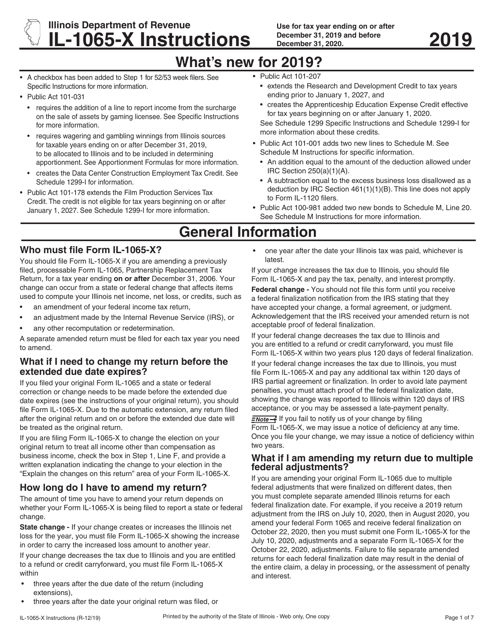

Il Form 1065

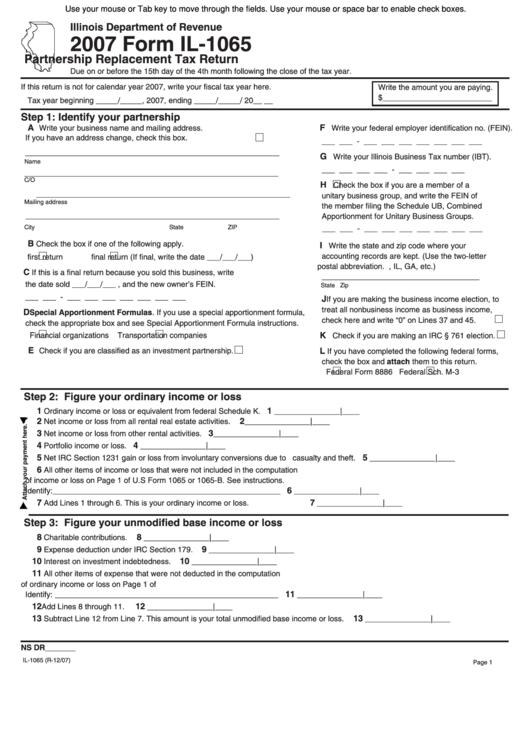

Il Form 1065 - For instructions and the latest. Web hit the get form option to start enhancing. Make your check or money order payable to “illinois department of revenue.” mail your completed voucher. Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. Get ready for tax season deadlines by completing any required tax forms today. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. Return of partnership income, including recent updates, related forms and instructions on how to file. Payment voucher for 2022 partnership replacement tax. Make sure the information you add to. Web where to file your taxes for form 1065. Enter your federal employer identification number (fein). Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. If this return is not for calendar year. Web hit the get form option to start enhancing. For tax years ending on or after december 31, 2021, and before. Payment voucher for 2022 partnership replacement tax. Review the pte worksheet to the. Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. Web hit the get form option to start enhancing. Make your check or money order payable to “illinois department of revenue.” mail your completed voucher. Activate the wizard mode in the top toolbar to get more recommendations. Enter your federal employer identification number (fein). Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. If this return is not for calendar year 2022, enter your fiscal tax year here. For tax years ending on or after. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. If this return is not for calendar year 2022, enter your fiscal tax year here. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Activate the wizard mode in the top toolbar to. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Make sure the information you add to. Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. Payment. Make sure the information you add to. Complete, edit or print tax forms instantly. Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Make your check or money order payable to “illinois department of revenue.” mail your completed voucher. Web use for tax year ending on or after. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Activate the wizard mode in the top toolbar to get more recommendations. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of. Enter your federal employer identification number (fein). Form 1065 is used to report the income of. Web use for tax year ending on or after. For tax years ending on or after december 31, 2021, and before. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. For tax years ending on or after december 31, 2021, and before. Web hit the get form option to start enhancing. Make sure the information you add to. Activate the wizard mode in the top toolbar to get more recommendations. The schedule was designed to provide. Make sure the information you add to. If this return is not for calendar year 2022, enter your fiscal tax year here. If this return is not for calendar year. Payment voucher for 2022 partnership replacement tax. If the partnership will be filing the return. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. Web hit the get form option to start enhancing. Activate the wizard mode in the top toolbar to get more recommendations. For tax years ending on or after december 31, 2021, and before. The schedule was designed to provide. Get ready for tax season deadlines by completing any required tax forms today. Return of partnership income, including recent updates, related forms and instructions on how to file. For a fiscal year or a short tax year, fill in the tax year. If this return is not for calendar year 2022, enter your fiscal tax year here. Department of the treasury internal revenue service. For instructions and the latest. Make your check or money order payable to “illinois department of revenue.” mail your completed voucher. Form 1065 is used to report the income of. If the partnership will be filing the return. Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. If this return is not for calendar year. Web where to file your taxes for form 1065. Make sure the information you add to. Web information about form 1065, u.s. Enter your federal employer identification number (fein).Fillable Form Il1065 Partnership Replacement Tax Return 2007

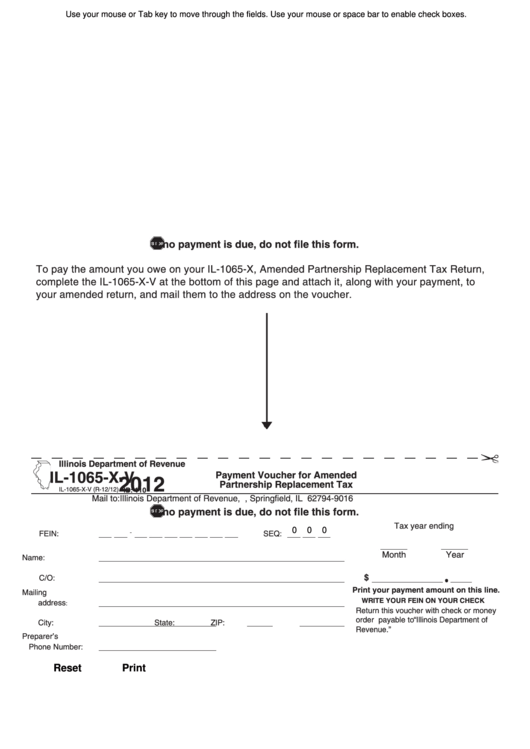

Fillable Form Il1065XV Payment Voucher For Amended Partnership

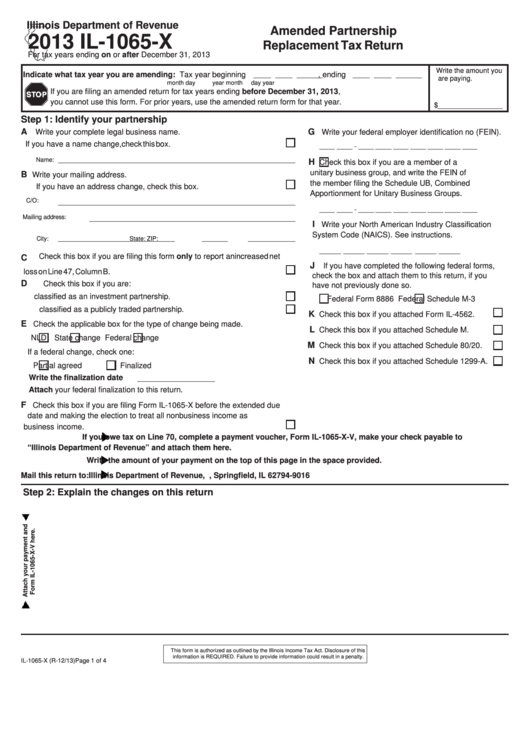

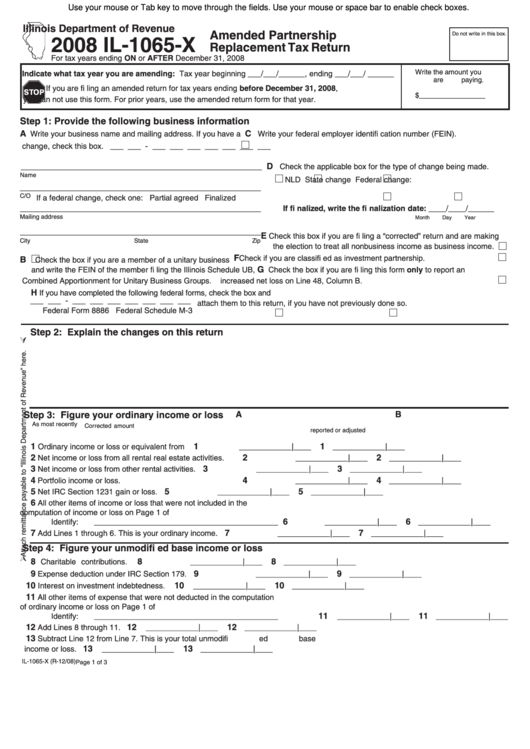

Fillable Form Il1065X Amended Partnership Replacement Tax Return

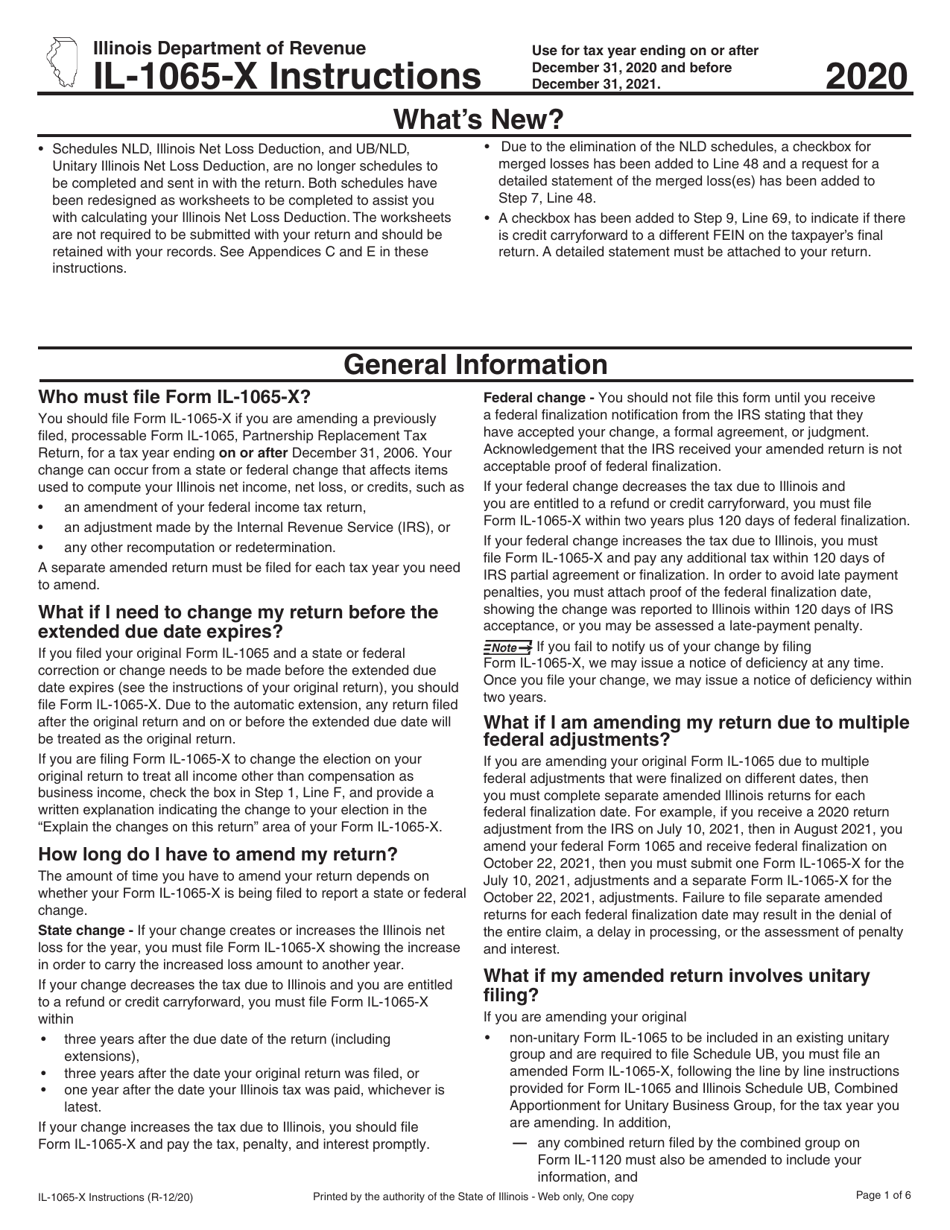

Download Instructions for Form IL1065X Amended Partnership

Fillable Form Il1065 Partnership Replacement Tax Return 2006

Form IL1065 Schedule F 2019 Fill Out, Sign Online and Download

How to fill out an LLC 1065 IRS Tax form

2017 Form 1065 Instructions Fill Out and Sign Printable PDF Template

Download Instructions for Form IL1065X ' amended Partnership

Fillable Form Il1065X Amended Partnership Replacement Tax Return

Related Post: