Irs Form 4835

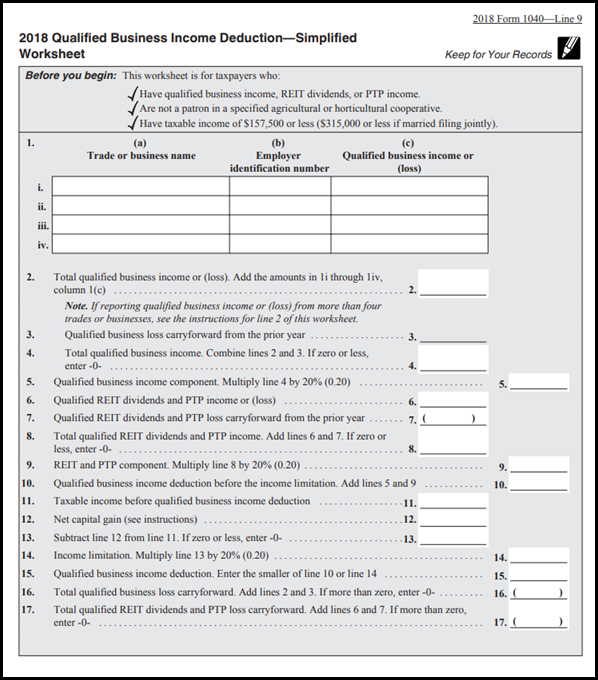

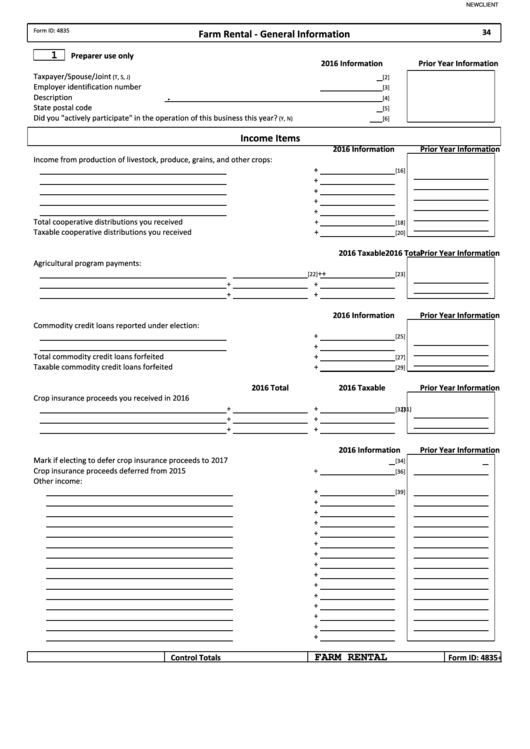

Irs Form 4835 - Do not use form 4835 if you. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for the 2024. Web up to $40 cash back form 4835 is used by farmers to report income and expenses related to farming activities. Web about form 4835, farm rental income and expenses. Farm rental income and expenses (crop and livestock shares (not cash) received by. Web how do i complete irs form 4835? Access irs forms, instructions and publications in electronic and print media. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. All forms individual forms information returns fiduciary. Save or instantly send your ready documents. Web to complete form 4835, from the main menu of the tax return (form 1040) select: Web how do i complete irs form 4835? Web about form 4835, farm rental income and expenses. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner. Save or. Web treasury/irs form 4835 department of the treasury internal revenue service. Web up to $40 cash back form 4835 is used by farmers to report income and expenses related to farming activities. Web forms, instructions and publications search. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash). Easily fill out pdf blank, edit, and sign them. Get ready for tax season deadlines by completing any required tax forms today. This is from the general instructions for irs form 4835; Access irs forms, instructions and publications in electronic and print media. Web how do i complete irs form 4835? This is from the general instructions for irs form 4835; Web treasury/irs form 4835 department of the treasury internal revenue service. Web up to $40 cash back form 4835 is used by farmers to report income and expenses related to farming activities. Web the “annual rental payments” are not rentals from real estate and should not be reported on form. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. Here are the steps to fill out form 4835: Web form 4835 to report rental income based on crop or livestock shares produced by a tenant if you didn't materially participate in. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner. Web earned income from a farm goes on schedule f which is subject to se tax. Web about form 4835, farm rental income and expenses. Web form 4835 department of the treasury internal revenue service. You can download or print. Web to complete form 4835, from the main menu of the tax return (form 1040) select: 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for the 2024. Farm rental income and expenses (crop and livestock shares (not cash) received by.. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web earned income from a farm goes on schedule f which is subject to se tax. Ad download or email irs 4835 & more fillable forms, register and subscribe now! 17, 2023 —. Get ready for tax season deadlines by completing any required tax forms today. Web forms, instructions and publications search. You can download or print. Web up to $40 cash back form 4835 is used by farmers to report income and expenses related to farming activities. Access irs forms, instructions and publications in electronic and print media. Web about form 4835, farm rental income and expenses. Web form 4835 to report rental income based on crop or livestock shares produced by a tenant if you didn't materially participate in the management or operation of a farm. Get ready for tax season deadlines by completing any required tax forms today. Web form 4835 department of the treasury internal. Web the “annual rental payments” are not rentals from real estate and should not be reported on form 4835, farm rental income and expenses, or schedule e,. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner. Web treasury/irs form 4835 department of the treasury internal revenue service. This is from the general instructions for irs form 4835; Ad download or email irs 4835 & more fillable forms, register and subscribe now! Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner. Use screen 4835 on the. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Here are the steps to fill out form 4835: Access irs forms, instructions and publications in electronic and print media. You can download or print. Web form 4835 department of the treasury internal revenue service farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner. Web about form 4835, farm rental income and expenses. All forms individual forms information returns fiduciary. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for the 2024. Web form 4835 to report rental income based on crop or livestock shares produced by a tenant if you didn't materially participate in the management or operation of a farm. Web up to $40 cash back form 4835 is used by farmers to report income and expenses related to farming activities. Web forms, instructions and publications search. Web up to $40 cash back 2014 4835 form.Section 199a Information Worksheet

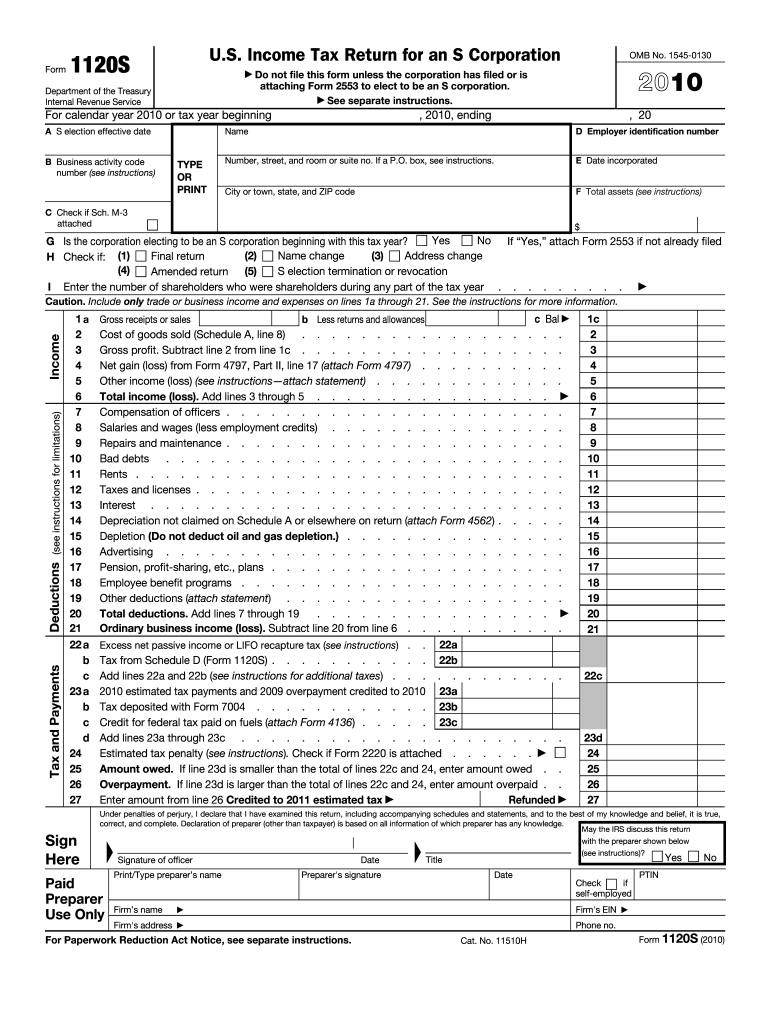

2010 Form IRS 1120SFill Online, Printable, Fillable, Blank pdfFiller

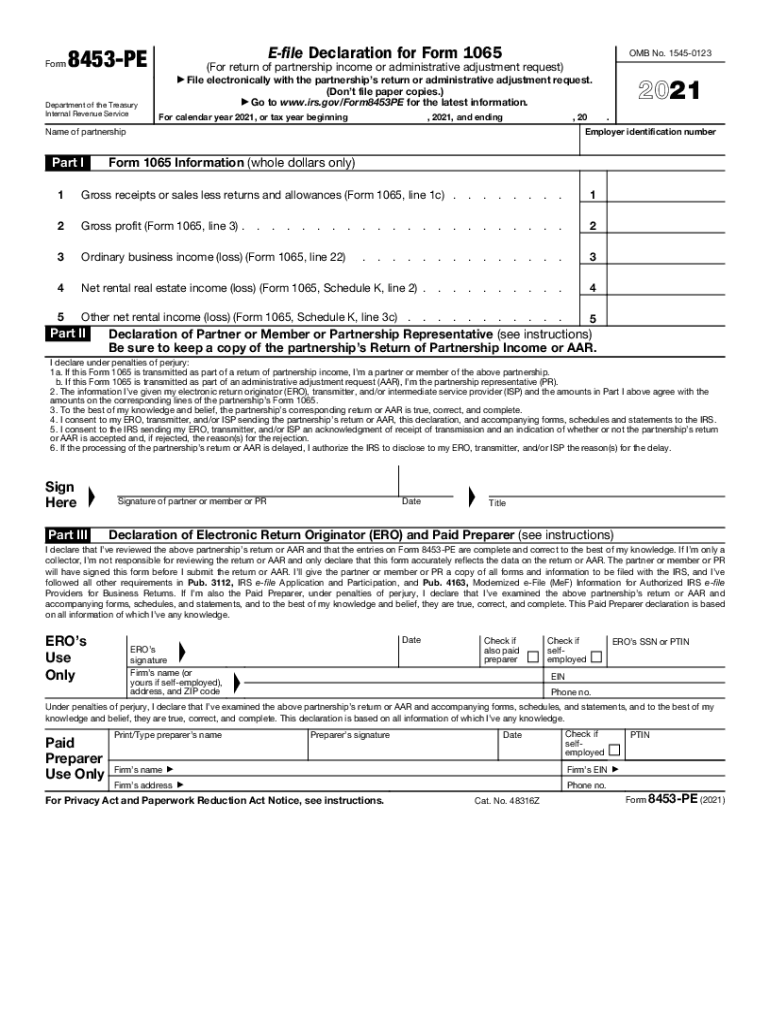

2021 Internal Revenue Service Form Fill Out and Sign Printable PDF

Top 13 Form 4835 Templates free to download in PDF format

IRS Form 4835 walkthrough (Farm Rental & Expenses) YouTube

Fill Free fillable F4835 Accessible 2019 Form 4835 PDF form

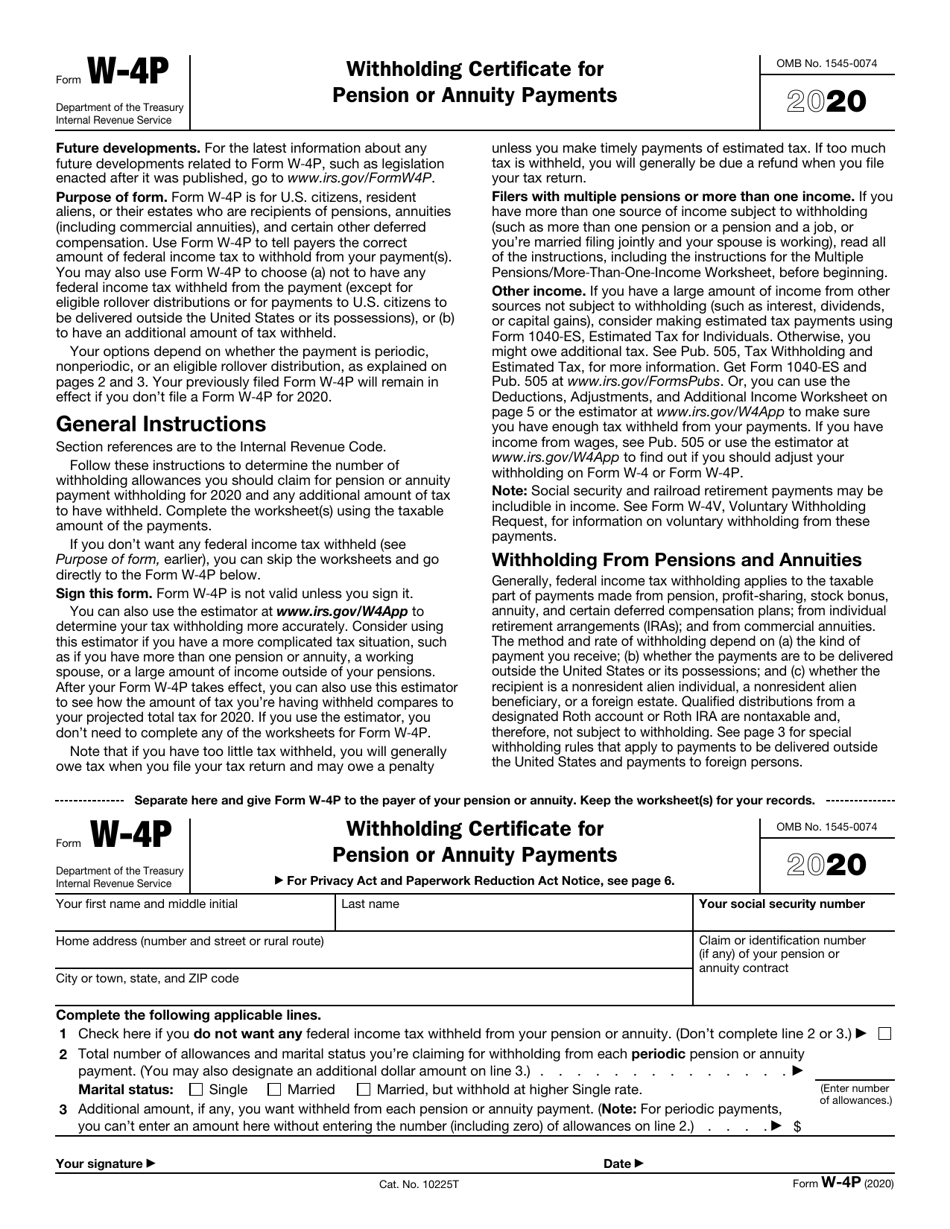

U.S. TREAS Form treasirs48352000

Irs Form W 4p Download Fillable Pdf Or Fill Online Free Nude Porn Photos

2019 Form IRS 4835 Fill Online, Printable, Fillable, Blank PDFfiller

Form 4835Farm Rental and Expenses

Related Post: