2210 Form Instructions

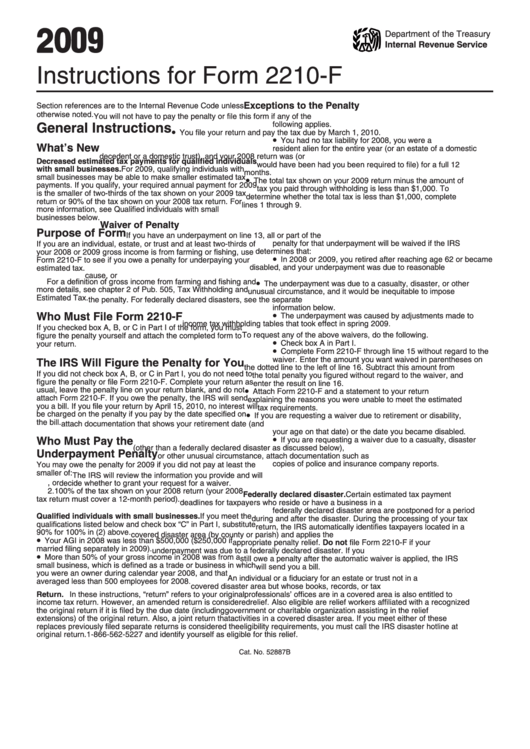

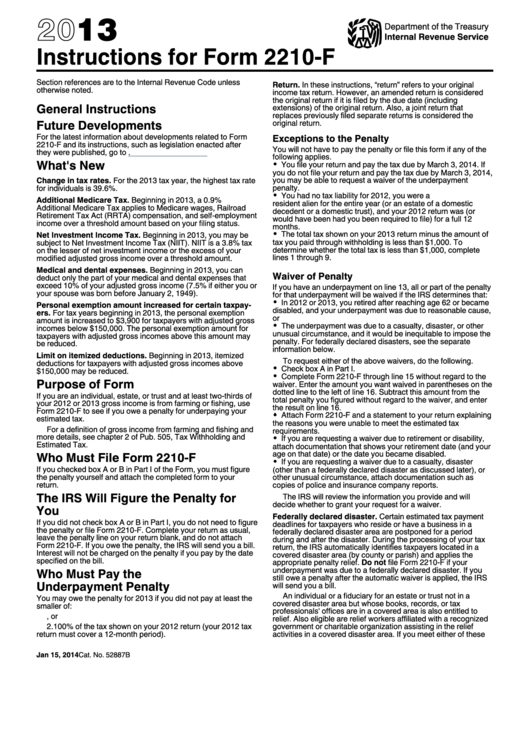

2210 Form Instructions - Special rules for farmers, fishermen, and : Underpayment of estimated tax by individuals, estates, and trusts. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Part ii reasons for filing. Department of the treasury internal revenue service. What is the purpose of this form? Your income varies during the year. What is irs form 2210? Section references are to the internal revenue code unless otherwise. Section references are to the internal revenue code unless otherwise noted. What is irs form 2210? How do i avoid tax underpayment penalty? Learn about form 2210 and penalties for underpayment of estimated taxes here. This form contains both a short. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a. What is the purpose of this form? This form contains both a short. Special rules for farmers, fishermen, and : You should figure out the amount of tax you have underpaid. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Underpayment of estimated tax by individuals, estates, and trusts. Underpayment of estimated tax by individuals, estates, and trusts. How do i avoid tax underpayment penalty? Department of the treasury internal revenue service. Waiver (see instructions) of your entire penalty. Special rules for farmers, fishermen, and : The form doesn't always have to be. What is the purpose of this form? Web instructions for form 2210. What is irs form 2210? Underpayment of estimated tax by individuals, estates, and trusts. You must check this box and file page 1 of form 2210, but you are not required to figure your. Section references are to the internal revenue code unless otherwise noted. Web what is form 2210 underpayment penalty? Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts. Section references are to the internal revenue code unless otherwise noted. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Your income varies during the year. This form allows you to figure penalties you may owe if you did not make timely. Web form 2210 (or form 2220 for corporations) will help you determine the. Web instructions for form 2210. Department of the treasury internal revenue service. You should figure out the amount of tax you have underpaid. Department of the treasury internal revenue service. Instructions for form 2210 (2022) underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. Department of the treasury internal revenue service. This form contains both a short. Waiver (see instructions) of your entire. Underpayment of estimated tax by individuals, estates, and trusts. Waiver (see instructions) of your entire. Web what is form 2210 underpayment penalty? Underpayment of estimated tax by individuals, estates, and trusts. Special rules for farmers, fishermen, and : Part ii reasons for filing. What is irs form 2210? Special rules for farmers, fishermen, and : Section references are to the internal revenue code unless otherwise. Underpayment of estimated tax by individuals, estates, and trusts. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. What is irs form 2210? Web file only page 1 of form 2210. You must check this box and file page 1 of form 2210, but you are not required to figure your. Part ii reasons for filing. This form allows you to figure penalties you may owe if you did not make timely. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. 12/22) underpayment of estimated income tax by individuals, trusts, and estates. Underpayment of estimated tax by individuals, estates, and trusts. Underpayment of estimated tax by individuals, estates, and trusts. This form contains both a short. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. Learn about form 2210 and penalties for underpayment of estimated taxes here. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Section references are to the internal revenue code unless otherwise. Underpayment of estimated tax by individuals, estates, and trusts. Section references are to the internal revenue code unless otherwise noted. Web what is form 2210 underpayment penalty? Web instructions for form 2210.Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

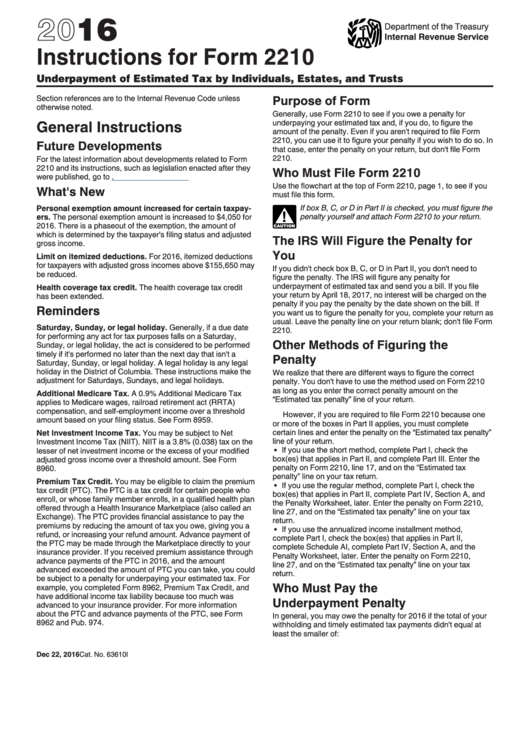

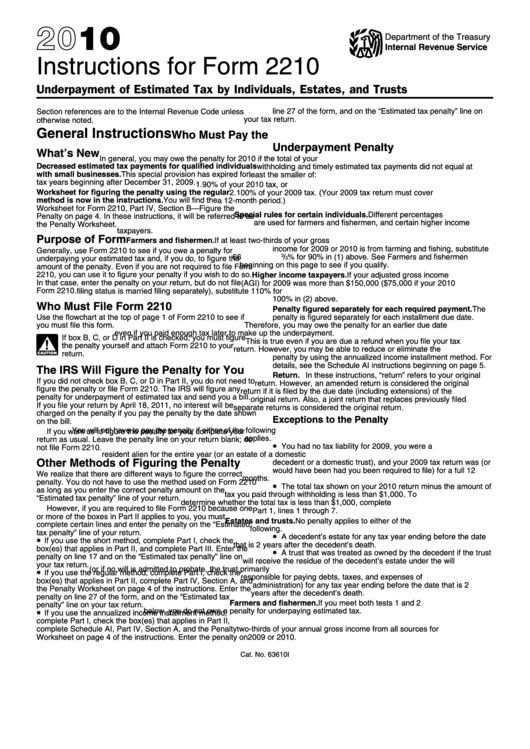

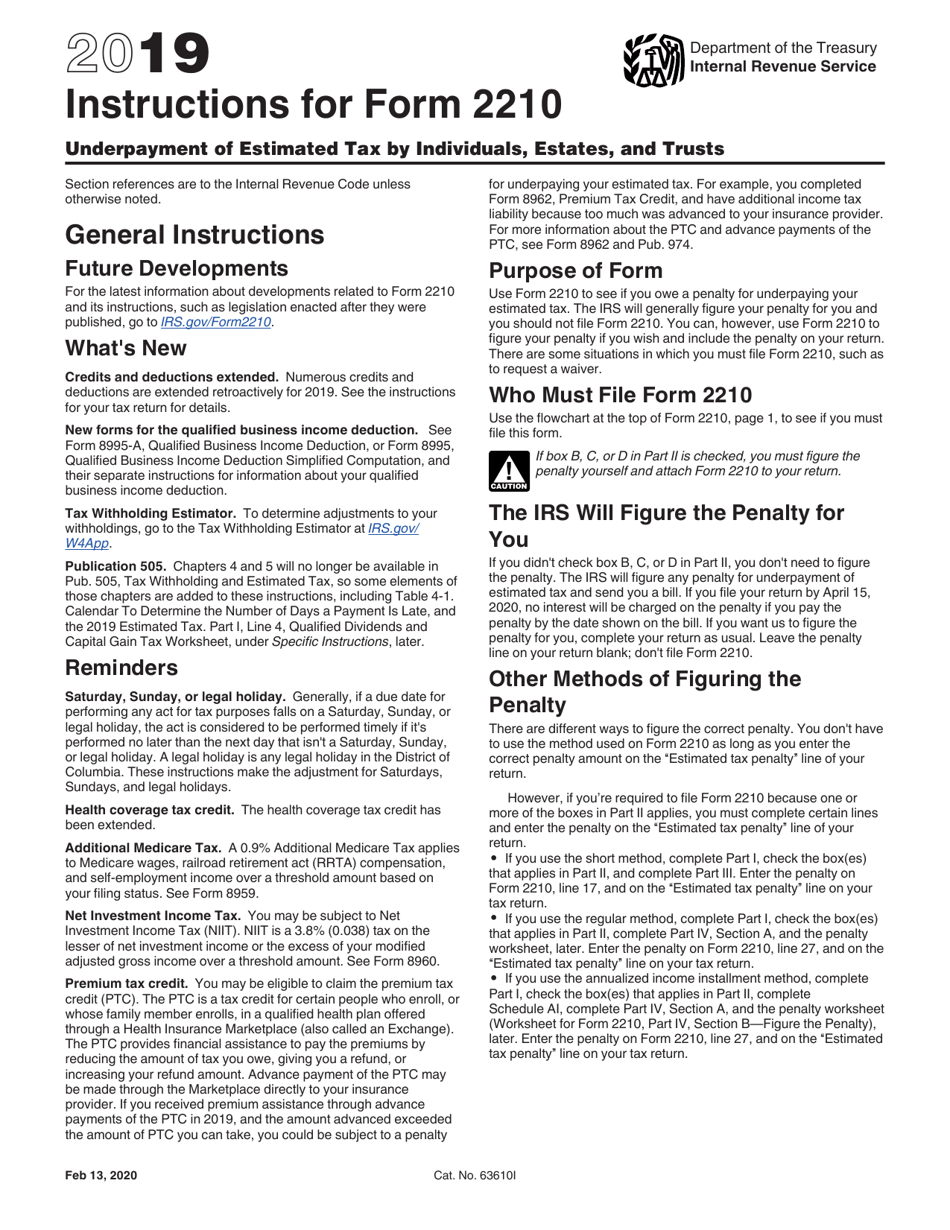

Instructions For Form 2210 Underpayment Of Estimated Tax By

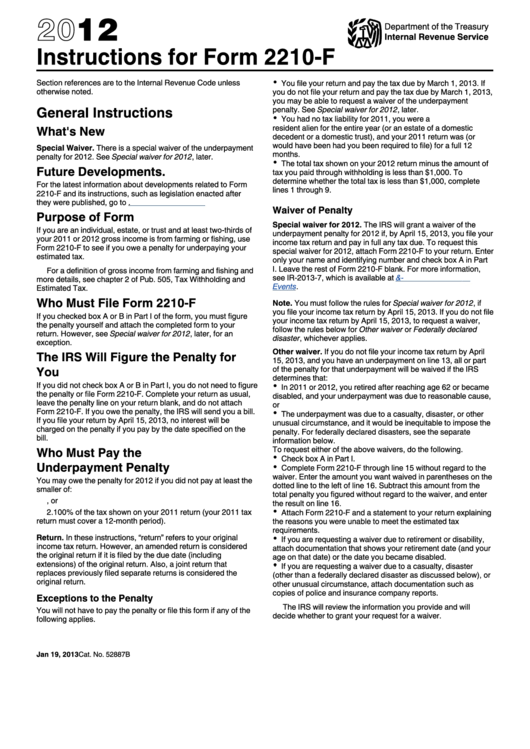

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

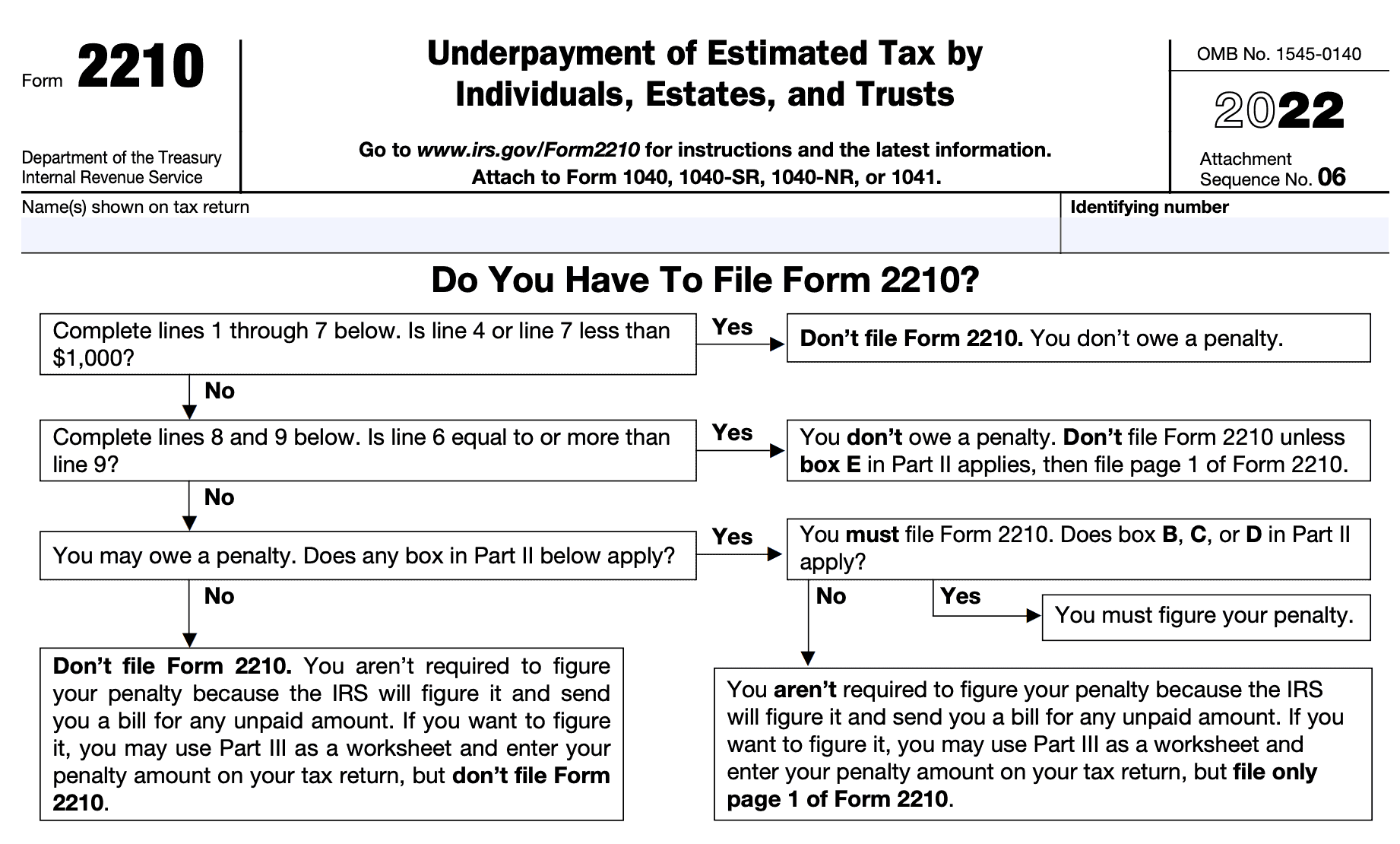

Download Instructions for IRS Form 2210 Underpayment of Estimated Tax

IRS Form 2210 Instructions Underpayment of Estimated Tax

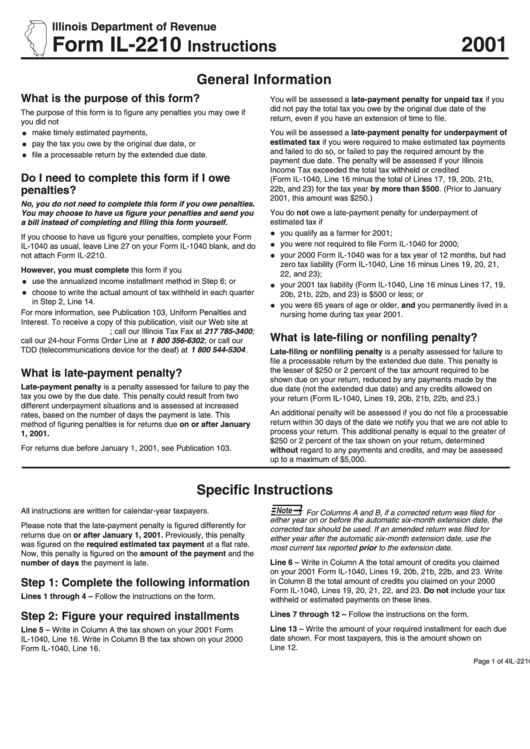

Form Il2210 Instructions 2001 printable pdf download

Instructions for Form 2210 (2022)Internal Revenue Service Fill out

Fillable Online 2005 IL2210 Form IL2210 Instructions FormSend Fax

Related Post: