Instructions Form 4562

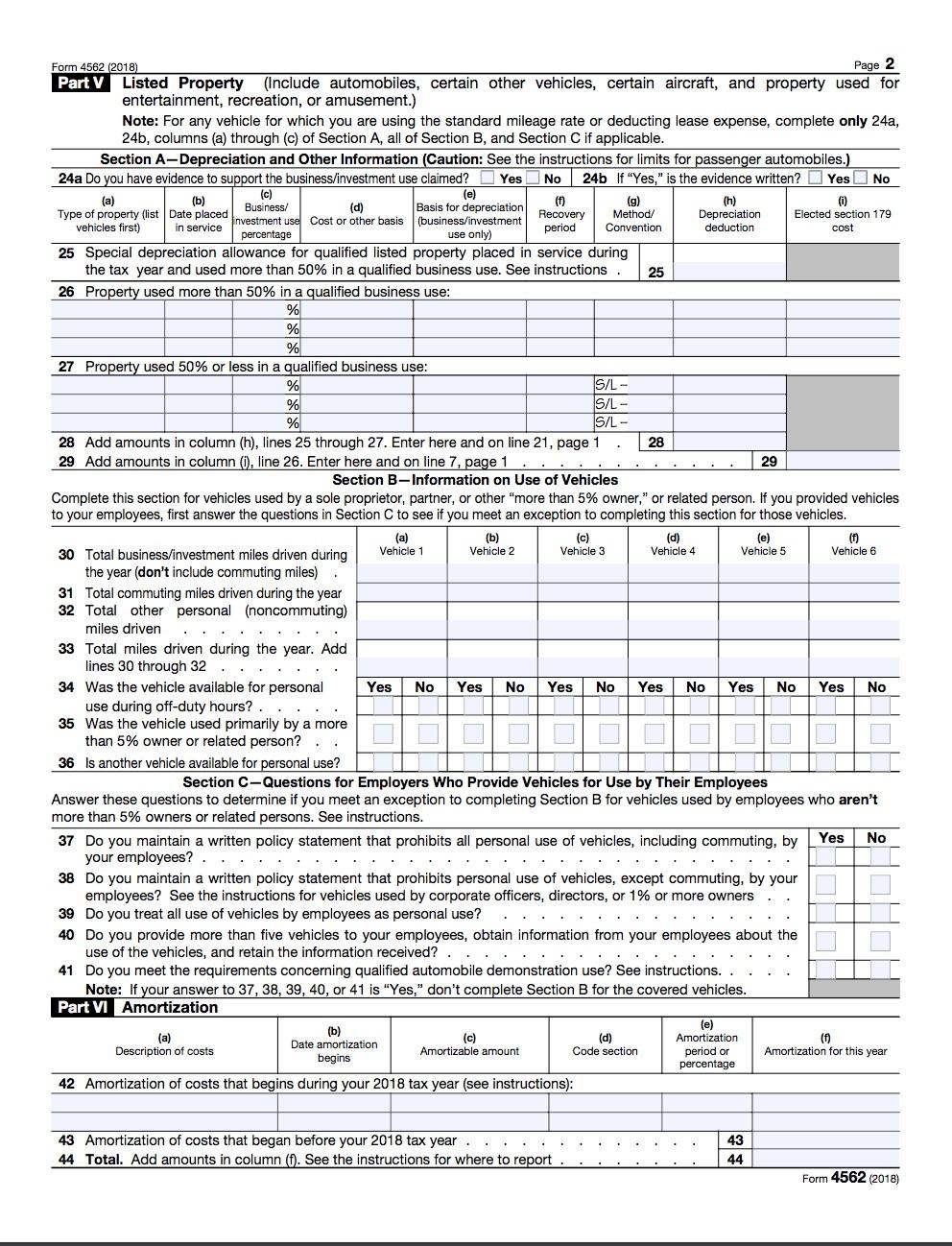

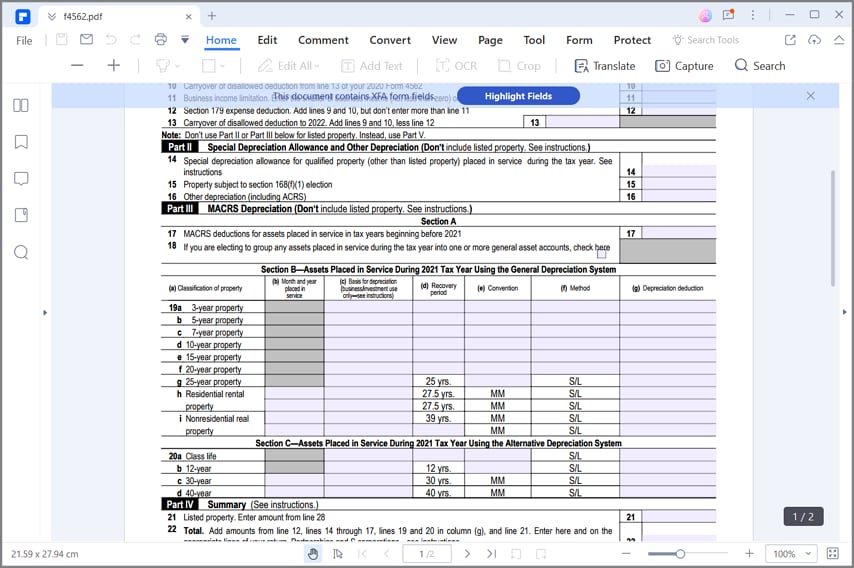

Instructions Form 4562 - Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. You must make section 179 election on irs form 4562. Irs suggests submitting one form 4562 per business or activity included on your tax return. Web the awesome s'witty kiwi show. General instructions purpose of form use form 4562 to: Upload, modify or create forms. When you enter depreciable assets—vehicles, buildings, farm. Ad get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web use worksheet 1 provided in the form 4562 instructions to determine the amount entered on line 1. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. To complete form 4562, you'll need to know the. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property). See the instructions for lines 20a through 20d, later. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. To complete form 4562, you'll need to know the. If you are claiming any of the following,. Form 4562 is used to. Web common questions for form 4562 in proseries. Web instructions for form 4562 (rev. Irs suggests submitting one form 4562 per business or activity included on your tax return. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. You must make section 179 election on irs form 4562. Web general instructions purpose of form use form 4562 to: Web the new rules allow for 100% bonus expensing of assets that are new or used. Generally,. Web irs form 4562 is used to calculate and claim deductions for depreciation and amortization. Web general instructions purpose of form use form 4562 to: Keep copies of all paperwork to support the claim. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. If you are claiming any of the following,. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web instructions for form 4562 (rev. Upload, modify or create forms. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Get ready for tax season deadlines by completing any required tax forms today. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. To complete form 4562, you'll need to know the. Web the new rules allow for 100% bonus expensing of assets that are new or. Web who must file form 4562? Get ready for tax season deadlines by completing any required tax forms today. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Generally, the maximum section 179 expense deduction is $1,050,000 for. Solved • by intuit • 3 • updated 1 year. Try it for free now! Web use worksheet 1 provided in the form 4562 instructions to determine the amount entered on line 1. Get answers to frequently asked questions about form 4562 and. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to. Keep copies of all paperwork to support the claim. If you are claiming any of the following,. Get answers to frequently asked questions about form 4562 and. Form 4562 is used to. Get ready for tax season deadlines by completing any required tax forms today. General instructions purpose of form use form 4562 to: Irs suggests submitting one form 4562 per business or activity included on your tax return. You must make section 179 election on irs form 4562. Web who must file form 4562? Web common questions for form 4562 in proseries. Web use worksheet 1 provided in the form 4562 instructions to determine the amount entered on line 1. Web the new rules allow for 100% bonus expensing of assets that are new or used. Web irs form 4562 is used to calculate and claim deductions for depreciation and amortization. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to. Learn how to fill out form 4562 step by step. When you enter depreciable assets—vehicles, buildings, farm. Read and follow the directions for every section, by recording the value as directed on the form 4562. To complete form 4562, you'll need to know the. Ad access irs tax forms. Web instructions for form 4562 (rev. Try it for free now! Web the awesome s'witty kiwi show. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Get ready for tax season deadlines by completing any required tax forms today. See the instructions for lines 20a through 20d, later.Form 4562 Depreciation And Amortization Worksheet

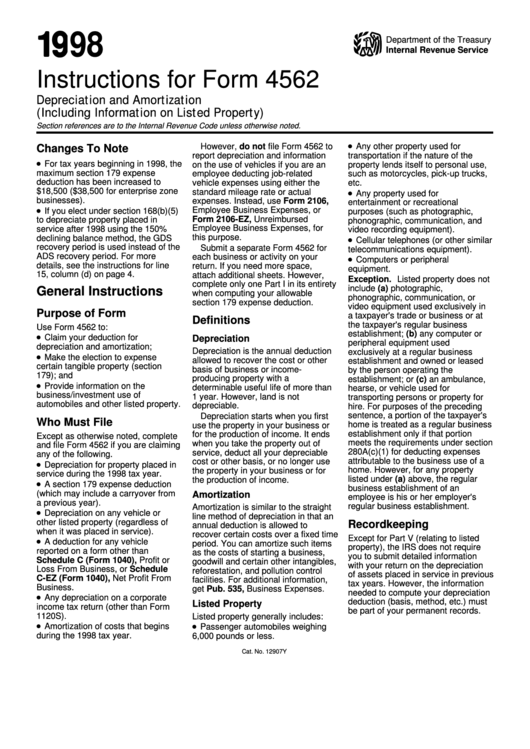

Instructions for Form 4562 (2022) Internal Revenue Service

Irs Form 4562 Instructions 2014 prosecution2012

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

2012 Form 4562 Instructions Universal Network

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

4562 Form 2022 2023

About Form 4562, Depreciation and Amortization IRS tax forms

for Fill how to in IRS Form 4562

2017 instructions 4562 form Fill out & sign online DocHub

Related Post: