Instructions For Form 4797

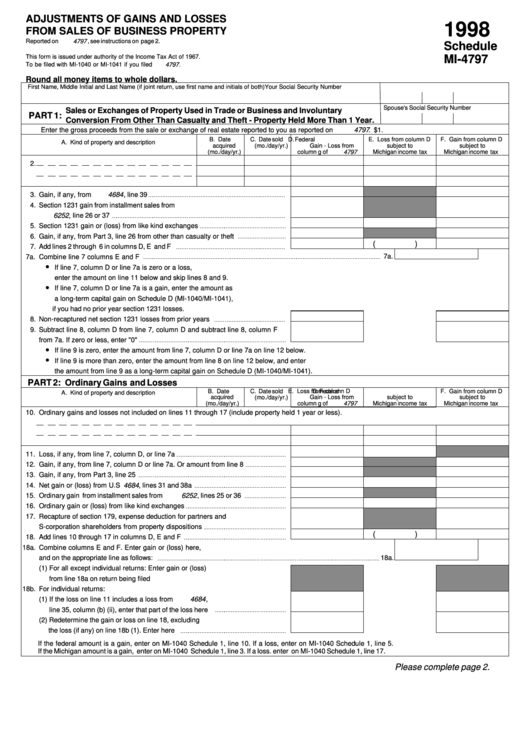

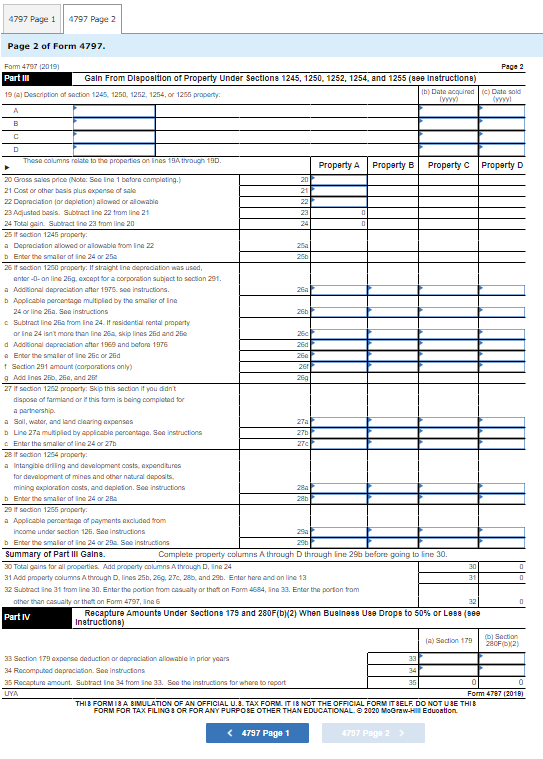

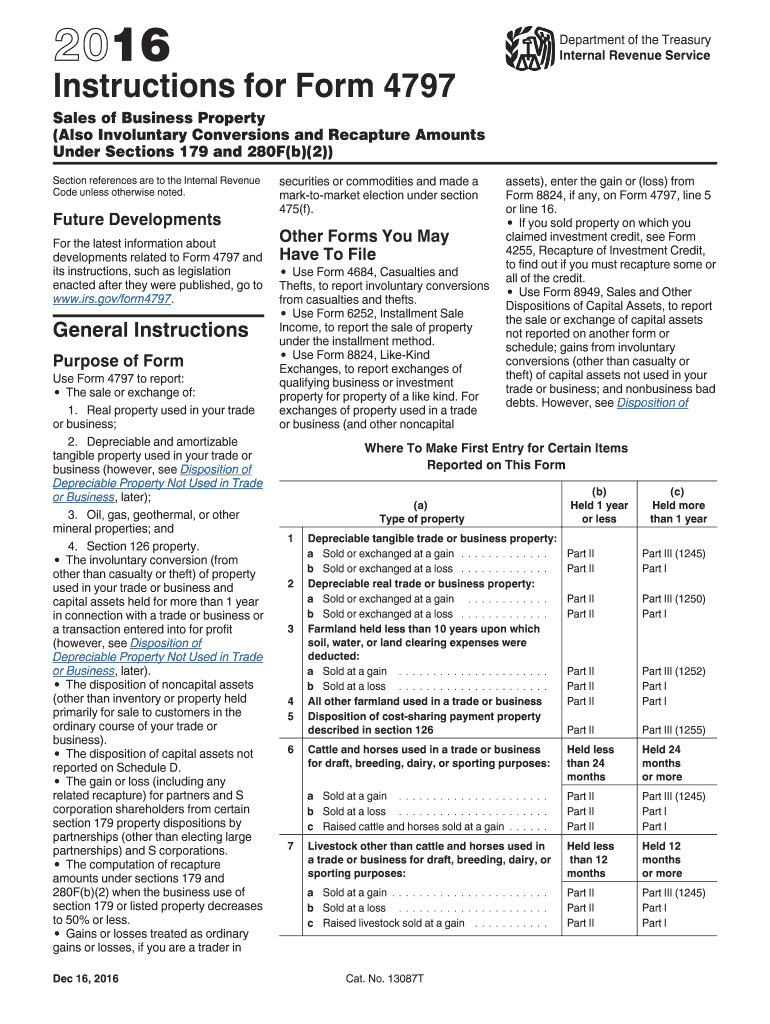

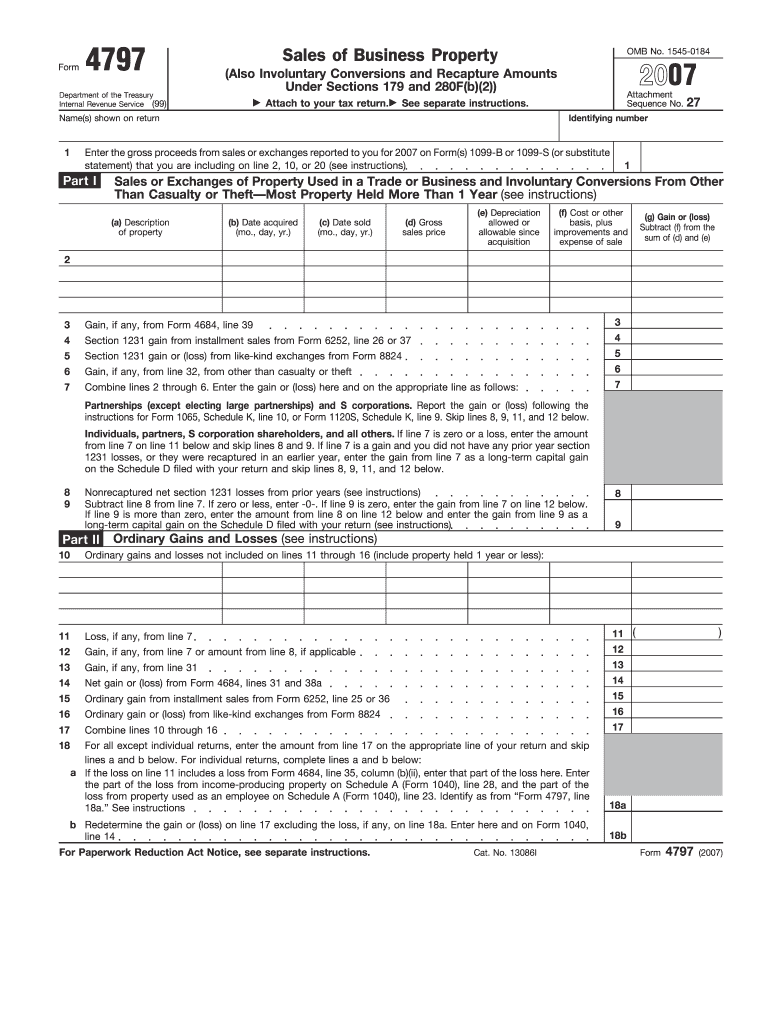

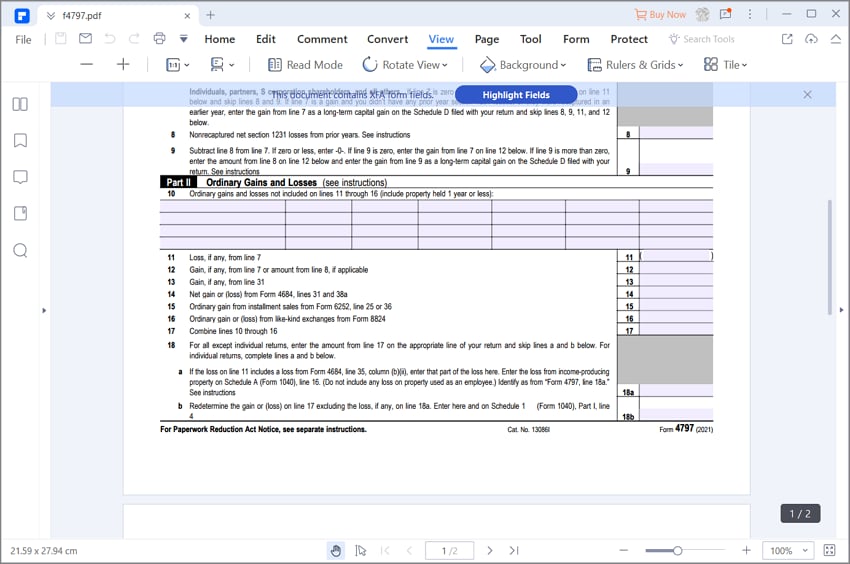

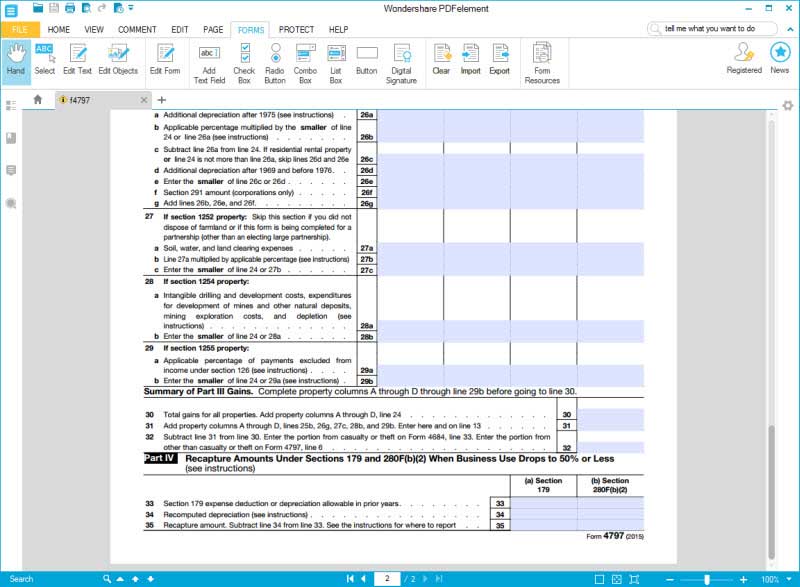

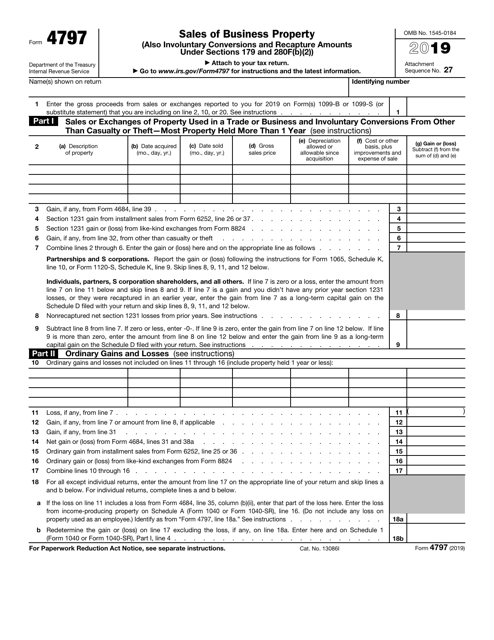

Instructions For Form 4797 - Get ready for tax season deadlines by completing any required tax forms today. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. • report the amount from line 1 above on form 4797, line 20; Web the disposition of each type of property is reported separately in the appropriate part of form 4797 sales of business property (for example, for property held more than one. General instructions purpose of form. Real property used in your trade or business. Web select take to my tax return, search for 4797, sale of business property (use this exact phrase) and then choose the jump to link in the search results. Use part iii of form 4797 to figure the amount of ordinary income recapture. Web 4797 form sales of business property omb no. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Form 6252, lines 1 through 4; Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web complete form 4797, line 19, columns (a), (b), and (c); Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Web according to the irs instructions for form 4797, you should file this form with your return if you sold or exchanged any: Get ready for tax season deadlines by completing any required tax forms today. Web. General instructions purpose of form. Web select take to my tax return, search for 4797, sale of business property (use this exact phrase) and then choose the jump to link in the search results. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer. Taxpayers use them to report gains on property sales. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Real property used in your trade or business. Complete, edit or print tax forms instantly. Web assets on form 4797, part i, ii, or iii, as applicable. Real property used in your trade or business. Web according to the irs instructions for form 4797, you should file this form with your return if you sold or exchanged any: Report the gain or (loss) following the instructions for form 1065, schedule. Form 6252, lines 1 through. Web 4797 form sales of business property omb no. Or form 8824, parts i and ii. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Or form 8824, line 12 or 16. Complete, edit or print tax. Web complete form 4797, line 19, columns (a), (b), and (c); First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Ad get ready for tax season deadlines by completing any required tax forms today. Form 6252, lines 1 through 4; Or form 8824, parts i and. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Web enter the amount in ordinary gain (loss) to be reported on 4797, line 10, or in passive ordinary gain (loss) to be reported on 4797, line 10. Web form 4797 department of the treasury internal revenue. Or form 8824, parts i and ii. Ad get ready for tax season deadlines by completing any required tax forms today. An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. Web according to the irs instructions for form 4797, you should file. Web complete form 4797, line 19, columns (a), (b), and (c); Web form 4797 department of the treasury. Web 4797 form sales of business property omb no. Web form 4797 department of the treasury internal revenue service sales of business property. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Taxpayers use them to report gains on property sales. Or form 8824, line 12 or 16. Real property used in your trade or business. Web the disposition of each type of property is reported separately in the appropriate part of form 4797 sales of business property (for example, for property held more than one. Get ready for tax season deadlines by completing any required tax forms today. Web these two forms share one common trait: Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Or form 8824, parts i and ii. Web the irs form 4797 is a tax form distributed by the irs that is used to report the income generated by the sale or exchange of a business property. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. • involuntary conversion of a portion of a macrs asset other than from a casualty or. The recapture amount is included on line 31 (and line 13) of form 4797. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. • report the amount from line 2 above. Form 6252, lines 1 through 4;Fillable Schedule Mi4797 Adjustments Of Gains And Losses From Sales

Complete Moab Inc S Form 4797 For The Year Aulaiestpdm Blog

4797 Instructions Form Fill Out and Sign Printable PDF Template signNow

IRS Form 4797 Instructions Sales of Business Property

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Instructions for Form 4797 Internal Revenue Service Fill Out and Sign

Formulário IRS 4797 Guia de como preencher o formulário IRS 4797

IRS Form 4797 Instructions Sales of Business Property

IRS Form 4797 Guide for How to Fill in IRS Form 4797

IRS Form 4797 Download Fillable PDF or Fill Online Sales of Business

Related Post: