Form Mi 1040Cr 7

Form Mi 1040Cr 7 - Both pages find the following information on this website: Web include form 5049) 7. Michigan department of treasury (rev. Improve the way you take care of legal papers management. You were a michigan resident at least six months of 2020. Form mi 5049, married, filing separately worksheet. Web 1 best answer. 2020 michigan home heating credit claim mi. *if you checked box “c,” enter dates of michigan residency in 2022. This form is for income earned in tax year 2022, with. Improve the way you take care of legal papers management. Type or print in blue or black ink. Web you may claim a property tax credit if all of the following apply: View all 98 michigan income tax forms see more Web video instructions and help with filling out and completing form mi 1040cr 7. Issued under authority of public act 281 of 1967, as amended. I did my taxes week ago, mi forms were unavailable for submission so printed mi forms on 19th, but few. Your homestead is located in michigan. Both pages find the following information on this website: Web you may claim a property tax credit if all of the following apply: June 7, 2019 4:23 pm. Homestead property tax credit claim: Web video instructions and help with filling out and completing form mi 1040cr 7. 2020 michigan home heating credit claim mi. The deadline for submitting this form is september 30, 2023. Homestead property tax credit claim for veterans and blind people: View all 98 michigan income tax forms see more Form mi 5049, married, filing separately worksheet. Filer’s full social security number. Web include form 5049) 7. Filling in lines if they do not apply to you or if the missing, incomplete, or applied. Form mi 5049, married, filing separately worksheet. 2020 michigan home heating credit claim mi. Web 1 best answer. Homestead property tax credit claim: 0000 2021 37 01 27 9. *if you checked box “c,” enter dates of michigan residency in 2022. Web you may claim a property tax credit if all of the following apply: This form is for income earned in tax year 2022, with tax. June 7, 2019 4:23 pm. Form mi 5049, married, filing separately worksheet. 2020 michigan home heating credit claim mi. Web include form 5049) 7. Both pages find the following information on this website: This form is for income earned in tax year 2022, with. Improve the way you take care of legal papers management. Michigan department of treasury (rev. Issued under authority of public act 281 of 1967, as amended. Web include form 5049) 7. Homestead property tax credit claim: Homeowners who moved in 2020. Watch our video recommendations to. Type or print in blue or black ink. Web you may claim a property tax credit if all of the following apply: Homestead property tax credit claim for veterans and blind people: *if you checked box “c,” enter dates of michigan residency in 2022. Issued under authority of public act 281 of 1967, as amended. Watch our video recommendations to. Homestead property tax credit claim: June 7, 2019 4:23 pm. The deadline for submitting this form is september 30, 2023. June 7, 2019 4:23 pm. Improve the way you take care of legal papers management. Filling in lines if they do not apply to you or if the missing, incomplete, or applied. 2020 michigan home heating credit claim mi. Homeowners who moved in 2020. Form mi 5049, married, filing separately worksheet. Web include form 5049) 7. Web video instructions and help with filling out and completing form mi 1040cr 7. Homestead property tax credit claim for veterans and blind people: Web you may claim a property tax credit if all of the following apply: Type or print in blue or black ink. View all 98 michigan income tax forms see more Both pages find the following information on this website: 0000 2021 37 01 27 9. Issued under authority of public act 281 of 1967, as amended. Filer’s full social security number. You were a michigan resident at least six months of 2020. This form is for income earned in tax year 2022, with tax. Your homestead is located in michigan.State Of Michigan Fillable Forms Fill Out and Sign Printable PDF

MI MI1040CR7 2018 Fill and Sign Printable Template Online US

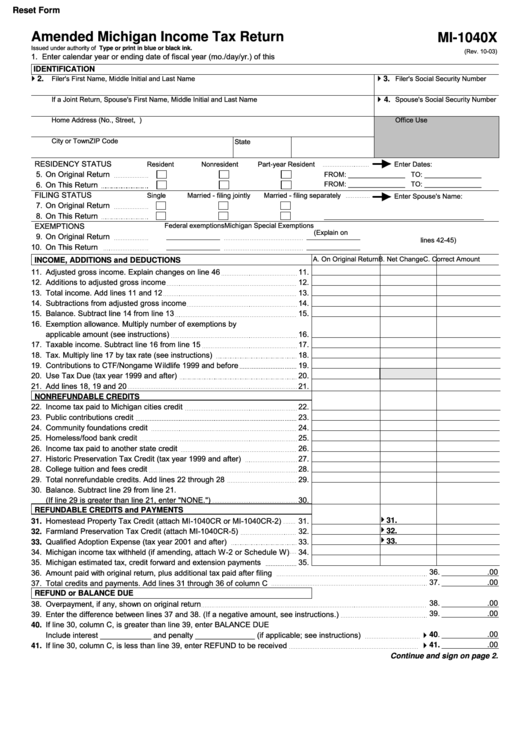

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

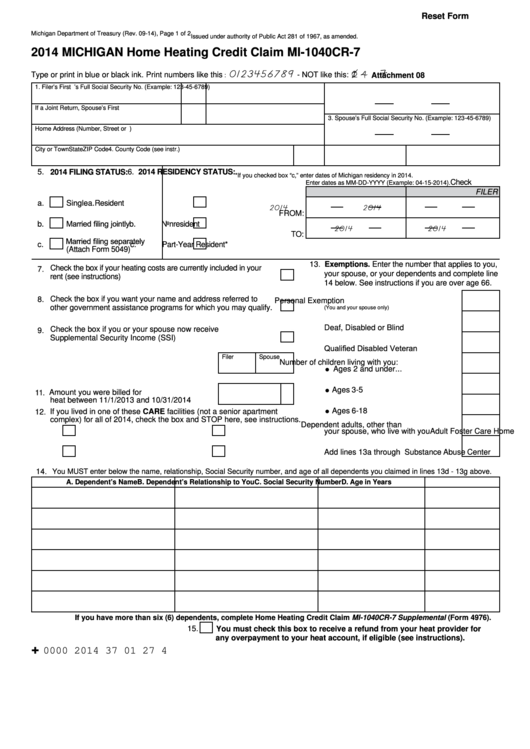

Fillable Form Mi1040cr7 Michigan Home Heating Credit Claim 2014

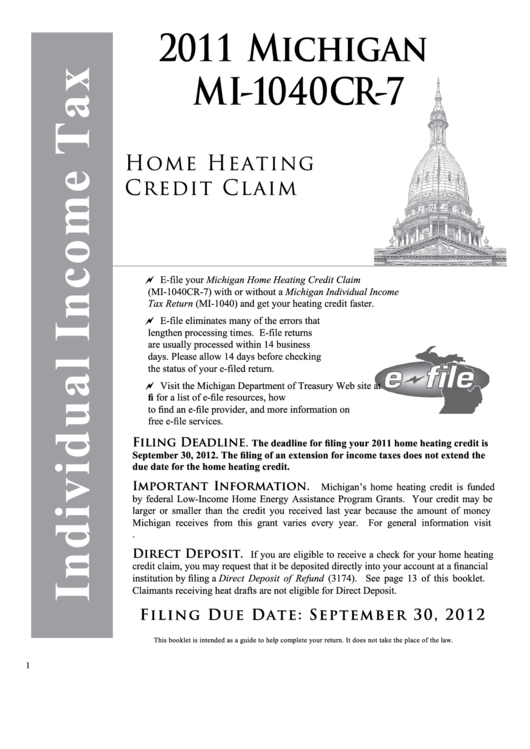

Instructions For Form Mi1040cr7 Michigan Home Heating Credit Claim

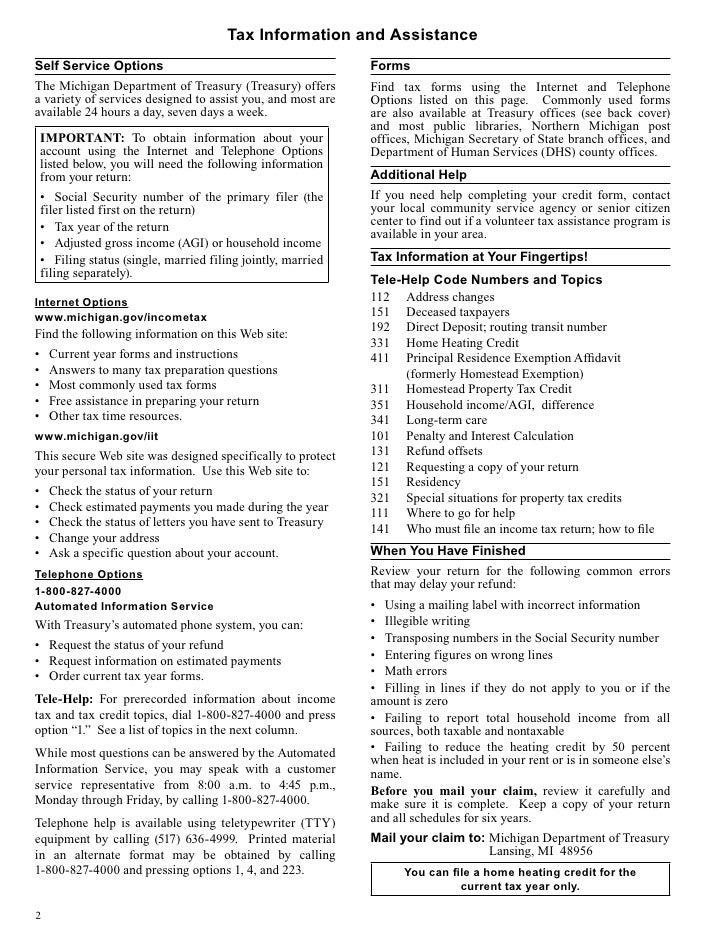

MI1040CR7booklet_michigan.gov documents taxes

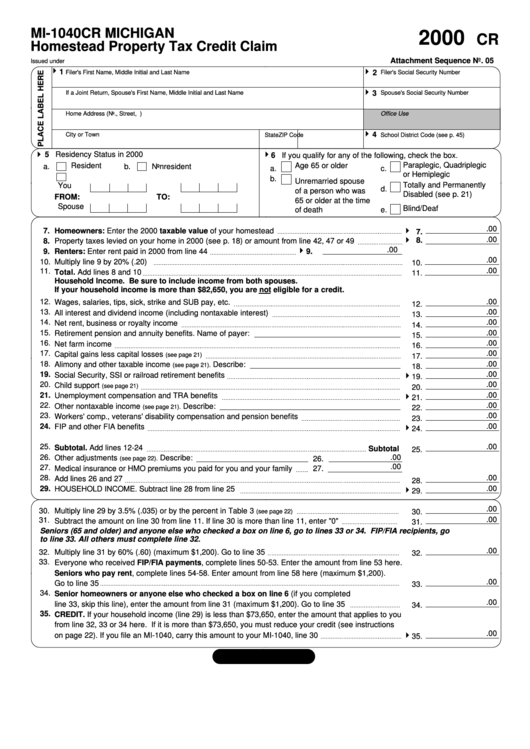

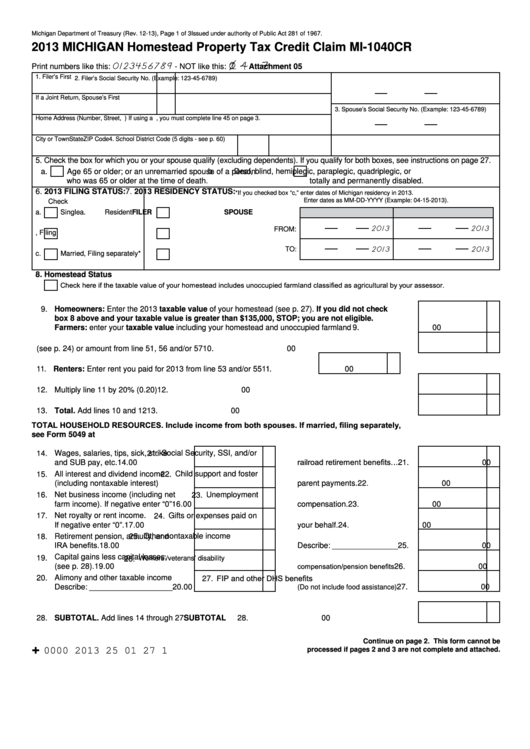

Form Mi1040cr Michigan Homestead Property Tax Credit Claim 2000

Fillable Form Mi1040cr Michigan Homestead Property Tax Credit Claim

2018 Michigan Homestead Property Tax Credit Claim Mi1040cr

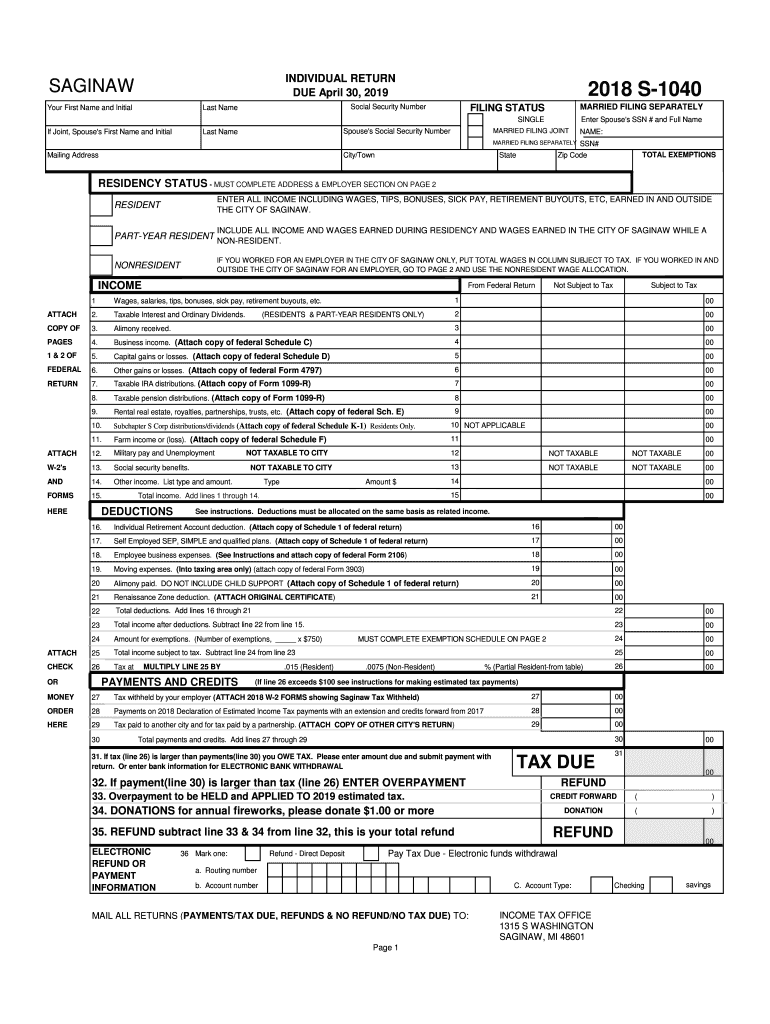

State Of Mi 1040 Form 2018 Fill Out and Sign Printable PDF Template

Related Post: