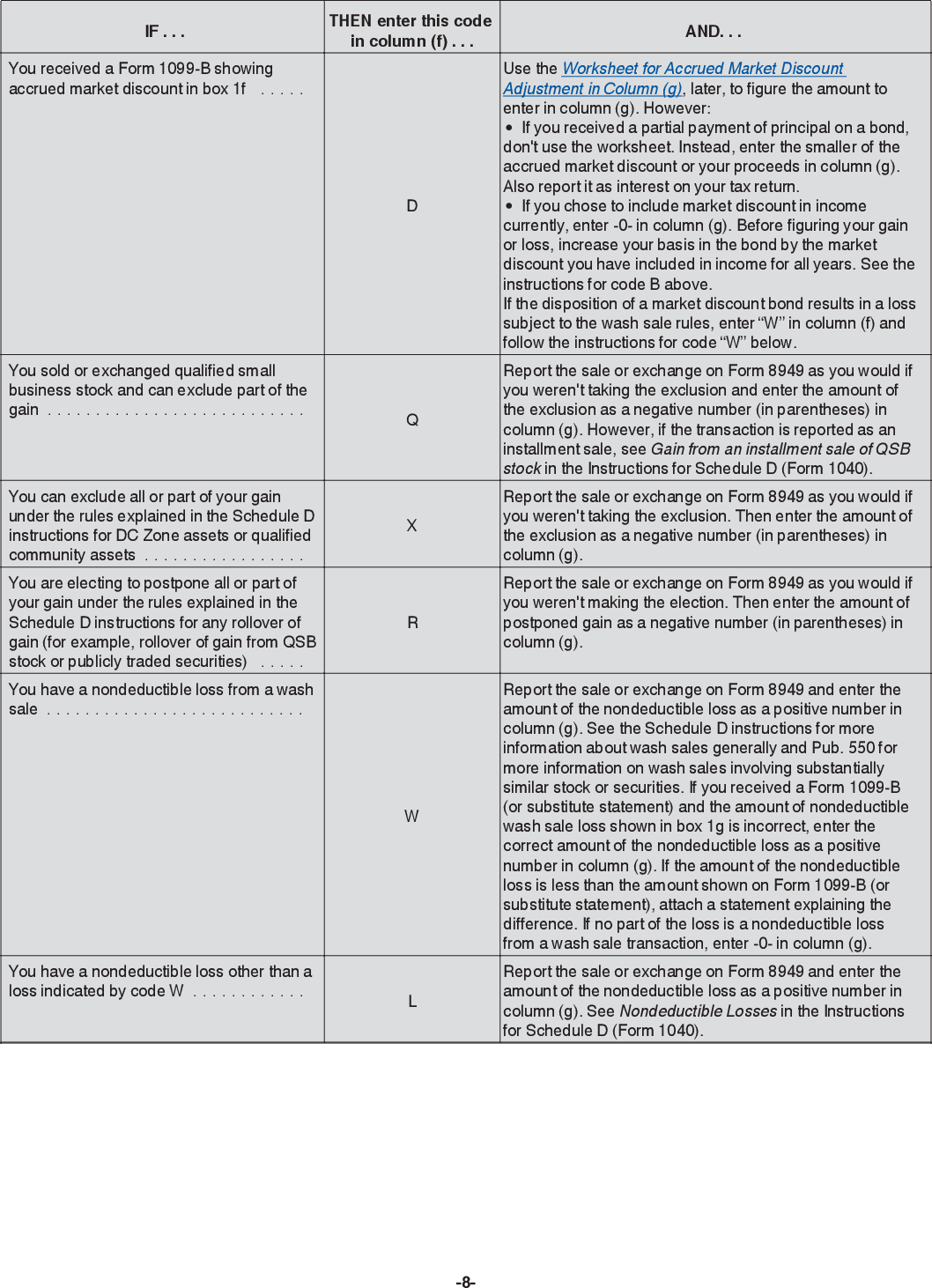

Form 8949 Code X

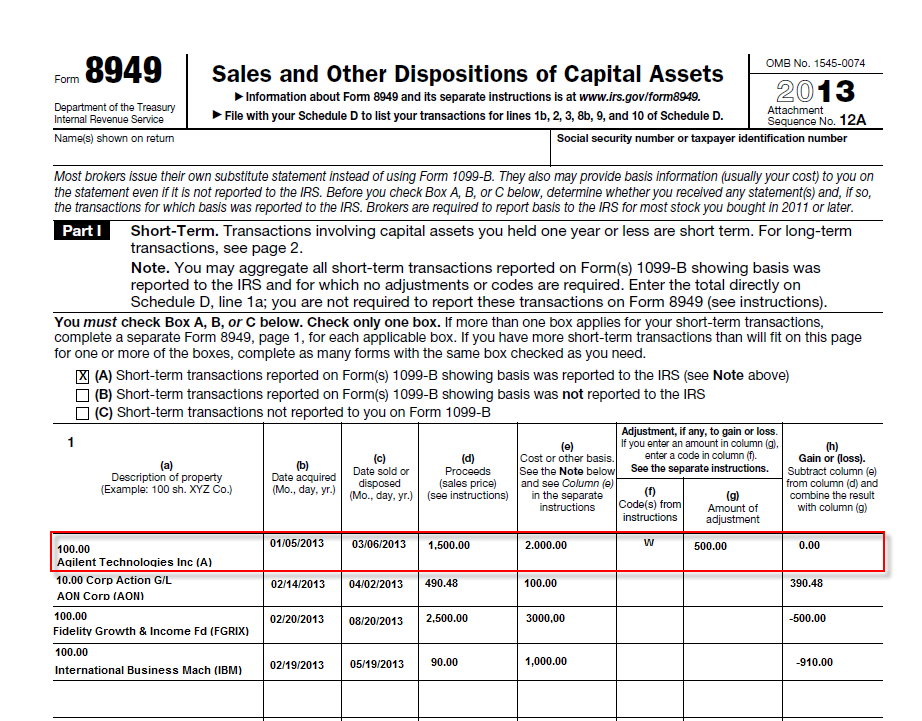

Form 8949 Code X - Complete, edit or print tax forms instantly. Web 12 rows report the gain or loss in the correct part of form 8949. Form 8949(sales and other dispositions of capital assets) records the details of. These are the only codes that will be included on form 8949. Web b, t, d, x, r, w, c, m, o, and z are valid choices. The codes that are noted as form 1040 are for informational. Solved•by turbotax•6711•updated 6 days ago. Complete, edit or print tax forms instantly. Then enter the amount of the exclusion as a negative number (in parentheses) in column (g). For a complete list of. Ad get ready for tax season deadlines by completing any required tax forms today. Then enter the amount of the exclusion as a negative number (in parentheses) in column (g). These are the only codes that will be included on form 8949. Web overview of form 8949: The irs form 8949 is divided into two sections: File form 8949 with the schedule d for the return you are filing. If you sell your assets within a year then. Use this code to report a transaction if you cannot determine whether the recipient should check box b or box e on form 8949 because the holding. Get ready for tax season deadlines by completing any required tax. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Form 8949(sales and other dispositions of capital assets) records the details of. Web b, t, d, x, r, w, c, m, o, and z are valid choices. Form 8949,. File form 8949 with the schedule d for the return you are filing. Ad get ready for tax season deadlines by completing any required tax forms today. Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. Web for exempt organization returns, only the codes b, t, d, x, r, w, c,. Form 8949, column (f) reports a code explaining any adjustments t you. Web 12 rows report the gain or loss in the correct part of form 8949. For a complete list of. Get ready for tax season deadlines by completing any required tax forms today. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. The codes that are noted as form 1040 are for informational. Web overview of form 8949: The irs form 8949 is divided into two sections: Then enter the amount of the exclusion as a negative number (in parentheses) in column (g). Report the sale or exchange on form 8949 as you would if you weren't taking the exclusion. Report the sale or exchange on form 8949 as you would if you weren't taking the exclusion. Web for exempt organization returns, only the codes b, t, d, x, r, w, c, m, o, and z are valid choices. Use this code to report a transaction if you cannot determine whether the recipient should check box b or box e. Form 8949, column (f) reports a code explaining any adjustments t you. Web use form 8949 to report sales and exchanges of capital assets. Web ultratax cs browse subjects index search options support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Web on part i of form 8949. Report the sale or exchange on. Web description of property date acquired date sold or (example: Web b, t, d, x, r, w, c, m, o, and z are valid choices. Solved•by turbotax•6711•updated 6 days ago. Report the sale or exchange on form 8949 as you would if you were not. Web this article will help you generate form 8949, column (f) for various codes in. Form 8949, column (f) reports a code explaining any adjustments t you. Use this code to report a transaction if you cannot determine whether the recipient should check box b or box e on form 8949 because the holding. Solved•by turbotax•6711•updated 6 days ago. The irs form 8949 is divided into two sections: For a complete list of. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Get ready for tax season deadlines by completing any required tax forms today. Web ultratax cs browse subjects index search options support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). For a complete list of. Web description of property date acquired date sold or (example: Web these instructions explain how to complete schedule d (form 1040). Form 8949(sales and other dispositions of capital assets) records the details of. Form 8949, column (f) reports a code explaining any adjustments t you. Complete, edit or print tax forms instantly. Web 12 rows report the gain or loss in the correct part of form 8949. Solved•by turbotax•6711•updated 6 days ago. Web overview of form 8949: Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. File form 8949 with the schedule d for the return you are filing. Use this code to report a transaction if you cannot determine whether the recipient should check box b or box e on form 8949 because the holding. Report the sale or exchange on form 8949 as you would if you were not. If you sell your assets within a year then. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web on part i of form 8949. Web b, t, d, x, r, w, c, m, o, and z are valid choices.Form 8949 Archives EquityStat Blog

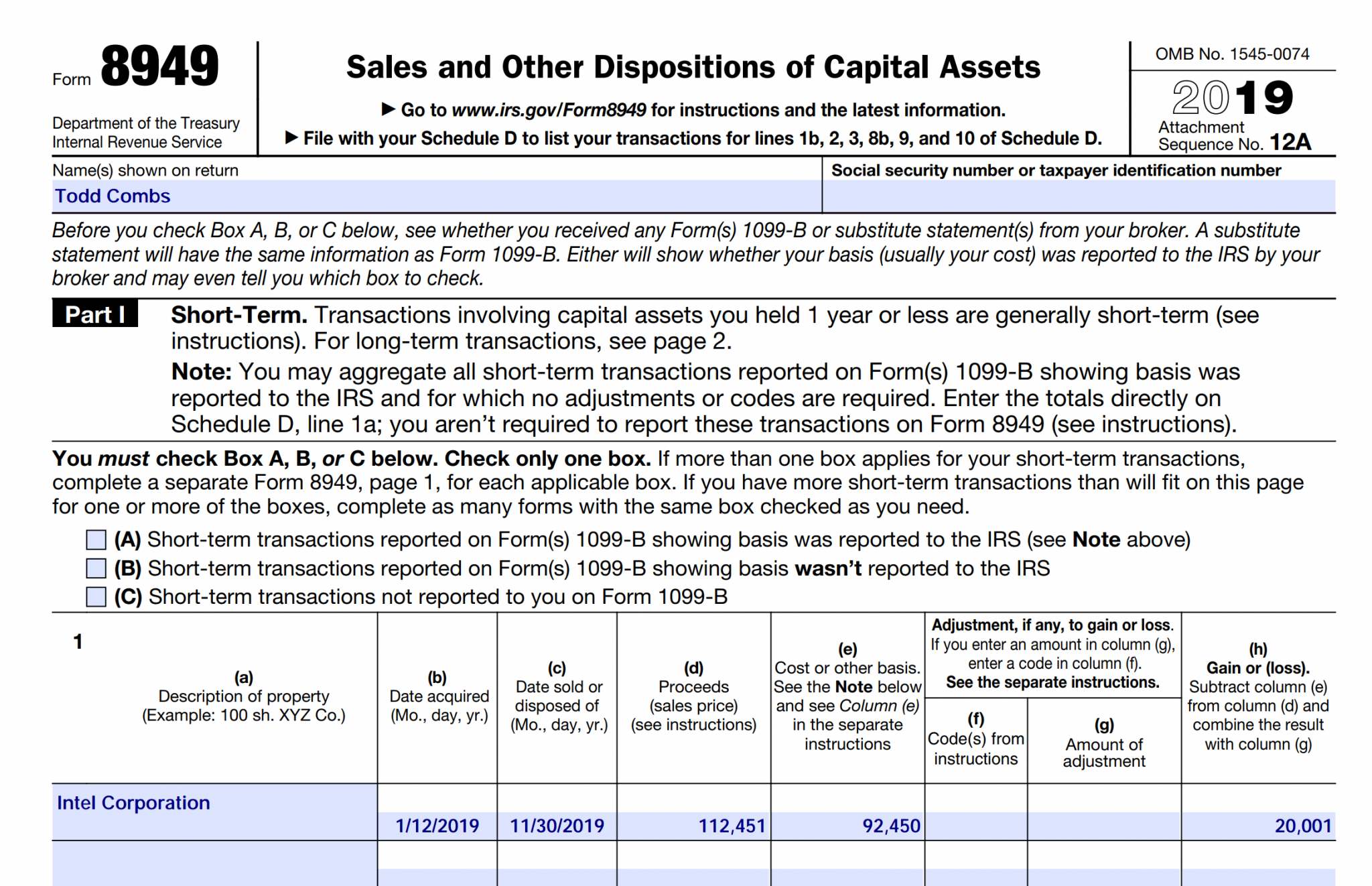

IRS Form 8949 Instructions 📝 Get 8949 Tax Form for 2022 Printable PDF

Form 8949 schedule d Fill online, Printable, Fillable Blank

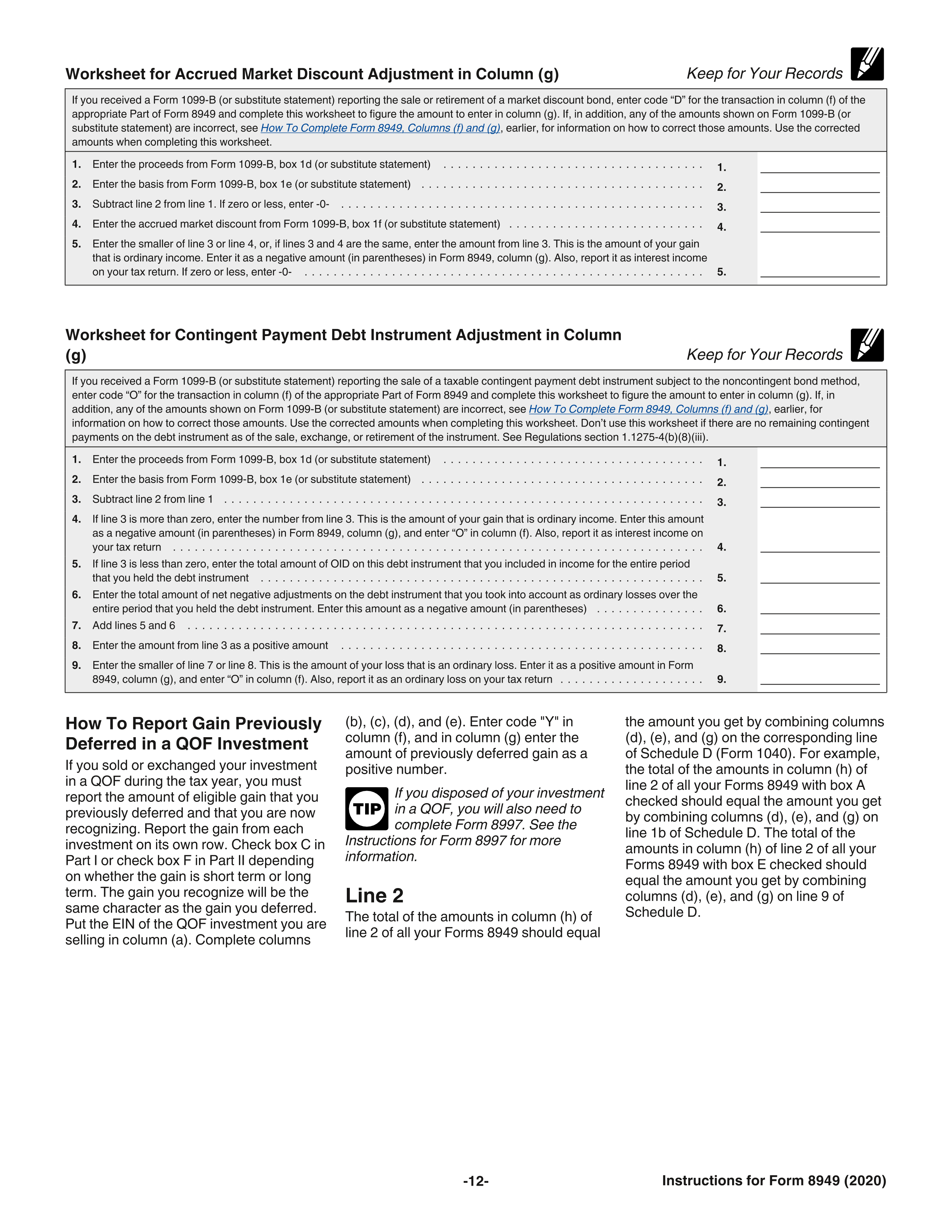

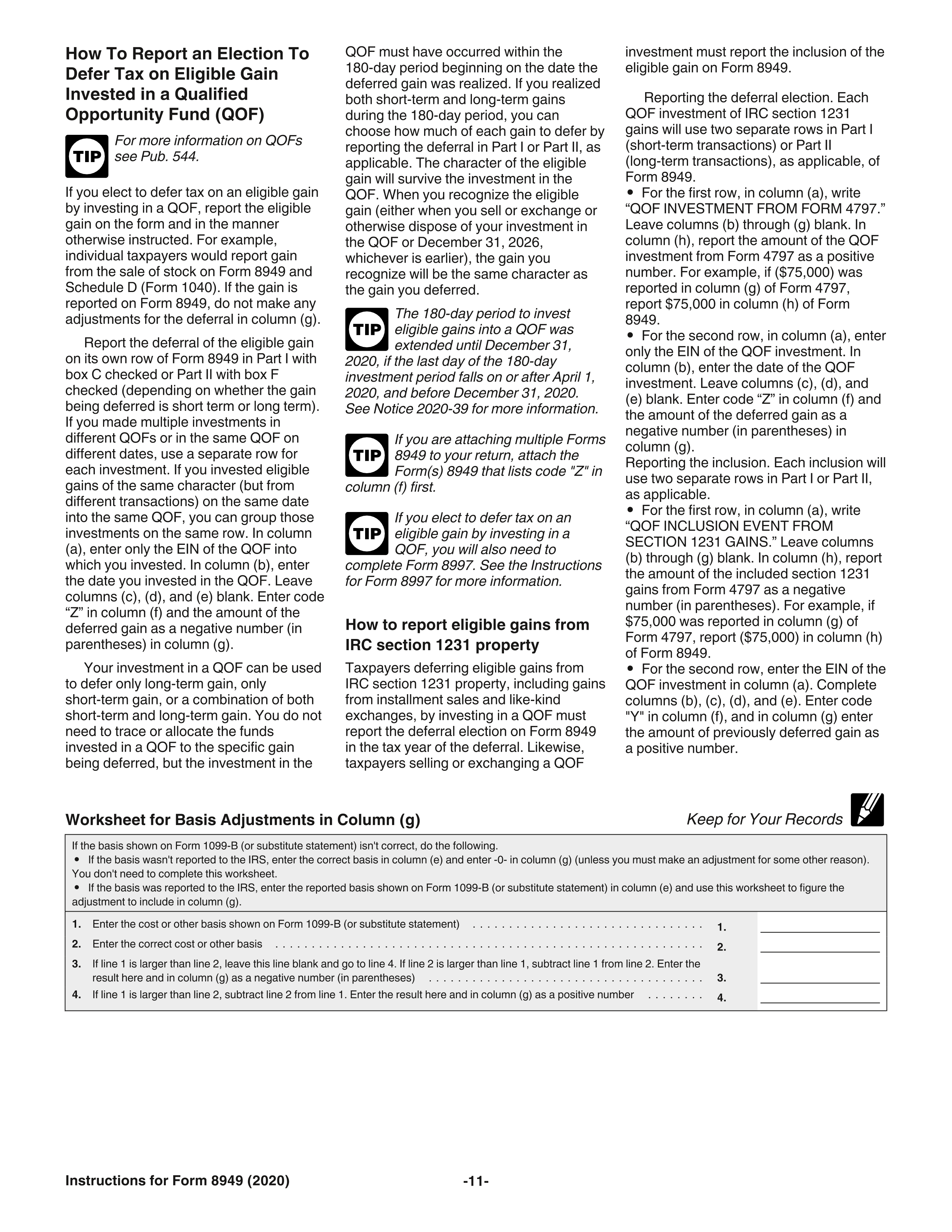

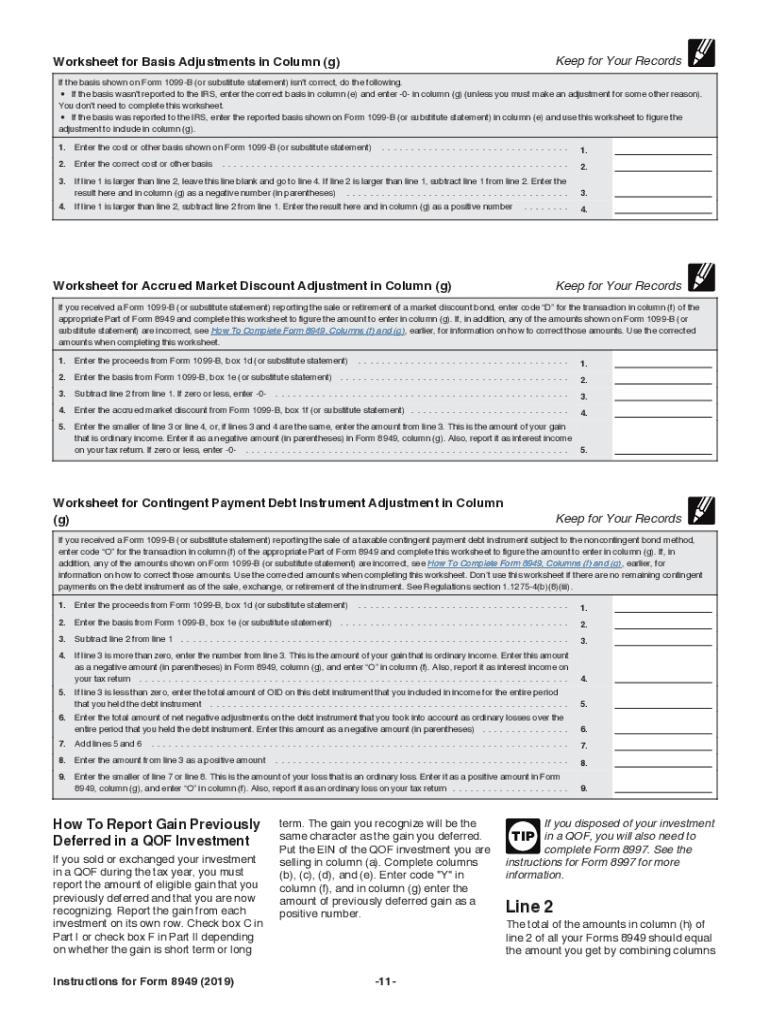

IRS Form 8949 instructions.

Form 8949 Fillable Printable Forms Free Online

IRS Form 8949 instructions.

Online generation of Schedule D and Form 8949 for 10.00

Stock options form 8949

To review Tess's completed Form 8949 and Schedule D IRS.gov

Form 8949 Example Filled Out Fill Out and Sign Printable PDF Template

Related Post: