How To Get Amazon Flex Tax Form

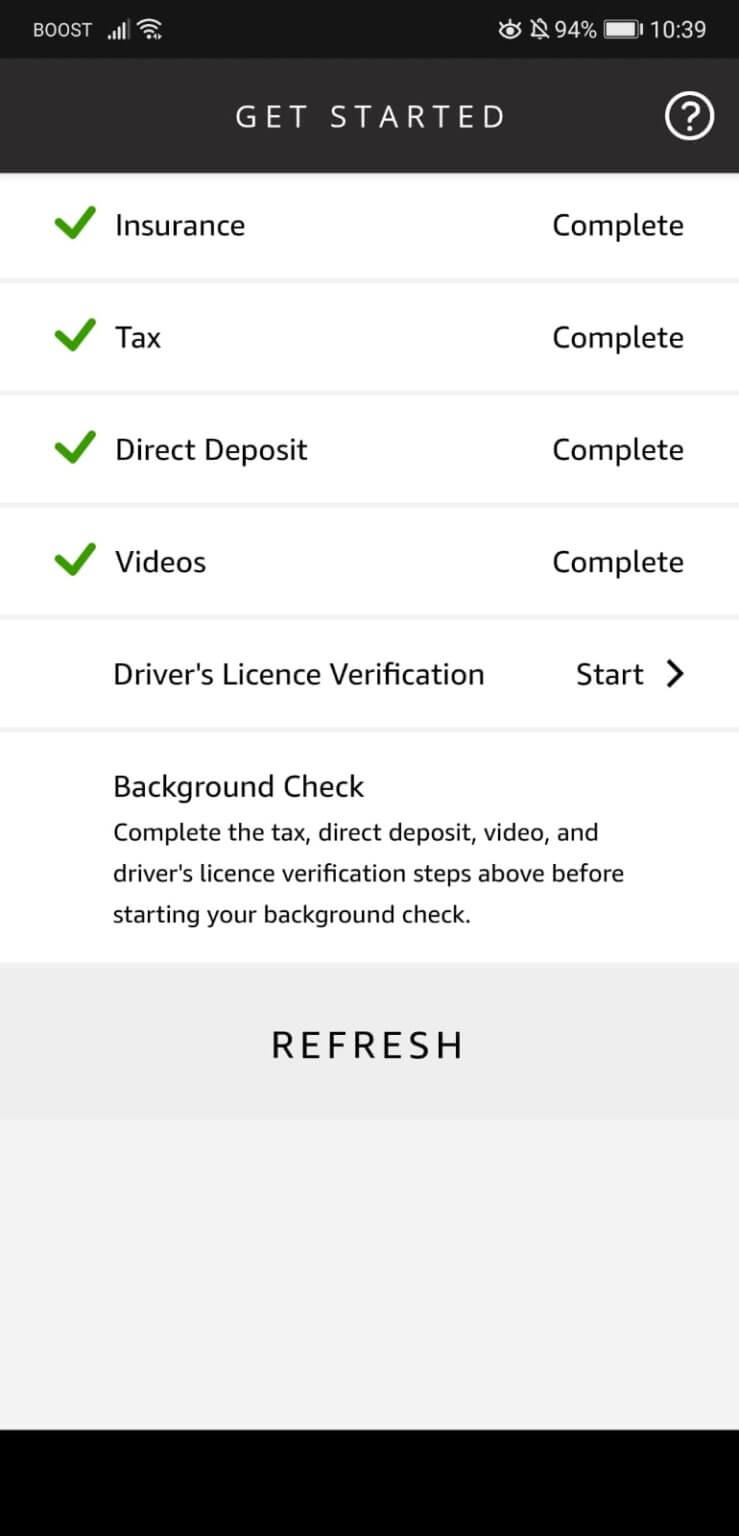

How To Get Amazon Flex Tax Form - Mileage deduction for your deliveries; Web 1099 form and your amazon flex earnings; Web you can get a 1099 from amazon flex by requesting one from the company. Internal revenue service regulations your amazon. Web if you have earned at least $600 during the tax year working as an amazon flex delivery driver, you can expect to receive a 1099 form. Web no matter what your goal is, amazon flex helps you get there. Or download the amazon flex app. We all know the phrase “you need to spend money to make money.” working as an amazon flex driver is no. Web to access your amazon flex tax form, you need to log in to your amazon flex account. If your payment is $600 or more, you will receive a 1099 tax form with your check. What to do if you don't get a 1099 from amazon. Web this video provides step by step instructions on how to download your 1099 tax form from amazon from amazon seller central. What information do i need to provide to amazon flex in order to get a 1099? You should report this income. Web no matter what your goal. Internal revenue service regulations your amazon. What information do i need to provide to amazon flex in order to get a 1099? Web how do you get your amazon flex 1099 tax form? We all know the phrase “you need to spend money to make money.” working as an amazon flex driver is no. With amazon flex, you work only. Web 1099 form and your amazon flex earnings; Once you’ve logged in, you’ll see a link to your tax form. Web this video provides step by step instructions on how to download your 1099 tax form from amazon from amazon seller central. Web we will issue a 1099 form by january 29 to any amazon associate who received payments of. If your payment is $600 or more, you will receive a 1099 tax form with your check. Web 1099 form and your amazon flex earnings; What information do i need to provide to amazon flex in order to get a 1099? Web 10 hours ago2] sign up on the amazon flex website or download the flex app, create an amazon. Once you’ve logged in, you’ll see a link to your tax form. Get started now to reserve blocks in advance or pick them daily based on your schedule. Web we will issue a 1099 form by january 29 to any amazon associate who received payments of $600 or more or received payments where taxes were withheld in the previous. Internal. Web how do you get your amazon flex 1099 tax form? Web 1099 form and your amazon flex earnings; Filling out schedule c for your amazon flex earnings; Web please log into taxcentral.amazon.com to access all your tax forms. Web to access your amazon flex tax form, you need to log in to your amazon flex account. Web please log into taxcentral.amazon.com to access all your tax forms. Web 1099 form and your amazon flex earnings; As an amazon flex, doordash, uber eats, grubhub or any other. I also explain why the 1099 does. Follow the instructions and provide. Web you can get a 1099 from amazon flex by requesting one from the company. Web to access your amazon flex tax form, you need to log in to your amazon flex account. If you earned less than $600 in amazon flex income — say, if you started. With amazon flex, you work only when you want to. We all. Filling out schedule c for your amazon flex earnings; Web 1099 form and your amazon flex earnings; Get started now to reserve blocks in advance or pick them daily based on your schedule. We all know the phrase “you need to spend money to make money.” working as an amazon flex driver is no. What information do i need to. Web please log into taxcentral.amazon.com to access all your tax forms. Web 1099 form and your amazon flex earnings; Web 10 hours ago2] sign up on the amazon flex website or download the flex app, create an amazon account or sign in if you already have one; I also explain why the 1099 does. Web 👉 increase your earnings. Web how do you get your amazon flex 1099 tax form? Web if you have earned at least $600 during the tax year working as an amazon flex delivery driver, you can expect to receive a 1099 form. Web you can get a 1099 from amazon flex by requesting one from the company. Web this video provides step by step instructions on how to download your 1099 tax form from amazon from amazon seller central. You should report this income. Web if you get a check, please cash it within 90 days. If you earned less than $600 in amazon flex income — say, if you started. Web please log into taxcentral.amazon.com to access all your tax forms. Once you’ve logged in, you’ll see a link to your tax form. Internal revenue service regulations your amazon. Web 👉 increase your earnings. Web no matter what your goal is, amazon flex helps you get there. Web make quicker progress toward your goals by driving and earning with amazon flex. Follow the instructions and provide. With amazon flex, you work only when you want to. Ad we know how valuable your time is. If your payment is $600 or more, you will receive a 1099 tax form with your check. What information do i need to provide to amazon flex in order to get a 1099? We all know the phrase “you need to spend money to make money.” working as an amazon flex driver is no. Web 10 hours ago2] sign up on the amazon flex website or download the flex app, create an amazon account or sign in if you already have one;Amazon Flex, Tax season is here and we need to get ready Now. Here some

How to Do Taxes For Amazon Flex YouTube

how to get amazon flex tax form Stephine Mundy

How to View all the Amazon Tax Forms (at One Place) YouTube

How to manage your Amazon Flex and taxes with Accountable

How To Fill Up Amazon Tax Information Form as a NonUSA Person? A

Amazon Flex 1099 forms, Schedule C, SE and how to file taxes and

Tax Forms Email AmazonFlexDrivers

Amazon Flex 1099 forms, Schedule C, SE and how to file taxes and

amazon flex take out taxes Augustine Register

Related Post: