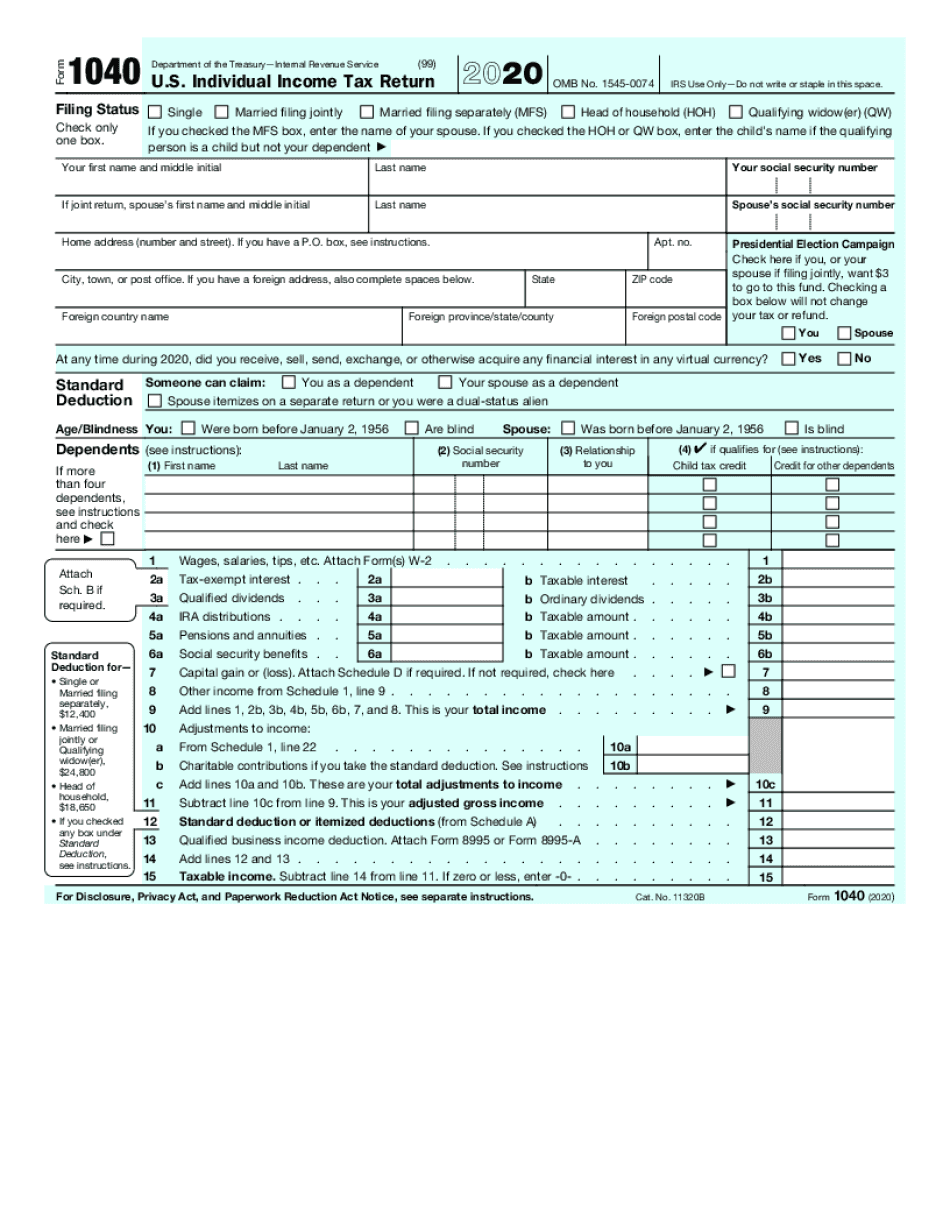

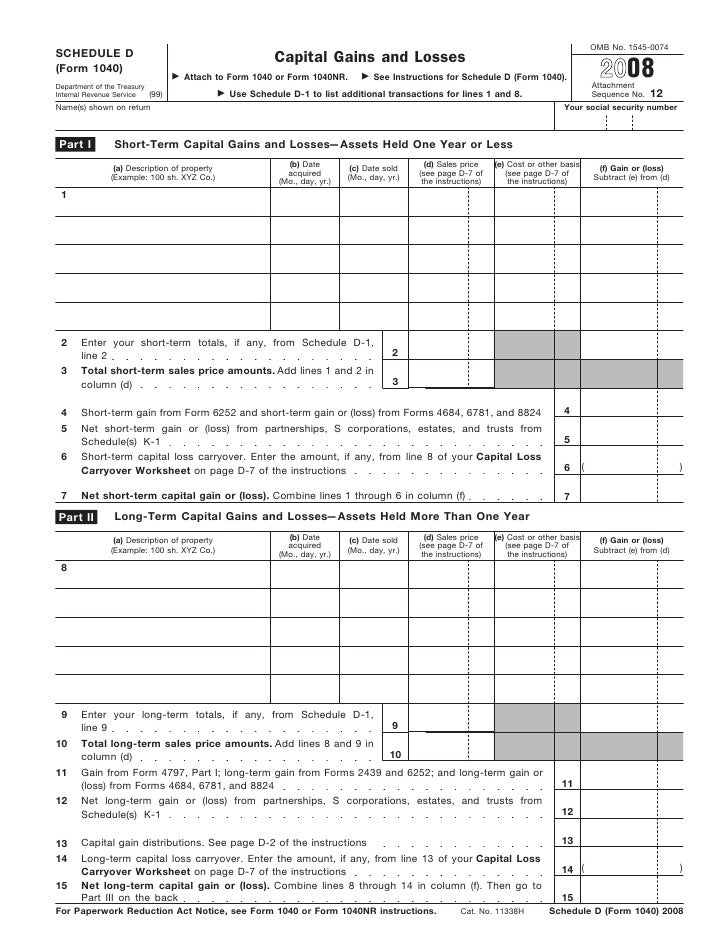

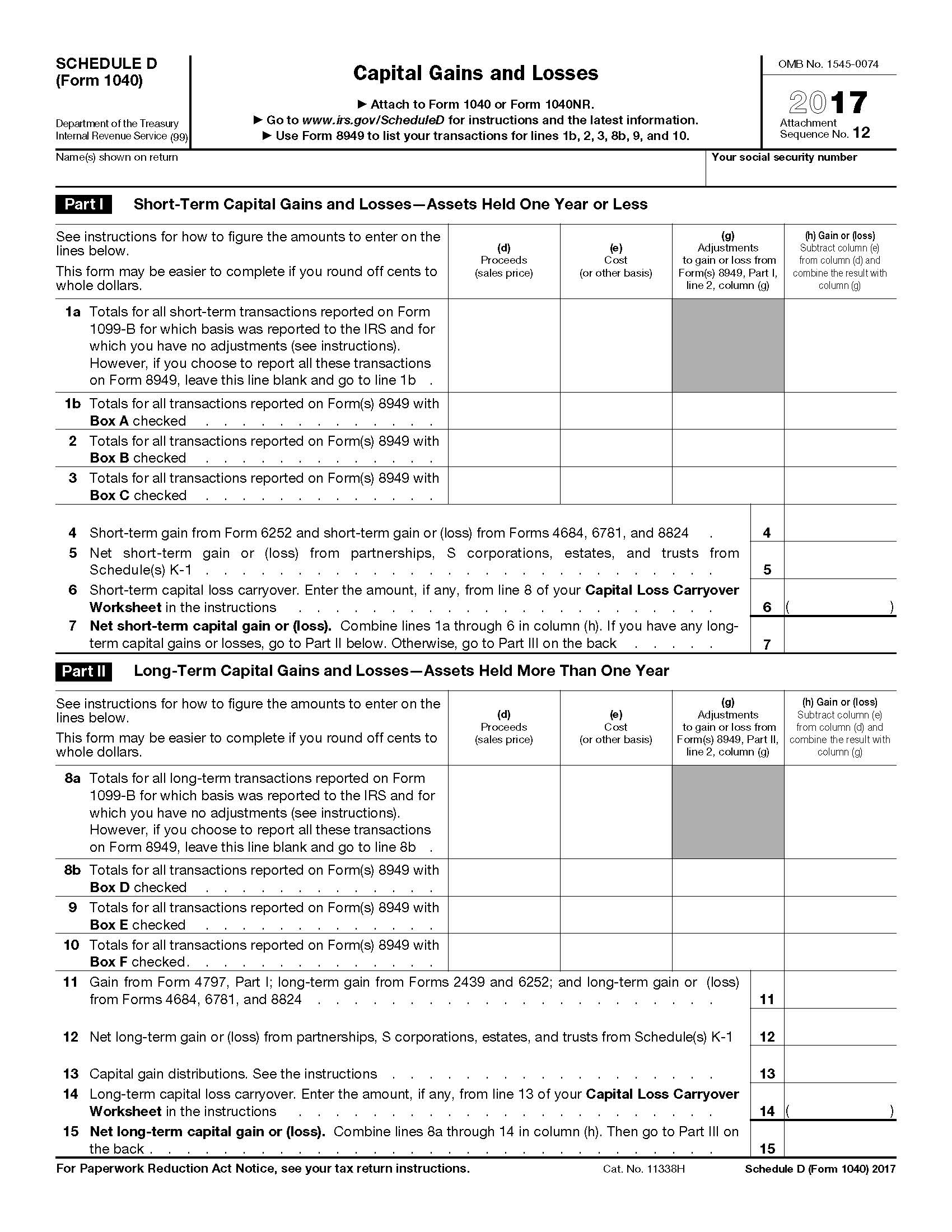

Form Schedule D 1040

Form Schedule D 1040 - This form will be used to report certain sales, exchanges,. If your income is greater than $103,000 and less than $397,000, the irmaa amount is $74.20. It is used to help. Schedule d is often used to report capital gains from the sale of. This form is used in conjunction with form 1040. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. Calculating the capital gains 28% rate in lacerte. Web the schedule d is known as a capital gains and losses form. Web medicare part d. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. The sale or exchange of a capital asset not reported on another form or schedule. Web medicare part d. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. In most cases cryptocurrency or virtual. It appears you don't have a pdf plugin for this browser. Name and ssn or taxpayer identification no. Web federal capital gains and losses. Web schedule r (form 940): The sale or exchange of a capital asset not reported on another form or schedule. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web schedule a, except the amount you include from line 5a of virginia schedule a may not exceed $10,000 or $5,000 if your federal filing status is married filing separately. It appears you don't have a pdf plugin for this browser. • on schedule d, line 14b, column (2), or line 14c, column (2), is more than zero, or •. Web do not file july 23, 2021 draft as of form 8949 (2021) attachment sequence no. Web schedule a, except the amount you include from line 5a of virginia schedule a may not exceed $10,000 or $5,000 if your federal filing status is married filing separately. This form is used in conjunction with form 1040. To request a new initial. Calculating the capital gains 28% rate in lacerte. 12a page 2 name(s) shown on return. This form is used in conjunction with form 1040. For 2023, the break begins to phase out for. Ad get ready for tax season deadlines by completing any required tax forms today. For 2023, the break begins to phase out for. This form is used in conjunction with form 1040. Name and ssn or taxpayer identification no. Capital losses that exceed the. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. This form is used in conjunction with form 1040. Please use the link below to. Schedule d is often used to report capital gains from the sale of. Web schedule d (form 1040) is a tax schedule from the irs that attaches to the form 1040, u.s. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. In most cases cryptocurrency or virtual. Please use the link below to. Capital losses that exceed the. Web federal capital gains and losses. Complete, edit or print tax forms instantly. Name and ssn or taxpayer identification no. (form 1040) department of the treasury internal revenue service (99) capital gains and losses. Web federal capital gains and losses. It appears you don't have a pdf plugin for this browser. It is used to help. This form will be used to report certain sales, exchanges,. 1040 (schedule d) federal — capital gains and losses. Web medicare part d. Web schedule d tax worksheet keep for your records complete this worksheet only if: Web the subtotals from this form will then be carried over to schedule d (form 1040), where gain or loss will be calculated in aggregate. Web schedule r (form 940): Name and ssn or taxpayer identification no. Generating form 8949, column (f) for various codes. Web the calculations from schedule d will impact your adjusted gross income when they are added to your individual form 1040. This form is used in conjunction with form 1040. If your income is greater than $103,000 and less than $397,000, the irmaa amount is $74.20. Web schedule a, except the amount you include from line 5a of virginia schedule a may not exceed $10,000 or $5,000 if your federal filing status is married filing separately. Capital losses that exceed the. For 2023, the break begins to phase out for. 12a page 2 name(s) shown on return. Ad get ready for tax season deadlines by completing any required tax forms today. Please use the link below to. Web federal capital gains and losses. • on schedule d, line 14b, column (2), or line 14c, column (2), is more than zero, or • both. Web do not file july 23, 2021 draft as of form 8949 (2021) attachment sequence no. December 2017) department of the treasury — internal revenue. Web use schedule d (form 1040) to report the following: It is used to help. Web medicare part d.who needs Form 1040 (Schedule D) Fill Online, Printable, Fillable

IRS Form 1040 Schedule D Fillable and Editable in PDF

form 1040 2020 2021 Fill Online, Printable, Fillable Blank irs

Form 1040, Schedule DCapital Gains and Losses

1040 schedule d instructions Fill Online, Printable, Fillable Blank

2017 IRS Tax Forms 1040 Schedule D (Capital Gains And Losses) U.S

Form 1040 Schedule D 1 2021 Tax Forms 1040 Printable

Solved How To Report These On Schedule D Tax Return James...

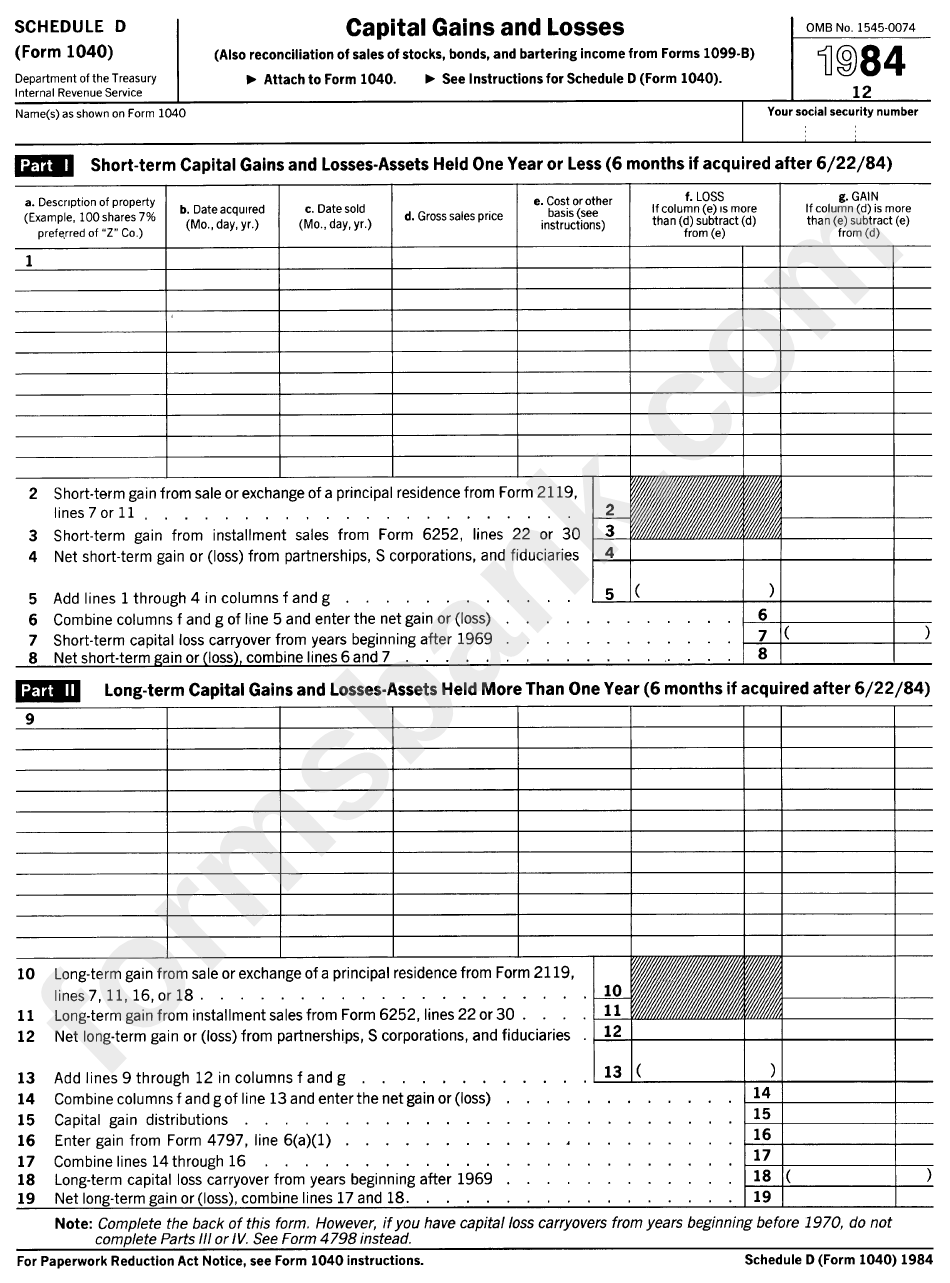

Form 1040 Schedule D Capital Gains And Losses 1984 printable pdf

Schedule D (Form 1040) Free Fillable Form & PDF Sample FormSwift

Related Post: