How To Fill Out Form 7203 In Turbotax

How To Fill Out Form 7203 In Turbotax - 28 nondeductible expenses and oil and gas. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Web 29 july 2022 are you curious about irs form 7203? Don't file it with your tax. How do i clear ef messages 5486 and 5851? You can still file 2021 & 2020 tax returns. You might check again after running update. In prior years, the irs. Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal emergency management. Web the form 7203, s corporation shareholder stock and debt basis limitations is not used or supported in any of the personal turbotax desktop editions,. Free federal & $17.99 state Freetaxusa can file your past year federal taxes free. Enjoy great deals and discounts on an array of products from various brands. In prior years, the irs. Basis is handled as follows: Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal emergency management. It just says, here is a link to the form, now complete it by yourself! Keep it for your records. Ad file your prior year taxes. Basis is handled as follows: Freetaxusa can file your past year federal taxes free. Ad they help you get your taxes done right, save you time, and explain your unique situation. Web 1040 individual what is form 7203? You may find your answers in this irs document instructions for form 7203, s corporation shareholder stock and debt basis limitations. Starting in tax year 2021, form. Don't file it with your tax. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Ad file your prior year taxes. Ad explore the collection of software at amazon & take your skills to the next level. In prior years, the irs. Web 29 july 2022 are you curious about irs form 7203? Web shareholders will use form 7203 to calculate their stock and debt basis, ensuring the losses and deductions are accurately claimed. Basis is handled as follows: You may find your answers in this irs document instructions for form 7203, s corporation shareholder stock and debt basis limitations. Web multiply. Web multiply line 25 by line 19 27 debt basis before nondeductible expenses and losses. Web the form 7203 interview is slightly different in turbotax desktop, but the main entries on the form are made manually using the same format as turbotax. Ramsey tax advisors are redefining what it means to “do your taxes right.” Basis of a gift to. Web the form 7203 interview is slightly different in turbotax desktop, but the main entries on the form are made manually using the same format as turbotax. Basis of a gift to figure the basis of property you receive as a gift, you must know (a) its adjusted basis to the donor just before it was given to you, (b). Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. This form is used by s corporation shareholders to figure out the potential limitations of their share of the s corporation’s. Learn more about what will be covered in. In prior years, the irs. Basis is handled as follows: This form is used by s corporation shareholders to figure out the potential limitations of their share of the s corporation’s. Free federal & $17.99 state Web if one of these requirements applies, then form 7203 is required. Web the form 7203, s corporation shareholder stock and debt basis limitations is not used or supported in any of the personal turbotax desktop editions,. Web 29 july 2022 are you curious about irs form 7203? Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items. Ad they help you get your taxes done right, save you time, and explain your unique situation. 28 nondeductible expenses and oil and gas. Keep it for your records. Web multiply line 25 by line 19 27 debt basis before nondeductible expenses and losses. Web the form 7203 interview is slightly different in turbotax desktop, but the main entries on the form are made manually using the same format as turbotax. How do i clear ef messages 5486 and 5851? Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Basis of a gift to figure the basis of property you receive as a gift, you must know (a) its adjusted basis to the donor just before it was given to you, (b) its. New items on form 7203. Web 43 4,858 reply bookmark icon rlc54326666 level 2 i am having the same problem with this form. Web if one of these requirements applies, then form 7203 is required. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for. Web 29 july 2022 are you curious about irs form 7203? Enjoy great deals and discounts on an array of products from various brands. You can still file 2021 & 2020 tax returns. Ramsey tax advisors are redefining what it means to “do your taxes right.” Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal emergency management. You might check again after running update. Learn more about what will be covered in this webinar.National Association of Tax Professionals Blog

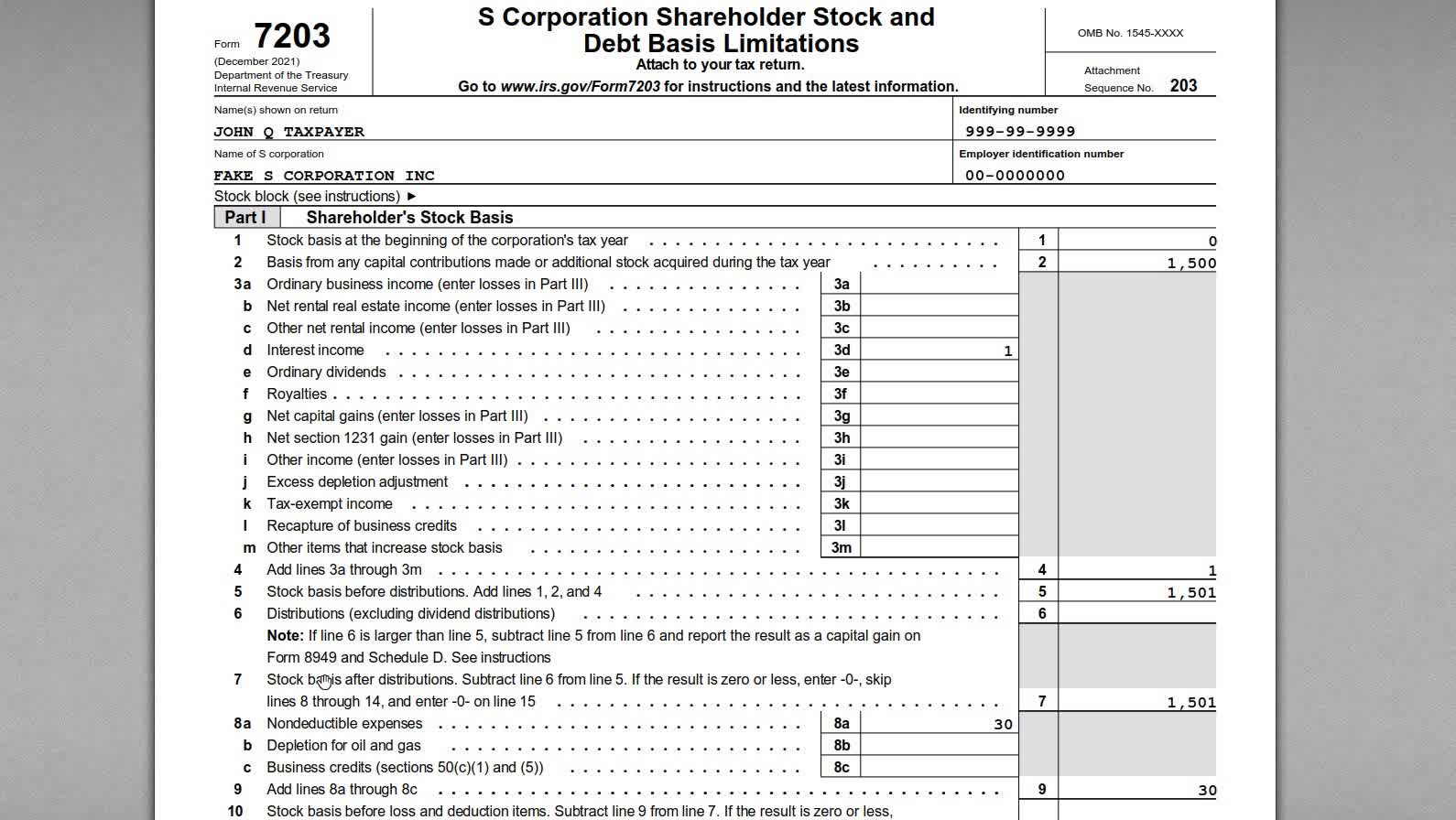

More Basis Disclosures This Year for S corporation Shareholders Need

Form7203PartI PBMares

National Association of Tax Professionals Blog

Form 8962 turbotax Fill online, Printable, Fillable Blank

Turbotax Worksheet

IRS Form 7202 Examples

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

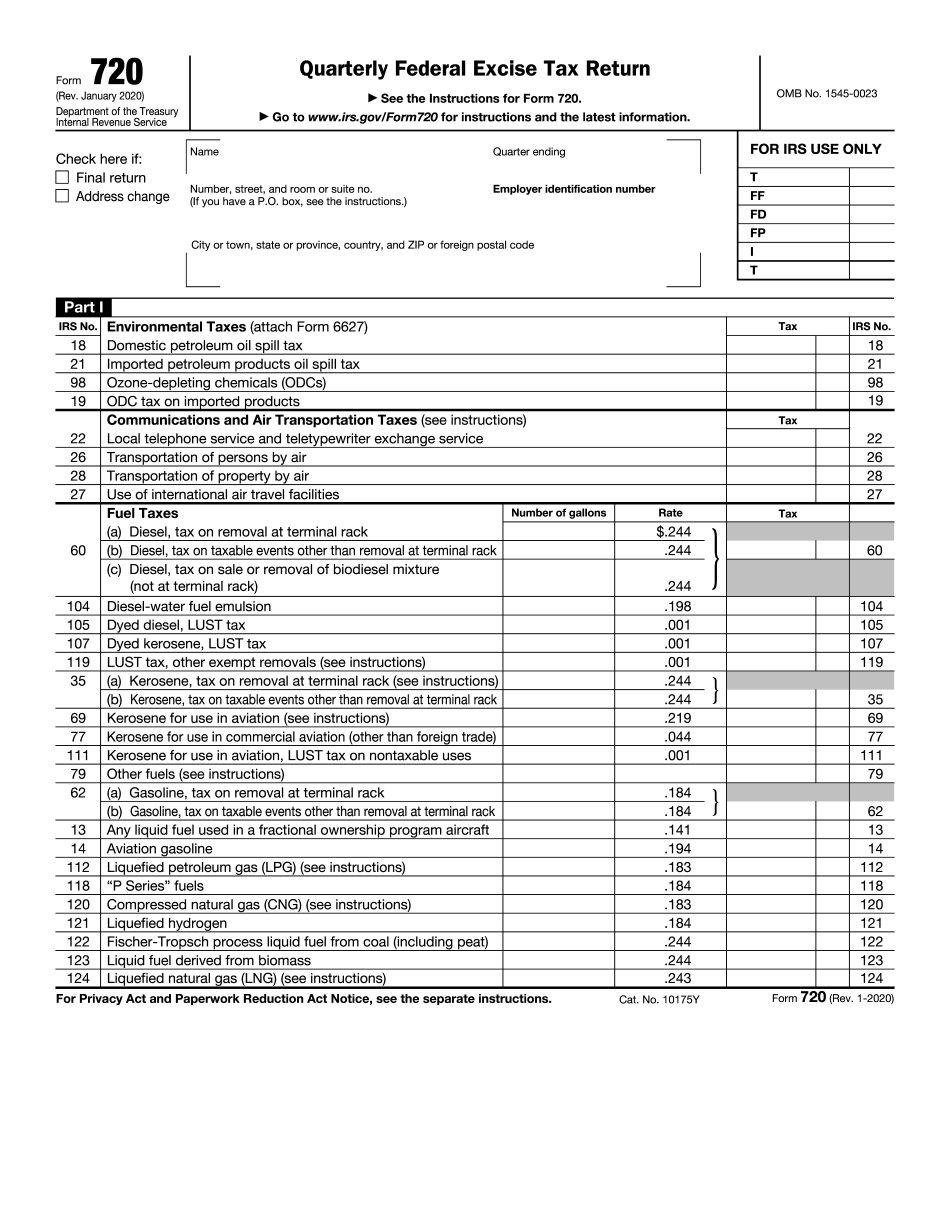

irs form 720 electronic filing Fill Online, Printable, Fillable Blank

How to Complete IRS Form 7203 S Corporation Shareholder Basis

Related Post: